Life insurance is a contract that ensures your loved ones are financially protected after your death. The payout amount, known as a death benefit, can be used to cover funeral and burial expenses, pay off debts, or fund an inheritance. When choosing a life insurance policy, it's important to consider your loved ones' future financial needs, the length of coverage required, and your budget.

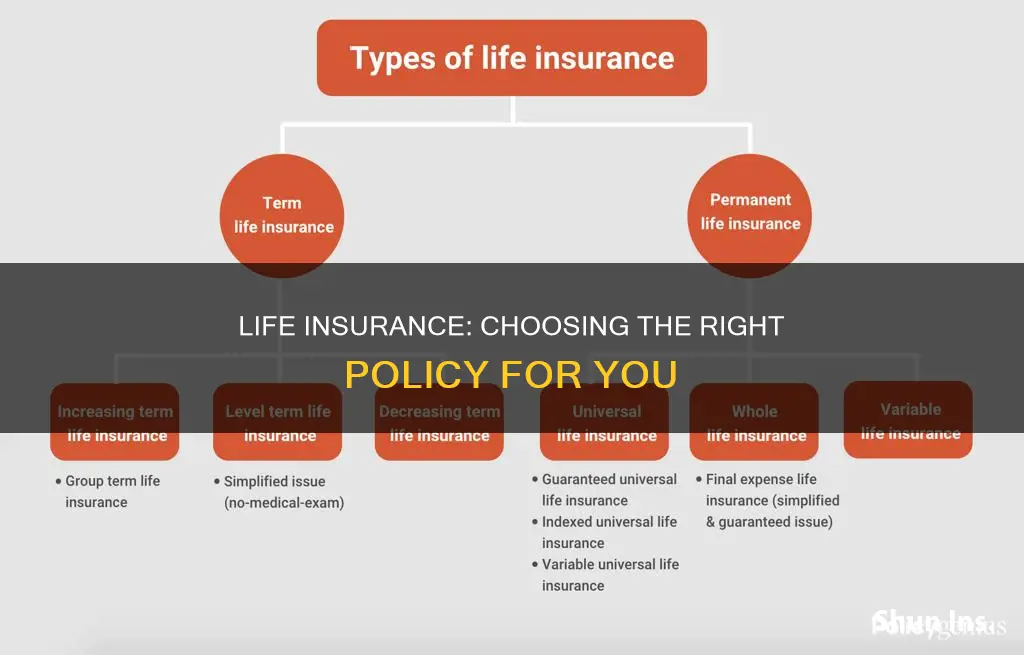

There are two main types of life insurance: term and permanent. Term life insurance provides coverage for a specified period, such as 5 to 30 years, and is ideal for those who want to protect their loved ones during their prime working years or until their children are grown. On the other hand, permanent life insurance lasts a lifetime and often includes a savings component that grows in value over time. While term life insurance is generally more affordable, permanent life insurance offers the advantage of lifelong coverage and the ability to build cash value.

Within these two main categories, there are several subtypes to consider. For example, whole life insurance, a type of permanent life insurance, offers guaranteed rates and coverage for life, while universal life insurance allows for adjustable premiums and has a cash value component tied to market interest rates. Variable life insurance is another option, where the cash value is tied to investment accounts, offering the potential for higher gains but also carrying more risk.

Additionally, there are specialized types of life insurance, such as burial insurance or final expense insurance, which cover end-of-life expenses, and mortgage life insurance, which covers the balance of your mortgage.

When deciding how much life insurance to get, it's recommended to calculate your financial obligations, including debts, future needs, and income replacement, and then choose a coverage amount that will ensure your loved ones can maintain their standard of living.

| Characteristics | Values |

|---|---|

| Purpose | Provide financial protection for loved ones, pay off debts, fund an inheritance, cover funeral and burial expenses |

| Type | Term life, final expense, permanent life, whole life, universal life, variable life, burial insurance, final expense insurance, mortgage life insurance, credit life insurance, accidental death and dismemberment insurance, joint life insurance |

| Coverage length | Temporary (1, 5, 10, 15, 20, 25 or 30 years), permanent |

| Cost | Dependent on type of insurance, age, health, gender, amount of coverage, etc. |

| Payout | Dependent on type of insurance and coverage amount |

| Application process | Medical exam, health questionnaire, big data algorithms |

What You'll Learn

Term life insurance

When considering a term life insurance policy, it is important to evaluate your loved ones' future financial needs and your budget. You can use online calculators to estimate the coverage amount you may need, taking into account factors such as your income, mortgage, future needs, and existing assets.

Compared to whole life insurance, term life insurance rates are typically lower since you are only paying for a specific period. If the policyholder outlives the term, the insurance company will keep the premium payments, and there is no cash value accumulation. However, term life insurance can be a great option for those who want to plan around a specific timeline and budget.

Life Insurance: What's Covered and What's Not

You may want to see also

Final expense insurance

One of the main benefits of final expense insurance is that it does not require a medical exam for qualification. Instead, individuals need only answer a few health questions on the application. The approval process is quick and easy, and coverage can often be issued on the same day as the application. Final expense insurance policies also offer flexible payment options, allowing individuals to align their payments with their Social Security deposits.

The cash benefit from final expense insurance can be used to cover various end-of-life expenses, including funeral and burial costs, medical needs, legal and accounting costs, and outstanding credit card bills. The beneficiary can use the payout as they see fit, and any remaining funds after funeral-related expenses can be used to pay off other debts.

When considering final expense insurance, it is important to look at your monthly expenses and potential funeral costs to determine the appropriate coverage amount. Final expense insurance is a great option for individuals who want to provide financial support for their loved ones but find the cost of traditional whole life insurance policies too high.

Canceling Gerber Life Insurance: A Step-by-Step Guide

You may want to see also

Permanent life insurance

There are several types of permanent life insurance policies, including:

- Whole life insurance: This is the most common type of permanent life insurance. It features fixed premiums and a slowly accumulating cash value. Premiums can be paid up to a certain age, for a fixed number of years, or as a single payment.

- Universal life insurance: This type of policy allows for adjustable premiums and death benefits, giving the policyholder flexibility as their financial circumstances change. However, adjusting premiums may negatively impact the cash value and cause them to increase over time.

- Variable universal life insurance: This policy combines universal life insurance with a savings component that can be invested in a variety of ways, offering more growth potential but also more risk.

- Indexed universal life insurance: This type of policy is similar to universal life insurance, but the cash value grows based on a chosen stock market index. If the chosen index performs well, the account will grow; if not, some companies allow it to grow at a minimum rate.

The main benefit of permanent life insurance is that it offers lifelong coverage, whereas term life insurance only covers a specific period. Additionally, permanent life insurance provides a cash value component that can be accessed during the policyholder's lifetime. However, permanent life insurance is significantly more expensive than term life insurance, and certain policies require careful investment monitoring to ensure the cash value performs well.

MetLife Insurance: Accidental Death Coverage and Exclusions

You may want to see also

Whole life insurance

There are several types of whole life insurance policies, including level payment, single premium, limited payment, and modified whole life insurance. Level payment policies have unchanged premiums throughout the duration of the policy, while single premium policies involve a one-time large premium payment. Limited payment policies involve higher premiums for a limited number of years, and modified whole life insurance offers lower premiums initially, followed by higher premiums in later years.

When considering whole life insurance, it is important to compare different insurance providers and their financial strength. Additionally, factors such as age, occupation, and health history can impact the cost of whole life insurance. Overall, whole life insurance can provide valuable financial protection and peace of mind for individuals and their loved ones.

Usaa Life Insurance: Understanding Exclusions and Their Impact

You may want to see also

Universal life insurance

The cash value earns an interest rate set by the insurer, which can change frequently, although there is usually a minimum rate. If the cash value decreases due to underperformance, the policyholder's premiums could eventually increase. Additionally, if the cash value falls to zero and the premiums do not cover the cost of insurance, the policy may lapse.

When choosing a life insurance policy, it is important to consider your loved ones' individual needs and future finances. Universal life insurance can provide financial protection, pay off debts, or fund an inheritance. It is essential to evaluate your budget, the financial situation of your loved ones, and the length of time they will require financial support to determine if universal life insurance is the best option for your needs.

Cobra Coverage: Life Insurance Benefits Explained

You may want to see also

Frequently asked questions

Life insurance is a contract under which an insurance company agrees to pay a specified amount after the death of an insured party, as long as the premiums are paid current. The payout amount is called a death benefit. Policies give insured people the assurance that their loved ones will have financial protection and peace of mind after their death.

The younger and healthier you are, generally, the less you’ll pay for premiums. However, older people can still get life insurance. It is recommended that you purchase at least 10 times your annual income in coverage.

There are two main types of life insurance: permanent and term. Permanent life insurance policies do not have an expiration date, meaning you’re covered for life as long as your premiums are paid. Term life insurance, on the other hand, only covers you for a set number of years and does not accumulate cash value.