Yes, you can get hourly auto insurance in the UK. This type of insurance is designed for when you only need cover for a short period of time, such as an hour or a few hours, rather than a whole day. It's a flexible and affordable option that allows you to get the cover you need for the duration you need it. This type of insurance is ideal for borrowing a friend's car, test-driving a car, or making a quick trip. It's also perfect for learner drivers who want to get extra practice without committing to a long-term policy.

To get hourly auto insurance, you'll typically need to provide some personal details, such as your name, address, date of birth, occupation, and email address, as well as information about the car you wish to insure, including its registration number and your driving licence number.

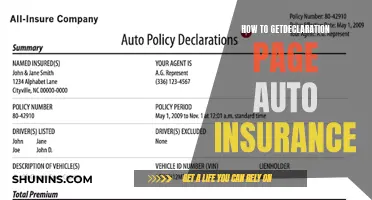

| Characteristics | Values |

|---|---|

| Time Period | 1 hour to 12 hours |

| Policy Documents | Emailed instantly |

| Quote Time | Under 2 minutes |

| Quote Requirements | Name, address, date of birth, occupation, car registration, driving licence number |

| Payment Methods | Debit or credit card |

| Cover | Damage to your vehicle, damage to third-party property, personal injury, theft, fire damage |

| Add-ons | Breakdown cover, legal expenses cover, excess reduction cover |

| Eligibility | Age, driving licence, vehicle type, previous claims, location, vehicle value |

What You'll Learn

Temporary insurance for learner drivers

The DVSA recommends that learner drivers get as much private practice as possible alongside their lessons, especially as most learners now take six months or more to pass their test.

There are several benefits to taking out a temporary insurance policy as a learner driver. Firstly, it is a flexible and affordable option, allowing you to pay for cover only when you need it. Secondly, it protects the car owner's No Claims Discount. If you are added to a friend or family member's insurance policy and have an accident, this may affect their No Claims Discount. However, with a temporary learner policy, their No Claims Discount will be protected.

To take out a temporary learner driver insurance policy, you will typically need to meet the following criteria:

- Hold a current provisional UK driving licence

- Be a permanent UK resident

- Have an address on your provisional driving licence that matches the address on your insurance policy

- Have no previous driving offences or convictions

- Be aged between 17 and 35 (although some insurers offer policies for drivers up to 75 years old)

- Have the permission of the car owner

The car you wish to insure will also need to meet certain criteria, including:

- Be worth less than £40,000-£50,000

- Be registered in the UK

- Not have any modifications

- Have seven seats or fewer

When taking out a temporary learner driver insurance policy, you can choose from different cover levels, such as fully comprehensive or third-party fire and theft. The cost of the policy will depend on various factors, including the length of the policy, your age, and the type and age of the vehicle.

It is important to note that temporary learner driver insurance is not the same as dual insurance, which refers to two insurance policies covering the same risk. Temporary learner insurance is a separate policy that covers the learner as the risk when they are behind the wheel.

Once you have passed your driving test, your learner driver insurance will no longer be valid, and you will need to take out a new insurance policy.

Comprehensive Claims: Auto Insurance Rates Impact

You may want to see also

Hourly insurance for new car purchases

If you've just bought a new car, you'll need insurance to drive it home. Temporary car insurance can be purchased for as little as one hour, and it's a good alternative to being added as a named driver on the owner's policy.

Benefits of Hourly Insurance for New Car Purchases

- You only pay for what you need.

- It's quick and easy to get a quote and set up cover.

- It's flexible. You can choose the duration of your policy, from one hour to 28 days.

- It's fully comprehensive cover.

- It's separate from the car owner's annual policy, so there's no impact on their No Claims Discount.

- It's affordable.

- It's legal.

When to Use Hourly Insurance for New Car Purchases

- When you're driving a new car home from the dealership.

- When you're test-driving a car from a private seller.

What's Covered by Hourly Insurance for New Car Purchases

- Accidental damage to the insured vehicle or damage to another vehicle.

- Personal injury to you or anyone else involved in an accident.

- Damage to other people's property as a result of an accident relating to the insured vehicle.

- Cover for any personal belongings that are damaged or stolen from the vehicle.

What's Not Covered by Hourly Insurance for New Car Purchases

- The excess you agreed to pay.

- Release from an impound (unless you buy a specific temporary impounded vehicle policy).

- Additional drivers – only the driver named on the policy is covered.

- A sole claim or separate cover for broken/damaged glass, including the windscreen.

How to Get Hourly Insurance for New Car Purchases

To get a quote for hourly insurance for a new car purchase, you'll need to provide the following details:

- The car's registration number.

- Your name, date of birth, and address.

- Your driving licence number and type.

- The estimated value of your car.

- Your email address and phone number.

- When you'd like your hourly car insurance policy to start.

You can get a quote online or via an app, and your insurance certificate will be emailed to you instantly upon payment.

Gap Insurance Tax in Florida

You may want to see also

Hourly insurance for borrowed cars

Borrowing a car from a friend or family member is a common scenario, but it can be confusing when it comes to insurance coverage. Here's what you need to know about hourly insurance for borrowed cars:

In most cases, car insurance follows the car, not the driver. This means that if you borrow a car from someone else, their insurance policy will typically be responsible for covering any damages or injuries that occur while you're driving. This is known as "permissive use", which allows someone who is not listed on the car owner's insurance policy to drive the vehicle with the owner's permission. However, it's important to note that permissive use usually applies only when the borrowing is occasional and not regular.

The Role of the Borrower's Insurance

While the owner's insurance is primarily responsible, the borrower's insurance might also come into play. If the owner's insurance coverage limits aren't sufficient to cover all the damages or injuries resulting from an accident, the borrower's insurance may have to cover the remaining costs. Additionally, if the borrower is at fault in an accident, their insurance rates may increase, even though they weren't driving their own vehicle.

Non-Owner Insurance

If you frequently borrow a car or drive long distances, it might be a good idea to purchase non-owner insurance. This type of insurance can cover bodily injury and property damage in the event of an accident, but it typically doesn't cover damage to the vehicle you're driving or your own injuries. Non-owner insurance rates are generally less expensive than standard auto insurance, and it can provide additional protection in case the owner's insurance isn't sufficient.

Exclusions and Considerations

There are a few important exclusions and considerations to keep in mind:

- Frequent drivers: If someone borrows a car regularly, the owner's insurance may not cover them. It's important to check with the insurance provider to clarify what constitutes "regular" use.

- Members of the household: If a household member who is not the car owner borrows a car frequently, they should be added to the owner's insurance policy.

- Excluded drivers: If a driver is specifically excluded from the owner's policy, they will not be covered when driving the car. This often applies to high-risk drivers with a history of accidents or DUI.

- Commercial purposes: Standard auto insurance typically does not cover vehicles used for business or commercial purposes. If you plan to use a borrowed car for such purposes, you may need to purchase additional commercial insurance.

Tips for Borrowing or Lending a Car

To ensure peace of mind when borrowing or lending a car, consider the following tips:

- Check your insurance policy: Review your policy or contact your insurance provider to clarify coverage details, including any exclusions or restrictions.

- Only lend to trusted individuals: When lending your car, ensure you trust the borrower and set clear expectations for usage, duration, and cleanliness.

- Document the vehicle's condition: Take photos of the car before lending it to have a record of its condition and facilitate the insurance claim process if necessary.

- Understand the insurance implications: Both the owner and the borrower should be aware of their respective insurance coverages and any potential gaps that may arise in the event of an accident.

Auto Insurance Claims: Tax Return Benefits

You may want to see also

Hourly insurance for long journeys

Hourly insurance is a great option for those going on long journeys and sharing the driving. It is a flexible, affordable, and efficient way to get covered for a borrowed car. It is also a good option if you want to preserve any other insurance policies you have.

Hourly insurance is perfect for long drives where you want to share the driving load with a friend or family member. It is also ideal for learner drivers who want to get extra practice outside of lessons. Additionally, if you are buying a car, hourly insurance can be useful for test-driving before you buy.

There are several companies that offer hourly insurance, including GoShorty, Dayinsure, Cuvva, and Tempcover. The process of getting a quote and setting up cover is usually quick and simple, and you can get insured in under two minutes.

To get a quote, you will typically need to provide some basic information, such as your name, address, date of birth, occupation, the car's registration number, and your driving licence number. You may also need to provide details about the car you want to insure, such as its value and whether it has a valid MOT.

It's important to note that the eligibility criteria and requirements may vary depending on the company and your specific circumstances. Be sure to review the terms and conditions carefully before purchasing hourly insurance for your long journey.

RV Insurance: What Owners Need to Know

You may want to see also

Hourly insurance for emergencies

Hourly car insurance is a flexible and affordable option for those who need to get somewhere quickly in an emergency but are not insured to drive someone else's car. It can also be useful if you need to borrow a car to help someone else in an emergency.

- You need to get to a hospital or another location quickly due to a personal or family emergency.

- You need to help a friend or family member who is facing an emergency situation and does not have access to their vehicle.

- You are experiencing car trouble and need to borrow a car temporarily while yours is being repaired or serviced.

- You need to transport someone to a medical appointment or procedure and require the use of a vehicle.

- You are running an errand or completing a task that requires the use of a car, such as picking up prescriptions or shopping for essentials.

Benefits of Hourly Car Insurance in Emergencies:

- Flexibility: Hourly car insurance provides the flexibility to get insured for the exact duration you need, whether it's one hour or a few hours. This means you only pay for the cover you require and don't have to commit to a long-term contract.

- Speed and Convenience: Obtaining hourly car insurance can be quick and convenient. Some providers offer quotes in under 2 minutes, and the entire process can be completed online or through a mobile app. This allows you to get on the road as soon as possible to address the emergency.

- Comprehensive Cover: Hourly car insurance typically provides fully comprehensive cover, protecting you against accidental damage to the insured vehicle, damage to another vehicle, personal injury, and damage to other people's property resulting from an accident.

- No Impact on No Claims Discount: Hourly car insurance policies are separate from annual policies, so they won't affect your No Claims Discount or the vehicle owner's No Claims Bonus in case of an incident.

- Peace of Mind: Hourly car insurance provides peace of mind for both you and the vehicle owner. It ensures that you are legally allowed to drive and are covered in case of any incidents or accidents during the emergency.

Eligibility and Requirements:

To be eligible for hourly car insurance, you typically need to meet certain requirements, including:

- Age: The age limits may vary depending on the provider, but most require drivers to be between 17 and 75 years old.

- Driving Licence: You will need a valid UK or EU driving licence and may be required to have held it for a minimum period (e.g., at least one year).

- Driving History: Some providers may have restrictions based on your driving history, such as the number of penalty points, claims, or motoring convictions.

- Vehicle Ownership: You will need permission from the vehicle owner to insure and drive their car. Additionally, the car must meet certain criteria, including age, value, roadworthiness, and registration requirements.

Providers:

Several providers in the UK offer hourly car insurance, including:

- Cuvva

- GoShorty

- Tempcover

- Dayinsure

- Veygo

Each provider may have slightly different eligibility criteria, coverage options, and pricing, so it is essential to review their specific terms and conditions before purchasing a policy.

Auto Insurance: Can You Be On Your Parent's Policy?

You may want to see also

Frequently asked questions

Hourly auto insurance is a flexible option that allows you to get a policy only for the time you need it for, typically from 1 hour to 12 hours at a time. It is perfect for when you need cover for a short time, such as borrowing a friend's car, going for a test drive, or making a quick trip.

Hourly auto insurance can be set up in minutes. You provide some basic information about yourself and the car you want to insure, receive a quote, select the duration of cover, and make the payment. Your insurance policy documents are then sent to you via email, and your coverage begins instantly or at the time you specified.

Hourly auto insurance typically provides fully comprehensive cover, including accidental damage to your vehicle, damage to third-party property, personal injury, and theft or attempted theft. It also protects the car owner's No Claims Discount or No Claims Bonus.