A Motor Vehicle Certificate of Self-Insurance is a document that proves the holder meets the minimum third-party insurance requirements to drive their vehicle. In the US, the rules and requirements for self-insurance vary from state to state. For example, in Texas, private employers can apply for self-insurance for workers' compensation, while in Florida, individuals can apply for self-insurance for their vehicles. In India, a motor insurance policy is mandatory to drive a vehicle, and a certificate of insurance is issued by the insurer upon purchase or renewal of the policy. This certificate is a summary document that contains details about the vehicle, the policyholder, and the insurance policy.

What You'll Learn

- Motor vehicle self-insurance is not an insurance policy but proof of financial responsibility

- It covers third-party risks, including bodily injury, death, and property damage

- Self-insured vehicles must be registered or leased by the name(s) on the certificate

- In Texas, certified self-insurers (CSI) must be a member of the Texas Certified Self-Insurer Guaranty Association (TCSIGA)

- The certificate of motor insurance is a one- or two-page document that serves as proof of the minimum third-party insurance required by law

Motor vehicle self-insurance is not an insurance policy but proof of financial responsibility

Motor vehicle self-insurance is not an insurance policy but rather a means of proving financial responsibility. It is a way for individuals or businesses to demonstrate that they have the financial capacity to pay for any damages resulting from a vehicle accident, even if they are not at fault. This is often required by law, as in the case of Texas, where drivers must provide proof of financial responsibility if they are charged with failing to have insurance.

In the state of Florida, the Department of Highway Safety and Motor Vehicles issues a certificate of self-insurance to qualified individuals or entities, as outlined in Section 324.171, Florida Statutes. This certificate is not an insurance policy but rather proof of financial responsibility. To obtain this certificate, individuals must provide proof of their unencumbered net worth, such as bank statements or appraisals of other assets. The certificate is valid for one year and covers vehicles that are registered or leased by the individual.

Similarly, in Nevada, a person in whose name more than 10 motor vehicles are registered may qualify as a self-insurer by obtaining a certificate of self-insurance from the Department. The requirements include demonstrating the ability to pay judgments and providing security to satisfy those judgments.

It is important to note that self-insurance is not the same as having an insurance policy. While it allows individuals to demonstrate financial responsibility, it does not provide the same coverage and benefits as an insurance policy.

Non-Owners Insurance: Vehicles Covered?

You may want to see also

It covers third-party risks, including bodily injury, death, and property damage

Motor vehicle insurance is mandatory for driving on Indian roads. A motor vehicle must have at least third-party liability coverage to comply with the rules and regulations. When you buy or renew a motor insurance policy, the insurer will issue an insurance certificate, which is a summary document containing details about the vehicle, the policyholder, and the insurance policy. This certificate is a legally required document in India and must be kept in the vehicle at all times. It should be produced along with other documents such as a driving license, registration certificate, and PUC certificate whenever the vehicle is stopped by the police for inspection.

Third-party liability insurance covers third-party risks, including bodily injury, death, and property damage caused by an accident involving the insured vehicle. This means that if the insured vehicle causes bodily injury (including death) or property damage to a third party, the insurance company will take care of the financial risks that come with third-party liabilities. For example, if a vehicle with third-party liability insurance crashes into another car and damages it, the insurance company will cover the cost of repairing or replacing the damaged car.

Third-party property damage refers to the physical damage caused to a motor vehicle or other tangible property arising out of a motor vehicle accident. This includes the resulting loss of use of such property. For instance, if a vehicle with third-party liability insurance collides with and damages a building, the insurance company will cover the cost of repairing the building and any loss of use of the building during the repairs.

In the state of Florida, a certificate of self-insurance provides limits of liability insurance in the amount of $10,000 of bodily injury to, or death of, one person in any one crash, $20,000 of bodily injury to, or death of, two or more persons in any one crash, and $10,000 of injury to, or destruction of, property of others in any one crash. To obtain a certificate of self-insurance in Florida, an individual must provide proof of an unencumbered net worth of at least $40,000 by submitting bank statements or appraisals of other assets.

Vehicle Removal: Insurance Coverage?

You may want to see also

Self-insured vehicles must be registered or leased by the name(s) on the certificate

In the United States, most states allow residents to register and insure their vehicles under different names. However, Florida is an exception to this. In the state of Florida, a certificate of self-insurance is only valid for vehicles that are registered or leased (under a lease-purchase agreement) by the name(s) on the certificate.

The Florida Department of Highway Safety and Motor Vehicles issues a certificate of self-insurance to qualified individuals or entities. This certificate is not an insurance policy but rather proves that the individual is financially responsible for the vehicle. The certificate provides liability insurance in the amount of $10,000 of bodily injury to, or death of, one person in any one crash, $20,000 of bodily injury to, or death of two or more people in any one crash, and $10,000 of injury to, or destruction of, property of others in any one crash.

To obtain a certificate of self-insurance in Florida, individuals must provide proof of their unencumbered net worth by submitting bank statements or appraisals of other assets. The applicant's signature on the Statement of Net Worth must be notarized. If the application lists two names, both signatures must be notarized.

Any changes to the vehicles listed on the certificate must be reported within 30 days, and a failure to do so will result in the cancellation of the certificate. The certificate is valid for a period of one year from the effective date.

It is important to note that using different names for vehicle insurance and registration can cause confusion for insurance companies and may result in delays in the claims process. Therefore, it is essential to ensure that the information on the insurance policy and vehicle registration is consistent.

Vehicle Ownership: Insurance Costs After Paying Off Loans

You may want to see also

In Texas, certified self-insurers (CSI) must be a member of the Texas Certified Self-Insurer Guaranty Association (TCSIGA)

A motor insurance policy is mandatory to drive a vehicle. Motor vehicle insurance must include at least third-party liability coverage to comply with the rules and regulations. When you buy or renew a motor insurance policy, the insurer will issue an insurance certificate along with other policy documents. This certificate is a summary document that contains details about the vehicle, the policyholder, and the insurance policy itself.

In Texas, certified self-insurers (CSI) are private employers that have been approved for a certificate of authority to self-insure workers' compensation. Each CSI is a member of the Texas Certified Self-Insurer Guaranty Association (TCSIGA). The Texas Certified Self-Insurer Guaranty Association provides for the payment of workers' compensation insurance benefits for the injured employees of an impaired employer. To become a CSI for workers' compensation in Texas, a private employer must meet several requirements, including having an estimated unmodified manual insurance premium for workers' compensation of at least $500,000 in Texas or $10,000,000 nationwide, presenting audited financial statements, and having a qualifying financial rating.

TCSIGA is required to maintain a Texas certified self-insurer guaranty trust fund of at least $2 million for the emergency payment of compensation liabilities of an impaired CSI. The regulatory fee covers the Texas Department of Insurance, Division of Workers' Compensation's (DWC) cost to administer the self-insurance program and is charged to each individual CSI. The maintenance tax covers the cost of administering the Labor Code and is based on the individual company's amount of liabilities for Texas workers' compensation claims from the previous year.

Gap Insurance: Is My Vehicle Covered?

You may want to see also

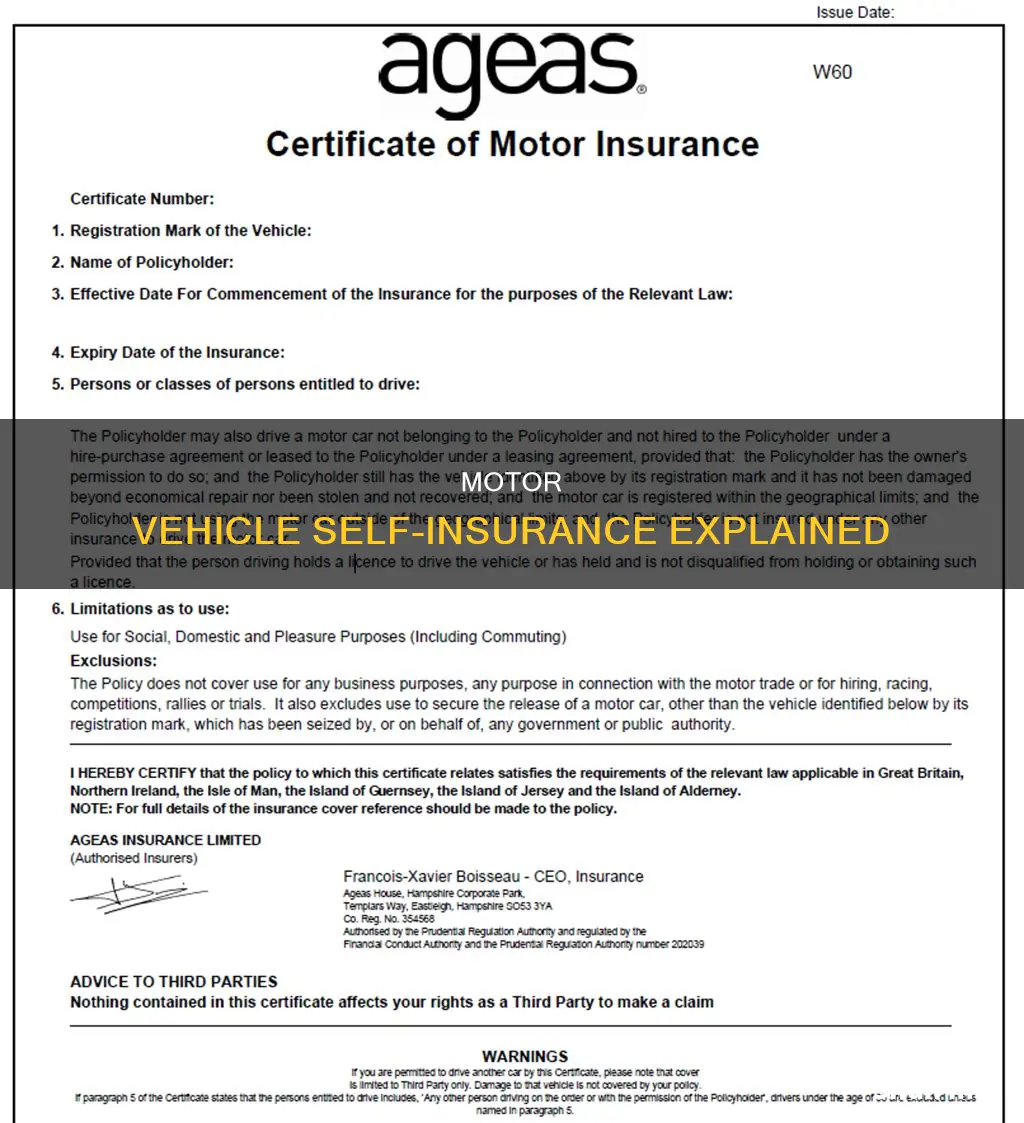

The certificate of motor insurance is a one- or two-page document that serves as proof of the minimum third-party insurance required by law

The certificate of motor insurance is a crucial document for any driver, serving as proof of the minimum third-party insurance required by law. This certificate, typically one to two pages in length, is issued by the insurance company or broker and outlines essential details about the vehicle, policyholder, and insurance policy. It is a summary of the insurance policy, providing a concise yet comprehensive overview of the coverage.

The certificate includes standard features such as a description of the vehicle, typically through its registration number or license plate, and may also include the make, model, and year of production. It identifies the policyholder by name and specifies the dates of insurance coverage, including the start date and the last day of the insurance period, typically lasting 365 days.

One of the critical aspects of the certificate is the list of permitted drivers. It outlines the individuals, such as the policyholder and any named drivers, who are authorised to operate the vehicle. This authorisation is granted on the condition that these individuals hold a valid driver's licence and are not disqualified from obtaining or holding such a licence.

The certificate also delineates the limitations and class of use, describing the types of vehicles covered by the policy and the purpose for which they can be used. This includes social, domestic, and pleasure use, commuting, and various levels of business use. It is important to note that certain activities are typically excluded from cover, such as hiring out the vehicle, using it for racing or competitions, or specific business activities without prior declaration.

The certificate of motor insurance is a legal requirement and must be kept in the vehicle at all times. It serves as proof of insurance in the event of an accident or police inspection. While it is no longer needed for vehicle tax purposes, it remains essential for ensuring compliance with the legal requirement of minimum third-party insurance.

In summary, the certificate of motor insurance is a concise yet comprehensive document that outlines the key aspects of a vehicle's insurance coverage. It includes details about the vehicle, policyholder, permitted drivers, and limitations of use. This certificate is a legal requirement and plays a vital role in ensuring that drivers meet the minimum third-party insurance standards mandated by law.

Vehicle Insurance File: What's Inside?

You may want to see also

Frequently asked questions

A Motor Vehicle Certificate of Self-Insurance is a document that proves a driver meets the minimum third-party insurance requirements to drive their vehicle. In the US, the requirements for self-insurance vary by state. In Florida, for example, the Department of Highway Safety and Motor Vehicles issues a certificate of self-insurance to qualified individuals or entities. In Texas, private employers can apply for a certificate of authority to self-insure workers' compensation.

A Motor Vehicle Certificate of Self-Insurance typically includes a description of the insured vehicle, such as the registration/number plate, make, model, and year of production. It also identifies who can legally drive the vehicle and any exclusions to cover, such as business use or racing.

The process for obtaining a Motor Vehicle Certificate of Self-Insurance varies depending on your location and vehicle type. In the UK, for example, you can obtain the certificate from your insurance company or broker. In the US, the requirements differ by state and vehicle type. For instance, in Florida, individuals must meet specific financial requirements to qualify for self-insurance, while in Texas, private employers must meet certain financial criteria and apply for a certificate of authority to self-insure.