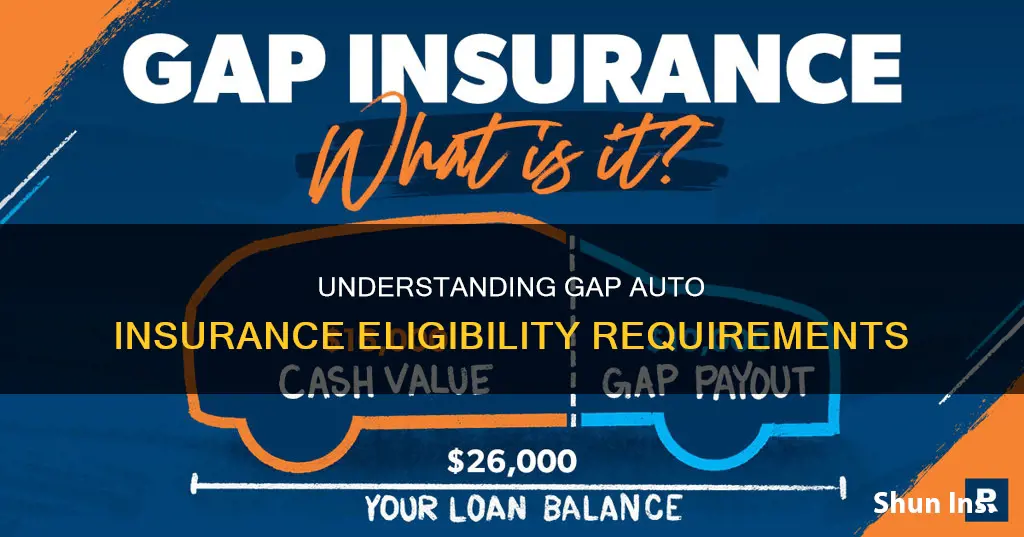

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between what a vehicle is worth and what is owed on it. To qualify for gap insurance, you must have comprehensive and collision coverage on your policy. Gap insurance is a good idea if you made less than a 20% down payment, financed for 60 months or longer, leased the vehicle, purchased a vehicle that depreciates faster than the average, or rolled over negative equity from an old car loan into the new loan.

| Characteristics | Values |

|---|---|

| Type of insurance | Optional auto insurance coverage |

| When to get it | When your loan amount is more than your vehicle is worth |

| What it covers | The difference between the amount paid out by your comprehensive or collision coverage and the balance left over on your vehicle loan or lease |

| When it applies | When your vehicle is stolen or deemed a total loss |

| Cost | Around $20 a year, according to the Insurance Information Institute |

| Who offers it | Car insurance companies, banks, credit unions, and car dealers |

What You'll Learn

- Gap insurance covers the difference between the value of a vehicle and the loan owed on it

- It is optional and covers drivers whose car loan balance is more than the vehicle's worth

- It is worth considering if you made less than a 20% down payment

- It is generally required for a lease

- It is not needed if you don't have a car loan or lease

Gap insurance covers the difference between the value of a vehicle and the loan owed on it

Gap insurance is optional car insurance coverage that helps bridge the financial gap for drivers whose car loan balance is more than what their vehicle is worth if it’s totaled. It is called "gap" insurance because it covers the "gap" between what you owe on your car loan and what your car is actually worth. This type of insurance is typically offered by car insurance companies, banks, credit unions, and car dealerships, although it may be more expensive if purchased through a dealership.

Here's how gap insurance works: let's say you owe $30,000 on your car loan, but your car is only worth $25,000. If your car is stolen or totaled, your car insurance company will pay you the current market value of your car, minus your deductible. Without gap insurance, you would only receive $20,000 (minus your deductible) and would still owe $10,000 on your loan. With gap insurance, however, the gap coverage would pay the remaining $5,000, so you wouldn't have to pay anything out of pocket.

It's important to note that gap insurance doesn't cover every situation. It only applies if your vehicle is stolen or deemed a total loss. Additionally, you must have comprehensive and collision coverage on your policy to qualify for gap insurance. Gap insurance also doesn't cover other property or injuries resulting from an accident, nor does it cover engine or transmission failure, or other repairs.

When considering whether to purchase gap insurance, it's essential to evaluate your financial situation and the value of your vehicle. If there is a significant difference between your car's value and what you owe on it, gap insurance can provide valuable protection. However, if the amount you owe is less than or only slightly more than the car's value, you may not need gap insurance.

Insurance Payouts: Total Loss Calculations

You may want to see also

It is optional and covers drivers whose car loan balance is more than the vehicle's worth

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It is designed to cover drivers whose car loan balance is more than the vehicle's worth. When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap insurance will cover the $5,000 gap, minus your deductible.

Gap insurance is particularly useful if you have a large car loan or you bought a vehicle that quickly depreciates in value. The average car depreciates by 38.8% after five years, but electric vehicles depreciate faster, losing about half of their value in the same period. Some types of luxury cars, such as the Maserati Quattroporte, BMW 7, and Maserati Ghibli, depreciate by more than 60% over five years.

Gap insurance is typically offered by car dealers and car insurance companies. It can also be added to your loan payments, although this means you'll pay interest on the cost of your gap insurance over the life of the loan, making it a more expensive option. Gap insurance is generally required for leased vehicles.

You may want to consider purchasing gap insurance if:

- You made less than a 20% down payment on your vehicle.

- You financed for 60 months or longer.

- You leased your vehicle.

- You purchased a vehicle that depreciates faster than average.

- You rolled over negative equity from an old car loan into a new loan.

Speeding Tickets: Auto Insurance Surge

You may want to see also

It is worth considering if you made less than a 20% down payment

If you made a down payment of less than 20% on your car, you could end up with negative equity on the vehicle as soon as you drive it away from the dealership. This is because most cars lose 20% of their value within a year. Therefore, gap insurance is worth considering if you made a smaller down payment on a new car.

Gap insurance is an optional, supplemental auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between what a vehicle is worth and what is owed on it. In other words, it covers the "gap" between the depreciated value of the car and the loan amount owed. This can help to protect you against potentially negative financial consequences if the vehicle is declared a total loss.

For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap coverage will cover the $5,000 gap, minus your deductible. This can be particularly useful if you have a long financing term for your vehicle, as the longer your vehicle is financed, the higher your chance of owing more on the vehicle than it's worth.

You can typically buy gap insurance from car insurance companies, banks, and credit unions. It is also available from car dealers, although this is usually more expensive. On most auto insurance policies, including gap insurance with collision and comprehensive coverage adds only about $20 a year to the annual premium.

Driver Advantage: Auto Insurance Benefits Explained

You may want to see also

It is generally required for a lease

Gap insurance is often required for a lease. This is because, when you lease a car, you don't own it, and the leasing company remains the legal owner of the vehicle. Therefore, leasing companies may require you to purchase gap insurance to protect their investment.

Gap insurance covers the difference between what you owe on your lease and the car's actual cash value in the event of a total loss. This means that, if your leased car is stolen or deemed a total loss, gap insurance will pay off the remaining balance of your lease, so you don't have to settle the balance out of pocket. This is especially important for leased cars because, once you lease a car, its value starts to decrease significantly. This depreciation leaves a gap between what you owe on your lease and the car's value.

For example, if your leased car is worth $10,000 at the time it gets totalled in a covered incident, but you still owe $15,000 on your lease, gap insurance will pay off the remaining $5,000 so you don't have to pay it yourself.

Gap insurance is also useful if you have made a small down payment on your leased vehicle. A small down payment increases the risk of owing more than the car is worth in the event of a total loss.

Aflac's Auto Insurance: Understanding Coverage for Rebuilt Title Cars

You may want to see also

It is not needed if you don't have a car loan or lease

Gap insurance is an optional, additional coverage that can help certain drivers cover the "gap" between the financed amount owed on their car and the car's actual cash value (ACV) in the event of a total loss. This type of insurance is not required if you don't have a car loan or lease.

Gap insurance is intended for drivers who owe more on their car loan than the car is worth. If you don't have a car loan or lease, there is no "gap" to bridge between the amount owed and the car's value, so gap insurance is not necessary.

However, if you have a car loan or lease and meet certain criteria, gap insurance may be beneficial. These criteria include making a down payment of less than 20%, financing for 60 months or longer, leasing the vehicle, purchasing a vehicle that depreciates faster than average, or rolling over negative equity from an old car loan into a new one.

It's important to note that gap insurance is not required by any insurer or state. It is meant to protect you financially when you owe money on a depreciated vehicle. The cost of gap insurance varies, but it is generally affordable and can provide valuable coverage in the event of a total loss or theft of your vehicle.

Auto and Motorcycle Insurance: Strategies for Affordability

You may want to see also

Frequently asked questions

Gap insurance is an optional, additional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between what your vehicle is worth and what is owed on it.

If your vehicle is stolen or involved in an accident that causes significant damage, gap insurance covers the difference between what your vehicle is currently worth (which your standard insurance will pay) and the amount you owe on it.

Gap insurance is worth considering if you have a long payoff period, a small down payment, a leased vehicle, a vehicle that depreciates faster than average, or negative equity rolled over from an old car loan.