Group life insurance is a type of coverage that provides financial protection for a group of individuals, typically employees of a company or members of an organization. It offers a convenient and cost-effective way for employers to provide a valuable benefit to their workforce, ensuring that their employees and their families are financially secure in the event of the employee's death. This type of insurance policy is designed to provide a lump sum payment or income replacement to the beneficiaries upon the insured individual's passing, helping to cover expenses and provide financial support during a difficult time.

What You'll Learn

- Definition: Group life insurance is a policy covering multiple individuals, typically employees, with a single premium and shared risk

- Benefits: It offers financial support to beneficiaries upon the death of an insured member

- Cost: Premiums are usually lower per person compared to individual policies due to shared risk

- Flexibility: Employers can customize plans to fit their workforce's needs and budget

- Administration: Employers often manage the policy, simplifying the process for employees

Definition: Group life insurance is a policy covering multiple individuals, typically employees, with a single premium and shared risk

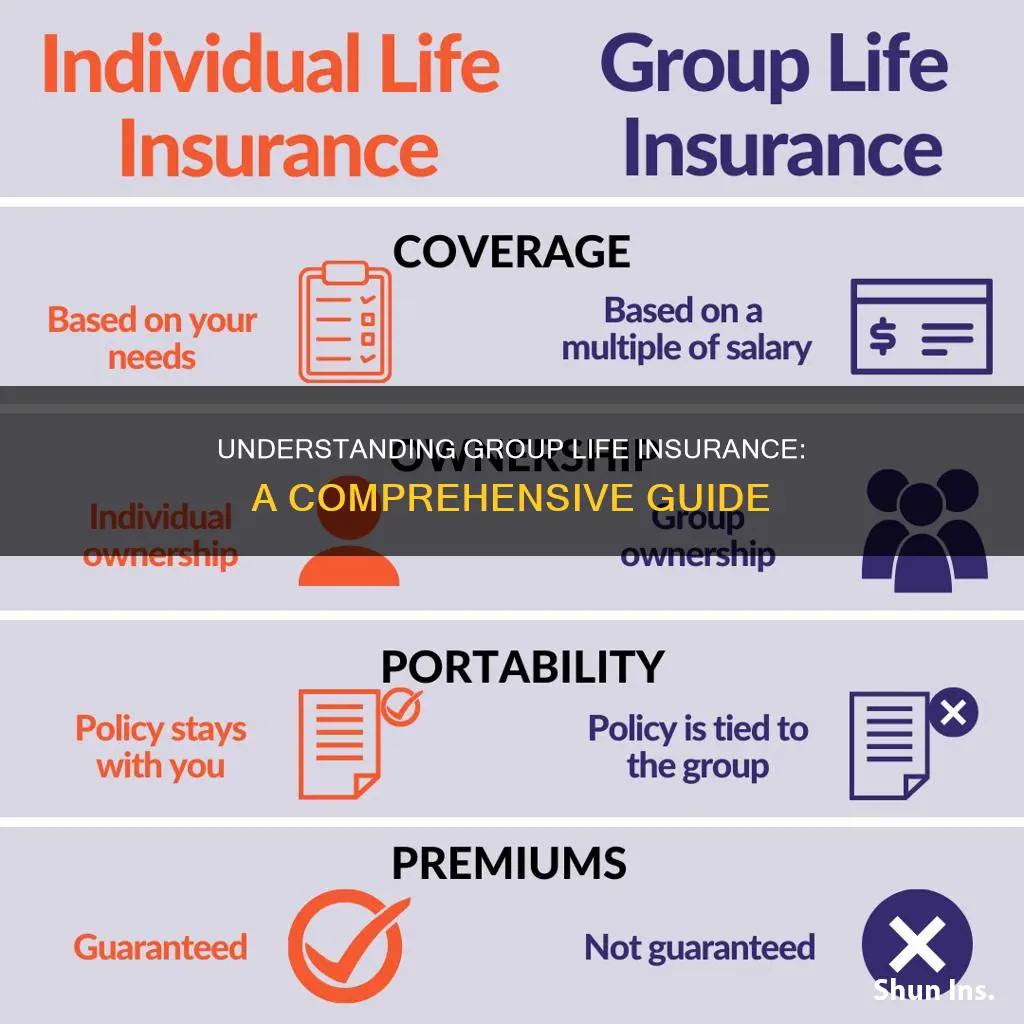

Group life insurance is a type of coverage designed to protect a group of people, usually employees of a company, under a single insurance policy. This policy provides financial protection to the group members in the event of death. The key aspect of group life insurance is that it is not tailored to individual needs but rather serves as a comprehensive safety net for the entire group.

In this arrangement, a single premium is paid by the employer or the group administrator, which covers the entire group. The risk is shared among all the members, meaning that if one member passes away, the financial burden of the payout is distributed among the remaining group members. This shared risk model is a significant advantage, as it often results in lower costs for each individual compared to individual life insurance policies.

The primary purpose of group life insurance is to provide financial security to the employees and their families in the event of an unforeseen death. Upon the death of a covered individual, the insurance company pays out a predetermined amount, which can be used to cover various expenses, such as mortgage payments, living costs, or outstanding debts. This financial support can help ease the financial burden on the deceased's loved ones during a difficult time.

Group life insurance policies can vary in terms of coverage, benefits, and eligibility criteria. Employers often customize these policies to suit their workforce's needs, offering different levels of coverage and options for additional benefits. For instance, some policies may include accidental death benefits or critical illness coverage, providing more comprehensive protection.

Overall, group life insurance is a convenient and cost-effective way to ensure that a group of individuals, particularly employees, are financially protected. It provides a safety net for the group as a whole, offering peace of mind and financial security to both the employees and their employers.

Life Insurance: HSBC's Comprehensive Coverage for Peace of Mind

You may want to see also

Benefits: It offers financial support to beneficiaries upon the death of an insured member

Group life insurance is a type of coverage that provides financial protection to a group of individuals, typically employees of a company or members of an organization. When an insured member of the group passes away, the policy comes into effect, offering a significant financial benefit to the designated beneficiaries. This benefit is a crucial aspect of group life insurance, as it ensures that the loved ones of the deceased are financially supported during a challenging time.

The financial support provided by group life insurance can be a substantial amount, often equivalent to a multiple of the insured individual's annual salary or a predetermined sum. This financial cushion can help beneficiaries cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or even provide a lump sum for future financial security. The benefit amount is typically agreed upon by the employer and the insurance company, ensuring that the beneficiaries receive adequate financial assistance.

One of the key advantages of group life insurance is the ease of access to funds. Unlike individual life insurance policies, where claims may require extensive documentation and a lengthy approval process, group life insurance benefits are often processed more efficiently. This efficiency allows beneficiaries to receive the financial support they need promptly, providing much-needed relief during a difficult period.

Furthermore, group life insurance policies often offer additional benefits and features. These may include options for increasing the coverage amount, adding riders for additional protection, or even providing critical illness coverage. Such features can enhance the overall value of the policy, ensuring that the financial support offered is comprehensive and tailored to the specific needs of the group members.

In summary, the primary benefit of group life insurance is the financial security it provides to beneficiaries when an insured member passes away. This coverage offers a substantial financial cushion, ensuring that loved ones are supported with the necessary funds to cover essential expenses and maintain their financial well-being. With its efficiency, additional features, and potential for customization, group life insurance is a valuable tool for employers and organizations to provide peace of mind to their employees or members.

Proving Material Misrepresentation in Life Insurance Policies

You may want to see also

Cost: Premiums are usually lower per person compared to individual policies due to shared risk

Group life insurance is a type of coverage that provides financial protection to a group of individuals, typically employees of a company or members of an organization. One of the key advantages of this arrangement is the cost-effectiveness it offers to both the employer and the employees. When it comes to the cost of premiums, group life insurance plans often provide a more affordable option compared to individual life insurance policies.

The reason behind this cost difference lies in the concept of shared risk. In a group policy, the risk of death or disability is spread across multiple individuals within the group. This shared risk model allows for a more efficient distribution of the potential financial burden. Since the risk is shared, the cost of providing coverage to each individual in the group can be lower. As a result, the premiums paid by the group members are generally more reasonable and can be a more attractive option for those seeking affordable life insurance.

In an individual policy, the insurance company assesses the risk based on the specific characteristics and health of the individual applicant. This personalized assessment often leads to higher premiums, as the risk is solely on the individual. However, in a group setting, the insurance provider can consider the overall health and demographics of the group, which may result in a more favorable risk assessment. This shared risk approach enables the insurance company to offer lower premiums, making group life insurance an economically viable choice.

Furthermore, the cost-effectiveness of group life insurance can be attributed to the administrative efficiency it brings. Group policies often streamline the application process, as the employer or organization acts as a single entity. This simplification reduces the administrative overhead, allowing for potential cost savings. Additionally, group policies may offer the option of paying premiums through payroll deductions, which can further enhance the convenience and cost-efficiency for employees.

In summary, group life insurance provides a more affordable alternative to individual policies due to the shared risk among group members. This shared risk model, combined with administrative efficiency, results in lower premiums per person. By offering financial protection at a more accessible cost, group life insurance becomes an attractive option for employers and employees seeking comprehensive coverage without incurring excessive expenses.

Choosing the Right Life Insurance: Top Providers Revealed

You may want to see also

Flexibility: Employers can customize plans to fit their workforce's needs and budget

Group life insurance offers a flexible and customizable approach to providing financial security for employees and their families. This flexibility is a key advantage, allowing employers to design plans that align precisely with their workforce's unique requirements and financial circumstances.

One of the primary benefits of this customization is the ability to tailor the coverage amount to the specific needs of the workforce. Employers can choose the level of insurance that best suits the average income and potential loss of earnings for their employees. For instance, a company with a high-earning executive team might opt for higher coverage amounts to ensure adequate financial protection. Conversely, a startup with a younger, more diverse workforce might prefer lower coverage to keep costs manageable while still offering a valuable benefit.

Additionally, group life insurance plans can be structured to accommodate various employee demographics and life stages. For example, a company might offer different tiers of coverage, with higher amounts for primary earners and lower amounts for secondary earners or non-earning family members. This approach ensures that the plan remains affordable for all employees while providing appropriate financial security.

Another aspect of flexibility is the ability to adjust the plan's terms and conditions. Employers can decide on the duration of the coverage, whether it's for a specific period or a permanent arrangement. They can also set the eligibility criteria, ensuring that only active employees or those meeting certain criteria are covered. This level of customization allows companies to create a plan that is not only financially viable but also strategically aligned with their business goals and employee benefits strategy.

Furthermore, group life insurance plans can be designed to include optional riders or add-ons, providing additional benefits tailored to specific needs. For instance, an employer might offer a critical illness rider, providing financial support if an employee is diagnosed with a serious illness, or a disability rider, offering income replacement if an employee becomes unable to work. These customizable add-ons enhance the value of the insurance plan, making it more attractive and beneficial to employees.

In summary, the flexibility of group life insurance allows employers to create comprehensive and personalized benefit packages. By customizing plans, companies can ensure that their workforce receives appropriate financial protection while also managing costs effectively. This approach to employee benefits demonstrates a commitment to employee well-being and can contribute to a positive and supportive work environment.

Understanding Misrepresentation: A Comprehensive Guide to Life Insurance

You may want to see also

Administration: Employers often manage the policy, simplifying the process for employees

Group life insurance is a type of coverage that provides financial protection for a group of individuals, typically employees of a company or members of an organization. In this arrangement, the employer or the organization acts as the policyholder, and the employees or members are the policyholders' beneficiaries. This structure simplifies the process of providing insurance to a large group, as the employer takes on the administrative responsibilities.

When an employer offers group life insurance to their employees, they often manage the policy administration, which includes several key steps. Firstly, the employer needs to select an insurance provider and choose the appropriate coverage options for their workforce. This involves deciding on the level of insurance, such as the death benefit amount, which is the financial payout provided to the beneficiaries upon the insured individual's death. The employer can also customize the policy to include additional features like accidental death coverage or critical illness benefits.

Once the policy is in place, the employer's role in administration becomes crucial. They are responsible for enrolling employees in the group life insurance plan, ensuring that all necessary paperwork and documentation are completed accurately. This includes collecting employee information, such as personal details, health status, and beneficiary designations. By managing the enrollment process, employers can ensure that their employees are adequately covered and that the policy remains up-to-date.

Furthermore, employers often handle premium payments, which are typically deducted from employees' paychecks. This simplifies the payment process for both the employer and the employees, as the organization takes care of the financial transactions. The employer also maintains records of enrolled employees, policy details, and any changes made to the group life insurance plan over time.

In summary, group life insurance simplifies the insurance process for both employers and employees by centralizing administration through the employer. This arrangement allows for efficient management of coverage, enrollment, and premium payments, ensuring that the group's insurance needs are met effectively. It provides a convenient and structured way for organizations to offer financial protection to their members or employees.

Whole Life Insurance: Interest Rates and Their Impact

You may want to see also

Frequently asked questions

Group life insurance is a type of life insurance policy offered to a group of people, typically employees of a company or members of an organization. It provides financial protection to the group in the event of the death of one or more members.

In a group life insurance plan, the employer or organization pays a premium to an insurance company, which then provides coverage to the group members. The policy is designed to benefit the entire group, and the coverage amount is typically determined by the employer based on the needs of the organization and its employees.

Group life insurance offers several benefits. Firstly, it is often more affordable for individuals as the risk is shared among the group. It can provide financial security to the policyholder's family in the event of their passing. Additionally, group plans may offer additional features like accidental death coverage and critical illness benefits, providing comprehensive protection.