If you're looking to sell your unpaid life insurance policy, you can do so through a life settlement, where a third party buys your policy and becomes the beneficiary. The buyer will pay you a lump sum and take over your premium payments. However, it's important to note that the death benefit will go to the buyer when you pass away, and your beneficiaries will not receive a payout.

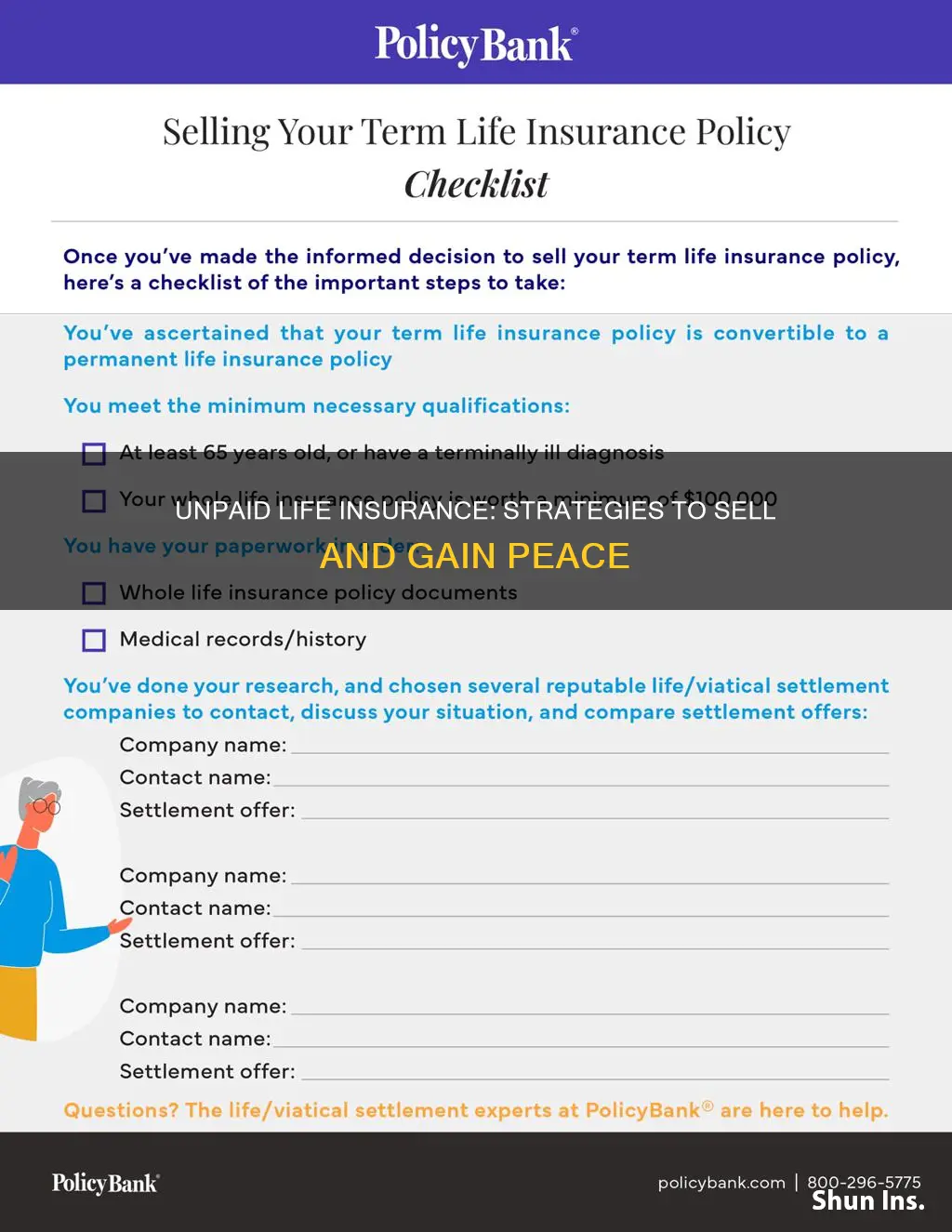

There are a few steps to selling your life insurance policy:

1. Determine whether you're eligible to sell your policy.

2. Decide whether a life settlement is the right choice for you.

3. Determine the value of your policy.

4. Choose a life settlement company.

5. Complete your application, which may include providing medical records.

6. Go through the underwriting process, where the company will verify your application and determine your policy's worth.

7. Receive and negotiate the offer.

8. Close the deal and transfer ownership of your policy.

It's also important to consider the tax implications of selling your life insurance policy, as well as alternatives to a life settlement, such as an accelerated death benefit rider or surrendering your policy.

| Characteristics | Values |

|---|---|

| Who can sell their life insurance policy? | People over 65 or those with certain medical conditions. |

| What type of life insurance policy can be sold? | Term, whole life, and universal policies can be sold on the secondary market. |

| How does it work? | Life settlement companies buy life insurance policies. They take over the policy and pay the premiums. In return, they become the beneficiary of the policy’s payout. |

| How much will I get from selling my life insurance policy? | It depends on your life expectancy, the life insurance face amount, and how much the buyer expects to pay in premiums while you’re alive. |

| Are there any tax implications? | Yes, you may have to pay taxes on the money you get from selling your life insurance policy. |

| Are there any alternatives to selling my life insurance policy? | Yes, you could surrender your policy, take out a loan against it, or withdraw funds from the cash value. |

What You'll Learn

How to sell your life insurance policy

Selling your life insurance policy can be a strategic way to unlock financial value, but it's important to understand your options and the implications. Here's a step-by-step guide on how to sell your life insurance policy:

- Understand the process and regulations: Familiarize yourself with life settlement transactions and associated regulations. Check with your state's insurance authority for information about the process, licensing requirements, and potential scams.

- Decide whether to use a broker: You can choose to work with a licensed life settlement broker who can answer your questions, look out for your interests, pull quotes, and handle negotiations. However, brokers will charge a fee for their services. Alternatively, you can choose to shop and compare on your own to avoid broker fees.

- Application: Complete an application for each life insurance settlement from which you want to solicit offers. As part of the process, you will need to grant the settlement company permission to access information about your policy and health. You may also be asked to provide additional documentation and disclosures.

- Documentation: Once you've submitted your application, the settlement company underwriters will gather information. They will contact your life insurance provider for policy details, including the death benefit and premiums. The underwriters will also request your medical records from your healthcare providers.

- Appraisal: After reviewing the relevant information, underwriters will determine the market value of your life insurance policy. They will consider the policy's value and your health status to assess whether it's a good investment. They will also look for signs of fraud.

- Offer: If your policy is deemed suitable for purchase, the settlement company will make an offer. You have the option to accept or decline. It is recommended to compare offers from multiple companies before making a decision. If you're working with a broker, they may be able to negotiate on your behalf.

- Closing: If you accept the offer, the settlement provider will send a closing package for you to review and sign. Once you return the signed documents, your insurance provider will be notified of the transaction. The ownership of the policy will change, and you will receive the settlement funds.

Note that the process can take between 60 and 120 days, depending on how quickly third parties respond to information requests. Additionally, selling a life insurance policy requires the cooperation of both the policy owner and the insured person.

Important Considerations:

- Tax implications: Selling your life insurance policy may result in tax consequences. The portion of the settlement that exceeds your contributions to the policy may be subject to taxes as ordinary income or capital gains. Consult a tax professional to understand the specific tax consequences.

- Impact on beneficiaries: Once you sell your policy, your beneficiaries will no longer receive a death benefit. Consider the financial implications for your loved ones before selling.

- Eligibility for public assistance: The money received from selling your policy may affect your eligibility for Medicaid and other financial assistance programs.

- Creditor claims: If you have any creditors, they may be able to make claims on the settlement payout, so it's important to address any outstanding debts beforehand.

- Alternative options: Before selling your policy, explore alternative options such as using the cash value of the policy, converting to a whole life insurance policy, seeking an accelerated death benefit, or surrendering the policy.

Life Insurance: Pre-Death Benefits and Payouts Explained

You may want to see also

Life settlement vs. viatical settlement

There are two main ways to sell your life insurance policy: a life settlement and a viatical settlement. Both allow you to sell your policy, but they are designed for different situations and offer varying payout amounts depending on your policy type and health condition.

A life settlement is the sale of an existing life insurance policy to investors in order to benefit from a cash lump sum. The buyer assumes all future premium payments and becomes the beneficiary of the policy. The transaction takes place on the secondary market and results in a one-time cash lump sum for the seller. The buyers of these policies are either looking to diversify their personal investment portfolio or are acting on behalf of an institution like a bank or investment firm.

To qualify for a life settlement, you must meet the following requirements:

- Age 65+, but ideal candidates are in their 70s

- A life expectancy of less than 15 years, with a change in health since the policy was issued

- A policy death benefit of at least $100,000

- The policy has been in force for at least 2 years

A viatical settlement is similar to a life settlement, but it is specifically for those with a terminal illness and a life expectancy of less than 24 months. The buyer expects to collect the death benefit sooner, so viatical settlements generally offer a higher payout. Payment amounts are regulated by state laws, ensuring that terminally ill individuals receive a fair percentage of the policy's value.

To qualify for a viatical settlement, you must meet the following requirements:

- A life expectancy of less than two years due to a medically diagnosed terminal condition

- A death benefit of at least $100,000

- The policy has been in force for at least 2 years

The key distinction between a life settlement and a viatical settlement is whether the insured is terminally/chronically ill or not. This distinction also has very specific tax consequences. For an insured person that is terminally ill, the viatical settlement payout is entirely tax-free. For an insured person that is chronically ill, the viatical settlement payout is tax-free only for proceeds used to pay for long-term care services that are not compensated by insurance. For an insured person that is neither terminally nor chronically ill, standard life settlement taxation is more complicated and you should consult a tax professional.

Credit Card Life Insurance: What Coverage Do You Get?

You may want to see also

How to sell your life insurance policy: Step-by-step

Selling your life insurance policy can be a strategic way to unlock financial value, but it's important to understand your options and the implications. Here is a step-by-step guide:

- Determine your eligibility: Make sure you meet the eligibility requirements, which often include having a death benefit of at least $100,000 and meeting a minimum age rule (typically 65 to 75 years old).

- Decide if it's right for you: Explore all options and determine if a life settlement is the best choice. Consider alternatives such as taking out a loan against your policy or adjusting your coverage.

- Determine your policy's value: While each company will make its own appraisal, it's helpful to know ahead of time how much your policy is worth to set realistic expectations and spot low-ball offers.

- Choose a life settlement company: Research and compare different life settlement companies to find the best fit for your situation. Consider factors such as settlement payment, speed of payment, and reputation.

- Complete the application: Gather the required documentation, including medical records, and be prepared to provide detailed health information.

- Go through the underwriting process: The life settlement company will verify your application, assess your eligibility, and determine the value of your policy.

- Receive and negotiate the offer: After the company's appraisal, you will receive an offer, which you can choose to accept or negotiate further.

- Close the deal: Transfer ownership of your policy to the buyer and receive your agreed-upon lump-sum payout, minus any applicable fees.

Remember, selling your life insurance policy has financial and legal implications, so it is recommended to consult with financial and legal professionals before proceeding.

Cancer and Life Insurance: Payouts and Policies Explained

You may want to see also

How does selling your life insurance policy affect your taxes?

Selling your life insurance policy can have several tax implications. The tax consequences depend on the type of settlement you choose, whether a viatical settlement or a life settlement, and your location.

Viatical Settlement

If you're terminally ill, the money you receive from a viatical settlement is usually tax-free. The Health Insurance Portability and Accountability Act of 1996 (HIPAA) ensures that those facing serious health issues can benefit from this exemption.

Life Settlement

The money you receive from a life settlement can be taxed in three ways: as ordinary income, as long-term capital gains, or as tax-free income.

- The portion of the sale amount equal to what you've paid in premiums (your "cost basis") is typically tax-free.

- The portion that exceeds your cost basis but is less than the cash value of the policy may be subject to income tax.

- Any amount above the cash value is subject to capital gains tax.

Estate Tax Impact

Selling your life insurance policy can also reduce the value of your taxable estate, which could lower the tax bill for your heirs. When you sell your policy, you transfer ownership rights. If this transfer occurs at least three years before your death, the policy is not included in your estate. Additionally, the cash you receive from the sale could be spent or gifted, further reducing the value of your estate.

State-Specific Tax Considerations

Some states have their own regulations and tax laws regarding the taxation of life settlement proceeds, which can vary widely and impact factors such as tax treatment, potential exemptions or deductions, and reporting requirements.

Given the complexity of the tax implications, it is always recommended to consult with a tax professional to determine the specific tax consequences of selling your life insurance policy.

Annuities vs Life Insurance: What's the Real Difference?

You may want to see also

What to avoid when selling your life insurance policy

Selling your life insurance policy can be a smart financial move, but there are a few things to keep in mind and potential pitfalls to avoid. Here are some key points to consider:

- Do not rush into the decision: Selling your life insurance policy is a significant financial decision that should not be taken lightly. Take the time to carefully consider your options and weigh the pros and cons before making any commitments. Settlement companies may use aggressive marketing tactics, but you are under no obligation to accept or even consider their bids.

- Avoid high fees and commissions: The fees and commissions charged by brokers or settlement companies can eat into your profits. Life insurance settlement commissions can be as high as 30% of the purchase price, so be sure to factor this into your calculations when evaluating offers.

- Do not neglect tax implications: The money you receive from selling your life insurance policy may be subject to taxes. Consult with a licensed tax attorney or professional to understand the specific tax consequences for your situation.

- Do not overlook the impact on your beneficiaries: Selling your policy will result in a loss of the death benefit for your beneficiaries. Consider their financial needs and how the sale will affect their inheritance, financial security, and estate plans.

- Avoid scams and disreputable buyers: Be cautious of life settlement solicitations and do your research to find a reputable, licensed broker or buyer. Check their license status, read reviews, and ask about their experience and process.

- Do not sell without exploring alternatives: Before selling your policy, explore alternative options such as policy loans, partial surrender, accelerated death benefits, or converting to a paid-up policy. These options can provide access to funds while retaining some or all of your life insurance coverage.

- Avoid acting without understanding: Make sure you fully understand how life insurance works, the type of policy you have, and its cash surrender value. This information will help you make an informed decision and avoid potential pitfalls.

- Do not sell without comparing offers: It is recommended to gather offers from multiple companies before selling your policy. You can use a life settlement broker to compare offers and negotiate on your behalf, but be aware of the fees involved.

- Avoid selling without seeking professional advice: Consult with a financial advisor, estate planning attorney, or insurance agent to discuss the legal and financial implications of selling your policy. They can provide personalized advice and help you explore all your options.

Life Insurance Application: Location, Location, Location?

You may want to see also

Frequently asked questions

You can sell your life insurance policy to a third party via a life settlement. You can do this by contacting a life settlement company directly or by using a life settlement broker to find you the best offer.

Pros:

- You will receive a lump sum of money.

- You will no longer have to pay premiums.

Cons:

- Your beneficiaries will no longer receive a death benefit.

- You will likely have to pay taxes on the money you receive.

- If you use public assistance, a life settlement could make you ineligible.

This depends on factors such as your age, health, the type and value of your policy, and the insurer's financial stability. In general, the older you are and the more severe your health condition, the more attractive your policy is to buyers.

There are several alternatives to selling your life insurance policy, including:

- Accelerating the death benefit.

- Taking out a loan against your policy.

- Withdrawing funds from the cash value.

- Replacing your policy.

- Surrendering your policy.

- Opting for a Medicaid life settlement.

- Reducing the death benefit.