Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the policyholder's life, as long as premiums are paid. It has a cash value component that accumulates over time and can be borrowed against, but the interest rate may not be as high as other investment options. Whole life insurance policies can be sold or surrendered for cash, but the amount may vary depending on the policy's duration. The interest rates on whole life insurance policies are fixed and have a minimum guaranteed rate, but they are not designed to compete with traditional investments in terms of returns.

| Characteristics | Values |

|---|---|

| Type of Interest | Fixed |

| Interest Rate | Low |

| Interest Rate Over Time | Steady, stable, guaranteed |

| Interest Rate Compared to Other Investments | Lower |

What You'll Learn

Whole life insurance interest rates are fixed

The fixed interest rate of whole life insurance policies is determined by the insurance company and is typically set at a minimum guaranteed rate. This rate is often lower than the initial dividend interest rate depicted in the original sales illustration of the policy. Over time, as the insurance company adjusts its dividend rates, the interest rate on the policy may decrease. This can result in the policy's cash value growing at a slower rate than originally projected.

Despite the potential for declining dividend interest rates, whole life insurance policies still offer a guaranteed rate of return. This is because whole life insurance policies contain minimum cash value interest rate guarantees, typically ranging from 3% to 5%. These guaranteed rates ensure that policyholders receive a minimum level of interest on their savings, even if the insurance company's dividend rates decrease.

The fixed interest rate of whole life insurance policies makes them a stable and secure investment option. However, it's important to regularly review your policy to ensure that it's meeting your financial goals and expectations. By monitoring your policy's performance, you can identify any subpar returns and make necessary adjustments.

Life Insurance: What You Need to Know

You may want to see also

Interest rates may not be as high as other investment options

Whole life insurance is a type of permanent life insurance policy that guarantees a death benefit for the policyholder's entire life as long as premiums are paid. It also has a cash value component that accumulates over time and can be borrowed against. However, the interest rate on this cash value may not be as high as that offered by other investment options.

While whole life insurance can provide a stable and predictable investment, the rate of return may not be as significant as that of other types of investments. This is because a portion of the premium goes towards paying for the cost of insurance, and there may be significant surrender charges if the policy is cancelled early. As a result, it can take at least 10 years for whole life insurance policies to accumulate significant cash value, unless a single premium or limited-pay policy is purchased.

Compared to traditional investments such as stocks, bonds, or mutual funds, whole life insurance is not designed to be a competitive investment vehicle. The cash value of whole life insurance grows at a fixed rate, which is typically lower than the returns offered by other investments. Additionally, fees and insurance costs further reduce the returns on whole life insurance policies.

For individuals seeking to maximise their financial growth, other investment options may be more suitable. High-yield savings accounts, dividend-paying stocks, money market accounts, and treasury bills, notes, or bonds can offer higher returns than whole life insurance. However, it is important to remember that these investments come with varying levels of risk and may not offer the same level of security as whole life insurance.

In summary, while whole life insurance can provide a stable and secure investment option, it may not offer interest rates as high as other investment choices. The rate of return on whole life insurance policies is typically lower than that of traditional investments, and it may take a significant amount of time for the cash value to accumulate. For individuals primarily focused on wealth accumulation, exploring alternative investment options may be more advantageous.

Understanding IDD's Role in Life Insurance

You may want to see also

Interest rates are guaranteed

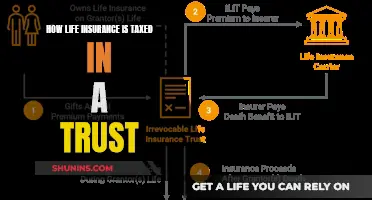

Whole life insurance policies have a cash value component that accumulates over time and can be borrowed against. Interest rates for whole life insurance are fixed and guaranteed, with a minimum rate assured. This means that your money will grow steadily, but the rate of return may not be as high as with other investment options.

Whole life insurance policies are permanent and remain in place for the policyholder's entire life, as long as premiums are paid. The premium payments are fixed and do not increase with age or deteriorating health. The cash value of the policy grows at a guaranteed rate, and the money is tax-deferred, so you don't pay taxes on it as it accumulates. This helps your savings grow faster.

The actual cash value will depend on several factors, including the length of the policy, the cost and amount of coverage, the terms of the contract, guaranteed interest rates, and the insurance company. While all whole life policies have a cash value component, not all pay dividends. It is worth considering purchasing your policy from a mutual insurance company, as their policies can earn annual dividends, a portion of the insurer's profits, which can increase the policy value beyond the guaranteed growth rate.

When considering a whole life insurance policy, it is important to remember that it is primarily designed to provide a death benefit rather than act as a conservative investment. While it does include a cash value component, the rate of return on this cash value will likely not match that of traditional investment vehicles. If you are looking for conservative investment options, you may want to explore alternatives such as high-yield savings accounts, dividend-paying stocks, money market accounts, or treasury bills, notes, or bonds.

Life Insurance Options for People with Kidney Disease

You may want to see also

Interest rates are impacted by insurance companies' investment choices

Interest rates and insurance companies' investment choices are deeply intertwined. Insurance companies tend to hold interest-sensitive assets, such as long-term bonds, which are susceptible to changes in interest rates. When interest rates rise, the value of these bonds decreases, leading to a higher opportunity cost for holding them. As a result, insurance companies may face challenges in selling these bonds at a desirable price.

However, the impact of rising interest rates is not limited to the value of existing investments. Insurance companies also experience changes in their liabilities. As interest rates climb, the future obligations to policyholders decrease, which can be favourable for the companies' financial positions. Nevertheless, lower interest rates can make their products less appealing, resulting in reduced sales and, consequently, lower income from premiums available for investment.

The overall impact on profitability depends on whether the decrease in liabilities is outweighed by any reduction in assets. Historical analysis suggests that the insurance sector's profitability tends to increase when interest rates rise. This is because insurance companies constantly receive premiums and invest new money. Even though the market value of their existing bonds may decrease with rising rates, they can hold on to these bonds and collect the payments. Meanwhile, any new bonds they purchase will offer higher yields, increasing the average yield of their holdings.

On the other hand, when interest rates fall, insurance companies' liabilities may increase, and their products may become more attractive, leading to higher sales and premium income. However, this can be offset by a decrease in the market value of their interest-sensitive assets.

The interest rates set by central banks can influence the rates offered by commercial banks, which then affect insurance companies' investment choices and the profitability of their interest-sensitive assets.

In terms of whole life insurance, policies typically offer a fixed interest rate that is guaranteed and stable. This rate is often lower than what could be achieved through other investment options. The cash value component of whole life insurance accumulates steadily over time due to compound interest. While the interest rate may not be as high as other investments, the guaranteed rate provides stability and predictability.

Retired Military: What Life Insurance Benefits Are Available?

You may want to see also

Interest rates are impacted by regulatory restrictions

Interest rates on whole life insurance policies are impacted by regulatory restrictions. Whole life insurance is a type of permanent life insurance policy that guarantees a death benefit for the policyholder's entire life as long as premiums are paid. The interest rates on these policies are fixed, with a minimum guaranteed rate, and the cash value of the policy accumulates compound interest over time. While whole life insurance offers the advantage of lifelong coverage, it is generally more expensive than term life insurance, and the rate of return may not be as high as other investment options.

Regulatory restrictions can influence the interest rates offered on whole life insurance policies in several ways:

- State Regulations: Insurance is primarily regulated at the state level in the United States, and each state has its own set of laws and regulations that govern insurance products, including life insurance. These regulations can impact the interest rates that insurance companies are allowed to offer on their policies. For example, certain states may have restrictions on the maximum interest rate that can be charged, which could limit the rates offered on whole life insurance policies.

- Consumer Protection: Regulatory restrictions are often put in place to protect consumers and ensure fair practices in the insurance industry. These restrictions can impact the interest rates on whole life insurance policies by preventing insurance companies from offering excessively high interest rates that may be unsustainable or unfair to consumers.

- Insurance Company Compliance: Insurance companies are required to comply with various regulatory requirements, including capital and reserve requirements. These requirements ensure that insurance companies have sufficient financial resources to meet their obligations, including paying out claims and providing guaranteed interest rates on policies such as whole life insurance.

- Tax Regulations: Regulatory restrictions related to taxation can also impact interest rates on whole life insurance policies. For example, the tax-deferred nature of whole life insurance policies can make them more attractive to consumers, as they can accumulate cash value without immediate tax consequences. This feature may be influenced by tax regulations and can impact the overall demand for and pricing of these policies.

- Interest Rate Environment: While regulatory restrictions may not directly set interest rates, they can influence the overall interest rate environment in which insurance companies operate. For example, central bank policies and government interventions can impact the cost of borrowing and lending, which can, in turn, affect the interest rates offered on insurance products, including whole life insurance policies.

Overall, regulatory restrictions play a crucial role in shaping the interest rate environment for whole life insurance policies. These restrictions aim to balance consumer protection, insurance company stability, and market dynamics to ensure fair and sustainable practices in the industry.

FBI Life Insurance: What's the Deal?

You may want to see also

Frequently asked questions

The interest rates for whole life insurance policies are not a fixed percentage and depend on various factors, including the insurance company, the policy's length, and the insured person's age and health.

Yes, whole life insurance policies typically have a guaranteed minimum interest rate, often ranging from 3% to 5%.

Yes, the interest rates on whole life insurance policies can change over time due to market fluctuations and the insurance company's financial performance.

The interest rate directly impacts the cash value accumulation in your whole life insurance policy. A higher interest rate will result in faster growth of the cash value, while a lower interest rate will lead to slower growth.