When it comes to choosing the best life insurance cover, it's important to consider your individual needs and circumstances. Life insurance provides financial protection for your loved ones in the event of your passing, and the right policy can offer peace of mind and security. The best cover will vary depending on factors such as your age, health, income, and family responsibilities. It's crucial to evaluate different types of life insurance, such as term life, whole life, and universal life, to determine which one aligns best with your goals and budget. Additionally, understanding the coverage amount, premium costs, and policy terms will help you make an informed decision to ensure your loved ones are adequately protected.

What You'll Learn

- Term Life Insurance: Temporary coverage, affordable, and provides a lump sum to beneficiaries

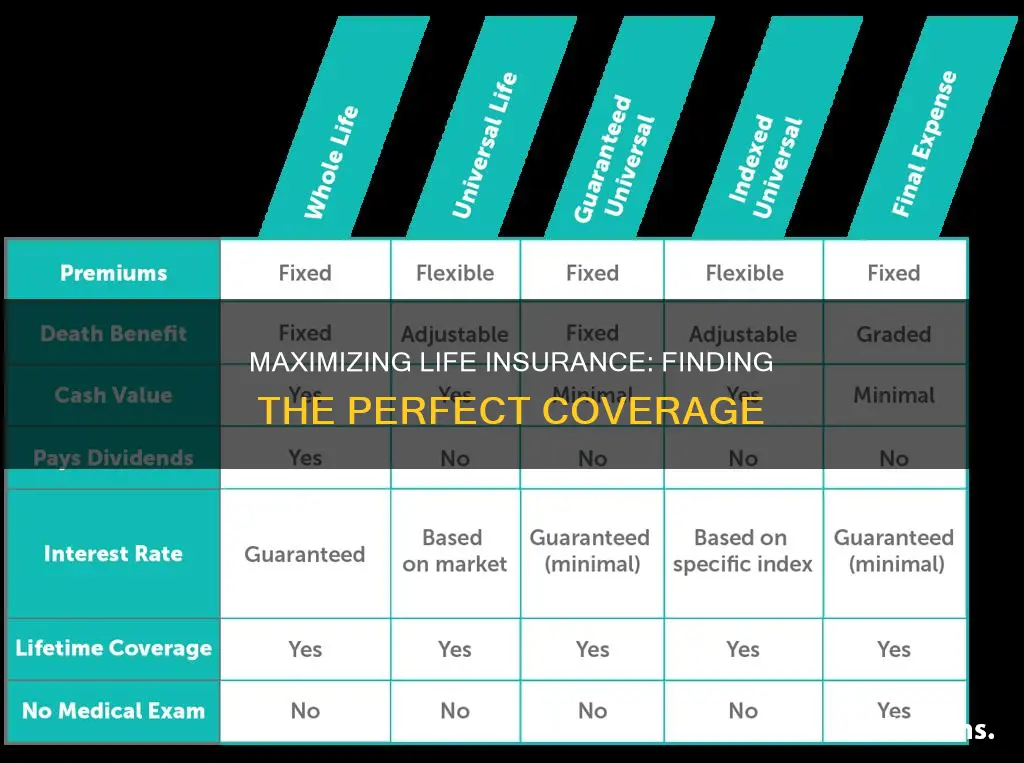

- Whole Life Insurance: Permanent coverage with a savings component, offering guaranteed death benefit and cash value

- Universal Life Insurance: Flexible coverage with adjustable premiums and potential for higher returns on investment

- Variable Universal Life Insurance: Offers investment options, providing potential for higher returns but also higher risk

- Final Expense Insurance: Covers funeral and burial expenses, often for older individuals with pre-existing conditions

Term Life Insurance: Temporary coverage, affordable, and provides a lump sum to beneficiaries

Term life insurance is a type of life insurance that provides coverage for a specific period, hence the term "term." It is a popular and affordable option for individuals seeking temporary protection for their loved ones. This insurance policy offers a straightforward approach to securing financial support during the most critical years of one's life, such as when raising a family or paying off a mortgage.

The beauty of term life insurance lies in its simplicity and cost-effectiveness. It is typically more affordable than permanent life insurance because it does not accumulate cash value over time. Instead, the primary focus is on providing a death benefit to the policyholder's beneficiaries if the insured individual passes away during the term period. This feature makes it an excellent choice for those who want to ensure their family's financial security without the added complexity of building cash value.

One of the key advantages of term life insurance is its flexibility. Policyholders can choose the duration of the term, which can range from a few years to several decades, depending on their specific needs. For instance, a young professional starting a family might opt for a 20-year term policy, ensuring their children's financial well-being during their formative years. As individuals progress through life, they can adjust their coverage by either renewing the policy or transitioning to a different type of life insurance.

In the event of the insured person's death, the term life insurance policy will pay out a lump sum amount to the designated beneficiaries. This financial payout can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or educational fees for dependent children. The lump sum provides a one-time financial boost, ensuring that the beneficiaries can manage their finances effectively during a challenging time.

When considering term life insurance, it is essential to evaluate your specific circumstances and consult with a financial advisor or insurance professional. They can help determine the appropriate coverage amount and term length based on your family's needs and financial goals. Additionally, understanding the policy's terms, conditions, and exclusions is crucial to making an informed decision. Term life insurance offers a practical and affordable way to provide financial security for your loved ones, making it a valuable component of a comprehensive financial plan.

Child Life Insurance: Unborn Children and Policy Options

You may want to see also

Whole Life Insurance: Permanent coverage with a savings component, offering guaranteed death benefit and cash value

Whole life insurance is a type of permanent life insurance that provides long-term coverage and offers a unique combination of protection and savings. It is designed to offer financial security to individuals and their families, ensuring that a death benefit is paid out to beneficiaries upon the insured's passing. One of the key advantages of whole life insurance is its guaranteed nature; the death benefit is assured, providing peace of mind and financial stability for the policyholder's loved ones.

This insurance policy is structured with a savings component, allowing the policyholder to build cash value over time. As the insured pays premiums, a portion of each payment goes towards accumulating cash value, which grows tax-deferred. This cash value can be used for various purposes, such as borrowing funds, paying for college expenses, or even taking out a loan against the policy's value. The savings aspect of whole life insurance makes it an attractive option for those seeking both financial protection and a way to grow their wealth.

The guaranteed death benefit is a critical feature, ensuring that the insured's beneficiaries receive a specified amount regardless of when the policyholder passes away. This guarantee is particularly valuable as it provides a stable financial foundation for the family, especially during challenging times. Additionally, the cash value accumulation can be a valuable asset, allowing policyholders to build a substantial sum over the policy's lifetime.

When considering whole life insurance, it is essential to understand the policy's terms and conditions. These may include the initial death benefit amount, the premium payments, and the investment options available. Policyholders can customize their coverage by choosing the death benefit amount that best suits their needs and selecting investment options to maximize the growth of their cash value.

In summary, whole life insurance offers permanent coverage with a built-in savings component, providing a guaranteed death benefit and the potential for cash value accumulation. It is a comprehensive financial tool that can help individuals secure their family's future and build long-term wealth. By carefully reviewing the policy details and understanding the benefits, individuals can make an informed decision about the best life insurance cover to suit their specific requirements.

Fronting: Uncovering the Hidden Costs in Life Insurance

You may want to see also

Universal Life Insurance: Flexible coverage with adjustable premiums and potential for higher returns on investment

Universal life insurance offers a unique and flexible approach to life coverage, providing policyholders with a range of benefits that can adapt to their changing needs and financial goals. This type of insurance is designed to offer both a death benefit and an investment component, allowing individuals to customize their policy to fit their specific requirements. One of the key advantages of universal life insurance is its flexibility. Unlike traditional term life insurance, where premiums are fixed for the duration of the policy, universal life insurance premiums are adjustable. This means that policyholders can choose to pay more or less, depending on their financial situation and goals. For example, during the early years of the policy, when the investment component is growing, individuals may opt for higher premiums to maximize the potential for returns. As they age and the investment value grows, they can adjust the premiums downward, ensuring that the policy remains affordable while still providing adequate coverage.

The investment aspect of universal life insurance is a powerful feature that sets it apart from other life insurance products. Policyholders can allocate a portion of their premiums to an investment account, which can grow over time, potentially earning higher returns compared to traditional savings accounts. This investment component can be a valuable tool for those seeking to grow their wealth while also ensuring that their loved ones are financially protected in the event of their passing. The investment options within the policy may vary, offering a choice between different investment strategies, such as fixed, variable, or indexed options, each with its own level of risk and potential for growth.

A significant advantage of universal life insurance is the potential for higher returns on investment. The investment accounts within these policies often have access to a diverse range of investment vehicles, including stocks, bonds, and mutual funds. This allows policyholders to benefit from market growth and potentially accumulate wealth over time. As the investment value grows, it can be used to increase the death benefit, ensuring that the policy remains adequate even as the individual's financial situation changes. Additionally, the investment growth can also be used to pay for policy loans or withdrawals, providing policyholders with financial flexibility.

Another benefit of universal life insurance is its ability to adapt to the policyholder's changing needs. As individuals progress through different life stages, their insurance needs may evolve. For instance, a young family might require higher coverage to protect their children's future, while an older individual may seek to reduce their coverage as their family becomes more financially independent. With universal life insurance, policyholders can adjust the death benefit and premiums accordingly, ensuring that the policy remains relevant and appropriate throughout their lives. This flexibility is particularly valuable for those who want to maximize their insurance coverage during their working years and then scale it back as they approach retirement.

In summary, universal life insurance provides a flexible and adaptable solution for individuals seeking comprehensive life coverage. Its adjustable premiums and investment options allow policyholders to customize their policy, ensuring that it aligns with their financial goals and changing circumstances. The potential for higher returns on investment and the ability to adjust coverage make universal life insurance an attractive choice for those who want both financial protection and the opportunity to grow their wealth over time. By offering a blend of insurance and investment benefits, universal life insurance provides a powerful tool for individuals to secure their family's future and achieve their long-term financial objectives.

Best Rating for Guardian Life Insurance: AM's Assessment

You may want to see also

Variable Universal Life Insurance: Offers investment options, providing potential for higher returns but also higher risk

Variable Universal Life Insurance, often referred to as VUL, is a type of life insurance that offers a unique blend of insurance protection and investment opportunities. It provides a way for individuals to secure their loved ones' financial future while also potentially growing their money through various investment options. This type of policy is particularly appealing to those who want more control over their insurance portfolio and are willing to take on some investment risk.

One of the key features of VUL is its flexibility. Policyholders can choose how much of their premium goes towards insurance coverage and how much is allocated to various investment accounts. This investment component is what sets VUL apart from traditional life insurance. It allows individuals to invest in a range of options, such as stocks, bonds, and mutual funds, which can offer the potential for higher returns compared to more conservative investment vehicles. However, this also means that the value of the policy's cash value can fluctuate, and there is a risk of losing some or all of the investment.

The investment aspect of VUL provides an opportunity for long-term growth. Policyholders can benefit from compound interest, where their investments can earn interest on both the initial amount invested and the previously earned interest. Over time, this can lead to substantial growth in the policy's value. Additionally, VUL policies often offer tax-deferred growth, meaning the earnings on investments are not taxed until they are withdrawn, providing a potential tax advantage.

However, it's important to understand the risks involved. The investment options in VUL can be complex, and the potential for higher returns comes with the possibility of greater volatility. If the markets perform poorly, the value of the policy's investments could decrease, impacting the overall value of the life insurance policy. Therefore, it is crucial for individuals to carefully consider their risk tolerance and investment goals before choosing this type of insurance.

In summary, Variable Universal Life Insurance offers a comprehensive approach to life insurance, combining insurance protection with investment opportunities. It provides policyholders with the potential for higher returns through various investment options, but it also carries the risk of investment loss. Understanding the features and risks of VUL is essential for anyone considering this type of insurance to ensure it aligns with their financial goals and risk profile.

Term Life Insurance: Annual Renewable Coverage Explained

You may want to see also

Final Expense Insurance: Covers funeral and burial expenses, often for older individuals with pre-existing conditions

When considering life insurance, it's important to understand the various types of coverage available to ensure you make the best choice for your needs. One specific type of life insurance that often gets overlooked is Final Expense Insurance, which provides a crucial safety net for individuals and their families. This type of insurance is designed to cover the costs associated with final arrangements, including funeral and burial expenses, which can be a significant financial burden for many families.

Final Expense Insurance is particularly beneficial for older individuals who may have pre-existing medical conditions. As people age, the likelihood of facing unexpected medical emergencies or critical illnesses increases. These situations often result in substantial medical bills, and without adequate insurance coverage, families might struggle to afford the necessary expenses. Final Expense Insurance steps in to provide a comprehensive solution, ensuring that the costs associated with end-of-life care are covered, allowing individuals to pass away with dignity and their families with peace of mind.

The beauty of this insurance lies in its simplicity and directness. It is a straightforward policy that pays out a lump sum upon the insured's death, covering the agreed-upon funeral and burial costs. This coverage is especially valuable for those who want to ensure their loved ones are not burdened with financial stress during an already difficult time. By having this insurance in place, individuals can rest assured that their final wishes will be respected, and their families will be financially protected.

For older individuals with pre-existing conditions, Final Expense Insurance can be a lifeline. Many traditional life insurance policies may not be suitable or affordable for this demographic due to health concerns. Final Expense Insurance, however, is tailored to meet the specific needs of older adults, providing them with the financial security they require without the extensive medical underwriting typically associated with other life insurance types. This makes it an ideal option for those who want to ensure their end-of-life expenses are covered without the added stress of complex insurance processes.

In summary, Final Expense Insurance is a specialized and essential component of life insurance coverage. It offers a straightforward solution to a challenging situation, providing financial protection for funeral and burial expenses. By considering this type of insurance, individuals can take control of their future and provide peace of mind for their loved ones, especially during a time of grief and loss. It is a wise decision that ensures a dignified farewell and financial security for the family.

Life Insurance: Securing Your Family's Future

You may want to see also

Frequently asked questions

The best type of life insurance depends on your individual needs and circumstances. Term life insurance is often recommended for those seeking coverage for a specific period, such as until a child is financially independent or a mortgage is paid off. It offers a straightforward and cost-effective solution with a defined term. Permanent life insurance, on the other hand, provides lifelong coverage and includes a savings component, making it suitable for long-term financial planning and legacy goals.

Determining the right coverage amount involves considering several factors. Start by evaluating your financial obligations and future expenses, such as mortgage payments, children's education costs, and any outstanding debts. Also, factor in your income replacement needs, ensuring your beneficiaries can maintain their standard of living in your absence. It's essential to strike a balance between adequate coverage and affordability, as a higher coverage amount may increase premiums.

Yes, there are several additional benefits and riders that can enhance your life insurance policy. These may include waiver of premium, which allows you to suspend payments if you become disabled, and a critical illness rider, providing an additional payout if you're diagnosed with a critical illness. Some policies also offer an accelerated death benefit, allowing you to access a portion of your death benefit if you're diagnosed with a terminal illness. These riders can provide valuable financial security and peace of mind.