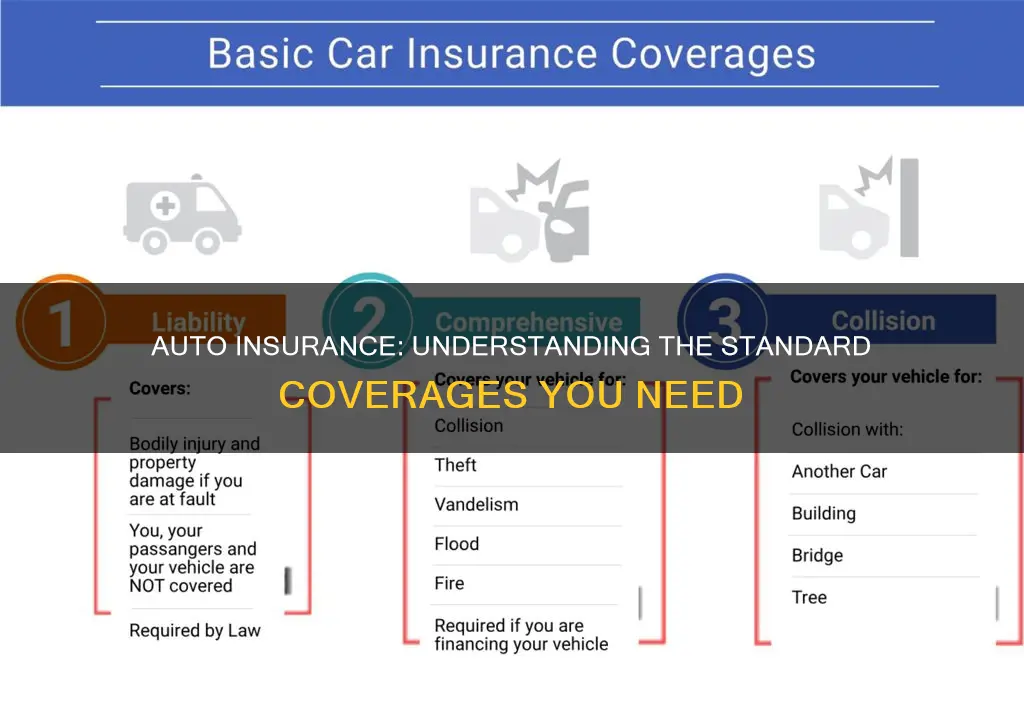

Auto insurance policies vary, but most basic auto insurance policies consist of six types of coverage: bodily injury liability, personal injury protection, property damage liability, collision, comprehensive, and uninsured/underinsured motorist coverage. The minimum insurance requirements vary by state, but most states require drivers to have liability insurance, which covers damage and injuries caused to others in an accident. Liability insurance includes bodily injury liability, which covers injuries to other drivers, their passengers, and pedestrians, and property damage liability, which covers damage to another person's property. Collision coverage pays for damage to your car resulting from a collision with another car or object, while comprehensive coverage reimburses you for loss due to theft or damage caused by something other than a collision. Uninsured and underinsured motorist coverage reimburses you if you are hit by a driver without insurance or insufficient insurance.

| Characteristics | Values |

|---|---|

| Bodily injury liability | Coverage for injuries caused to someone else |

| Medical payments or personal injury protection (PIP) | Coverage for treatment of injuries to the driver and passengers |

| Property damage liability | Coverage for damage to someone else's property |

| Collision | Coverage for damage to your car resulting from a collision with another car, an object, or as a result of flipping over |

| Comprehensive | Coverage for damage caused by something other than a collision with another car or object |

| Uninsured and underinsured motorist coverage | Coverage if you are hit by an uninsured driver or a driver who doesn’t have sufficient insurance |

What You'll Learn

Bodily injury liability

In most states, bodily injury liability is legally required. The coverage limits are typically represented by three numbers, such as "100/300/100." The first number indicates the maximum amount your insurance company will pay for bodily injury claims per person, while the second number represents the total amount covered per accident. The third number pertains to property damage liability, which is separate from bodily injury coverage.

While each state has its own minimum requirements for bodily injury liability coverage, experts recommend carrying higher limits to adequately protect your assets in the event of a lawsuit. It is generally advised to have enough coverage to safeguard your net worth. If your insurer offers limited liability coverage, consider purchasing an umbrella policy to provide additional protection.

Auto Insurance Rates: The Post-Accident Impact

You may want to see also

Medical payments or personal injury protection (PIP)

The specific benefits covered by PIP can vary depending on the state and the insurance provider. For example, in Kansas, PIP covers medical expenses up to $4,500 per person, lost income up to $900 per month for one year, in-home services up to $25 per day for up to a year, funeral and burial expenses up to $2,000, and rehabilitation expenses up to $4,500. On the other hand, in Michigan, drivers can choose between unlimited medical coverage or lower limits, such as a $250,000 limit with medical exclusions or a $50,000 limit for those on Medicaid.

It's important to note that PIP has minimum coverage amounts and per-person maximum coverage limits. If the cost of necessary medical care exceeds the auto insurance policy's PIP limits, health insurance may cover further expenses. Additionally, PIP does not cover bodily injuries to the other driver and their passengers, injuries that occur while driving for work purposes, injuries sustained while committing a crime, damage to someone else's property, or damage to the policyholder's vehicle.

When considering whether to purchase PIP, it's essential to review the specific coverage offered by the insurance provider and the applicable state laws. In states where PIP is optional, it is generally recommended to have this coverage, especially if there are gaps in health care coverage or high deductibles.

Auto Insurance: Validity and Expiry Dates Explained

You may want to see also

Property damage liability

The amount of property damage liability coverage required varies by state. For example, in Illinois, the minimum Property Damage (PD) liability limit is $20,000 per accident. However, it's important to consider your specific circumstances when deciding on the coverage amount. If you own a home or other valuable assets, travel in high-traffic areas, or live in an area with expensive vehicles, you may want to increase your coverage limit.

When choosing your property damage liability limit, it's crucial to remember that each car insurance policy has a maximum payout limit per accident. If the cost of damages exceeds your coverage limit, you will be responsible for the remaining amount out of pocket. Therefore, it's advisable to select a higher limit or consider adding an umbrella insurance policy for additional protection.

GEICO: Salvage Vehicle Insurance

You may want to see also

Collision coverage

When deciding on collision coverage, it is important to consider the cost of your car and the potential cost of repairs. If you have a higher collision deductible, you will cover more of the repair costs yourself, which will lower your monthly premium. On the other hand, a lower monthly premium may put you at risk in the event of an accident.

Overall, collision coverage is an important consideration for vehicle owners, especially those with valuable cars or those who are leasing or financing their vehicles. By understanding what collision coverage entails and weighing the potential costs and benefits, drivers can make informed decisions about their auto insurance choices.

Auto Insurance: Allstate's Rates in TN vs. WY

You may want to see also

Comprehensive coverage

The amount of comprehensive coverage you need will depend on the actual cash value of your vehicle. Comprehensive coverage does not have a limit that you select; instead, it is based on the value of your vehicle. You will also need to pay a deductible, which is the amount you agree to pay before the insurance company starts paying for damages. Typically, a higher deductible will result in lower insurance costs, while a lower deductible will lead to higher insurance costs.

AAA Auto Insurance: Rated and Reviewed

You may want to see also

Frequently asked questions

A basic auto insurance policy typically includes bodily injury liability, personal injury protection, property damage liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

Liability coverage pays for injuries and property damage caused to others in an accident. Collision coverage pays for damage to your car resulting from a collision with another object. Comprehensive coverage pays for damage to your vehicle caused by events other than a collision, such as theft, vandalism, or natural disasters.

The amount of liability coverage you need depends on your state's minimum requirements and your personal financial situation. It is generally recommended to get the highest level of coverage you can comfortably afford to ensure adequate protection.