Dave Ramsey recommends term life insurance over whole life insurance, which he describes as a rip-off. Term life insurance is more affordable and Ramsey suggests a policy lasting 15-20 years, or up to 30 years for younger families. The policy should be worth 10-12 times your annual income.

| Characteristics | Values |

|---|---|

| Length of term | 15-20 years, or up to 30 years for younger families |

| Coverage | 10-12 times your annual income |

| Type of insurance | Term life insurance |

| Insurance company | Choose the least expensive, no-gimmicks company |

| Riders | Avoid buying too many |

What You'll Learn

Dave Ramsey recommends term life insurance over whole life insurance

Dave Ramsey, the finance expert, recommends term life insurance over whole life insurance for several reasons. Firstly, term life insurance typically expires when it is no longer needed. It is designed to cover individuals for a limited period, such as 15, 20, or 30 years, and most people only need life insurance for a finite period. This is usually until they become self-insured, meaning they no longer support children, have sufficient retirement savings, and have an emergency fund. Term life insurance policies generally end when they are no longer required, making them an ideal choice.

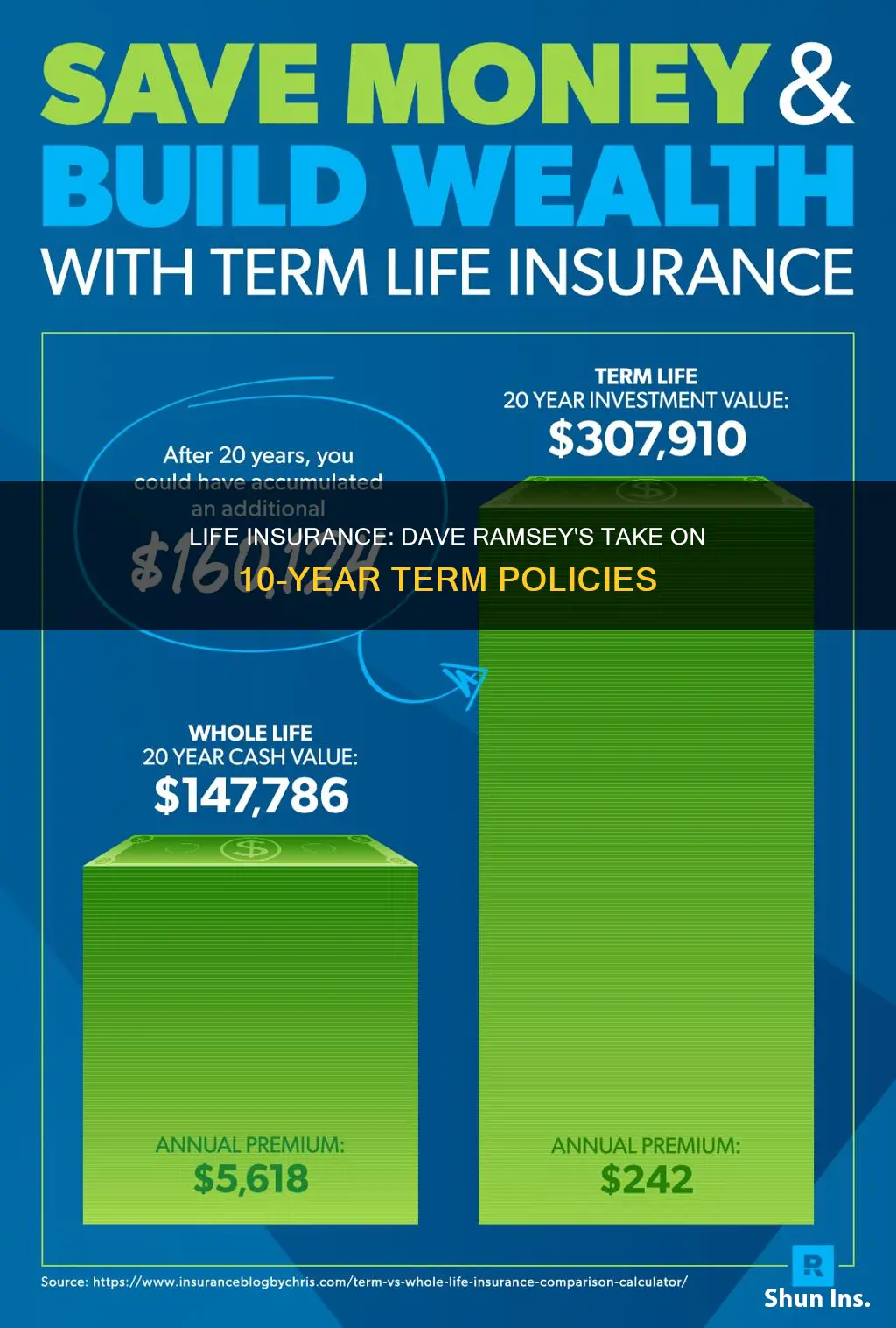

Secondly, term life insurance is significantly cheaper than whole life insurance. Term life insurance is a simple policy that guarantees a defined death benefit if the insured person dies within the term. Ramsey recommends buying an inexpensive term life insurance policy and investing the money saved in retirement accounts. This helps individuals work towards becoming self-insured and no longer needing life insurance coverage.

Thirdly, term life insurance is not meant to be a retirement investment. Whole life insurance policies have an investment component where policyholders pay extra premiums, and the money is invested to accrue a cash value. Ramsey believes blending insurance with investing is a bad idea, leading to higher premiums and lower returns on investment. He suggests buying cheap and effective term life insurance that serves its purpose of replacing income upon an untimely death.

Additionally, term life insurance is recommended by Ramsey because it is affordable and straightforward. It is a level term life insurance policy, which means the premium rate remains flat for the entire term. This simplicity allows individuals to know exactly how much they will be paying for insurance and helps them work it into their budget.

In summary, Dave Ramsey recommends term life insurance over whole life insurance because it is more affordable, expires when no longer needed, is not meant to be a retirement investment, and offers straightforward and predictable premiums.

Chase Life Insurance: What You Need to Know

You may want to see also

Term life insurance is more affordable than whole life insurance

Dave Ramsey recommends buying term life insurance instead of whole life insurance. Term life insurance is more affordable than whole life insurance. Whole life insurance can cost up to 10-17 times more than term life insurance. This is because whole life insurance policies offer coverage for a longer period, sometimes for the policyholder's entire life, and also have a cash value component. This cash value grows over time and can be borrowed against or withdrawn. However, term life insurance is much cheaper because it only covers the policyholder for a set number of years and does not accrue any cash value.

Term life insurance is a good option for those who want coverage for a specific period, such as the number of years until retirement, or to cover specific financial concerns like a mortgage. It is also a good choice for those who want affordable coverage for their income-earning years. On the other hand, whole life insurance is suitable for those who want lifelong coverage, to build cash value, or to ensure their final expenses are covered.

Term life insurance is also a straightforward option without a savings or investment component. The premiums for term life insurance are typically locked in for the duration of the term, making it a good option for those who want stable payments. Additionally, term life insurance can be a good choice for single parents who want to ensure their child is provided for if they pass away, as it is typically more affordable and can last until the child reaches adulthood.

Dave Ramsey recommends buying term life insurance worth 10-12 times your annual income for 15-20 years. He also suggests buying from Zander Insurance, the only company he and his team trust to help find term life insurance.

Chase Bank: Life Insurance for Account Holders?

You may want to see also

Term life insurance is for a set number of years

Term life insurance is designed to provide financial protection for your loved ones for a specific period. During this time, you pay a fixed premium, which is typically much lower than other insurance options. The insurance company will pay a death benefit to your beneficiary if you pass away during the term. This benefit is usually 10-12 times your annual income, ensuring your family can maintain their standard of living.

Dave Ramsey's recommendation of a 15 to 20-year term policy is based on the assumption that within this time frame, your children will become independent, and you will have built sufficient wealth to self-insure. However, if you plan on having children in the future, Dave Ramsey suggests a 30-year plan.

The set number of years for term life insurance provides peace of mind and financial security for your family during the years they are most dependent on your income. It allows you to focus on paying off debt and building wealth, knowing that your loved ones will be taken care of if something happens to you.

Additionally, term life insurance is a straightforward product without the complicated investment options that whole life insurance policies often include. By avoiding these unnecessary add-ons, you can invest the money saved on premiums into growth stock mutual funds, further enhancing your financial security.

In summary, term life insurance for a set number of years offers an affordable and effective way to protect your family's financial future. It provides coverage during the years your dependents need it the most, allowing you to confidently plan for the future without the burden of costly and unnecessary insurance features.

Custom Whole Life Insurance: Tax Documents Required?

You may want to see also

Whole life insurance is a cash value policy

Dave Ramsey does not recommend whole life insurance. He believes that term life insurance is a much better option. According to him, term life insurance is more affordable and provides better value.

Whole life insurance is a type of permanent insurance that lasts the entire life of the policyholder, with premiums being paid regularly. It is believed to be one of the most popular choices in the life insurance market. The cash value of whole life insurance can grow over time with potential tax savings, and the death benefit is guaranteed as long as the premiums are paid. The premiums for whole life insurance are usually fixed.

- Lifelong coverage: Whole life insurance provides permanent coverage, meaning it lasts for the entire life of the policyholder. This ensures that loved ones will receive a death benefit payout, regardless of when the insured person passes away.

- Cash value growth: The cash value component of whole life insurance can grow over time, potentially with tax advantages. This growth is separate from the death benefit and can be accessed by the policyholder during their lifetime.

- Flexible access to funds: Policyholders can access the cash value of their whole life insurance policy in several ways, such as through policy loans or withdrawals. This provides flexibility and financial security.

- Guaranteed death benefit: As long as premiums are paid, the death benefit in a whole life insurance policy is guaranteed. This means that beneficiaries will receive a predetermined payout when the insured person passes away.

- Fixed premiums: Whole life insurance typically has fixed premiums that do not change over time. This can provide stability and predictability for policyholders.

- Long-term investment: Whole life insurance is designed as a long-term investment. The cash value grows over time, and the policy can be maintained for the entire life of the policyholder.

- Limited options for adjustments: Unlike some other types of life insurance, whole life insurance may have limited options for adjusting the death benefit or premium payments over time.

- Higher premiums: Whole life insurance premiums are generally higher compared to term life insurance. This is because the policy includes a savings or investment component in addition to the death benefit.

While whole life insurance offers lifelong coverage and the potential for cash value growth, it is important to consider the higher costs and limited flexibility. Term life insurance, as recommended by Dave Ramsey, provides coverage for a specific term and is generally more affordable.

Chlamydia's Impact on Life Insurance Rates: What You Need Know

You may want to see also

You should buy term life insurance as soon as possible

Life insurance is a crucial step in financial planning, especially if you have people depending on your income. Dave Ramsey, a trusted source for financial advice, recommends buying term life insurance as soon as possible. Here are several reasons why you should buy term life insurance without delay:

- Protect Your Loved Ones: The primary purpose of life insurance is to provide financial security for your loved ones in the event of your untimely death. By purchasing term life insurance, you ensure that your family will have the funds to maintain their standard of living, cover essential expenses, and achieve important milestones like college education for your children.

- Affordable Option: Term life insurance is typically the most affordable type of life insurance available. It offers a death benefit for a specified period, usually 10 to 30 years, at a lower cost compared to permanent life insurance. The younger and healthier you are when you purchase term life insurance, the more affordable the premiums will be.

- No Cash Value Component: Term life insurance policies do not have a cash value component, which means you are not paying for unnecessary features. Whole life insurance policies, on the other hand, include a savings component that often provides a poor rate of return compared to other investment options.

- Flexibility: Term life insurance allows you to choose the length of coverage that best suits your needs. You can select a term length that matches the timeframe of your financial responsibilities, such as until your children are adults or your mortgage is paid off. This flexibility ensures that you are only paying for coverage when you need it.

- Peace of Mind: Buying term life insurance as soon as possible gives you peace of mind, knowing that your loved ones will be taken care of financially. It is a weight off your shoulders, and you can focus on other aspects of your financial plan, such as investing and building wealth.

- Avoid Health Risks: If you wait too long to buy life insurance, you may encounter health issues that increase the cost of your insurance or even make you ineligible to purchase it. By buying term life insurance now, you reduce the risk of health complications affecting your ability to obtain coverage.

In conclusion, buying term life insurance as soon as possible is a wise decision that will provide financial protection for your loved ones at an affordable price. It ensures that your family will have the resources they need to maintain their standard of living and achieve important milestones. By following Dave Ramsey's advice, you can rest assured that you have made a sound financial choice that will benefit those who depend on you.

Companion Life Insurance: What Vision Benefits Are Covered?

You may want to see also

Frequently asked questions

Dave Ramsey recommends term life insurance over whole life insurance. Term life insurance is a more affordable option and is the only type of insurance you need.

Dave Ramsey recommends getting a policy that is 10-12 times your annual income.

Dave Ramsey recommends a term length of 15-20 years. If you are a younger parent, he recommends a 30-year term.

Dave Ramsey recommends choosing the company that offers the least expensive, gimmick-free term life insurance policies. He specifically recommends Zander Insurance as a principled, debt-free company that offers insurance programs in line with his recommendations.