When you purchase life insurance, it's important to understand the timeline for coverage and the process that follows. After buying a policy, there is typically a waiting period, known as the elimination period, during which the insurance company may not provide benefits. This period can vary depending on the type of policy and the insurance provider. Once the waiting period is over, the policyholder can start receiving benefits if a covered event, such as death or a specified illness, occurs. It's crucial to review the terms and conditions of your specific policy to know the exact timeline and any potential exclusions or limitations.

What You'll Learn

- Initial Waiting Period: Understand the policy's grace period before coverage begins

- Claim Process: Learn how to file a claim and receive benefits

- Policy Activation: Discover how and when the policy becomes active

- Benefits Payout: Explore the timeline for receiving death benefits

- Policy Review: Regularly assess the policy's performance and coverage

Initial Waiting Period: Understand the policy's grace period before coverage begins

When you purchase a life insurance policy, it's important to understand that there is typically an initial waiting period, also known as the grace period, before the full coverage kicks in. This waiting period is a standard feature of most life insurance policies and serves as a safety net for both the insurer and the policyholder. During this time, the insurance company evaluates the risk associated with the policy and ensures that the coverage is appropriate for the insured individual.

The duration of the initial waiting period can vary depending on the type of policy and the insurance provider. It is usually a set period, often ranging from 30 to 90 days, after which the policy becomes fully effective. For instance, if you purchase a term life insurance policy with a 30-day waiting period, the coverage will start 30 days after the policy is issued, provided there are no pre-existing conditions or exclusions that might affect the insurer's decision.

This grace period is in place to prevent fraudulent activities and ensure that the insurance company is not providing coverage for an individual who may have recently developed a serious health condition or an existing illness that could impact their longevity. It also allows the insurer to assess the insured's health and lifestyle, especially if they have recently undergone significant changes, such as a major surgery or a lifestyle modification.

During this waiting period, if the insured individual passes away, the insurance company may not provide any financial benefit to the policyholder. However, this is a standard clause in most policies, and it is essential to review the terms and conditions carefully before purchasing. Understanding the waiting period is crucial as it ensures that the policyholder is aware of the coverage's activation timeline and any potential limitations.

In summary, the initial waiting period is a critical aspect of life insurance, providing a buffer zone for both the insurer and the policyholder. It is a standard practice that allows for a thorough evaluation of the risk and ensures that the coverage is appropriate and beneficial for the insured individual. Being aware of this grace period can help individuals make informed decisions when selecting and purchasing life insurance policies.

Beneficiary Life Insurance: Taxable or Not?

You may want to see also

Claim Process: Learn how to file a claim and receive benefits

The claim process for life insurance is a crucial step in ensuring that your beneficiaries receive the financial support they are entitled to after your passing. Here's a comprehensive guide on how to navigate this process:

- Understand the Claim Process: When you purchase life insurance, the policy includes a set of instructions and procedures for making a claim. Familiarize yourself with these details. Typically, the process involves notifying the insurance company of the insured's death and providing the necessary documentation to support the claim.

- Notify the Insurance Company: As soon as you become aware of the insured's passing, contact the life insurance company. You can usually reach out via phone or email, using the contact information provided on your policy documents. Inform the company about the death and request a claim form or application. Be prepared to provide personal details of the deceased, such as their full name, date of birth, and policy number.

- Gather Required Documents: The insurance company will require specific documents to process the claim. These may include a certified copy of the death certificate, which can be obtained from the local vital records office. You might also need to provide the original life insurance policy document, the beneficiary's identification, and any other supporting paperwork. Ensure that all documents are accurate and up-to-date.

- Complete and Submit the Claim Form: Fill out the claim form provided by the insurance company. This form typically includes sections for personal details, policy information, and beneficiary details. Provide all the necessary information accurately and completely. Submit the completed form, along with the required documents, to the insurance company's claims department.

- Timeline for Processing: The timeline for claim processing can vary depending on the insurance company and the complexity of the case. Generally, the process involves an initial review, verification of the claim, and a decision on benefit payment. After submitting the claim, the insurance company will review the information and may contact you for additional details. This step can take a few days to a few weeks. Once approved, the benefits will be paid out according to the policy's terms.

- Receive Benefits: Upon successful claim processing, the life insurance benefits will be disbursed to the designated beneficiaries. The timeline for receiving the payout depends on the insurance company's procedures and the method of payment chosen. Common payment methods include direct deposit to a bank account or a check sent via mail. It is essential to keep the beneficiaries informed throughout this process to ensure a smooth transition of benefits.

Remember, each insurance company may have specific requirements and procedures, so it's crucial to follow their guidelines. Timely action and proper documentation are key to a successful claim process, ensuring that your loved ones receive the financial support they need during a difficult time.

Cashing in on Gerber Life Insurance: A Step-by-Step Guide

You may want to see also

Policy Activation: Discover how and when the policy becomes active

When you purchase a life insurance policy, the process doesn't end with the signature on the dotted line. The activation of your policy is a crucial step that ensures you're protected as soon as possible. Here's a breakdown of what happens and when your policy becomes active:

Understanding the Waiting Period:

Most life insurance policies have a waiting period, often referred to as the "elimination period." This is a predetermined time frame (usually ranging from 30 days to 2 years) during which the policy doesn't provide any benefits. The waiting period serves as a safety net for the insurance company, allowing them to verify the insured individual's health and lifestyle before committing to long-term coverage.

Activation Timeline:

- Finalization of Purchase: Once the insurance company receives all the necessary documentation, including proof of payment and any required medical exams, they will process your application. This typically takes a few days to a week.

- Waiting Period Commencement: After processing, the waiting period begins. During this time, it's essential to disclose any significant changes in your health or lifestyle to the insurance company. Failing to do so could lead to a claim being denied if a pre-existing condition worsens or a new health issue arises.

- Policy Activation: At the end of the waiting period, your policy officially becomes active. This means you're now fully covered by the terms and conditions outlined in your policy document. Any benefits, such as death benefit payouts or disability income, will be available if the need arises.

Important Considerations:

- Review Your Policy: Carefully review your policy documents to understand the specific waiting period and any other relevant terms.

- Disclose Information Promptly: Be transparent with the insurance company about your health history and any lifestyle changes.

- Contact Your Insurer: If you have any questions or concerns about the activation process, don't hesitate to contact your insurance provider for clarification.

Remember, the waiting period is a standard industry practice and ensures that both you and the insurance company are protected. Once your policy is active, you can have peace of mind knowing that you're financially protected and your loved ones are cared for.

Kobe Bryant's Life Insurance: What Was His Plan?

You may want to see also

Benefits Payout: Explore the timeline for receiving death benefits

When it comes to life insurance, understanding the timeline for receiving death benefits is crucial for both the policyholder and their beneficiaries. The process can vary depending on the type of policy and the insurance company, but here's a breakdown of the typical timeline for benefits payout:

Initial Application and Approval: The first step is the purchase and application process. Once the policy is in force, the insurance company will review the application and conduct a medical examination if required. This step ensures the policyholder's eligibility and helps determine the premium amount. The timeline for this process can vary, but it typically takes a few weeks to a month. During this period, the insurance company assesses the policyholder's health and financial information to make an informed decision.

Policy Issuance and Waiting Period: After approval, the insurance company will issue the policy, which includes the death benefit amount. However, there is often a waiting period, also known as the "elimination period," before the death benefit becomes payable. This waiting period can range from 30 days to several years, depending on the policy terms. For instance, a term life insurance policy might have a 30-day waiting period, while a whole life insurance policy could have a longer waiting period to ensure the policyholder's long-term commitment.

Death and Benefits Payout: When the policyholder passes away, the beneficiary must notify the insurance company promptly. The company will then verify the death and initiate the claims process. This verification process can take a few days to a week. Once confirmed, the insurance company will pay out the death benefit according to the policy terms. The payout is typically made within a few weeks to a month after the verification process is complete.

Beneficiary's Role: It's essential for beneficiaries to provide all necessary documentation and information promptly to ensure a smooth claims process. This includes death certificates, policy documents, and any other relevant paperwork. The insurance company will guide the beneficiaries through the process and provide the necessary forms to complete the claim.

Policy Types and Variations: It's worth noting that the timeline can vary based on the type of life insurance policy. For instance, term life insurance policies typically have a straightforward claims process, while whole life insurance policies may involve more complex procedures due to their permanent nature. Additionally, some policies might offer accelerated death benefits, allowing policyholders to access a portion of the death benefit if they are diagnosed with a terminal illness, which can expedite the payout process.

Life Insurance Certificate Rider: What You Need to Know

You may want to see also

Policy Review: Regularly assess the policy's performance and coverage

When you purchase life insurance, it's essential to understand that the policy is a long-term commitment, and its effectiveness can change over time. Regular policy reviews are a crucial aspect of maintaining and optimizing your insurance coverage. Here's a detailed guide on why and how to conduct these reviews:

Understanding the Need for Policy Reviews:

Life insurance policies are not static documents; they evolve with your life circumstances, financial goals, and changing needs. Over time, your risk profile may alter due to various factors. For instance, getting married, having children, purchasing a home, or experiencing career advancements can significantly impact your insurance needs. Additionally, changes in the insurance market, policy terms, and coverage options might also require a re-evaluation of your existing policy. Regular reviews ensure that your insurance remains relevant and adequate to protect your loved ones and financial interests.

Frequency of Policy Reviews:

It is generally recommended to review your life insurance policy annually or whenever there are significant life changes. Annual reviews provide an opportunity to assess the policy's performance and ensure it aligns with your current situation. However, if you experience major life events like a significant career change, the birth of a child, or a substantial financial milestone, more frequent reviews might be necessary. These reviews allow you to make timely adjustments to your policy, ensuring it provides the desired level of protection.

Key Areas to Assess During a Policy Review:

- Coverage Amount: Evaluate whether the death benefit (the amount paid out upon your passing) is still sufficient to cover your family's expenses, mortgage, education costs, and other financial obligations. Consider your current and future income, as well as the potential for inflation, when making this assessment.

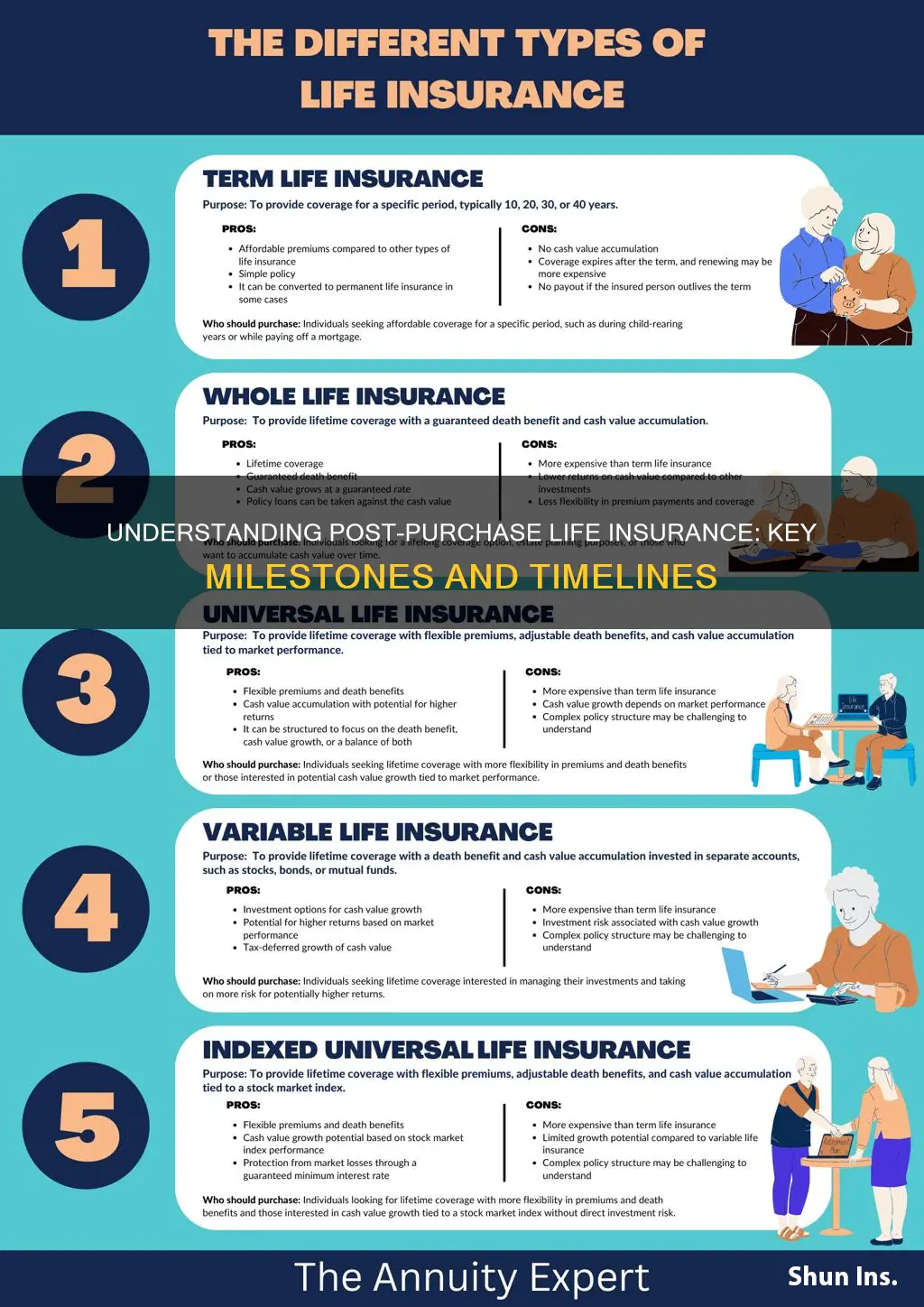

- Policy Type and Riders: Understand the different types of life insurance policies (term, whole life, universal life) and the riders (optional add-ons) attached to your plan. Review the terms and conditions of these riders to ensure they provide the desired benefits and are worth the additional cost.

- Premiums and Costs: Assess the premium payments and any associated fees. Check if the premiums are still affordable and consider the long-term financial implications. Look for opportunities to optimize your policy without compromising coverage.

- Health and Lifestyle Changes: Review your health and lifestyle factors, as these can impact your insurance rates and coverage. Any significant health improvements or changes in lifestyle habits might lead to lower premiums, while adverse changes could result in increased costs or policy adjustments.

- Market and Industry Trends: Stay informed about market trends and changes in the insurance industry. New products, policy updates, or regulatory changes might offer better options for policyholders, and reviewing industry news can help you make informed decisions.

By regularly assessing your policy's performance and coverage, you can ensure that your life insurance remains a valuable asset, providing the necessary financial security for your loved ones. It empowers you to make proactive decisions, adapt to life's changes, and maintain a comprehensive safety net.

Primerica Life Insurance: Drug Testing Requirements Explained

You may want to see also

Frequently asked questions

Life insurance typically becomes effective immediately after the policy is issued and the initial premium is paid. However, there might be a waiting period, known as the "incontestability period," which is usually around 2 to 3 years from the date of issue. During this period, the insurance company cannot contest the policy's coverage or deny claims due to pre-existing conditions.

Yes, you can typically cancel your life insurance policy within a certain period after purchase, often referred to as the "cooling-off period" or "free look period." This period varies by jurisdiction and insurance company but is usually around 10 to 14 days from the date of delivery of the policy documents. If you cancel during this time, you may receive a full refund of any premiums paid, minus any applicable fees.

Missing a premium payment can lead to a lapse in coverage. The insurance company will typically provide a grace period, usually 30 days, after which the policy may be terminated. If the policy is terminated, coverage will end, and you may need to go through the entire process again to reinstate the policy. It's important to set up automatic payments or reminders to ensure timely premium payments.

Most life insurance policies allow for changes to be made during the initial period, often referred to as the "conversion period" or "policy review period." This period typically lasts for a few months to a year from the date of purchase. During this time, you can make adjustments to coverage, increase or decrease the death benefit, or add riders to enhance the policy's benefits. After this period, changes may be subject to medical underwriting and other restrictions.