Cash value life insurance is a type of permanent life insurance that includes a cash value feature. This means that the policy has a death benefit and also accumulates value in a separate account within the policy. This is possible because, with each premium payment, the money is split into three categories: the cost of insurance, fees and overhead, and the cash value. The cash value can be accessed by the policyholder during their lifetime and can be used for various purposes, such as paying for a child's education, supplementing retirement income, or buying a home. The cash value of life insurance is an attractive feature for those seeking lifelong financial protection and a savings component in their insurance plan.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Features | Cash value savings component |

| Use | Borrowing, withdrawing, paying policy premiums |

| Compared to term life insurance | More expensive, no expiry, higher premiums |

| Interest | Accrues interest, grows tax-deferred |

| Tax | Withdrawals are usually tax-free |

| Policy loans | Allowed, charged at a low annual interest rate |

| Partial withdrawals | Permissible, may reduce death benefit |

| Policy cancellation | Receive net cash value, minus fees and charges |

What You'll Learn

Permanent life insurance policies

There are several types of permanent life insurance policies, each offering different features and levels of flexibility. Here are some of the most common types:

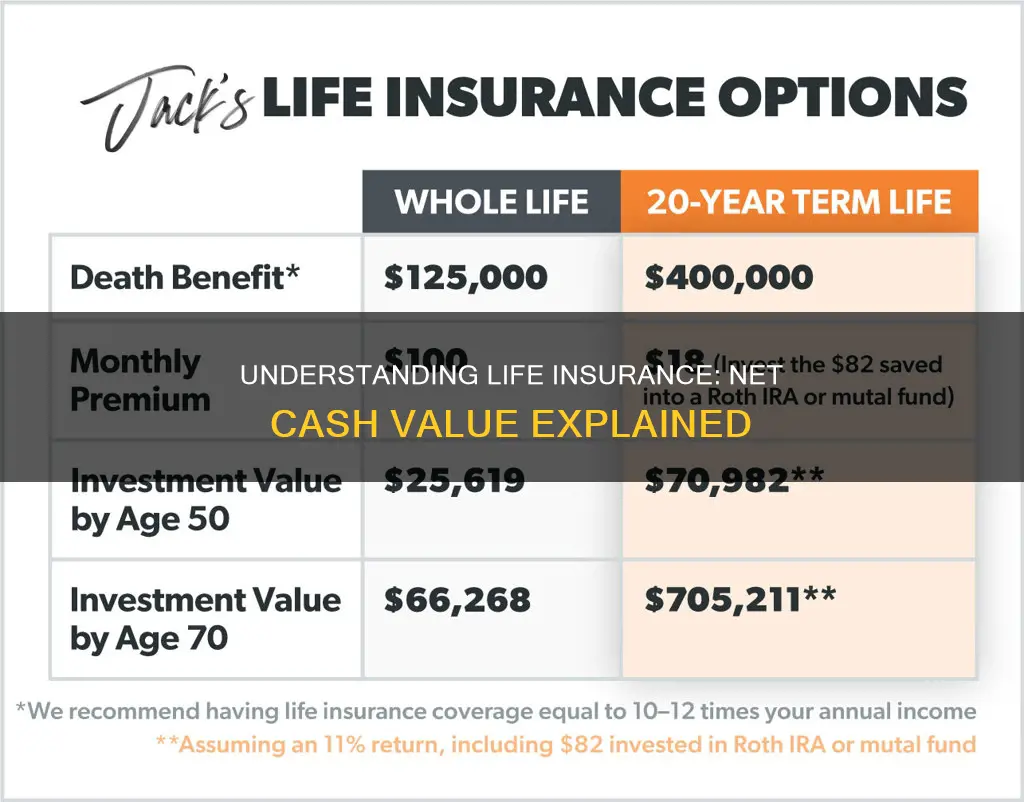

- Whole Life Insurance: This is the most common type of permanent insurance policy, offering a death benefit along with a savings account. Whole life insurance policies have fixed and guaranteed premiums, a guaranteed rate of return on cash value, and a fixed death benefit. The cash value component increases over time based on the interest rate. While whole life insurance offers predictability and the opportunity to earn dividends, it tends to be more expensive and less flexible than other options.

- Universal Life Insurance: Universal life insurance (UL) policies offer more flexibility than whole life insurance. They allow for adjustments to premium payments and death benefits within certain parameters. The cash value gains within a UL policy can be based on market interest rates, the performance of an index, or tied to investment subaccounts that the policyholder can choose and manage. UL policies tend to be less expensive than whole life insurance but still more costly than term life insurance.

- Variable Universal Life Insurance: This type of policy combines the features of variable and universal life insurance. It offers the investment risks and rewards of variable life insurance, along with the ability to adjust premiums and death benefits characteristic of universal life insurance.

- Variable Life Insurance: Variable life insurance allows policyholders to tie their policy's cash value to specific investment accounts and manage those allocations. The cash value can be invested in aggregated portfolios offered by the insurer, similar to mutual funds.

When considering a permanent life insurance policy, it is important to weigh the benefits of lifelong coverage and the accumulation of cash value against the typically higher premiums and potential complexities of these policies. Permanent life insurance may be particularly suitable for individuals who want to ensure a death benefit payout for their loved ones regardless of when they pass away or those who want to capitalise on the cash value or investment component.

Term Life Insurance: Living Benefits and Their Impact

You may want to see also

Interest and tax advantages

Cash value life insurance is a form of permanent life insurance that lasts for the lifetime of the holder and features a cash value savings component. The cash value of life insurance earns interest, and taxes on the accumulated earnings are deferred.

Accumulation of Cash Value

A portion of each premium payment made by the policyholder is deposited into an interest-bearing savings account, allowing the cash value to grow over time. This cash value can be accessed for various purposes during the policyholder's lifetime.

Tax-Deferred Growth

The cash value component of life insurance grows tax-deferred, meaning the IRS does not tax the accumulated earnings. This allows the cash value to grow without being reduced by taxes.

Tax-Free Withdrawals

Policyholders can withdraw money from the cash value of their life insurance, and these withdrawals are considered a return of the premiums paid for the policy. As a result, policyholders can withdraw their money without paying taxes, as long as they do not withdraw more than the amount they have paid into the cash value.

Policy Loans

Policyholders can borrow against the accumulated cash value, and these loans are not subject to income tax. The interest rates on these loans are typically quite low, and the loan does not appear on the policyholder's credit report. However, if the policyholder passes away before repaying the loan, the value of the loan will be deducted from the death benefit paid to the beneficiaries.

Death Benefit

Upon the death of the policyholder, the insurance company pays the full death benefit, which is also tax-free to the beneficiaries.

Life Insurance: Choosing the Right Policy for You

You may want to see also

Cash value withdrawal

Cash value life insurance policies provide lifelong coverage and an investment account. Whole life, universal life, and variable life policies are all types of cash value life insurance. Each time you make a premium payment, a portion of it goes into the investment account, which is called the cash value. This money grows with interest over time.

There are several ways to access the cash value of your life insurance policy. You can borrow against the cash value, make a withdrawal, use the cash value to pay premiums, or surrender your policy for its net cash value. Here is an overview of each option:

Borrowing Against Cash Value

You can borrow money from your insurer, with the cash value of your policy used as collateral. The loan can be used to pay for medical expenses, a car, or anything else you might need. There are no underwriting or credit check requirements, and you can keep the loan for as long as you want. However, if you pass away before the loan is repaid, the value of the loan will be deducted from the death benefit your beneficiaries receive. Borrowing against your policy's cash value typically comes with low-interest rates, but you need to either pay interest out of pocket or carefully monitor the size of the loan relative to the policy's cash value. If the loan ever exceeds the policy's cash value, the policy will lapse and your coverage will be canceled.

Withdrawing Cash Value

You can make a partial or full withdrawal of the cash value. A partial withdrawal may be ideal if you want to keep your life insurance but reduce the overall death benefit. Withdrawing more than you've paid into the cash value may result in taxes, and any withdrawal will typically reduce the death benefit. Withdrawing cash value can also slow the growth of your cash value account.

Using Cash Value to Pay Premiums

Variable and universal life insurance policies allow you to use the policy's cash value to pay premiums. This strategy requires careful monitoring of the cash value to ensure it doesn't drop too far, as this could result in a loss of coverage.

Surrendering Policy for Net Cash Value

If you want to cash in your life insurance policy early and surrender your coverage to the insurer, you will receive the policy's net cash value, which is the cash value minus fees. Surrendering your policy will result in the loss of coverage, meaning your beneficiaries will not receive a death benefit.

Beagle Street: Does Life Insurance Cover Suicidal Death?

You may want to see also

Cash value as collateral

Cash value life insurance policies provide lifelong coverage, with an investment account that accumulates cash value. This cash value can be used as collateral for a loan.

How to Use Cash Value Life Insurance as Collateral

The cash value of a life insurance policy can be used as collateral on a bank loan, immediate financing arrangement, or other types of credit facilities. This is known as a collateral assignment. This is only possible with permanent life insurance policies that have a cash value that grows over time, such as whole life insurance and universal life insurance. Term life insurance policies do not accumulate cash value and are therefore not suitable for this purpose.

To use your life insurance policy as collateral, you must go through the following steps:

- Set up a cash value life insurance policy with the help of a broker.

- Wait for the policy to accumulate value. This may take several years.

- Apply for a loan with a lender, such as a bank or another creditor.

- List your cash value life insurance policy as an asset to be used as collateral on your loan application.

- Contact your insurance company to conditionally appoint your lender as the primary beneficiary of the policy's death benefit.

- Use the loan funds to achieve your financial goals.

Benefits of Using Cash Value Life Insurance as Collateral

Using cash value life insurance as collateral has several benefits:

- Your personal property and assets are protected. If you are unable to repay the loan, you are not risking your home, car, or other belongings.

- Loan proceeds are tax-free, meaning you pocket more of the loan amount.

- You can obtain affordable interest rates. Secured loans mean less risk for the lender, which often results in lower interest rates for you.

Risks of Using Cash Value Life Insurance as Collateral

There are also some risks associated with using cash value life insurance as collateral:

- If you outlive your projected death date, the lender may ask for additional collateral or early repayment of the loan.

- Interest and return rates can change. If bank loan rates increase or the rate of your cash value growth decreases, your cash value may not be able to keep up.

- Your policy could be cancelled if you don't repay the loan. This would leave your family without coverage, and you would have to start over with life insurance.

- Your death benefit could be reduced. If you don't repay the loan, the lender can deduct the amount you owe from your death benefit, leaving your loved ones with less money or nothing at all.

Alternatives to Using Cash Value Life Insurance as Collateral

There are alternative options to using cash value life insurance as collateral, such as:

- HELOC (Home Equity Line of Credit): This allows you to borrow against the equity in your home, but it puts your home at risk if you fail to repay.

- Home Equity Loan: This involves borrowing against your home's value and typically comes with fixed interest rates.

- Unsecured Loan: This type of loan doesn't require collateral, making it a less risky option for your assets. However, interest rates may be higher, and credit requirements may be more stringent.

Employer Life Insurance: Borrowing from Your Policy?

You may want to see also

Whole, universal and variable universal life insurance

Whole life insurance is a type of permanent insurance that lasts the entire life of the policyholder, with premiums being paid regularly. It is believed to be one of the most popular choices in the life insurance market. The cash value of whole life insurance can grow with potential tax savings, and the death benefit is guaranteed as long as the premiums are paid. The premiums in this type of plan are usually fixed.

Universal life insurance is a type of permanent life insurance that offers the ability to adjust premium payment amounts (within certain parameters). It also allows you to tap into the policy's cash value. Indexed universal life and variable universal life insurance also offer the chance for larger cash value growth. Universal life insurance can be in force for the rest of your life (assuming premium payments are made).

Variable universal life insurance is very similar to an indexed universal policy. The primary difference is that you invest the cash value in grouped investments similar to mutual funds. You will receive a list of potential investments, along with their performance history and fees. You can choose how much of the cash value is invested in each.

Each variable universal life insurance investment has management fees. The management and administrative fees for variable universal policies are typically higher than for other universal life insurance policies. So, even if you choose great investments, the fees can significantly eat into your returns.

Life Insurance and Stroke: What You Need to Know

You may want to see also

Frequently asked questions

The net cash value of a life insurance policy is the amount of money that the policyholder will receive if they cancel their permanent life insurance policy. It is also known as the net surrender cash value.

The cash value of a life insurance policy is the amount of money that has accumulated in the policyholder's account. The surrender value is usually lower than the cash value for a number of years, as part of the premiums goes toward agent commissions, office personnel salaries, lab fees, etc. The net cash value represents the cash value minus all fees, surrender charges and any outstanding loans against the policy.

The biggest benefit of permanent life insurance is that it provides the insured with a permanent death benefit for as long as they live at rates based on the age they were at the time of application. It also has an investment component that earns interest, provides a living benefit, and has level premiums for a lifetime.