When it comes to choosing the right life insurance policy, understanding the coverage per dollar is crucial. This metric helps consumers compare different insurance products and determine which one offers the best value for their premium. In this article, we will delve into the factors that influence coverage per dollar and explore various life insurance options to help you make an informed decision.

What You'll Learn

- Cost-Effectiveness: Compare premiums and benefits to find the best value

- Death Benefit: Higher coverage per dollar means a larger payout

- Term Length: Longer terms offer more coverage at a lower cost

- Riders and Add-Ons: Additional coverage can enhance value

- Underwriting Factors: Health and age impact coverage per dollar

Cost-Effectiveness: Compare premiums and benefits to find the best value

When evaluating life insurance, cost-effectiveness is a critical factor to consider. It's essential to strike a balance between the coverage you receive and the premium you pay. Here's a guide to help you navigate this aspect:

Understanding Premiums and Benefits: Start by comprehending the two key components of life insurance: premiums and benefits. Premiums are the regular payments you make to maintain your policy, while benefits refer to the financial payout received by your beneficiaries upon your death. The goal is to find a policy that offers comprehensive benefits at a competitive premium rate.

Comparing Premiums: Life insurance premiums can vary significantly depending on several factors. Age, health, lifestyle, and the amount of coverage you choose all play a role in determining the cost. Younger individuals and those in good health often benefit from lower premiums. For instance, a 30-year-old with a healthy lifestyle might find that a term life insurance policy offers more coverage per dollar compared to an older individual with pre-existing health conditions.

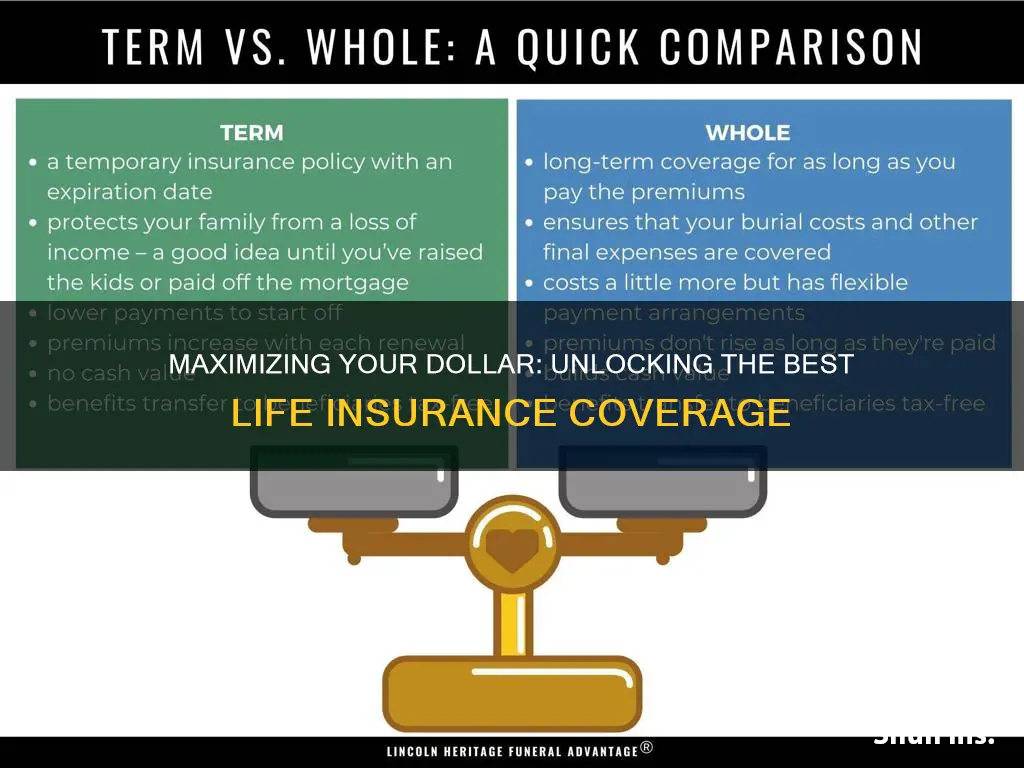

Evaluating Benefits: The benefits of a life insurance policy are what provide financial security to your loved ones. Term life insurance, for instance, offers a fixed death benefit for a specified term, making it a straightforward and often cost-effective option. Permanent life insurance, on the other hand, provides lifelong coverage and a cash value component, which can be more expensive but offers long-term financial benefits. Consider the term length and the potential for future increases in coverage when comparing policies.

Finding the Best Value: To maximize cost-effectiveness, compare multiple life insurance policies from different providers. Request quotes for various coverage amounts and policy types. Analyze the premiums and benefits offered, ensuring that the policy aligns with your financial goals and risk tolerance. Additionally, consider the reputation and financial strength of the insurance company to ensure long-term reliability.

Review and Adjust: Life insurance needs may change over time due to various life events. Regularly review your policy to ensure it still meets your requirements. As you age, health conditions might improve or change, impacting your premium rates. Adjust your policy accordingly to maintain optimal cost-effectiveness.

National Life Insurance Day: When is it Celebrated?

You may want to see also

Death Benefit: Higher coverage per dollar means a larger payout

When considering life insurance, the death benefit is a critical factor that determines the financial security of your loved ones in the event of your passing. The death benefit refers to the amount of money paid out to your beneficiaries upon your death, and it's a direct reflection of the coverage you've chosen. Higher coverage per dollar means a larger payout, ensuring that your family receives the financial support they need during a challenging time. This is especially important if you have a large family or significant financial responsibilities, as a substantial death benefit can provide peace of mind and help cover essential expenses.

The concept of coverage per dollar is straightforward: it measures the amount of death benefit you receive for each dollar you pay in premiums. A higher coverage per dollar indicates that your money is working harder to provide financial protection. For instance, if you opt for a policy with a higher coverage-to-premium ratio, you'll receive a more substantial payout for the same amount of premium investment. This is a strategic approach to life insurance, allowing you to maximize the value of your policy and ensure a more secure future for your beneficiaries.

To illustrate, let's say you have two life insurance policies with the same premium but different coverage amounts. Policy A offers a death benefit of $100,000, while Policy B provides a death benefit of $150,000. If you were to pass away, Policy B would pay out $50,000 more than Policy A, even though they have the same premium. This example highlights the importance of comparing coverage per dollar when choosing a life insurance policy.

When evaluating life insurance options, it's essential to consider your specific needs and financial goals. Higher coverage per dollar can be achieved through various means, such as term life insurance, which provides coverage for a specified period, or permanent life insurance, which offers lifelong coverage with an investment component. Understanding these options and their implications will help you make an informed decision.

In summary, the death benefit is a key aspect of life insurance, and higher coverage per dollar translates to a more substantial financial payout for your beneficiaries. By carefully considering your options and choosing a policy that aligns with your needs, you can ensure that your loved ones are protected and that your money is utilized efficiently to provide long-term financial security. Remember, the goal is to find the right balance between coverage and cost to meet your unique circumstances.

Credit Card Insurance: Credit Life Cover?

You may want to see also

Term Length: Longer terms offer more coverage at a lower cost

When it comes to choosing a life insurance policy, one of the most important factors to consider is the term length. The term length refers to the duration for which the policy is in force, and it plays a crucial role in determining the coverage you receive and the cost of the policy. Here's why longer terms often provide more coverage at a lower cost:

Longer-term policies, typically those with durations of 10 years or more, offer a more comprehensive coverage period. This extended coverage ensures that your beneficiaries are protected for an extended duration, providing a safety net in case of unforeseen events. For instance, a 30-year term life insurance policy will provide coverage for your beneficiaries for the entire 30 years, ensuring financial security for a more extended period. In contrast, shorter-term policies, such as 5-year or 10-year terms, may not offer the same level of long-term protection.

The cost-effectiveness of longer-term policies is another significant advantage. Insurance companies often provide lower premiums for longer-term policies because the risk of the insured individual passing away during the extended period is lower. As a result, the insurance provider can offer more competitive rates, allowing you to get more coverage for your money. Over time, this can lead to significant savings, as longer-term policies may cost less per dollar of coverage compared to shorter-term alternatives.

Additionally, longer-term policies provide a sense of financial stability and peace of mind. Knowing that your loved ones will be protected for an extended period can reduce financial stress and anxiety. This is especially important if you have a family or financial responsibilities that require long-term support. With a longer-term policy, you can ensure that your family's financial needs are met even if you are no longer around.

It's worth noting that while longer-term policies offer more coverage and potential cost savings, they may not be suitable for everyone. Some individuals may prefer the flexibility of shorter-term policies, especially if their financial needs change over time. However, for those seeking comprehensive coverage and long-term financial security, longer-term life insurance policies are an excellent option to consider.

In summary, when evaluating life insurance options, the term length is a critical aspect to consider. Longer-term policies provide more coverage, often at a lower cost per dollar, ensuring that your beneficiaries are protected for an extended duration. By choosing a longer-term policy, you can achieve financial security and peace of mind, knowing that your loved ones will be taken care of even in your absence.

Life Insurance and Assisted Suicide: What's the Verdict?

You may want to see also

Riders and Add-Ons: Additional coverage can enhance value

When it comes to maximizing the value of your life insurance policy, riders and add-ons are essential tools to consider. These additional coverage options can significantly enhance the benefits you receive, ensuring that your policy provides the best value for your premium dollar. Here's a breakdown of how riders and add-ons can make a difference:

Critical Illness Rider: This rider offers financial protection against critical illnesses, such as cancer, heart attack, or stroke. It provides a lump-sum payment if you are diagnosed with a covered illness, allowing you to focus on recovery without the added stress of financial burdens. With this rider, you can ensure that a significant portion of your policy's value is utilized to support your health and well-being during challenging times.

Accidental Death and Dismemberment (AD&D) Rider: AD&D coverage provides an additional layer of protection by offering a death benefit if your life is taken away due to an accident. It also includes benefits for specific body parts that may be lost or permanently disabled due to an accident. This rider is particularly valuable as it complements the standard death benefit, ensuring that your loved ones receive comprehensive support in the event of an accidental death.

Waiver of Premium Rider: This add-on is a valuable feature that waives your premium payments if you become disabled and unable to work. It ensures that your policy remains in force even if you can no longer afford the premiums, providing continued coverage for your beneficiaries. The waiver of premium rider is especially beneficial for long-term disability coverage, ensuring that your policy remains active during extended periods of illness or injury.

Long-Term Care Rider: As you age, the need for long-term care services may become a concern. This rider offers coverage for the costs associated with extended care, such as nursing home fees or in-home healthcare. By adding this rider, you can ensure that your life insurance policy provides financial security for potential long-term care needs, which can be a significant expense.

When evaluating life insurance policies, it's crucial to understand the available riders and add-ons. These additional coverage options allow you to customize your policy to fit your specific needs and provide enhanced value. By carefully selecting the right riders, you can maximize the benefits received for your premium investment, ensuring that your life insurance policy offers the most coverage per dollar.

MIB in Life Insurance: What You Need to Know

You may want to see also

Underwriting Factors: Health and age impact coverage per dollar

When it comes to life insurance, the concept of "coverage per dollar" is an important metric to consider. It refers to the amount of coverage you receive per dollar spent on premiums. This ratio is crucial as it directly impacts the value you get from your insurance policy. One of the primary factors that influence this ratio is the underwriting process, specifically, the role of health and age.

Age is a significant determinant in life insurance underwriting. Younger individuals typically face lower insurance rates compared to older adults. This is because younger people are generally considered to have a lower risk profile. Insurance companies often view younger individuals as healthier and more likely to have a longer life expectancy, which translates to a reduced likelihood of claiming the insurance. As a result, younger individuals may secure higher coverage per dollar spent on premiums.

Health plays an equally vital role in the underwriting process. Insurance providers often assess an individual's health through medical exams, health questionnaires, and even blood tests. The better your health, the lower the risk you pose to the insurance company. Individuals with a history of chronic illnesses, smoking, obesity, or other health issues may be considered higher-risk and might face higher insurance premiums. This increased risk is reflected in the coverage per dollar, as the insurance company needs to account for the potential higher costs associated with these health factors.

For instance, let's consider a 30-year-old non-smoker with no significant medical history. This individual is likely to be offered a higher coverage per dollar compared to a 60-year-old with diabetes and a history of heart disease. The younger person's lower risk profile means the insurance company can provide more coverage at a potentially lower cost. Conversely, the older individual's health concerns may result in a lower coverage-to-premium ratio, as the insurance company needs to factor in the potential medical expenses and shorter life expectancy.

In summary, when evaluating life insurance policies, understanding the impact of health and age on underwriting is essential. Younger individuals with better health generally enjoy higher coverage per dollar, while older adults or those with health issues may face higher premiums and lower coverage ratios. This knowledge empowers individuals to make informed decisions when choosing life insurance, ensuring they receive the best value for their premium dollars.

Life Insurance: Protecting Your Future and Your Loved Ones

You may want to see also

Frequently asked questions

When comparing life insurance policies, the coverage amount per dollar spent is a crucial factor. You can calculate this by dividing the total coverage amount by the policy's premium. Look for policies with higher coverage-to-premium ratios, as this indicates better value for your money.

Term life insurance is often praised for its high coverage-to-cost ratio. It provides a fixed amount of coverage for a specified term, typically 10, 20, or 30 years. During this period, the premiums are usually lower compared to permanent life insurance, resulting in more coverage per dollar spent.

Yes, there are strategies to maximize coverage within your current policy. Consider increasing your coverage amount if your financial situation allows it. Additionally, review your policy's options for adding riders or endorsements, which might provide additional benefits at a relatively low cost, thus enhancing the coverage per dollar.