Life insurance proceeds are a significant financial benefit that can provide financial security for beneficiaries after the death of the insured individual. When a life insurance policy is in force, it is essential to understand where and how these proceeds are reported to ensure compliance with tax laws and financial regulations. This paragraph will explore the various avenues through which life insurance proceeds are reported, including tax forms, financial institutions, and the impact on beneficiaries' financial records. Understanding these reporting requirements is crucial for both the insurance company and the beneficiaries to ensure a smooth and transparent process.

| Characteristics | Values |

|---|---|

| Tax Treatment | Generally, life insurance proceeds are not taxable income for the beneficiary. However, if the policy is a "term" policy and the proceeds are received after the insured's death, they may be subject to income tax in the year of receipt. |

| Reporting Requirements | Beneficiaries typically do not need to report life insurance proceeds on their tax returns unless the policy is a "term" policy and the proceeds exceed a certain threshold (e.g., $1,000 for non-itemizers). |

| Estate Tax Implications | Life insurance proceeds are generally not included in the deceased's estate for estate tax purposes, unless the policy is owned by the deceased and the proceeds exceed a specific threshold (e.g., $5 million in 2023). |

| State-Specific Rules | Some states may have unique regulations regarding the reporting or taxation of life insurance proceeds. It's advisable to consult state-specific tax laws. |

| Business Continuation | If the deceased owned a business, life insurance proceeds can be used to continue the business operations, especially if the policy was designed as a business continuity tool. |

| Personal Use | Proceeds can be used for personal expenses, such as funeral costs, outstanding debts, or living expenses, depending on the beneficiary's needs. |

| Investment Options | Some life insurance policies offer investment components, allowing beneficiaries to invest the proceeds in various assets, which may have tax implications. |

What You'll Learn

- Tax Implications: Report proceeds to IRS for tax purposes

- Estate Planning: Proceeds are listed in estate assets

- Bank Accounts: Funds are deposited into designated bank accounts

- Beneficiary Notifications: Notify beneficiaries of the insurance payout

- Financial Institutions: Proceeds are reported to financial advisors and banks

Tax Implications: Report proceeds to IRS for tax purposes

When you receive life insurance proceeds, it's important to understand the tax implications and ensure you report them to the Internal Revenue Service (IRS) accurately. Life insurance payments can be a significant financial benefit, and the tax treatment varies depending on the type of policy and the circumstances. Here's a detailed guide on how to navigate the tax reporting process for life insurance proceeds:

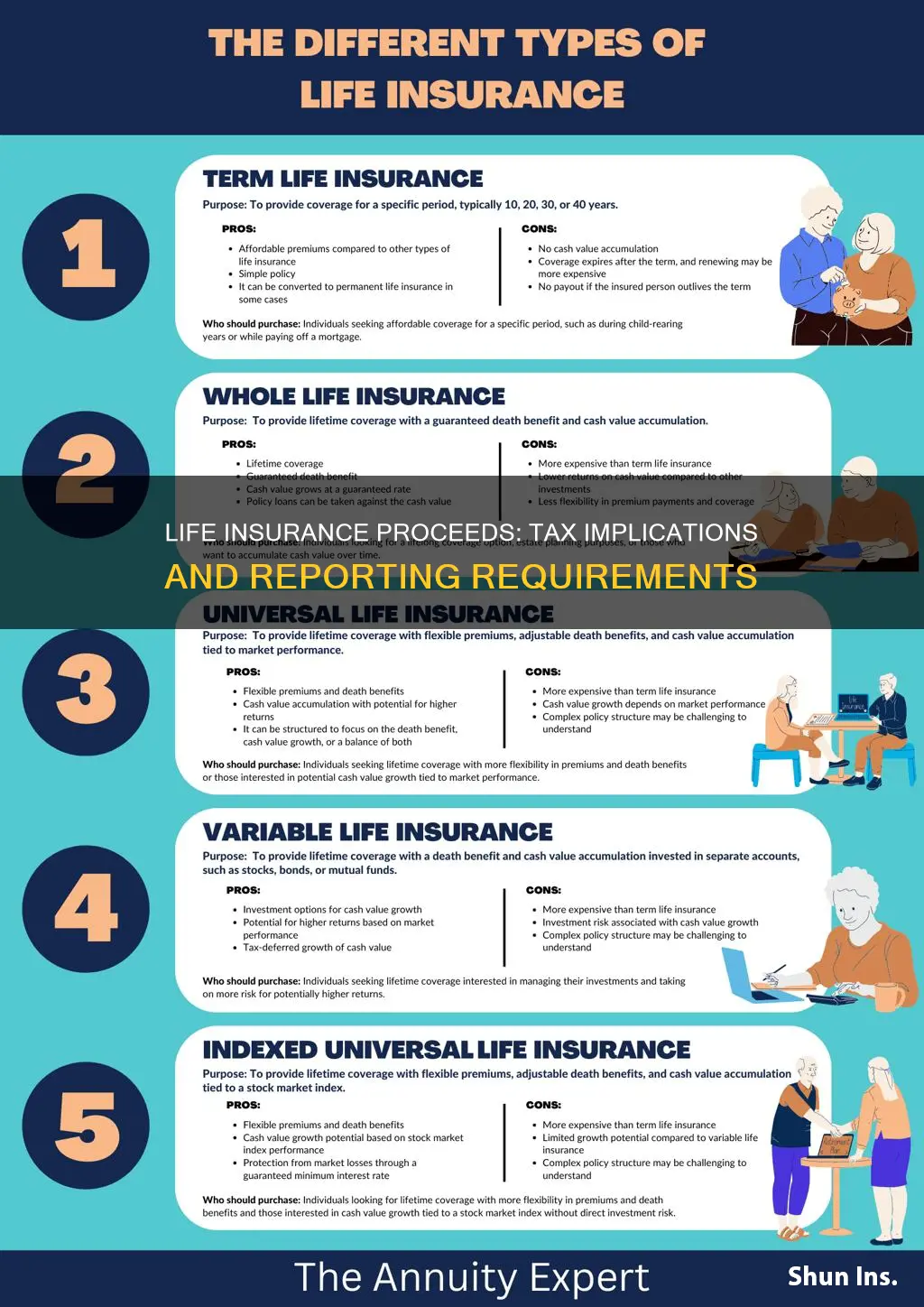

Understanding Taxable Proceeds: In most cases, life insurance benefits are generally not taxable. However, there are exceptions and specific scenarios where the proceeds may be considered taxable income. For instance, if you receive a lump-sum payment from a term life insurance policy, it might be taxable, especially if the policy was taken out for a specific purpose, such as business interruption coverage. The key is to determine whether the proceeds are considered ordinary income or fall under a specific tax category.

Reporting Requirements: The IRS requires you to report life insurance proceeds, especially if they exceed a certain threshold. For tax year 2023, the standard deduction for single filers is $12,950, and for married filing jointly, it is $25,900. If the life insurance payout is below these amounts, it may not be reportable. However, if the proceeds are substantial or if you have other income, you must report them on your tax return. You can use Form 1099-G, "Certain Government Payments," to report the payment if it is $600 or more. This form is typically provided by the insurance company and includes details about the payment.

Taxable Events: There are situations where life insurance proceeds may be taxable. For example, if you receive a payment from a permanent life insurance policy with cash value, the IRS may consider it a taxable distribution. Additionally, if the policy was taken out with a loan, the proceeds could be subject to tax. It's crucial to review the policy terms and consult a tax professional to understand the specific tax treatment in your case.

Deductions and Credits: While life insurance proceeds themselves are not typically deductible, there might be deductions or credits available depending on your overall financial situation. For instance, if you itemize deductions, you can claim certain expenses related to the insurance policy. It's essential to keep track of these expenses and consult a tax advisor to ensure you maximize any potential deductions.

Consulting a Tax Professional: Given the complexity of tax laws, it is highly recommended to consult a tax professional or accountant who can provide personalized advice based on your specific circumstances. They can help you navigate the reporting process, ensure compliance with IRS regulations, and optimize your tax strategy regarding life insurance proceeds. Remember, accurate reporting is crucial to avoid penalties and ensure a smooth tax process.

Flight Emergencies: Insurance Coverage for Flight-for-Life Services

You may want to see also

Estate Planning: Proceeds are listed in estate assets

When it comes to estate planning, one crucial aspect often overlooked is the proper reporting of life insurance proceeds. These proceeds, which can be a significant part of an estate, need to be carefully considered and included in the overall financial planning strategy. Here's a detailed guide on how to handle life insurance proceeds within the context of estate assets:

Understanding the Proceeds: Life insurance proceeds are typically a tax-free financial benefit paid out to the designated beneficiaries upon the insured individual's death. These proceeds can be a substantial amount and should be treated as part of the estate's assets. It is essential to recognize that life insurance money is not always exempt from estate taxes, especially in high-net-worth estates.

Inclusion in Estate Assets: When preparing an estate inventory, life insurance proceeds must be listed as an asset. This process involves calculating the total amount payable and ensuring it is accurately reflected in the estate's financial records. The proceeds should be considered liquid assets, as they can be quickly converted into cash, and their value should be determined at the time of the insured's death.

Beneficiary Designation: Estate planners should pay close attention to the beneficiary designations on life insurance policies. The designated beneficiaries will receive the proceeds, and it is crucial to ensure that these beneficiaries are up-to-date and align with the estate's distribution plans. Regularly reviewing and updating beneficiary information is essential to avoid potential disputes and ensure the proceeds are distributed according to the insured's wishes.

Tax Implications: As mentioned earlier, life insurance proceeds may be subject to estate taxes. It is advisable to consult with a tax professional or estate planner to understand the tax implications and potential strategies to minimize the tax burden. Proper planning can help ensure that the proceeds are utilized efficiently and in accordance with the insured's estate distribution preferences.

Distribution and Estate Planning: Once the life insurance proceeds are received, they should be managed and distributed according to the estate's plan. This may involve paying off debts, fulfilling final wishes, or funding ongoing expenses. Estate planners can work with beneficiaries to create a structured distribution plan, ensuring that the proceeds are utilized effectively and in line with the insured's intentions.

By incorporating life insurance proceeds into the estate planning process and treating them as a valuable asset, individuals can ensure a more comprehensive and efficient distribution of their wealth. It is a critical step in estate management, allowing for better financial organization and peace of mind for both the insured and their beneficiaries.

Life Insurance and Divorce: What You Need to Know

You may want to see also

Bank Accounts: Funds are deposited into designated bank accounts

When it comes to life insurance proceeds, the process of reporting and depositing these funds into designated bank accounts is a crucial step in the overall administration of the policy. This step ensures that the beneficiaries receive their rightful payments and that the insurance company's records are accurate and up-to-date. Here's a detailed guide on how this process typically works:

Upon receiving a claim, the insurance company will initiate the payment process, which may involve various methods depending on the policy and the beneficiary's preferences. One common method is direct deposit into a designated bank account. This account is specifically set up for the purpose of receiving life insurance benefits and is often referred to as a 'beneficiary account'. The insurance company will provide the necessary details, including the account number and routing information, to facilitate the transfer. It is essential for the beneficiary to provide accurate and up-to-date bank account information to ensure a smooth and timely deposit.

The funds are then transferred according to the agreed-upon schedule, which could be immediate or scheduled for a specific date. For instance, some policies may require the payment to be made within a few days of the claim being approved, while others might specify a monthly or annual payout. Once the money is deposited, the beneficiary will have access to the funds, which can be used for various purposes as per the policy's terms.

It is worth noting that the process might vary slightly depending on the insurance provider and the jurisdiction. Some companies might offer the option to receive the proceeds in a lump sum, while others may provide periodic payments over time. Additionally, certain tax implications and reporting requirements may apply, especially for large payouts, which should be considered by the beneficiary.

In summary, the reporting and depositing of life insurance proceeds into designated bank accounts is a critical phase in the administration of life insurance policies. It ensures that beneficiaries receive their benefits efficiently and in accordance with the policy's terms. By following the insurance company's guidelines and providing accurate account details, beneficiaries can navigate this process smoothly and securely.

How to Reinstate Lapsed Life Insurance Policies?

You may want to see also

Beneficiary Notifications: Notify beneficiaries of the insurance payout

When an individual passes away, the distribution of their life insurance proceeds becomes a crucial aspect of the settlement process. It is essential to notify the designated beneficiaries promptly to ensure a smooth and transparent process. Here's a guide on how to handle beneficiary notifications:

Understanding the Importance of Timely Communication:

Life insurance policies often specify the order of beneficiaries and the amount each is entitled to. When the insured person's death is confirmed, the insurance company initiates the payout process. Prompt notification to beneficiaries is vital for several reasons. Firstly, it respects the wishes of the deceased, ensuring that the intended recipients receive their rightful share. Secondly, it prevents potential disputes among beneficiaries, which can be emotionally challenging during an already difficult time.

Methods of Notification:

- Direct Contact: The most common approach is to contact the beneficiaries directly. This can be done through phone calls, emails, or even personal meetings if the beneficiaries are nearby. Inform them about the insurance payout and provide relevant details such as the amount, any applicable tax implications, and the expected timeline for receiving the funds.

- Legal Representatives: In cases where the deceased had appointed a legal representative or executor of their estate, it is essential to notify them first. They can then communicate the news to the beneficiaries and guide the distribution process.

- Online Portals: Many insurance companies now offer online portals where beneficiaries can access information. This method provides a secure and efficient way to deliver updates, especially for those who may not be readily available for direct contact.

Key Information to Communicate:

- Payout Amount: Clearly state the total amount of the insurance payout.

- Tax Implications: Inform beneficiaries about any taxes they may need to pay on the proceeds, as these can vary depending on the jurisdiction.

- Timeline: Provide an estimated timeline for when the beneficiaries will receive their share. This helps manage expectations and allows them to plan accordingly.

- Next Steps: Guide the beneficiaries on the subsequent steps they should take, such as providing necessary documentation or choosing how they want to receive the payment (bank transfer, check, etc.).

Confidentiality and Sensitivity:

When communicating with beneficiaries, it is crucial to maintain confidentiality and sensitivity. Respect their privacy and avoid discussing the details of the insurance policy or the deceased's personal affairs with anyone who is not authorized. Offer support and be understanding of their emotional state during this challenging period.

By following these steps, insurance companies and beneficiaries can ensure a transparent and efficient process for distributing life insurance proceeds, providing much-needed financial support to those who have been left behind.

Leaving Life Insurance to a Trust: Is It Possible?

You may want to see also

Financial Institutions: Proceeds are reported to financial advisors and banks

When an individual passes away, their life insurance policy becomes a crucial asset to be managed and distributed according to the policyholder's wishes. Financial institutions, including banks and financial advisors, play a significant role in this process. Upon receiving notification of the insured individual's death, the financial institution is responsible for handling the life insurance proceeds with care and precision.

The first step for financial institutions is to verify the authenticity of the death and the validity of the claim. This involves obtaining official death certificates and other necessary documentation. Once the claim is confirmed, the financial institution must locate and notify the designated beneficiaries or the policyholder's estate. This step is crucial to ensure that the proceeds are distributed to the rightful recipients.

Financial advisors and banks are often involved in the distribution of life insurance money for several reasons. Firstly, they act as intermediaries between the insurance company and the beneficiaries. They facilitate the transfer of funds by providing the necessary paperwork and guidance to ensure a smooth process. Secondly, financial advisors can offer valuable advice to beneficiaries, helping them understand their options and make informed decisions regarding the use of the proceeds. This may include financial planning, investment strategies, or tax considerations.

Banks also play a vital role in managing life insurance payouts. They can provide secure and accessible methods for beneficiaries to receive their funds, such as direct deposits into bank accounts. Additionally, banks may offer financial products or services tailored to the beneficiaries' needs, such as loans or investment accounts, to help them make the most of the life insurance proceeds.

In summary, financial institutions, including banks and financial advisors, are integral to the distribution of life insurance proceeds. They ensure that the process is handled efficiently, providing support to beneficiaries and offering financial guidance. By working together, these institutions contribute to a seamless transition for the insured individual's estate and beneficiaries, allowing them to navigate the complexities of receiving and managing life insurance money.

Reliance Nippon Life Insurance: Is It Worth Investing In?

You may want to see also

Frequently asked questions

Life insurance proceeds are generally considered taxable income and should be reported on your annual tax return. The amount you receive will be included in your total income for the year. It's important to note that the tax laws regarding life insurance vary by country and region, so it's advisable to consult a tax professional or refer to the relevant tax guidelines in your jurisdiction.

Yes, even if you don't itemize your deductions, you still need to report the life insurance proceeds on your tax return. The standard deduction may not cover the entire amount, but you must include it in your taxable income. It's recommended to consult a tax advisor to ensure you understand the implications and any potential tax benefits or liabilities.

In some cases, life insurance proceeds may be exempt from taxation. For example, if the policy was owned by an individual and the beneficiary is their spouse, certain exemptions may apply. Additionally, if the policy has been in effect for a long period and the proceeds are a result of a long-term investment strategy, there might be specific tax treatments. It's best to review the tax laws or seek professional advice to determine if any exceptions apply to your situation.

If you receive multiple life insurance payments during the tax year, you should report each payment separately. Include the total amount received and any relevant details on your tax return. It's important to keep records of the payments and any associated documentation for your records and tax purposes.