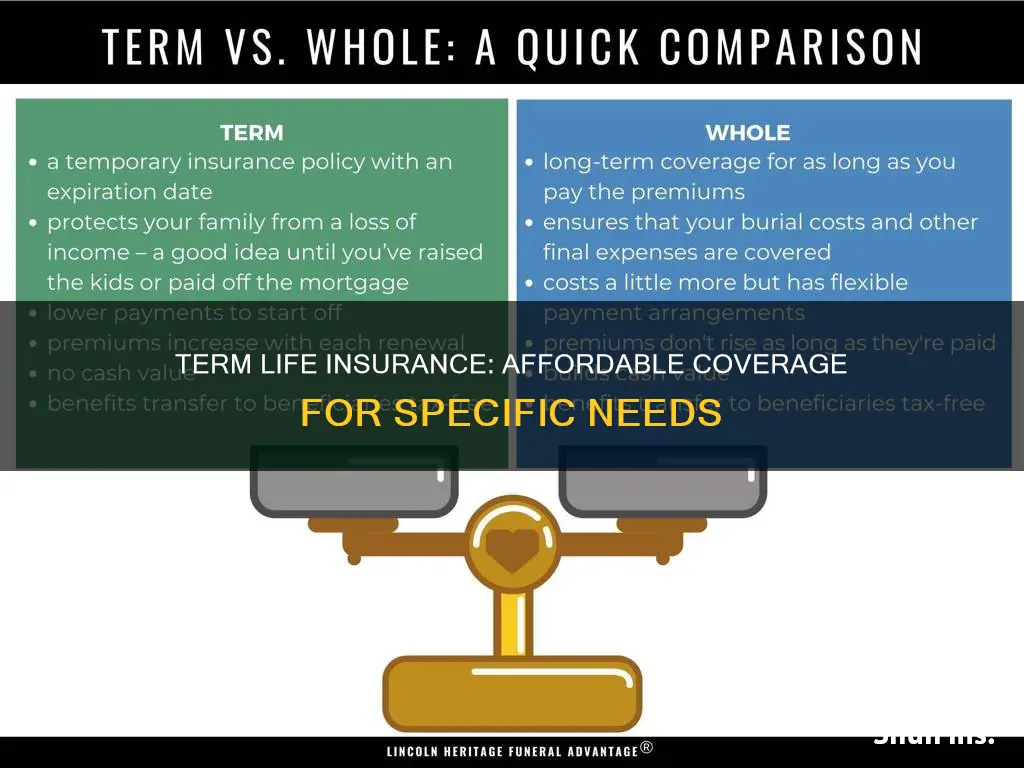

Term life insurance is a type of coverage that provides financial protection for a specific period, typically 10, 20, or 30 years. It is a straightforward and cost-effective way to secure your loved ones' financial future by offering a lump sum payment (death benefit) to your beneficiaries if you pass away during the term. This insurance is particularly beneficial for those who want to cover short-term financial obligations, such as mortgage payments, children's education expenses, or business startup costs. Unlike permanent life insurance, term life insurance does not accumulate cash value, making it a simpler and more affordable option for individuals seeking pure protection during a defined period.

What You'll Learn

- Affordable Coverage: Provides cost-effective protection for a specific term, ideal for short-term needs

- Fixed Premiums: Consistent payments over the term, offering budget-friendly insurance

- Death Benefit: A lump sum payout upon death, covering financial obligations

- Term Lengths: Customizable durations for tailored protection, from 10 to 30 years

- No Lapse: Ensures coverage doesn't expire, unlike permanent life insurance

Affordable Coverage: Provides cost-effective protection for a specific term, ideal for short-term needs

Term life insurance is a type of coverage that offers a straightforward and affordable way to protect your loved ones for a specific period. It is an excellent solution for individuals seeking cost-effective protection during a particular phase of their lives, often referred to as a "short-term need." This type of insurance is particularly beneficial for those who want to provide financial security for their families without breaking the bank.

The beauty of term life insurance lies in its simplicity and affordability. It is designed to cover a specific period, such as 10, 20, or 30 years, depending on the policyholder's needs. During this term, the insurance company promises to pay out a predetermined death benefit to the designated beneficiaries if the insured individual passes away. The key advantage is that the premiums for term life insurance are typically lower compared to other types of life insurance, making it an attractive option for those on a budget.

For short-term needs, such as covering mortgage payments, funding children's education, or providing financial support during a career transition, term life insurance can be a perfect fit. It ensures that your family has the necessary financial resources to manage these obligations in the event of your untimely demise. For example, if you have a 30-year mortgage and a family that relies on your income, a 20-year term life insurance policy can provide the peace of mind that your mortgage will be paid off and your family's living expenses will be covered if something happens to you.

One of the significant advantages of term life insurance is its flexibility. Policyholders can choose the coverage amount based on their specific needs and financial goals. For instance, if you want to cover a substantial mortgage, you can opt for a higher death benefit. Additionally, the premiums remain consistent throughout the term, providing predictable expenses. This predictability is especially valuable for budgeting and financial planning.

In summary, term life insurance is an affordable and efficient way to address short-term financial obligations. It offers a simple yet powerful solution to ensure your family's well-being during critical periods. By providing cost-effective protection for a defined term, this type of insurance allows individuals to focus on other aspects of their lives, knowing that their loved ones are financially secure. It is a practical choice for those seeking a practical and affordable way to manage their family's financial future.

Digital Life Verification: ICICI Prudential's Online Insurance Process

You may want to see also

Fixed Premiums: Consistent payments over the term, offering budget-friendly insurance

Term life insurance is a popular and straightforward way to protect your loved ones financially during a specific period. One of its most appealing features is the predictability and consistency it offers in terms of premiums. When you opt for a term life insurance policy, you agree to pay a fixed amount of money, known as the premium, for a predetermined period, typically 10, 15, 20, or 30 years. This structured approach to insurance payments provides several advantages.

Firstly, fixed premiums ensure that your budget remains stable and predictable. Unlike some other insurance products, term life insurance does not have variable premiums that can fluctuate based on market conditions or changes in your personal circumstances. Knowing exactly how much you will pay each month, quarter, or year allows you to plan your finances effectively and avoid unexpected financial strain. This predictability is especially beneficial for long-term financial planning, as you can allocate your resources accordingly without the worry of sudden premium increases.

Secondly, the consistent payment structure of term life insurance makes it an affordable and cost-effective solution for many individuals. Since the premiums are fixed, you can calculate the total cost of the insurance over the term, which can be a valuable tool for budgeting and financial management. This transparency enables you to assess whether the coverage is suitable for your needs and financial capabilities. Additionally, the simplicity of fixed premiums means there are no hidden costs or surprises, making it easier to compare different policies and choose the one that best fits your requirements.

For those who prioritize financial stability and predictability, term life insurance with fixed premiums is an excellent choice. It provides a sense of security, knowing that your loved ones will have a financial safety net during the agreed-upon term. Whether you're a young professional starting your career or a family looking to protect your assets, this type of insurance offers a straightforward and reliable approach to life insurance. By understanding the benefits of fixed premiums, you can make an informed decision about your insurance needs and ensure that your loved ones are protected without the stress of unpredictable costs.

Understanding Voluntary Life Insurance Under Section 125

You may want to see also

Death Benefit: A lump sum payout upon death, covering financial obligations

Term life insurance is a type of coverage that provides a financial safety net for your loved ones in the event of your untimely passing. One of its key benefits is the death benefit, which is a lump sum payment made to your beneficiaries when you pass away during the term of the policy. This payout is designed to help cover various financial obligations and ensure your family's financial security.

The death benefit can be a crucial financial tool to address several critical aspects of your family's life. Firstly, it can help pay off any outstanding debts, such as mortgages, loans, or credit card balances. By providing a lump sum, term life insurance ensures that your family doesn't have to worry about these financial burdens during a difficult time. This is especially important if you are the primary breadwinner, as your income is suddenly replaced.

Additionally, the death benefit can be utilized to cover the costs associated with your children's education. It can provide the necessary funds to ensure your children's future, covering tuition fees, books, and other educational expenses. This aspect of term life insurance is particularly valuable for families with young children or those planning for long-term financial goals.

Furthermore, the lump sum payout can be used to replace lost income, ensuring that your family maintains their standard of living. It can cover daily expenses, such as groceries, utilities, and other household costs, providing financial stability during a time of grief and adjustment. This aspect is often overlooked but can significantly impact your family's well-being.

In summary, the death benefit of term life insurance is a powerful tool to provide financial security and peace of mind. It ensures that your loved ones are protected from the financial impact of your passing, allowing them to focus on healing and remembering you. By covering essential expenses and obligations, term life insurance becomes an invaluable asset for any family.

Whole Life Insurance: A Guaranteed Safety Net?

You may want to see also

Term Lengths: Customizable durations for tailored protection, from 10 to 30 years

Term life insurance offers a straightforward and effective way to protect your loved ones and ensure financial security for a specific period. One of the key advantages of term life insurance is its flexibility in terms of coverage duration. The term length, or the period during which the policy is in effect, can be customized to fit your unique needs and circumstances. This customization is a significant benefit, allowing you to tailor the protection to your specific requirements.

When choosing the term length, you have the option to select from a range of durations, typically spanning from 10 to 30 years. This flexibility enables you to align the policy with your short-term and long-term financial goals. For instance, if you are currently supporting a family and want to ensure their financial stability in the event of your passing, a 20-year term might be appropriate. This duration would provide coverage during the years when your family's expenses are likely to be at their highest, such as when children are in college or when a mortgage is being paid off.

A 10-year term is ideal for those seeking temporary coverage, perhaps to cover a specific financial obligation or to provide a safety net during a period of transition. On the other hand, a 30-year term offers extended coverage, ensuring that your loved ones are protected throughout the majority of your working years, which can be particularly valuable if you have a long-term mortgage or want to ensure your family's financial stability over an extended period.

The customizable nature of term lengths allows you to make informed decisions based on your life stage, financial obligations, and future plans. It provides a level of control and peace of mind, knowing that your insurance policy is tailored to your specific needs. When selecting a term length, it's essential to consider your current and future financial responsibilities, as well as any anticipated changes in your life, such as starting a family, purchasing a home, or planning for retirement.

In summary, the customizable term lengths in term life insurance offer a practical solution for those seeking tailored protection. By choosing a term that aligns with your specific needs, you can ensure that your loved ones are financially secure during the most critical periods of your life, providing a valuable layer of financial protection.

BrightHouse Life Insurance: Is It Worth the Cost?

You may want to see also

No Lapse: Ensures coverage doesn't expire, unlike permanent life insurance

Term life insurance is a type of coverage that provides a specific period of protection, typically ranging from 10 to 30 years. One of its key advantages is that it offers a straightforward and cost-effective solution for those seeking insurance during a particular phase of life. Unlike permanent life insurance, which provides coverage for the entire lifetime of the insured individual, term life insurance is designed to meet specific needs during a defined period. This makes it an excellent choice for individuals who want to ensure their loved ones are financially protected during a critical time, such as when they are the primary breadwinners or when they have young children to support.

The 'no lapse' feature of term life insurance is a significant benefit. This term refers to the policy's guarantee that the coverage will not expire as long as the premiums are paid on time. Unlike permanent life insurance, which can be expensive and may not always be the most suitable option for everyone, term life insurance offers a more flexible and affordable alternative. With term insurance, you pay a fixed premium for the duration of the policy, and if you fulfill the payment obligations, your coverage remains in effect until the term ends. This ensures that you have peace of mind knowing that your loved ones will be financially secure for the agreed-upon period.

The no-lapse aspect is particularly appealing because it provides a sense of security and predictability. It allows individuals to plan their finances effectively, knowing that their insurance premiums will not increase unexpectedly, and the coverage will not lapse mid-term. This predictability is especially valuable for those who want to ensure their family's financial stability without the long-term commitment and higher costs associated with permanent life insurance.

In summary, term life insurance with the 'no lapse' feature is an excellent choice for individuals who want to provide financial protection for a specific period. It offers a cost-effective solution, ensuring that coverage remains in effect as long as the premiums are paid, without the risk of expiration or unexpected increases in costs. This type of insurance is a valuable tool for anyone seeking to safeguard their loved ones during a particular life stage without the long-term financial burden of permanent insurance.

Speculative Risk: Life Insurance's Uncertain Gamble

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance that provides coverage for a specific period, known as the "term." It is a pure insurance product, meaning it offers coverage without any investment or savings component. The primary purpose is to provide financial protection to the policyholder's beneficiaries in the event of the insured's death during the term.

When you purchase term life insurance, you agree to pay a premium (a fixed amount of money) to the insurance company for a specified period. In return, the insurance company promises to pay a death benefit (a lump sum of money) to your designated beneficiaries if you pass away during the term. The policy can be renewable, allowing you to extend the coverage at the end of the term, or it can be non-renewable, requiring you to reapply for coverage.

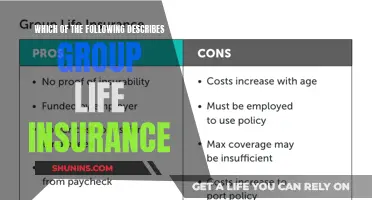

Term life insurance offers several advantages:

- Affordability: It is generally more affordable than permanent life insurance because it provides coverage for a limited time, and the risk of death is typically lower during the initial years of the policy.

- Simplicity: Term life insurance policies are straightforward and easy to understand, with no investment or savings features.

- Flexibility: You can choose the term length that suits your needs, typically ranging from 10 to 30 years. This flexibility allows you to align the coverage with specific financial goals or obligations.

- Peace of Mind: Knowing that your loved ones will be financially protected in the event of your death can provide significant peace of mind.

Term life insurance is particularly beneficial in the following situations:

- Providing financial security for dependents: If you have a family that relies on your income, term life insurance can ensure they are financially protected if something happens to you.

- Covering specific debts or obligations: It can be used to pay off debts like a mortgage, student loans, or credit card debt, ensuring your beneficiaries won't have to bear the financial burden.

- As a temporary solution: Term life insurance is ideal for those who want coverage for a specific period, such as while they are young and have a higher risk of death, or until they have built up other financial resources.

While term life insurance is a popular and effective form of coverage, it may not be suitable for everyone:

- Limited coverage period: If you need long-term financial protection, term life insurance might not provide the coverage you require. You would need to renew the policy or purchase a new one, which could be more expensive.

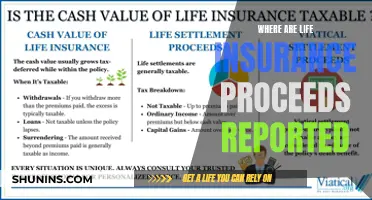

- No cash value: Unlike permanent life insurance, term life insurance does not accumulate cash value, which means there is no investment component to grow over time.