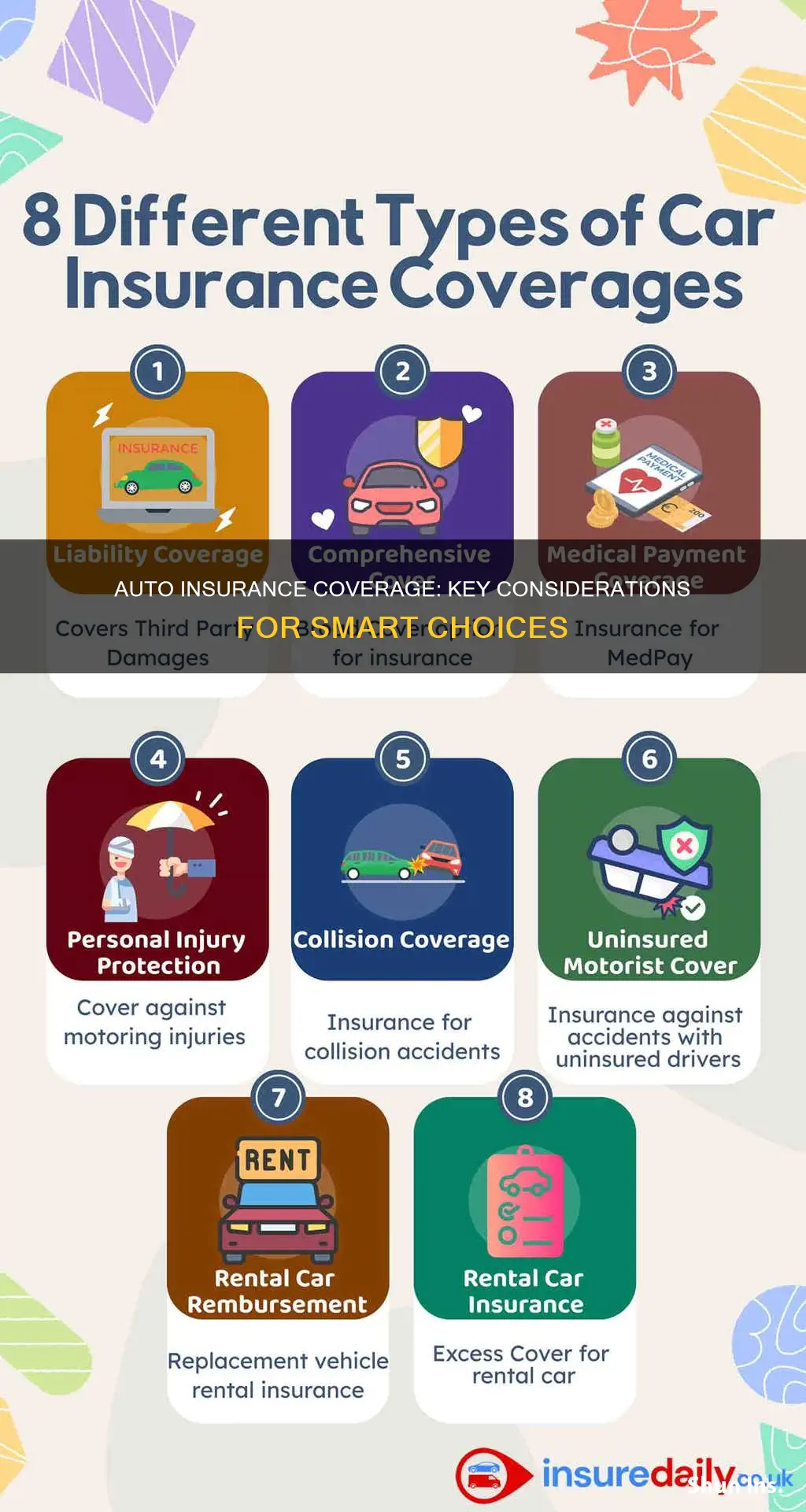

Auto insurance is a necessity for all drivers, but it can be challenging to navigate the different types of coverage available. When choosing an auto insurance policy, it is essential to understand the various coverage options and select the ones that best suit your needs. The most common types of auto insurance coverage include liability insurance, collision insurance, comprehensive insurance, uninsured/underinsured motorist coverage, personal injury protection, and medical payments coverage. Liability insurance is mandatory in almost every state and covers bodily injury and property damage caused to others in an accident. Collision insurance covers repairs to your vehicle in the event of a collision with another object or vehicle, while comprehensive insurance protects against non-accident-related damage, such as theft or weather damage. Uninsured/underinsured motorist coverage protects you if you are hit by a driver with insufficient insurance, and personal injury protection covers medical expenses and lost wages for you and your passengers. Finally, medical payments coverage pays for reasonable medical expenses regardless of who is at fault. When deciding on auto insurance coverage, it is crucial to consider your financial situation, the value of your assets, and the level of protection you require.

| Characteristics | Values |

|---|---|

| Medical or personal injury protection | Medical payments coverage, also called MedPay, covers reasonable medical expenses for the driver and any other passengers, regardless of fault. Personal Injury Protection, or PIP, is similar to MedPay but covers more than just medical expenses, such as lost wages and funeral costs. |

| Uninsured/underinsured motorist | UM coverage helps pay for damages when an uninsured motorist injures you. UIM coverage applies when the other party's liability limits are not high enough to cover all your damages. |

| Collision and Comprehensive | Collision coverage covers damage to your own vehicle in an accident. Comprehensive coverage covers other non-accident damage, such as vehicle theft or adverse weather damage. |

| Liability | Bodily injury liability insurance covers the other party's medical expenses, lost wages, rehabilitation expenses, pain and suffering costs, etc. Property damage liability covers any damage to other vehicles and property. |

| GAP insurance | GAP insurance helps cover the difference between the actual cash value of your vehicle and how much you owe on the loan or lease if something happens to your vehicle before it's paid off. |

| Mechanical Breakdown | Mechanical breakdown coverage lets you choose where you want your car repaired, but it's not always worth it as you could achieve the same outcome by contributing to an emergency fund. |

| OEM Endorsement | With an OEM endorsement, you can have the same manufacturer parts that were originally on your vehicle. |

What You'll Learn

Liability insurance

When choosing liability insurance, it's important to select a coverage limit that matches or exceeds your net worth. This ensures that your assets are adequately protected. The coverage limit is the maximum amount your insurance company will pay out for injuries or property damage caused by you. Typically, these limits are broken down into three numbers: bodily injury liability per person, bodily injury liability per accident, and property damage liability per accident. For example, in Illinois, the minimum auto insurance liability limit is $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage per accident.

It's worth noting that liability insurance does not cover injuries to you or the people in your household, nor does it cover damage to your own vehicle. To protect yourself and your passengers, you may consider additional coverages such as medical payments coverage or personal injury protection.

In summary, liability insurance is a vital component of auto insurance, safeguarding you from financial risks if you cause harm to others or their property in a car accident. By understanding the components and coverage limits of liability insurance, you can make informed decisions about the level of protection you need. Remember to review your state's requirements and choose a coverage limit that aligns with your financial situation.

Driving Hospital Vehicles: Get Insured

You may want to see also

Collision insurance

While collision insurance is not required by state law, it is often a smart option to protect your investment, especially for new or inexperienced drivers. If you are leasing or financing your vehicle, your lender or lessor may require you to purchase collision insurance. Collision insurance can be expensive, but you can save on premiums by choosing a higher deductible.

Factors Influencing Auto Insurance Premiums: A Comprehensive Overview

You may want to see also

Comprehensive insurance

- Vandalism, fire, and explosions

- Windshield and glass damage

- Falling trees, limbs, or other objects

- Rocks or objects kicked up by or falling off cars

- Storms, hail, wind, floods, lightning, and earthquakes

- Accidents with animals, such as hitting a deer

- Civil unrest or riots

When deciding whether to add comprehensive coverage to your policy, consider the value of your car, your financial circumstances, and your personal preferences. If your car has a high cash value or you cannot afford to repair or replace your vehicle out of pocket, comprehensive coverage could be a worthwhile investment. Additionally, if you live in an area prone to weather-related disasters or high car theft rates, comprehensive insurance may provide added peace of mind.

Understanding GAP Auto Insurance Eligibility Requirements

You may want to see also

Personal injury protection

In the US, PIP is only available in states with no-fault laws. Texas, for example, does not require PIP coverage, but insurers are legally required to offer it, and drivers must submit their refusal in writing if they choose to decline it.

PIP covers reasonable medical costs, including surgeries, medications, diagnostics (x-rays, CT scans, etc.), prosthetics, nursing care, physical therapy, and medical devices. It also covers rehabilitation therapy, lost income resulting from the accident, and replacement of necessary services provided by the injured party, such as childcare or household maintenance.

The amount of PIP coverage varies by state and insurer. In Texas, for example, insurers are required to offer a minimum of $2,500 in PIP coverage, which can typically be increased to $5,000 or $10,000. The coverage limit refers to the total amount the insurance will pay per person injured in an accident.

When filing a PIP claim, it is important to include all relevant documentation, such as receipts, bills, and proof of income, to ensure the claim is processed quickly. PIP usually covers 100% of medical treatment, ambulance services, and funeral costs, and 80% of lost wages and caregiver expenses.

Insufficient Auto Insurance: Risks and Financial Burdens

You may want to see also

Uninsured motorist coverage

Protection Against Uninsured Drivers

The primary purpose of uninsured motorist coverage is to safeguard you if you're involved in an accident with a driver who doesn't have auto insurance. In such cases, the uninsured motorist coverage steps in to cover the costs associated with the accident, ensuring you don't have to bear the financial burden. This includes coverage for both bodily injuries and property damage.

Underinsured Motorist Coverage

Alongside uninsured motorist coverage, underinsured motorist coverage is usually offered. This type of coverage comes into play when the at-fault driver doesn't have sufficient insurance to pay for the damages or injuries they caused. It helps fill the gap between the at-fault driver's insurance limits and the total cost of your damages.

Coverage for Hit-and-Run Accidents

Protection for Passengers and Pedestrians

Lost Wages and Benefits

Another important aspect of uninsured motorist coverage is that it can compensate for lost wages and benefits resulting from an accident caused by an uninsured driver. This includes coverage for diminished earning potential, out-of-pocket expenses, and permanent impairments or disabilities.

Peace of Mind and Financial Security

While the cost of the insurance policy may be a consideration, uninsured motorist coverage provides an extra layer of protection and peace of mind. With a relatively low cost compared to the potential benefits, it ensures that you and your passengers are financially protected in the event of an accident involving an uninsured or underinsured driver.

Progressive Auto Insurance: Good or Bad?

You may want to see also

Frequently asked questions

There are several types of auto insurance coverage, including:

- Medical or personal injury protection

- Uninsured/underinsured motorist coverage

- Collision coverage

- Comprehensive coverage

- Liability coverage

- Guaranteed Auto Protection (GAP) insurance

- Mechanical Breakdown coverage

- Original Equipment Manufacturer (OEM) endorsement

When choosing an auto insurance company, it is important to shop around and compare quotes from multiple providers. Consider the company's customer service, reviews, and ratings, as well as the cost of coverage. Additionally, look for applicable discounts that can lower your premium.

To get a quote for auto insurance coverage, you will typically need to provide the following information:

- Vehicle Identification Number (VIN)

- Driver's license number

- Annual mileage estimates

- Current auto insurance policy (if applicable)

- Monthly and annual insurance premium estimates