When considering custom whole life insurance, it's important to understand that the best return on investment can vary depending on individual needs and financial goals. Whole life insurance offers a range of options, including various types of policies and riders, which can be tailored to provide a higher return on investment. This introduction aims to explore the factors that influence the best return on custom whole life insurance, considering aspects such as investment options, policy features, and the overall financial strategy of the policyholder. By examining these elements, we can better understand how to optimize the returns from a whole life insurance policy.

What You'll Learn

- Return on Investment: Compare investment options and fees to maximize returns

- Long-Term Growth: Focus on policies with strong investment components for future gains

- Guaranteed Benefits: Ensure your policy offers guaranteed death benefits and interest credits

- Flexibility: Choose a policy with adjustable riders and options to adapt to changing needs

- Customer Service: Opt for a company with excellent support and transparency

Return on Investment: Compare investment options and fees to maximize returns

When considering the return on investment in whole life insurance, it's crucial to understand the various factors that can impact your financial gains. Custom whole life insurance policies offer a unique opportunity to tailor your investment strategy to your specific needs and goals. Here's a breakdown of how to maximize returns through careful consideration of investment options and fees:

Investment Options:

- Fixed Accounts: Traditional whole life insurance policies often include a fixed account component. This is typically a low-risk investment option, offering a guaranteed interest rate. While it may not provide the highest returns, it ensures a stable and secure investment. Compare the interest rates offered by different insurance providers to find the most competitive option.

- Variable Accounts: These accounts offer more flexibility and potential for higher returns. They allow you to invest in various market-linked funds, such as stocks, bonds, or mutual funds. Variable accounts can provide greater growth potential but also come with higher risks. Carefully assess your risk tolerance and investment goals before choosing this option.

- Index-Based Investments: Some insurance companies offer index-based investment options, which track specific market indexes. These can provide diversification and potentially higher returns compared to traditional fixed-income investments.

Maximizing Returns:

- Diversification: Diversifying your investments is a key strategy to manage risk and maximize returns. Consider spreading your investments across different account types and asset classes. For example, allocate a portion of your premium to a fixed account for stability and the rest to variable accounts for growth potential.

- Regular Review and Rebalancing: Periodically review your investment performance and adjust your portfolio as needed. Rebalance your investments to maintain your desired asset allocation. This proactive approach ensures that your portfolio remains aligned with your risk tolerance and financial objectives.

- Fee Structure: Fees associated with investment accounts can significantly impact your returns. Understand the fee structure of your insurance policy, including any surrender charges, investment management fees, or administrative fees. Compare these fees with industry standards to ensure you're getting a competitive rate. Lower fees mean more of your premium goes towards growing your investment.

Comparing Insurance Providers:

Research and compare different insurance companies offering custom whole life insurance policies. Each provider may have unique investment options, fee structures, and policy features. Analyze their investment performance over time and consider the following:

- Historical returns on investments.

- Fee transparency and competitiveness.

- The flexibility of investment options to suit your strategy.

- Customer reviews and ratings regarding investment performance and customer service.

By carefully evaluating investment options, understanding fees, and comparing providers, you can make informed decisions to maximize the return on your custom whole life insurance investment. Remember, a well-structured investment strategy tailored to your goals can provide long-term financial benefits.

Life Insurance for Your Boyfriend: Is It Possible?

You may want to see also

Long-Term Growth: Focus on policies with strong investment components for future gains

When considering long-term growth in whole life insurance, it's crucial to focus on policies that offer robust investment components. These investment-linked policies are designed to provide potential for future gains, which can be a significant advantage over traditional term life insurance. The key to achieving long-term growth lies in the insurance company's investment strategy, which should be carefully evaluated.

One of the primary benefits of these investment-based policies is the potential for tax-advantaged growth. Many whole life insurance policies offer a tax-deferred growth environment, allowing your money to accumulate over time without being taxed. This feature is particularly attractive for long-term financial planning, as it enables your investments to grow more rapidly. The investment options within these policies can vary, ranging from fixed-income investments to more aggressive equity-based strategies.

To maximize long-term growth, you should seek policies with a strong investment performance track record. Look for insurance companies that have a history of consistently outperforming the market or at least matching the performance of a relevant benchmark index. These companies often have dedicated investment teams that research and select assets, ensuring that your money is invested in a way that aligns with your financial goals.

Additionally, consider the flexibility offered by these investment-linked policies. Some insurers provide policyholders with the ability to allocate their premiums across different investment options, allowing for customization based on individual risk tolerance and financial objectives. This flexibility can be a powerful tool for adapting to changing market conditions and optimizing your investment strategy over time.

In summary, when aiming for long-term growth in whole life insurance, prioritize policies with strong investment components. These policies offer the potential for tax-advantaged growth and can be tailored to individual needs. By carefully selecting insurance companies with a proven track record of investment success, you can make informed decisions to secure your financial future and potentially achieve significant gains over time. Remember, thorough research and understanding of the investment strategies employed by insurance companies are essential to making the right choice.

Understanding VA Life Insurance Payout Timelines and Process

You may want to see also

Guaranteed Benefits: Ensure your policy offers guaranteed death benefits and interest credits

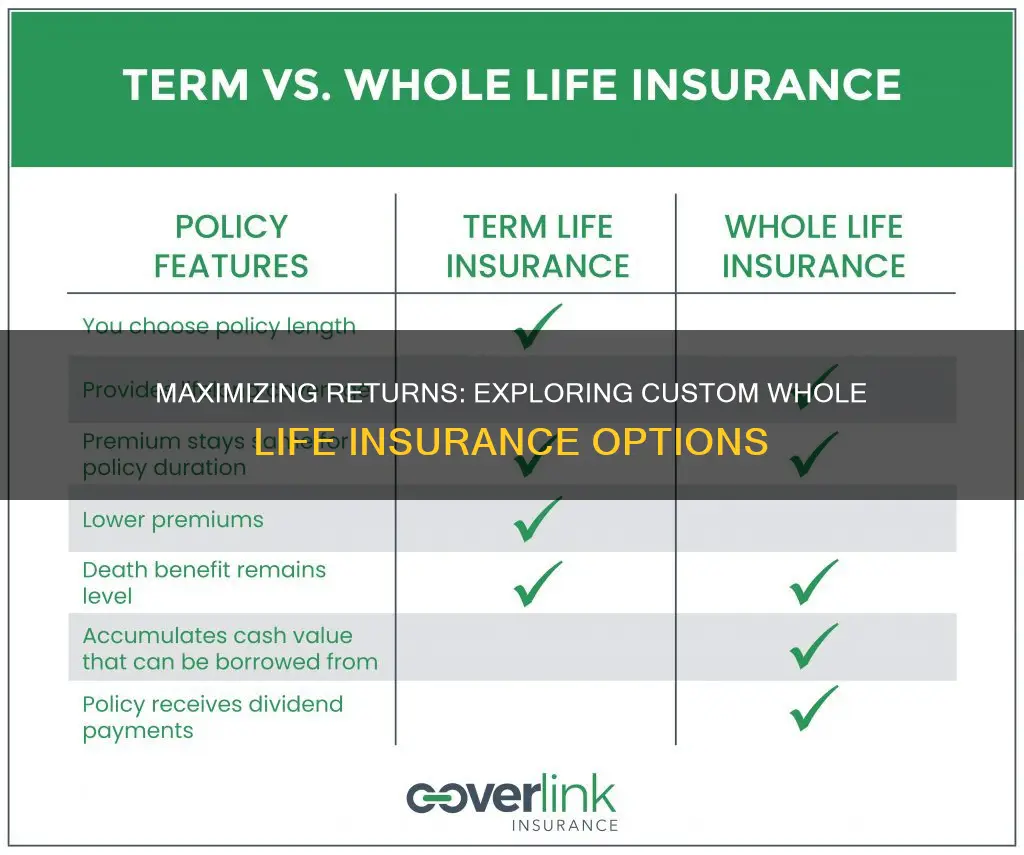

When considering whole life insurance, one of the most important aspects to look for is the guarantee of death benefits and interest credits. These guarantees are essential as they provide a level of security and predictability that is crucial for long-term financial planning. Here's why this feature should be at the top of your list when evaluating different policies:

Guaranteed Death Benefits: Whole life insurance is designed to provide a death benefit, which is a fixed amount paid out to your beneficiaries upon your passing. The key word here is 'guaranteed.' This means that regardless of market fluctuations or changes in the insurance company's investment performance, the death benefit will remain the same. For example, if you choose a policy with a $100,000 death benefit, your beneficiaries will receive exactly that amount when you pass away. This guarantee is particularly valuable as it ensures financial security for your loved ones, especially if they rely on that income to cover essential expenses or maintain their standard of living.

Interest Credits: Another critical aspect of guaranteed benefits is the potential for interest credits. These credits are essentially the interest earned on the policy's investment component. In whole life insurance, a portion of your premium is allocated to an investment account, which grows over time. The insurance company guarantees a certain rate of return on this investment, and any interest earned is credited to your policy. These interest credits can accumulate and, in some cases, be used to reduce future premiums or increase the cash value of your policy. This feature ensures that your money works harder for you, providing potential long-term financial gains.

When shopping for whole life insurance, it's essential to understand the specific guarantees offered by each policy. Some companies may provide more favorable interest rates or investment options, allowing for greater potential growth. Additionally, consider the policy's flexibility in allowing you to access these guaranteed benefits. For instance, some policies may offer the option to take out loans against the cash value or make extra payments to build up the death benefit faster.

In summary, when evaluating whole life insurance policies, prioritize those that offer guaranteed death benefits and interest credits. These guarantees provide financial security and predictability, ensuring that your loved ones receive the intended financial support, and your investment grows according to the terms agreed upon. By choosing a policy with these features, you can make informed decisions about your long-term financial strategy and have peace of mind knowing that your insurance is tailored to your specific needs.

Life Insurance for Phoenix Police: What Cover Do They Get?

You may want to see also

Flexibility: Choose a policy with adjustable riders and options to adapt to changing needs

When considering whole life insurance, flexibility is a key aspect to look for, especially if you want a policy that can adapt to your evolving circumstances and financial goals. One way to ensure this flexibility is to opt for a policy that offers adjustable riders and various customization options. Here's why this feature is essential and how it can benefit you:

Riders for Customization: Whole life insurance policies often come with riders, which are additional benefits or features that can be added to your base policy. These riders provide an extra layer of customization, allowing you to tailor the insurance to your specific needs. For instance, you might choose a rider that increases the death benefit during certain life stages, such as when you have children or when you reach a certain age. This way, your policy can grow with your life's changes. For example, a "Child Rider" could provide an additional payout if a covered dependent child passes away, ensuring financial security for your family. Similarly, a "Marriage Rider" might offer an increased benefit if the insured spouse gets married, reflecting the changing dynamics of their life.

Adaptability to Life Events: Life is full of unexpected twists and turns, and your insurance should be able to keep up. A flexible whole life insurance policy allows you to make adjustments as your life progresses. If you start a family, you can add riders to protect your growing family's financial future. When you retire, you might consider adjusting the policy to reflect a reduced need for a large death benefit, potentially saving you money. The ability to adapt ensures that your insurance remains relevant and effective throughout your life's journey.

Long-Term Financial Planning: Customizable policies often provide a more comprehensive financial planning approach. By regularly reviewing and adjusting your policy, you can ensure that it aligns with your long-term goals. For instance, you might start with a basic policy and gradually add riders as your financial situation improves. This approach allows you to build a robust insurance plan that can withstand the test of time and changing economic conditions.

Peace of Mind: Knowing that your insurance can adapt to your needs provides peace of mind. With a flexible policy, you can rest assured that your coverage will remain relevant and effective, even as your life circumstances change. This flexibility is particularly valuable for those who want a long-term financial strategy that can evolve with their evolving needs.

In summary, when seeking the best return on your whole life insurance investment, consider policies that offer adjustable riders and customization options. This flexibility ensures that your insurance can adapt to life's changes, providing tailored protection and financial security. By choosing a policy with these features, you gain the ability to customize your insurance, making it a valuable tool for long-term financial planning and a reliable safety net for your future.

Senators' Health Insurance: A Lifetime of Coverage?

You may want to see also

Customer Service: Opt for a company with excellent support and transparency

When considering custom whole life insurance, one of the most critical factors to evaluate is the quality of customer service provided by the insurance company. Opting for a provider with excellent support and transparency can significantly impact your overall experience and the success of your insurance investment. Here's why this aspect should be a top priority:

Quick Issue Resolution: Life insurance policies can be complex, and policyholders may encounter various issues or have questions over time. A company with a dedicated and responsive customer service team can provide quick resolutions to these problems. Whether it's policy changes, claims processing, or general inquiries, prompt assistance ensures that you're not left waiting for answers, which can be crucial during challenging times.

Transparency in Communication: Transparency is essential in building trust with customers. A good insurance company will provide clear and honest communication about policy details, fees, and potential risks. They should offer easy-to-understand explanations of your policy's benefits and any associated costs. Transparent practices ensure that you are well-informed and can make the best decisions regarding your insurance coverage.

Personalized Support: Every customer has unique needs, and a company that offers personalized support caters to these individual requirements. This might include tailored advice, regular policy reviews, and adjustments to ensure your insurance plan remains suitable over time. Personalized service demonstrates a commitment to understanding your specific circumstances and can lead to more effective and satisfying insurance solutions.

Efficient Claims Processing: In the unfortunate event of a claim, the efficiency and fairness of the claims process become vital. A company with a robust customer service team can guide you through the claims procedure, ensuring that all necessary documentation is in order and that the process is as smooth as possible. Quick and fair claims settlements can provide much-needed financial support during difficult times.

Long-Term Relationship Building: Choosing an insurance provider with excellent customer service can foster a long-term relationship. This relationship can evolve as your needs change over time, allowing the company to adapt and provide ongoing support. Building a trust-based connection with your insurance company can lead to better service and potentially more favorable policy options in the future.

In summary, when evaluating custom whole life insurance options, don't overlook the importance of customer service. A company that offers excellent support, transparency, and personalized attention will ensure that your insurance journey is as smooth and beneficial as possible. This aspect of the insurance provider's service can significantly impact your overall satisfaction and the long-term success of your insurance investment.

Keep Life Insurance Statements: How Long is Too Long?

You may want to see also

Frequently asked questions

The term "best return" in the context of whole life insurance refers to the highest potential financial benefit or profit that an individual can receive from their insurance policy over time. It is a measure of the policy's performance and the insurer's ability to generate returns for the policyholder.

Whole life insurance policies are designed to provide long-term financial security. They typically involve investing a portion of the premiums paid by the policyholder in various investment options offered by the insurance company. These investments can include stocks, bonds, real estate, or other assets. The returns are generated through the growth of these investments, and the insurance company uses these returns to pay death benefits and policyholder dividends.

Several factors influence the potential return on investment in a whole life insurance policy:

- Investment Options: Different insurance companies offer various investment portfolios, each with its own risk and return profile. Diversified investment options may provide more stable returns.

- Policy Type: There are different types of whole life insurance, such as traditional whole life, participating whole life, and non-participating whole life. Participating policies allow policyholders to receive dividends, which can contribute to higher returns.

- Investment Performance: The actual returns depend on the performance of the investments chosen by the insurance company. Market conditions and investment strategies play a significant role.

- Policyholder's Age and Health: Younger and healthier individuals may have more favorable terms and potentially higher returns, as they pose less risk to the insurer.

While whole life insurance policies offer the potential for attractive returns, there is no guarantee. The returns are dependent on various market factors and the insurer's investment performance. It is essential to understand the risks and consult with financial advisors to make informed decisions.

To maximize returns, consider the following strategies:

- Choose a reputable insurance company with a strong financial rating and a history of successful investments.

- Diversify your investment options within the policy to spread risk.

- Regularly review and adjust your policy to align with your financial goals and risk tolerance.

- Consider consulting a financial advisor who can provide personalized advice based on your circumstances.