Proof of auto insurance is a document that demonstrates that you have a current and valid auto insurance policy. It is required in most states to meet the minimum auto insurance requirements. You can obtain proof of auto insurance from your insurance company after purchasing a policy, either through a printed card, email, fax, or an electronic version on their mobile app. This proof is essential when registering a new vehicle, renewing your license, or getting pulled over by the police.

| Characteristics | Values |

|---|---|

| How to obtain proof of previous auto insurance | Contact your previous insurance company or your state's Department of Motor Vehicles |

| Purpose of obtaining proof of previous auto insurance | Insurance companies can run the necessary reports themselves, but there may be times when you have to provide the information |

| Proof of insurance | Documentation from your insurer proving you have an active insurance policy that meets state requirements |

| When to show proof of insurance | When you're pulled over, in an accident, leasing a vehicle, or otherwise requested to show it |

| Format of proof of insurance | Printed or electronic ID card provided by your insurer |

| Information included on proof of insurance | Name and address of the insurance company, NAIC number, effective date and expiration date, name of the insured, car's make and model, year, and VIN for the insured vehicle(s) |

| Proof of insurance and minimum coverage | Proof of insurance generally represents that you carry at least the minimum amount of coverage your state requires by law |

| Proof of insurance and coverage selections | Proof of insurance does not show coverage selections and limits; this information can be viewed on your policy's declarations page |

| Proof of insurance and digital ID cards | Most states accept digital insurance cards, but it's a good idea to carry a paper copy as well |

| Proof of insurance and SR-22 or FR-44 | SR-22 or FR-44 is a document that proves financial responsibility and may be required after certain violations, but it's not a substitute for proof of insurance |

What You'll Learn

How to obtain proof of previous auto insurance

There are several ways to obtain proof of previous auto insurance. The most common way is to contact your previous insurance company or companies. They can provide a printout of your auto insurance coverage and claims history, often called a letter of experience. Alternatively, if you can't remember your previous insurance company, you can try contacting your state's Department of Motor Vehicles (DMV), which may have information on your past insurance policies. The DMV can also provide a copy of your motor vehicle record (MVR).

If you need your claims history, you can access it through your CLUE report, which stands for Comprehensive Loss Underwriting Exchange and is maintained by LexisNexis. You can request a copy of your CLUE report by contacting LexisNexis directly or online. This report enables homeowners and automobile insurers to exchange information about claims.

Additionally, if you require proof of insurance for a specific time period, you will need to contact the insurance company that covered you during that time to request it. Proof of insurance does not include a claims history but instead provides coverage dates and details.

It is important to keep in mind that proof of insurance is different from proof of financial responsibility, such as an SR-22 or FR-44 form, which is required in certain situations, like license suspension or revocation.

Car-Free Auto Insurance: Is It Possible?

You may want to see also

Why you may need proof of previous auto insurance

Proof of previous auto insurance is a document that shows details about your auto insurance policy. It is essential to have this proof readily available, as it serves as evidence that you are complying with your state's auto insurance laws. Here are some reasons why you may need proof of previous auto insurance:

Registration and Licensing

To register a vehicle or renew your driver's license, you will likely need to provide proof of auto insurance to your state's Department of Motor Vehicles (DMV). The specific requirements and acceptable forms of proof vary by state, so it is essential to check with your local DMV for the necessary information.

Traffic Stops and Accidents

If you are pulled over by the police or involved in a car accident, you may be required to show proof of insurance. In most states, you can provide either a physical insurance ID card or an electronic version through your insurance company's mobile app. Failing to provide proof of insurance during a traffic stop can result in citations, fines, or other penalties.

Applying for New Insurance Policies

When applying for a new auto insurance policy, your new insurance company may request proof of insurance from your current or previous insurance provider. This information helps them assess your risk profile and determine your premium rates. A longer history of consecutive insurance coverage generally results in lower premium payments.

Court Proceedings

In certain situations, such as traffic violations or accidents, you may need to provide proof of insurance to the court. Presenting proof that you were insured at the time of the incident can help waive tickets or reduce penalties.

Employment Requirements

If your job requires you to drive your personal vehicle for work-related purposes, your employer may request proof of your auto insurance coverage. This is particularly relevant if your company has a vehicle policy that sets specific auto insurance limits for employees. By verifying your insurance liability limits, your employer can reduce the company's risk and potential liability in the event of an accident.

Comparing Vehicle Insurance: A Quick Guide

You may want to see also

What to do if you can't remember your previous insurance company

If you can't remember your previous insurance company, there are several steps you can take to find out. Firstly, check your emails. Most insurers send confirmation and policy details via email, so searching for terms like "insurance", "car insurance", or "policy" should help you locate an email from your insurer. You can also try searching for your vehicle registration number, as this may be included in emails from your insurer.

Secondly, check your paperwork. Your insurer likely provided you with hard copies of your policy details and other literature. Go through your files to see if you can locate these documents.

Thirdly, call your bank. If you have a standing order or direct debit arrangement for your insurance payments, your bank can confirm who you're insured with. You can also check your bank statements for this information.

Additionally, you can check the Motor Insurance Database (MID). By entering your vehicle registration into the MID, you can find out if your car has a valid insurance policy and the associated insurance company.

If all else fails, you can try contacting your state's Department of Motor Vehicles (DMV). They may have information on your previous insurance policies and can also provide a copy of your motor vehicle record (MVR).

It's important to keep a record of your insurance information, as it may be required when registering for a new vehicle, renewing your license, or applying for a new insurance policy.

Root Auto Insurance: Good or Bad?

You may want to see also

What to do if you don't have proof of insurance

If you don't have proof of insurance, you could face fines or even jail time, depending on the state. However, there are a few things you can do to mitigate the situation:

- Contact your insurance company: Get in touch with your insurance company as soon as possible to request the appropriate documentation. Most insurance companies provide proof of insurance immediately after purchasing a policy, so they should be able to send you a new copy.

- Contest the ticket: If you receive a ticket for not providing proof of insurance, you can usually contest it by mailing a copy of your proof of insurance to the relevant authority handling your case or by attending the court hearing with proof that you were insured.

- Respond to all correspondence: Make sure to respond to any correspondence related to your lack of proof of insurance. Failing to do so could result in your license and registrations being revoked or suspended.

- Keep a copy of your proof of insurance: It's always a good idea to keep a copy of your proof of insurance in a safe place so that you can easily access it if needed.

- Compare insurance rates: If you're unable to provide proof of insurance, your current provider may increase your premium. Shopping around and comparing insurance rates from different providers can help you find a more affordable option.

- Avoid lapses in coverage: Maintaining continuous insurance coverage is important, as lapses in coverage are considered high-risk by insurance companies and can result in higher premiums. Consider a non-owners policy if you don't currently own a vehicle but want to maintain your insurance coverage.

- Provide proof of financial responsibility: In all 50 states, you must show financial responsibility, which means having the ability to pay for property damage or injuries caused in a car accident. While most people show this through liability car insurance, you may be able to demonstrate financial responsibility through other means if necessary.

Remember that failing to provide proof of insurance is different from driving without insurance. The former is typically a less severe offence, while the latter can result in more severe penalties, including hefty fines, license suspension, and even jail time.

Grandchildren's Auto Insurance: USAA Eligibility

You may want to see also

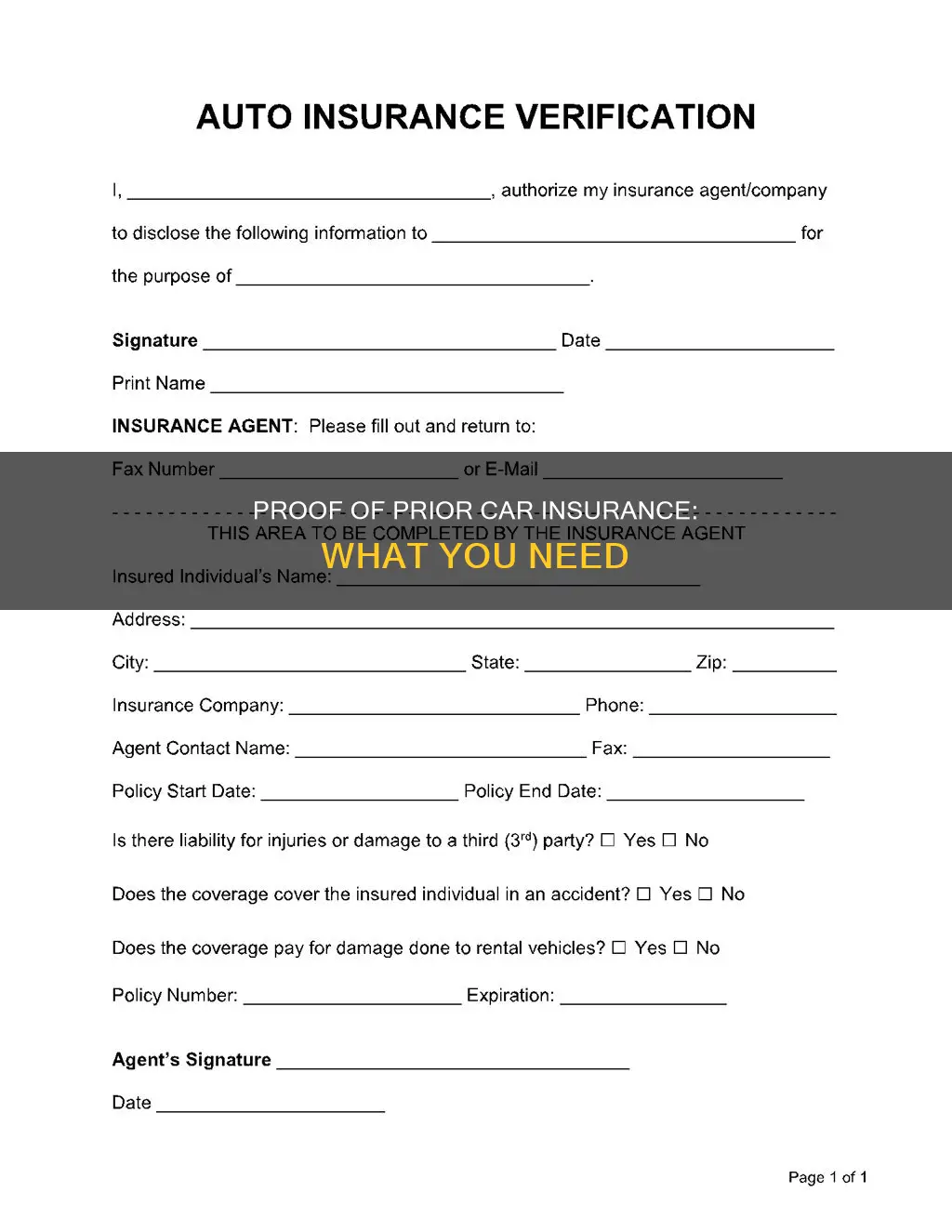

How to show proof of insurance

Proof of insurance is a document that shows you have the car insurance coverage required to legally drive in your state. It is important to have proof of insurance available whenever you're driving and to keep it in your car, as you will need it if you're pulled over by the police or if you're in a car accident.

There are several ways to show proof of insurance:

Insurance ID Card

The most common form of proof of insurance is an insurance ID card, which is usually mailed to you by your insurance company. You can also request a paper copy by mail, print it out yourself, or display it on your phone through your insurance company's mobile app. The information on the card varies but typically includes the policy number, effective and expiration dates, vehicle information, and policyholder name.

Proof of Coverage Letter

A proof of coverage letter from your insurance company can also serve as proof of insurance. This letter includes details about your policy, such as the insurance company's name and address, the policy number, effective and expiration dates, the policyholder's name, and the insured vehicle's information.

Digital Proof

In most states, you can show electronic proof of insurance on your phone through your insurance company's mobile app or by logging into their website. However, it is important to note that New Mexico does not accept digital proof of insurance during a traffic stop, so a physical copy is required when driving in this state.

It is important to always carry valid proof of insurance while driving, as failure to do so can result in fines, license suspension, or other penalties. Additionally, it is illegal to drive without insurance in almost every state, and you may be fined or face more severe consequences if caught driving uninsured.

Creating False Vehicle Insurance

You may want to see also

Frequently asked questions

Contact your previous insurance company and ask them to print out a history of your auto insurance coverage. This is often called a letter of experience.

Contact your state's Department of Motor Vehicles. They may have information on your previous insurance policies.

Your claims history can be found in your CLUE report, which is maintained by data analytics company LexisNexis. You can request a copy by contacting LexisNexis directly.

Proof of insurance provides basic information such as the name and address of the insurance company, the effective date and expiration of the policy, the policy number, the National Association of Insurance Commissioners (NAIC) number, the policyholder's name, and the insured vehicle's year, make, model, and vehicle identification number (VIN).

You may need to provide proof of auto insurance when registering your car, if you get pulled over, or if you get into a car accident. It shows that your car insurance is current and valid.