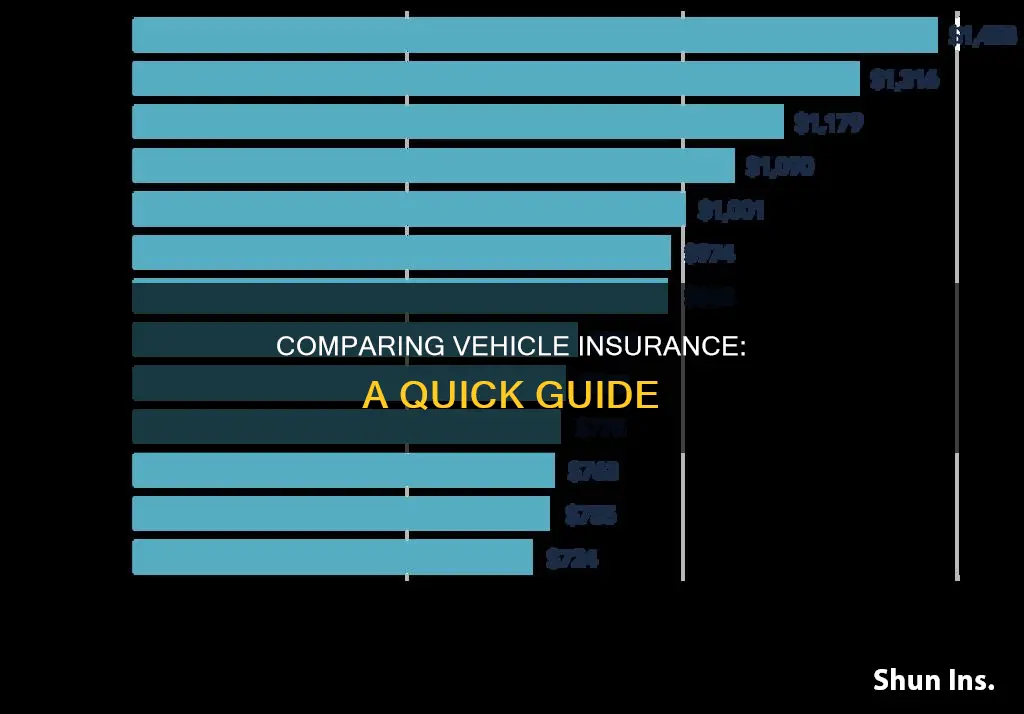

Comparing vehicle insurance quotes can be a straightforward process once you understand what parts of a quote you need to compare. Your insurance rates are based on personal factors like age, gender, vehicle, location, credit history, driving record, and claims history.

To compare car insurance quotes effectively, you'll want to gather quotes from multiple insurers with similar coverage levels and deductibles that meet your needs. Then, take a look at important factors like price, coverage options, customer reviews, and the insurer's reputation to make your decision.

| Characteristics | Values |

|---|---|

| Number of Quotes to Compare | At least 2 or 3 |

| Information Required | Personal details, vehicle information, driving history, insurance history |

| Liability Coverage | Bodily injury liability coverage, property damage liability coverage, uninsured/underinsured motorist protection |

| Full Coverage | Comprehensive coverage, collision coverage |

| Deductibles | Amount paid out of pocket towards a claim |

| Comparison Factors | Price, coverage options, customer reviews, insurer's reputation |

What You'll Learn

Compare quotes from different companies

Comparing quotes from different companies is a great way to find the best deal on vehicle insurance. Here are some tips to help you get started:

- Use a trusted insurance comparison site: Sites like The Zebra, NerdWallet, Insurify, Compare.com, and Gabi can provide you with quotes from multiple companies at once, making it easy to compare rates and find the best deal.

- Have the necessary information ready: To get accurate quotes, you'll need to provide personal information such as your age, driving history, vehicle information, and the level of coverage you want.

- Compare the same types and amounts of coverage: Make sure to compare quotes for the same levels of liability, deductibles, and additional coverages so you can find the best rates for the insurance you need.

- Consider the company's reputation and customer service: In addition to price, consider the company's customer satisfaction ratings, financial stability, and claims satisfaction.

- Get quotes from regional and national companies: Compare quotes from both regional and national insurance companies to find the best rates and coverage options.

- Look for discounts: Many insurance companies offer discounts for things like multiple policies, multiple cars, safe driving, and good grades. Be sure to ask about any potential discounts when getting a quote.

Fleet Insurance: Vehicles Count

You may want to see also

Understand the different types of coverage

Understanding the different types of vehicle insurance coverage is essential when comparing policies and choosing the right one for your needs. Here is a detailed overview of the various types of coverage available:

Liability Coverage

Liability coverage is one of the most common types of vehicle insurance and is required in almost every state. It pays for other people's expenses, such as medical bills and property damage, after an accident caused by the policyholder. This type of insurance does not cover any expenses for the policyholder or their passengers, except for legal fees if sued for the accident. Drivers in New Hampshire and Virginia are not required to have liability insurance but must meet other requirements.

Collision Coverage

Collision coverage pays to repair or replace the policyholder's car after any accident, regardless of fault. It is mandatory only for leased or financed cars. Collision coverage is ideal for those with a car loan or lease, as it ensures they can afford to repair or replace their vehicle if it is unexpectedly damaged.

Comprehensive Coverage

Comprehensive coverage is another common type of insurance that covers damage to the policyholder's vehicle caused by something other than a collision. This includes incidents like vandalism or natural disasters. Like collision coverage, comprehensive coverage is usually required for leased or financed cars. It is a good option for those who cannot afford to repair or replace their car if it is damaged by unforeseen circumstances.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) covers the policyholder's direct and indirect medical expenses after an accident. It includes traditional medical bills and other costs typically not covered by health insurance, such as lost income, childcare, or funeral expenses. PIP is required in 12 states: DE, FL, HI, MI, MA, KS, MN, NY, UT, OR, ND, and NJ. Even if it is not mandatory in your state, purchasing PIP can provide financial protection against hefty medical bills.

Uninsured/Underinsured Motorist Coverage

This type of coverage is essential, as it protects you if you are in an accident with a driver who does not have insurance or has insufficient liability insurance. It covers vehicle damage and medical expenses and is required in 20 states: CT, IL, KS, MA, MD, ME, MN, MO, NC, ND, NE, NH, NY, OR, SC, SD, VA, VT, WI, WV, and D.C.

Medical Payments (MedPay) Coverage

Medical Payments (MedPay) coverage pays for the policyholder's direct medical expenses after an accident, as well as those of their passengers, household members, and other policyholders. It can also cover the copays and deductibles of other insurance policies, including health insurance and PIP. MedPay is required in Maine and New Hampshire and is a valuable supplement to existing health insurance and PIP coverage, even in states where it is optional.

Other Types of Coverage

In addition to the standard types of coverage mentioned above, there are several other options available, depending on your needs and circumstances. These include:

- Gap insurance, which covers the difference between your vehicle's value and the balance of your loan or lease in the event of a total loss.

- Umbrella insurance, which provides extra liability protection beyond your homeowner's and auto policies, typically for assets of $1 million or more.

- Rental reimbursement, which covers the cost of a rental car while your vehicle is being repaired.

- Emergency roadside assistance, which can help with services like towing, jump-starting, and locksmith services.

- Mechanical breakdown insurance, which covers repairs to mechanical parts and systems, similar to an extended warranty.

- Usage-based insurance (UBI), where you allow the insurer to track your mileage and driving habits in exchange for discounts.

- Non-owner car insurance, a type of liability insurance for people who do not own a car but may need it to reinstate a suspended driver's license.

Calculating Vehicle Insurance Costs

You may want to see also

Compare liability limits

When comparing vehicle insurance, it's important to understand liability limits and choose the right coverage levels. Liability insurance covers damages you cause to others in an accident and protects you financially if you're sued. The coverage limits refer to the maximum amounts your insurer will pay out for bodily injury and property damage claims.

Liability limits are typically presented as a series of three numbers, such as 25/50/25 or 100/300/100. The first number represents the maximum coverage for bodily injury per person, the second number is the total coverage for bodily injuries per accident, and the third number indicates the maximum coverage for property damage per accident.

When choosing liability limits, consider your net worth. Ideally, the middle number (total bodily injury coverage per accident) should be equal to or greater than your net worth. This should also be the highest number in your policy's coverage limits. You can use a net worth calculator to determine your net worth if you're unsure.

Additionally, some insurers offer an alternative called "combined single limit" liability, where you get a larger, single liability limit that covers both bodily injury and property damage. This type of coverage is typically more flexible and provides more financial protection, but it generally costs more.

It's also important to understand your state's minimum car insurance requirements. Most states mandate a minimum level of liability coverage, but it's usually not enough to provide adequate protection in the event of a serious accident. Check your state's Department of Motor Vehicles or Department of Insurance website for specific requirements.

When comparing liability limits across different insurance companies, make sure to consider the same levels of coverage to ensure an accurate comparison.

Vehicle Registration: Insurance or Not?

You may want to see also

Choose your deductible

Choosing your deductible is one of the most important things to consider when comparing auto coverage. A high-deductible car insurance policy brings different financial consequences than a policy with a low deductible.

A deductible is the amount you pay out of pocket before your insurance carrier starts paying for repairs. You will have to pay the deductible each time you file a claim. For example, if you have a $3,000 repair and a $1,000 deductible, you would pay $1,000, and your insurance company would pay the remaining $2,000.

Most drivers choose a $500 deductible, but policies with higher deductibles cost less. The average deductible is $500, but they can range from $100 to $2,500.

When choosing your deductible, consider the following:

- The value of your car: If your car is not worth much, it's generally better to have a lower deductible.

- Your savings: If you don't have savings to cover a high deductible, it may be better to choose a low-deductible policy and pay higher monthly bills.

- Your tolerance for risk: Choosing a high-deductible plan is a gamble that you won't have a car accident. If you do have an accident, you will pay more out of pocket.

- Your driving history and likelihood of filing a claim: If you've had accidents in the past and often drive on busy roads, you may be more likely to file a claim and pay a deductible.

Vehicle Insurance: What's Covered?

You may want to see also

Compare rates by driver history

Comparing insurance rates by driver history is an important step in finding the best vehicle insurance policy for your needs. Insurance companies pay close attention to a driver's history when determining rates, so it's crucial to understand how different factors can impact your premiums. Here are some key points to consider:

- Driving Record: Your driving history is a significant factor in calculating insurance rates. Accidents, speeding tickets, and other violations can result in higher premiums. The impact of these incidents varies by company and state, so it's essential to compare rates from multiple providers.

- Age: Age is another critical factor in insurance rates. Younger and less experienced drivers often face higher premiums due to their higher risk of accidents. Rates tend to decrease around age 25 as drivers gain more experience, but they may increase again after age 70.

- DUI Convictions: A DUI conviction can significantly increase your insurance rates for up to ten years in some states. It's important to shop around for the best rates after a DUI, as the impact on your premiums can vary significantly between companies.

- Credit Score: While not directly related to driving, your credit score can affect your insurance rates. Insurance companies use credit scores to assess the likelihood of filing a claim. Improving your credit score may help lower your premiums.

- Location: Your location can also influence your insurance rates. Certain states have higher average premiums due to factors like weather risks or state regulations. Compare rates from companies that offer policies in your specific location.

- Coverage Levels: When comparing rates, ensure you're considering the same coverage levels, including liability, collision, and comprehensive insurance. This is crucial for an accurate comparison.

By considering these factors and comparing rates from multiple companies, you can make an informed decision about which vehicle insurance policy best suits your needs and budget. Remember that your driving history is just one aspect of determining insurance rates, and other factors, such as your age, location, and credit score, also play a role.

Gap Insurance: Vehicle Protection

You may want to see also

Frequently asked questions

You will need to provide the following information for all drivers and vehicles you plan to have on the policy:

- Driver's license and driving history information

- Vehicle identification numbers (VIN) and location (addresses) where they are kept and driven

Even though most insurance companies use the same customer information to provide a quote, each company has its own approach to pricing and discounts. Comparing quotes between different companies allows you to make the best coverage and price decision for your situation.

Not always. Make sure when comparing quotes that you select the same coverages, policy limits, and deductibles. If any of these are different, it could result in a lower or higher quote.

To compare vehicle insurance quotes effectively, you'll want to gather quotes from multiple insurers with similar coverage levels and deductibles that meet your needs. Then, take a look at important factors like price, coverage options, customer reviews, and the insurer's reputation to make your decision.