Whole life insurance can be a valuable financial tool, but it's not the right choice for everyone. While it offers lifelong coverage and a guaranteed death benefit, it can be expensive and may not be the best option for those seeking flexibility or wanting to invest in other areas. Additionally, the investment component of whole life insurance can be complex and may not perform as expected, potentially leading to higher costs or lower returns. This article will explore the reasons why someone might choose not to invest in whole life insurance, considering the potential drawbacks and alternatives available.

What You'll Learn

- High upfront costs: Whole life insurance premiums can be expensive, especially for younger buyers

- Limited flexibility: It's a long-term commitment with limited options to change coverage

- Slower growth: Cash value accumulation may be slower compared to term life

- Tax implications: Income tax may be owed on policy loans and withdrawals

- Complexity: Understanding the policy and its long-term impact requires careful consideration

High upfront costs: Whole life insurance premiums can be expensive, especially for younger buyers

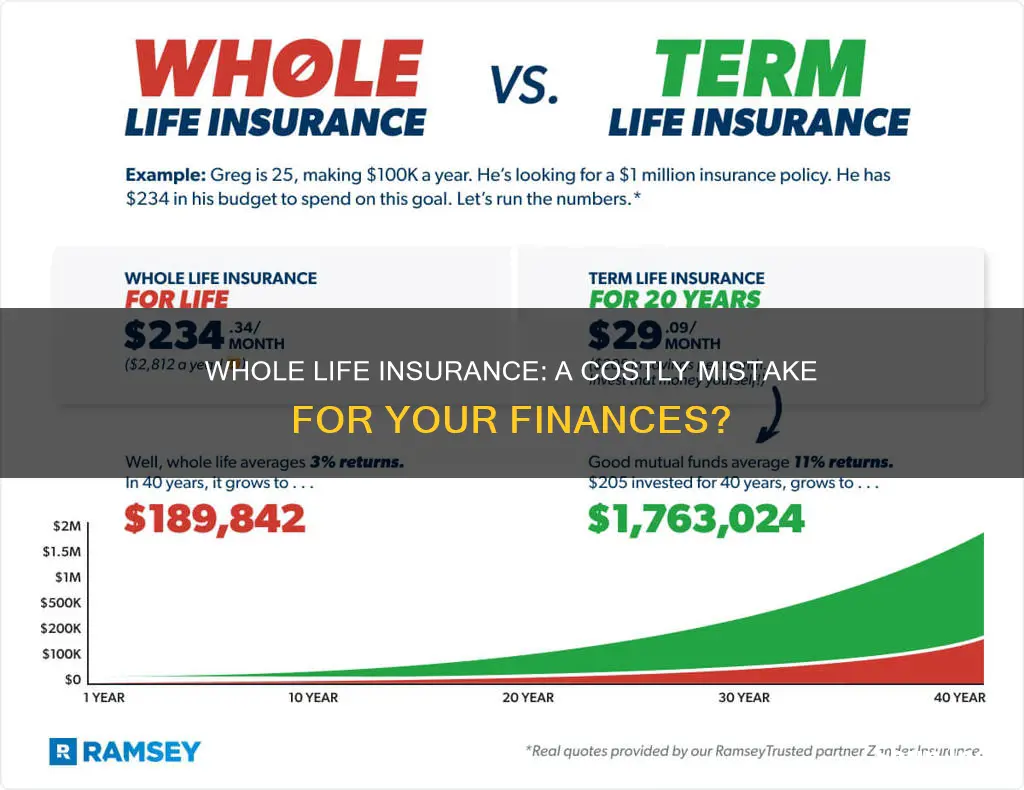

Whole life insurance, while offering lifelong coverage and potential investment benefits, often comes with a significant drawback: high upfront costs. This is particularly true for younger individuals who are just starting to build their financial portfolios. The initial premium payments can be a substantial financial burden, especially when compared to other insurance options. For instance, term life insurance, which provides coverage for a specified period, typically costs much less, making it an attractive choice for those on a tight budget.

The reason for these elevated premiums lies in the nature of whole life insurance. It provides a guaranteed death benefit and a cash value component that grows over time. This comprehensive coverage and the promise of a payout to beneficiaries contribute to the higher costs. Additionally, the longer lifespan of the policy means that the insurance company has to account for a more extended period of risk, further influencing the premium structure.

Younger buyers often face a trade-off between affording the premium and allocating funds for other financial goals. For instance, they might be saving for a home, investing in retirement plans, or funding education expenses. The high upfront costs of whole life insurance can make it challenging to meet these other financial objectives, especially when the premiums are a fixed monthly or annual expense.

However, it's important to note that while the initial costs may be high, whole life insurance can still be a valuable long-term investment. The guaranteed death benefit and the potential for cash value accumulation can provide financial security and peace of mind. For those who can afford the premiums, it might be a worthwhile consideration, especially if they have a long-term financial plan in place.

In summary, the high upfront costs of whole life insurance, particularly for younger buyers, can be a significant deterrent. It requires careful financial planning and consideration of one's overall financial goals. While it offers comprehensive coverage, the initial premium payments may be a challenge for those with limited financial resources.

Trust Funding: Life Insurance for Minors

You may want to see also

Limited flexibility: It's a long-term commitment with limited options to change coverage

Whole life insurance, while offering lifelong coverage, can be a restrictive choice for those seeking flexibility in their insurance plans. One of the primary drawbacks is the long-term commitment it entails. Once you've chosen this type of insurance, altering the coverage can be a complex and often costly process. This lack of flexibility can be a significant concern for individuals who may experience changes in their financial situation, health, or personal circumstances over time.

The initial process of purchasing whole life insurance involves a thorough assessment of your current and future needs. This includes evaluating your health, financial status, and risk factors. Once the policy is in place, making adjustments to the coverage can be challenging. For instance, if you decide to increase your coverage amount, you might face higher premiums and a more extensive medical examination, which could be a burden for those with pre-existing health conditions. Similarly, reducing coverage might not be an option, as it could leave you underinsured if your needs change.

The limited flexibility of whole life insurance is further emphasized by the fact that these policies typically have a fixed premium structure. This means that the cost of insurance remains relatively constant throughout the policy's duration, providing no room for adjustment based on changing circumstances. In contrast, term life insurance offers more flexibility, allowing policyholders to choose the duration of coverage, often with the option to renew or adjust the policy at the end of the term.

For those who prioritize adaptability in their insurance choices, this lack of flexibility can be a significant deterrent. It is essential to consider your long-term goals and financial plans when deciding on insurance coverage. If you anticipate significant life changes, such as starting a family, changing careers, or experiencing health issues, a more flexible insurance option might be more suitable. In such cases, term life insurance or adjustable whole life policies could provide the necessary adaptability to ensure your insurance plan remains aligned with your evolving needs.

Unlocking Elite Preferred Status for Life Insurance

You may want to see also

Slower growth: Cash value accumulation may be slower compared to term life

When considering whole life insurance, it's important to understand the potential trade-offs, particularly regarding the growth of your cash value. One significant aspect to note is that the accumulation of cash value in whole life insurance can be slower compared to term life insurance.

In whole life insurance, a portion of your premium payments goes towards building cash value, which grows over time through interest and investment returns. This cash value can be borrowed against or withdrawn, providing financial flexibility. However, the growth rate of this cash value is generally slower than the premium payments you make in term life insurance. Term life insurance focuses primarily on providing coverage for a specified period, with no investment component. As a result, the entire premium goes towards the death benefit, ensuring higher coverage amounts per dollar spent.

The slower growth of cash value in whole life insurance can be attributed to several factors. Firstly, the insurance company must ensure the policy's long-term viability, which may result in more conservative investment strategies. These strategies aim to provide stability and security, potentially limiting the potential for rapid growth. Additionally, the insurance company incurs various expenses, such as administrative costs and mortality costs, which are factored into the premium calculations and may impact the overall growth rate of the cash value.

Another consideration is the time it takes for the cash value to accumulate. With term life insurance, the focus is on providing immediate and substantial coverage, often at a lower cost. In contrast, whole life insurance encourages long-term savings, and the cash value builds up gradually over the policy's duration. This slower accumulation process might not appeal to those seeking quicker returns on their investments.

Despite the slower growth, it's essential to recognize that whole life insurance offers other benefits, such as lifelong coverage and the potential for tax-deferred growth. The trade-off between growth rate and these long-term advantages should be carefully evaluated based on individual financial goals and risk tolerance. Understanding these nuances can help individuals make informed decisions when considering whole life insurance as an investment option.

Creating Customized Life Insurance: Taking Control of Your Coverage

You may want to see also

Tax implications: Income tax may be owed on policy loans and withdrawals

When considering whole life insurance as an investment, it's crucial to understand the potential tax implications that may arise from policy loans and withdrawals. One of the primary reasons why some individuals might choose not to invest in whole life insurance is the potential tax burden associated with these actions.

Policy loans, a common feature of whole life insurance policies, can have significant tax consequences. When you take out a loan against your policy, you essentially borrow money from the insurance company using your policy's cash value as collateral. The loan is typically interest-free, but it still counts as taxable income. This means that the amount you borrow will be subject to income tax, and you may need to pay taxes on the full amount, even if you only use a portion of the loan. For example, if you take out a $10,000 loan and only use $5,000, you could still be liable for taxes on the entire $10,000. This can be a substantial financial burden, especially if you are in a higher tax bracket.

Additionally, withdrawals from your whole life insurance policy can also trigger tax implications. When you withdraw funds from the policy, you may be subject to income tax on the amount withdrawn, especially if the policy has accumulated significant cash value. The tax treatment of these withdrawals can vary depending on the policy and the jurisdiction. In some cases, the withdrawals may be considered taxable income, and you might need to pay taxes on the entire amount withdrawn. This can be a concern for investors who rely on the policy's cash value for financial goals, as it may reduce the overall value of the investment.

Furthermore, the tax implications of policy loans and withdrawals can be further complicated by the potential impact on your overall tax liability. If you are in a lower tax bracket, the tax on these transactions could be more manageable. However, for those in higher tax brackets, the tax burden can be substantial. It's essential to consider your tax situation and consult with a financial advisor or tax professional to understand the potential tax consequences before making any significant decisions regarding your whole life insurance policy.

In summary, the tax implications of policy loans and withdrawals in whole life insurance policies are an important consideration. The potential tax burden on borrowed amounts and withdrawals can be significant and may deter some investors. Understanding these tax consequences is crucial for making informed financial decisions and ensuring that the investment aligns with your long-term financial goals and tax strategy.

Life Insurance: Annual Return Declarations and Their Importance

You may want to see also

Complexity: Understanding the policy and its long-term impact requires careful consideration

When considering whole life insurance, it's crucial to understand the complexity of the policy and its long-term implications. This type of insurance is a long-term commitment, and the decision to invest in it should not be taken lightly. One of the primary reasons for this complexity is the extensive duration of the policy. Whole life insurance typically spans several decades, and the policyholder's financial situation and needs may change significantly over this period. For instance, a young adult purchasing whole life insurance might not foresee their financial goals evolving, such as starting a business or funding a child's education, which could require adjusting the policy's coverage.

The complexity arises from the intricate relationship between the policy's premiums and its long-term benefits. Whole life insurance policies often have higher initial premiums compared to term life insurance, and these premiums are typically non-refundable. This means that if the policyholder decides to cancel the insurance, they will have paid a substantial amount without receiving any financial return. Understanding the potential for long-term financial commitments is essential, especially when considering the impact on one's overall financial plan.

Another layer of complexity is the investment component of whole life insurance. Many policies offer an investment component, allowing the policyholder to grow their money over time. However, this investment aspect can be risky, and the performance of the investment is not guaranteed. The policyholder must carefully evaluate the investment options and their potential risks and rewards. Misunderstanding the investment strategy or the policy's investment-related fees could lead to financial losses or a failure to meet long-term financial goals.

Furthermore, the long-term impact of whole life insurance extends beyond the policy itself. It can influence retirement planning, estate planning, and even tax strategies. For example, the death benefit of a whole life insurance policy can provide a tax-free inheritance, which can be a valuable asset for beneficiaries. However, the tax implications of the policy's growth and the death benefit must be considered to ensure compliance with tax laws and to maximize the benefits for the intended recipients.

In summary, the complexity of whole life insurance lies in its long-term nature, the significant financial commitment it entails, and the potential impact on various aspects of personal finance. Prospective policyholders should carefully review the policy, seek professional advice when needed, and ensure they fully understand the implications of their investment. This careful consideration will help individuals make informed decisions about whole life insurance, ensuring it aligns with their financial goals and circumstances.

Understanding Life Insurance Delay Clauses and Their Impact

You may want to see also

Frequently asked questions

While whole life insurance can provide a sense of security and financial protection for your loved ones, it is not necessarily a good investment for everyone. The primary purpose of whole life insurance is to offer a death benefit to your beneficiaries, and the investment component is often considered secondary. The investment portion of whole life insurance can be volatile, and the performance is not guaranteed, especially in the long term. It's essential to evaluate your financial goals and consider other investment options that might better suit your needs.

Some individuals may opt not to invest in whole life insurance due to several reasons. Firstly, the premiums can be relatively high compared to other insurance products, making it a significant financial commitment. Additionally, the investment aspect of whole life insurance may not offer the same level of flexibility and potential returns as other investment vehicles. Moreover, there are alternative ways to secure your family's financial future, such as term life insurance or building an emergency fund, which might be more suitable for short-term needs.

Yes, there are a few potential drawbacks to consider. One significant disadvantage is the lack of liquidity. Whole life insurance policies are typically illiquid, meaning you cannot easily access the cash value or withdraw funds without penalties. This can be a concern if you need immediate access to funds for unexpected expenses. Additionally, the investment performance is tied to the insurance company's investment management, which may not always align with your investment goals or market trends.

The cost of whole life insurance can be a significant factor in decision-making. Whole life insurance policies generally have higher premiums compared to term life insurance, especially for younger and healthier individuals. The higher cost is primarily due to the lifelong coverage and the accumulation of cash value over time. If you are on a tight budget or have other financial priorities, exploring more affordable insurance options might be more beneficial. It's advisable to compare different policies and consider your long-term financial strategy before making a decision.