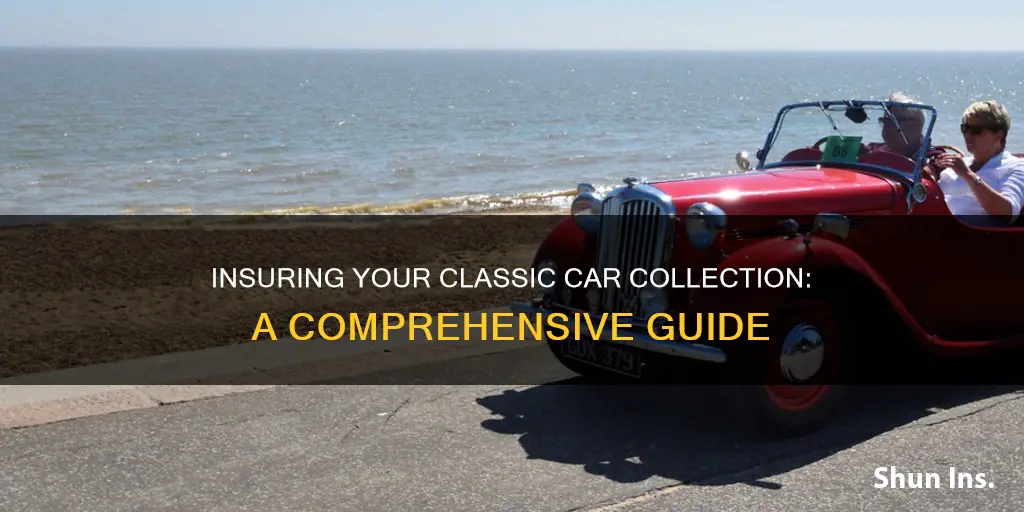

Classic car insurance is a special type of insurance that caters to the unique needs of vintage car collectors. This type of insurance is designed for vehicles that are not used as daily drivers but are instead driven occasionally for leisure or hobby purposes. Classic car insurance policies typically offer similar coverages to standard auto insurance policies, including liability, uninsured and underinsured motorist coverage, and medical coverages. However, classic car insurance also includes additional benefits such as coverage for spare parts, towing, and roadside assistance. One of the key differences between classic and regular auto insurance is the way the value of the vehicle is determined. In classic car insurance, the value of the vehicle is agreed upon upfront between the owner and the insurer, and this agreed value is listed on the policy declarations page. This ensures that the unique characteristics and worth of the classic car are taken into account in the event of a total loss. When choosing a classic car insurance provider, it is important to consider factors such as coverage options, mileage allowances, and the availability of online quotes.

What You'll Learn

How to get a quote for auto insurance for a collection

Getting a quote for auto insurance for a collection of cars is a straightforward process. Here is a step-by-step guide on how to get started:

Identify Your Collection's Needs:

Firstly, you will need to identify the specific needs of your collection. This includes understanding the types of vehicles in your collection, their age, value, and any unique characteristics or requirements. For example, classic or antique cars may have different insurance requirements compared to modern vehicles.

Research Providers:

Look for insurance providers that have experience insuring vehicle collections. Some companies may even have specialized programs for collectors. Compare their coverage options, discounts, and customer reviews.

Gather Information:

Before reaching out for a quote, gather all the necessary information about your collection. This typically includes:

- Vehicle Identification Number (VIN) for each car

- Make, model, and year of each vehicle

- Mileage or an estimate of annual usage for each car

- Safety features and any modifications made to the vehicles

- Value of the vehicles, especially if they are classics or antiques

- List of drivers, their ages, and driving history, including any accidents or violations

Contact Insurance Providers:

With your information gathered, you can now contact insurance providers for quotes. Many companies offer online forms or calculators to get a quick quote. You can also call them or visit their local offices for more personalized assistance.

Compare Quotes:

Once you have received quotes from different providers, it's essential to compare them carefully. Ensure you are comparing similar coverage options, policy limits, and deductible amounts. Look at the overall price and the specific protections offered for your collection.

Ask Questions:

Don't hesitate to ask questions and clarify any doubts you may have. Discuss your collection's unique needs and ensure the insurance provider understands your requirements. Ask about any available discounts, such as those for bundling policies or having safety features.

Make a Decision:

After comparing quotes and considering your collection's specific needs, you can now make an informed decision. Choose the insurance provider that offers the best coverage for your collection at a competitive price. Ensure you understand the terms and conditions of the policy before finalizing.

Remember, getting insurance for your collection is about finding the right balance between comprehensive coverage and affordability. Taking the time to research, compare, and ask questions will ensure you make the best decision for protecting your valuable collection.

Autonomous Cars: Disrupting Industries

You may want to see also

The benefits of auto insurance for a collection

Auto insurance for a collection of vehicles can provide many benefits to the policyholder. Here are some advantages of opting for such coverage:

Agreed Value Coverage:

The standout feature of collection auto insurance is the Agreed Value coverage. This means that the insurance company and the policyholder agree on a specific value for each vehicle in the collection at the beginning of the policy. In the event of a total loss, the policyholder will receive the agreed-upon value, providing certainty and accurate coverage that reflects the vehicle's true worth. This is in contrast to regular auto insurance policies, which typically offer Actual Cash Value (ACV) coverage, factoring in depreciation and resulting in a lower payout.

Enhanced Coverage and Lower Premiums:

Collection auto insurance policies often provide enhanced coverage options tailored to the unique needs of collectors. This can include coverage for spare parts, automotive tools, towing, emergency services, and more. Additionally, due to the specialised usage, reduced risk of accidents, and lower claims associated with collector vehicles, collection auto insurance premiums are generally lower than standard auto insurance policies.

Flexible Usage and Mileage Options:

Collection auto insurance policies typically offer flexible usage and mileage options. Policyholders are not restricted to limited mileage plans and can choose from options like regular use, allowing for higher annual mileage, or unlimited mileage, perfect for collectors who frequently drive their classic cars. This flexibility ensures that collectors can enjoy their vehicles without worrying about strict usage restrictions.

Coverage for a Diverse Range of Vehicles:

Collection auto insurance policies cater to a diverse range of vehicles, including antiques, vintage cars, classic cars, modern classics, muscle cars, sports cars, vintage race cars, classic trucks, SUVs, motorcycles, and even military vehicles. This broad coverage ensures that collectors can protect their entire collection under one policy, regardless of the variety of vehicles they own.

Expert Claims Handling and Specialist Knowledge:

Insurance providers offering collection auto insurance often have extensive knowledge and expertise in the field. They understand the unique needs and challenges of collectors and can provide expert claims handling. In-house parts specialists can assist in tracking down rare or hard-to-find replacement parts, ensuring that your classic or collector car receives the specialised care it deserves.

Optional Coverage Packages and Customisation:

Collection auto insurance policies often provide optional coverage packages, allowing policyholders to customise their coverage according to their specific needs. These packages can include benefits such as salvage buyback options, VIN fraud coverage, valuable papers coverage, deductible waivers, and more. This flexibility ensures that collectors can tailor their insurance plan to match their collection's unique characteristics and their own personal preferences.

Auto Insurance and Your Teen: What You Need to Know

You may want to see also

How to choose the best auto insurance for a collection

Choosing the best auto insurance for a collection of cars requires careful consideration of your unique needs, the types of coverage available, and the financial strength of the insurance provider. Here are some detailed steps to help you make an informed decision:

- Determine your unique needs: Understand your financial situation and specific requirements. For example, if you have teen drivers in your household, look for insurance providers offering discounts or programs for young adults. Consider if you prefer a simple and manageable insurance policy or need more comprehensive coverage.

- Understand the types of coverage: Familiarize yourself with the different types of auto insurance coverage available. Focus on core coverages such as liability insurance, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical or personal injury protection. Additionally, explore other optional coverages like guaranteed auto protection (GAP), mechanical breakdown, and OEM endorsement.

- Assess your financial situation: Evaluate your financial resources and assets when deciding on coverage and deductibles. If you have significant assets, consider higher liability limits to protect yourself from potential lawsuits. Consider your liquidity when setting a deductible—a higher deductible can lower your monthly premiums, but ensure you can afford to pay it if needed.

- Compare insurance providers: Research multiple insurance companies and compare their offerings. Look for providers that match your priorities and specific needs. Consider both large and small insurers, as they have their advantages. Evaluate their financial stability using ratings from agencies like AM Best, Moody's, and Fitch. Also, check customer satisfaction ratings and reviews to gauge their performance in handling claims and providing customer service.

- Look for discounts: Insurance providers often offer various discounts that can help lower your premiums. Look for discounts such as low mileage, occupational or alumni affiliations, good driving records, bundling home and auto insurance, or student discounts for teen drivers. Contact insurance agents or use online tools to get quotes and compare the cost and coverage options between different providers.

- Get the necessary information: When shopping for auto insurance, have the following information ready: vehicle identification numbers, driver's license numbers, estimated annual and daily mileage, a copy of your current auto insurance policy (if applicable), and your current insurance premiums. This information will help you obtain accurate quotes and make informed comparisons.

Auto Club Homeowners Insurance: College Student Coverage

You may want to see also

The cost of auto insurance for a collection

Cost of Classic Car Insurance

Classic car insurance is designed for vehicles that are considered "special" and are typically not used as daily drivers. The cost of classic car insurance can vary depending on the company and the specific coverage options chosen. On average, classic car insurance can range from $1,300 to $2,800 per year for full coverage. However, it is important to note that the cost of classic car insurance can be significantly higher or lower depending on various factors.

Factors Affecting Classic Car Insurance Cost

- Vehicle Age and Type: Classic car insurance rates can vary depending on the age and type of vehicle being insured. For example, older and more unique vehicles may require specialized coverage, which can increase the cost.

- Driver Profile: The driver's age, gender, credit score, and driving history can also impact the cost of classic car insurance. Younger and less experienced drivers, as well as those with a history of accidents or violations, may pay higher rates.

- Storage and Usage: The way a vehicle is stored and used can also affect the cost of classic car insurance. Proper storage in a secure location, such as an enclosed garage, can help reduce the risk of theft or damage and may result in lower insurance rates. Additionally, limited usage and pleasure or hobby use may result in lower premiums.

- Agreed Value: Classic car insurance typically offers agreed value coverage, where the insurer and the owner agree on a specific value for the vehicle before any incidents occur. This can provide peace of mind and ensure that the vehicle is adequately covered in the event of a total loss.

- Coverage Options: The cost of classic car insurance can also vary depending on the coverage options chosen. Basic liability coverage will be less expensive than full coverage, which includes collision and comprehensive insurance. Additionally, optional coverages, such as towing, emergency lodging, and spare parts coverage, can increase the overall cost of the policy.

When insuring a collection of vehicles, it is important to consider the specific needs and characteristics of each vehicle, as well as the driver's profile and usage patterns. It is recommended to compare quotes from multiple insurance companies and review the coverage options and discounts offered to find the most suitable and cost-effective policy for the collection.

Auto Insurance Premiums: Annual Cost Increase Explained

You may want to see also

How to make a claim on auto insurance for a collection

Making a claim on your auto insurance can be stressful, but there are a few steps you can take to make it easier. Here's a guide on how to make a claim on auto insurance for a collection:

Step 1: Call Your Insurance Provider

As soon as an accident happens, contact your insurance provider, regardless of who is at fault. Even if the accident seems minor, it's important to inform your insurance company about the incident and find out if your policy covers the specific loss. Many insurers now offer mobile apps that allow you to report a claim, check its status, upload photos, and more.

Step 2: Gather Evidence and Documentation

Collect the necessary documents and information to support your claim. Your insurance company will typically require a "proof of claim" form and a copy of the police report if one was filled out at the scene of the accident. Take photos of the damage to your car and any other vehicles involved, as well as the surrounding area and road conditions. Get the names and phone numbers of everyone involved in the accident, including witnesses, and exchange insurance information with the other drivers.

Step 3: Understand Timing and Coverage

Ask your insurance provider about any time limits for filing claims, resolving disputes, and submitting additional information. Find out if your policy covers the cost of a rental car while your vehicle is being repaired, and understand the estimate and repair process related to your claim.

Step 4: Submit Required Information

Fill out the claim forms carefully and provide all the requested information to your insurer. Keep thorough records of anything related to the claim, including the names and contact information of everyone you speak to at your insurance company, as well as copies of any bills related to the accident.

Step 5: Speak with an Insurance Adjuster

An insurance adjuster will investigate your claim to determine the appropriate compensation for the damage and injuries caused in the accident. They will assess the damage, review your documentation, and address any personal injury claims. They may request additional information, so try to provide as much detail as possible when filing your claim.

Step 6: Receive Your Insurance Payout

Once the insurance adjuster has determined the claim payout, they will inform you of your options for receiving it. You may receive a payout and choose your own repair shop, or the adjuster may coordinate repairs and pay the shop directly. If your vehicle is deemed a total loss, you will receive a payment for the market value of the car, minus your deductible.

Remember, it's always important to review your insurance policy or contact your agent to understand exactly what's covered before making a claim. Additionally, filing a claim may result in an increase in your insurance rates, so carefully consider the potential costs and benefits before initiating the process.

Choosing the Right Full Coverage Auto Insurance

You may want to see also

Frequently asked questions

Classic car insurance is a contract between you and an insurance company that provides specialised coverage for a classic or antique car in exchange for a premium.

Yes, classic car insurance is typically cheaper than a standard car insurance policy. This is because classic cars are generally restricted to being used for hobby and pleasure use, so their chances of being in an accident are lower.

In general, to qualify for classic car insurance, your car must be at least 10 years old to be considered a classic and 25 years or older to be an antique. However, check eligibility requirements when shopping around as it varies by insurer.

The best classic car insurance companies are American Collectors, American Modern, Leland-West, Chubb, Hagerty, Condon Skelly, and Heacock, according to Forbes Advisor's analysis.

If your classic car is totalled due to a problem covered by the policy, such as a car accident, fire, or flood, you can file a claim. If your car is totalled, your insurance company will pay you either the stated value or the actual cash value of the vehicle, whichever is less.