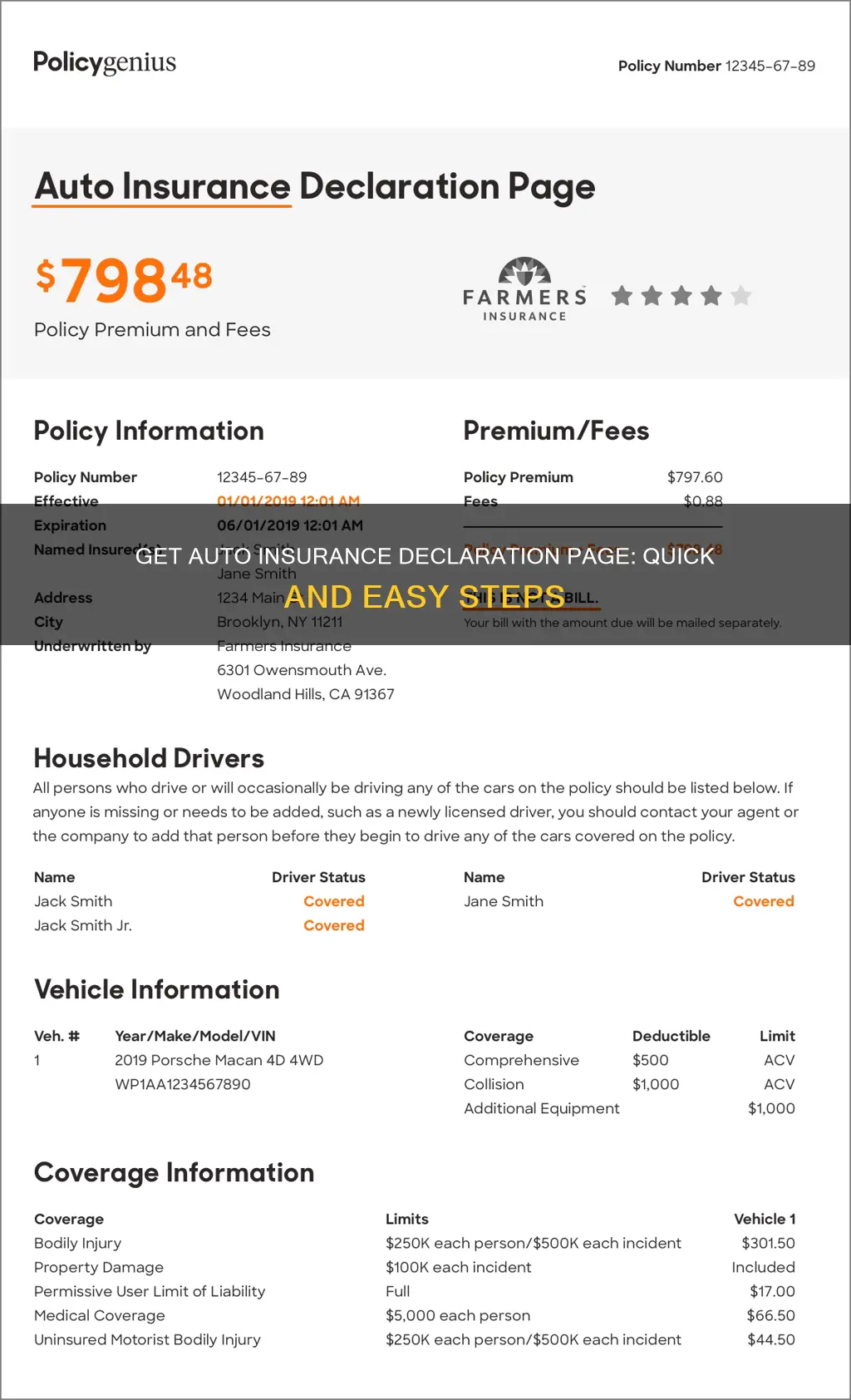

An insurance declaration page is a summary of your auto insurance policy. It includes details such as the policy number, the date coverage goes into effect, the expiration date, the names of all insured drivers, and the vehicles covered by the policy. It also includes the types of coverage and the limits of each. The declaration page is typically sent to the policyholder by the insurance company via email, fax, or regular mail. It may also be available online through the insurance company's website or mobile app. It is important to review the declaration page to ensure that all the information is accurate and to keep it on hand for future reference.

| Characteristics | Values |

|---|---|

| What is a declaration page? | A summary of your auto insurance policy, also known as a "dec page" |

| When do you get it? | Automatically sent by your insurance company when you buy or renew your policy |

| How do you get it? | By email, fax, regular mail, or online |

| What does it include? | Policy number, date coverage starts, expiration date, agent's name and contact information, insured drivers, covered vehicles, types of coverage, coverage limits, deductibles, premium amount, discounts, loss payees, policy period, accident history, mileage, etc. |

| What is it used for? | Getting an overview of your coverage types, amounts, and costs |

| Can it be used as proof of insurance? | Generally not, but can be used when buying a car |

| What if you lose it? | You can request a replacement from your insurance company |

| How often do you get a new one? | Every time you renew or change your policy |

What You'll Learn

- The declaration page is a summary of your auto insurance policy

- It includes details like policy number, coverage period, insured drivers, and vehicles

- You can access it via email, fax, mail, or your insurer's website

- It is not proof of insurance but can be used when buying a car

- Review it to ensure accuracy and understand your liabilities and coverage

The declaration page is a summary of your auto insurance policy

The declaration page, also known as the "dec page," is the first page or pages of your auto insurance policy. It includes essential details such as the policy number, the date the coverage starts, and the expiration date. If you purchased the policy through an agent, their name and contact information will also be included.

The page lists all the insured drivers, including the policyholder and any additional drivers covered under the same policy. It also specifies the vehicles covered by the policy, identified by make, model, year, and Vehicle Identification Number (VIN). If you have chosen different types and amounts of coverage for each vehicle, the declaration page helps clarify these details.

The declaration page outlines the various types of coverage included in your policy, such as comprehensive car insurance, collision coverage, uninsured motorist protection, or personal injury protection. It also states the coverage limits and deductibles you selected when purchasing the policy. This section may include per-person and per-accident limits for bodily injury liability, as well as any additional coverage types you've added.

Additionally, the declaration page breaks down the cost of your auto insurance. It shows how much you're paying for each coverage type and vehicle. If you're eligible for any discounts, these will also be listed, helping you understand the total premium cost.

While the declaration page provides a comprehensive summary of your auto insurance policy, it is not typically used as proof of insurance. Instead, it serves as a quick reference guide for understanding your coverage, limits, and other important details.

Tennessee Auto Insurance: Is It Mandatory?

You may want to see also

It includes details like policy number, coverage period, insured drivers, and vehicles

The auto insurance declaration page is a detailed document that provides important information about your policy. It is a summary of your auto insurance policy, usually in one or two pages, and is sometimes referred to as a "dec page".

The declaration page includes specifics such as the policy number, the date coverage goes into effect, and the expiration date. This page will also list the names of all insured drivers, including the policyholder and any additional drivers covered under the same policy. All vehicles covered by the policy will be listed, identified by make, model, year, and VIN.

The declaration page is a crucial document when it comes to making informed decisions about your insurance coverage, changing your policy, or filing a claim. It provides a comprehensive overview of your auto insurance policy, outlining important details that are not included on the insurance card. While the insurance card is useful as proof of coverage, it only provides basic information.

It is important to know how to locate your auto insurance declaration page, as the process may vary depending on your insurance company. Most companies will send the declaration page via email, fax, or regular mail when you purchase or renew your policy. You can also access it through your online account with the insurance company, usually in the "Policy Documents" or "Documents" section.

Eyecare Insurance: Filling the Gap

You may want to see also

You can access it via email, fax, mail, or your insurer's website

An insurance declaration page is a concise summary of your auto insurance policy, including policy periods and numbers, insured drivers, covered vehicles, and types of coverage. It is not the same as proof of insurance, which is usually a physical or digital insurance card. However, it can be used as proof of insurance in certain situations, such as when buying a car.

Your insurance company will typically send your insurance declaration page to you via email, fax, or regular mail as soon as you purchase your policy. You can also usually access it via your insurer's website or mobile app, especially if you bought your policy online.

If you have registered for an account or purchased your policy online, you may be able to print a declaration page directly from your insurer's website. You can also usually request that your insurer send a copy of your declaration page to a car dealership or other location via fax.

If you lose your declaration page, you can request a replacement from your insurer. You should also receive a new declaration page every time you renew or change your policy.

Accessing Your AAA Auto Insurance Bill: A Step-by-Step Guide

You may want to see also

It is not proof of insurance but can be used when buying a car

An insurance declaration page is a summary of your auto insurance policy. It includes essential details such as the policy number, the date coverage goes into effect, the expiration date, the agent's name and contact information, the names of all insured drivers, and the vehicles covered by the policy. While it is not proof of insurance, it can be very useful when buying a car.

When purchasing a new car, it is important to have a comprehensive understanding of your auto insurance policy. The declaration page can serve as a quick reference guide, providing an overview of the most important information about your policy. It outlines the coverage, deductible amount, and number of people insured under the policy. This information is crucial when deciding on the insurance details for your new car.

For instance, if you are buying a car that will be shared with other drivers, you can refer to the declaration page to see who is already listed as an insured driver under your current policy. This can help you determine if you need to add any additional drivers to your policy. Similarly, the declaration page will list all the vehicles covered by your policy, along with their make, model, year, and Vehicle Identification Number (VIN). This information can assist you in understanding the specific insurance requirements for your new car.

Additionally, the declaration page outlines the different types of coverage included in your policy, such as comprehensive car insurance coverage, collision coverage, uninsured motorist coverage, or personal injury protection. When buying a car, you can refer to the declaration page to ensure that you have the appropriate coverage for your new vehicle. It also details the coverage limits and deductibles, which can aid in your decision-making process when selecting insurance options for your new car.

While the declaration page is not proof of insurance, it can be a valuable tool when purchasing a car as it provides a concise summary of your existing auto insurance policy. It allows you to make informed decisions about the insurance coverage, insured drivers, and vehicle details for your new car. Therefore, it is recommended to keep your declaration page easily accessible, especially when you are in the process of buying a new car.

Motor Vehicle Insurance: When to Hire a Lawyer

You may want to see also

Review it to ensure accuracy and understand your liabilities and coverage

The declaration page of an auto insurance policy is a summary of all the vital information regarding the policy. It is important to review the declaration page to ensure that all the information is accurate and to understand the liabilities and coverage in case of an accident or incident.

The declaration page will list the names of all the insured drivers, including the policyholder and any additional drivers covered under the policy. It is important to check that all the names are spelled correctly and that there are no errors or omissions. This ensures that all the listed drivers are covered in the event of an accident.

The declaration page will also include a list of all the vehicles covered by the policy, identified by their make, model, year, and Vehicle Identification Number (VIN). Again, it is important to check that all the listed vehicles are correct and that there are no errors. This ensures that the policy covers the correct vehicles and that there are no discrepancies.

Additionally, the declaration page will outline the different types of coverage included in the policy. This includes liability coverage, such as bodily injury liability, and additional coverage types such as uninsured motorist coverage or personal injury protection. The declaration page will also specify the coverage limits for each type of coverage. Reviewing this section is crucial to understanding the extent of your insurance coverage and any potential liabilities you may face. For example, if you cause an accident that results in bodily injury to another person, your liability coverage will kick in, but only up to the specified limit. Knowing these limits beforehand can help you assess your risks and decide if you need to increase your coverage.

The declaration page will also mention any deductibles you have chosen for comprehensive and collision coverage. A deductible is the amount you will need to pay out of pocket before your insurance coverage kicks in. For instance, if you have a $500 deductible for collision coverage and you get into an accident, you will need to pay the first $500 out of pocket before your insurance company covers the remaining costs of the repairs. Understanding your deductibles is essential for managing your finances in the event of an accident or claim.

Finally, the declaration page will break down the auto insurance premiums, showing how much you are paying for each coverage type and vehicle. It will also list any discounts you are receiving on your policy. This section helps you understand the cost breakdown of your policy and ensures that you are being charged correctly.

In conclusion, reviewing the declaration page of your auto insurance policy is crucial to ensure the accuracy of the information and to give you a clear understanding of your liabilities and coverage. It serves as a quick reference guide, providing vital information about your policy, covered drivers, vehicles, and the different types and limits of coverage. By reviewing the declaration page, you can make informed decisions about your insurance choices and be better prepared in the event of an accident or claim.

Auto Insurance: California's Mandatory Law

You may want to see also

Frequently asked questions

A declaration page, or "dec page", is the first page of your auto insurance policy. It concisely summarizes vital policy information, including policy periods and numbers, insured drivers, covered vehicles, and elected coverages.

A declaration page includes the policy number, the date coverage goes into effect, and the expiration date. It also lists the names of all insured drivers and the details of the covered vehicles. Additionally, it outlines the different types of coverage, their limits, and the associated costs.

When you purchase an auto insurance policy, the insurance company will typically send you a copy of the policy with the declaration page attached to the first page. This can be sent via mail, email, or fax. If you bought your policy online, some insurers may allow you to print the declaration page directly from their website.

If you lose your auto insurance declaration page, you can request a replacement from your insurance company. You should also receive a new declaration page every time you renew or make changes to your policy.