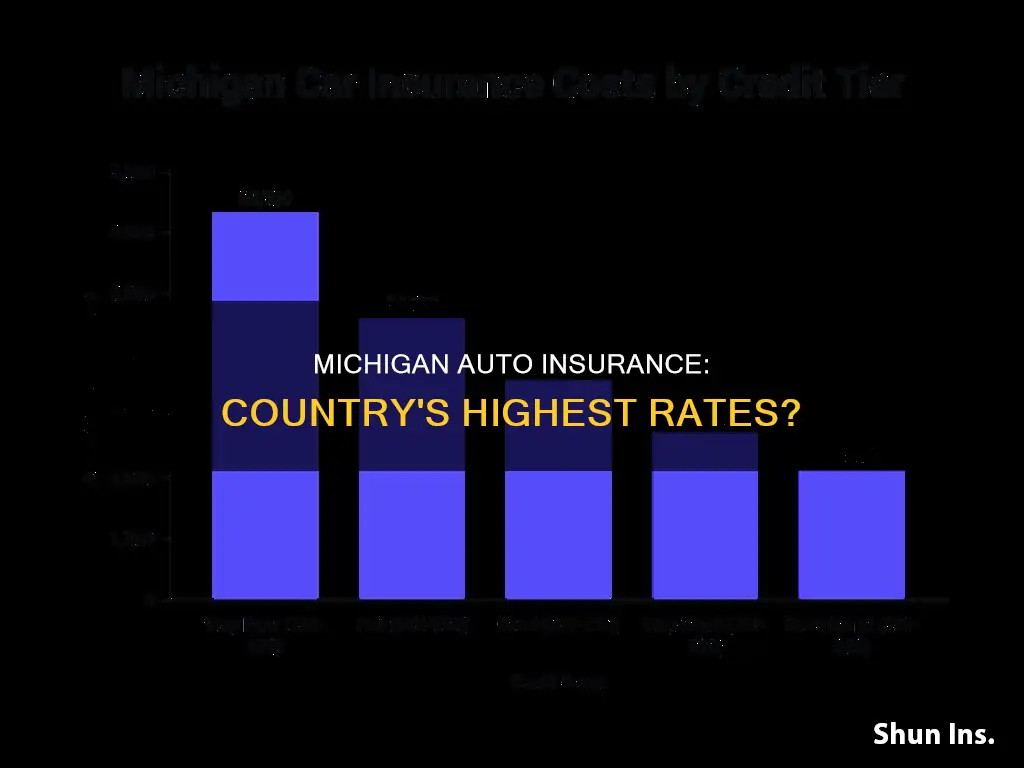

Michigan has some of the highest auto insurance rates in the United States. The average cost of auto insurance in Michigan is $5,471 for a full-coverage policy, which is nearly 300% higher than the national median rate. This is due to a variety of factors, including the state's no-fault insurance system, high rates of insurance fraud, and a large number of uninsured drivers. The state's insurance requirements, median healthcare costs, and other factors also contribute to the high cost of auto insurance in Michigan.

| Characteristics | Values |

|---|---|

| Average cost of auto insurance | $5,471 for a full coverage policy |

| Average cost of auto insurance compared to other states | The highest in the country |

| Average increase in auto insurance rates from 2015 to 2020 | 51% |

| Average annual insurance rate | $3,688 |

| Average national median insurance rate | $1,517 |

| Average increase in insurance rates from 2019 to 2020 | 18% |

| Average cost of auto insurance for senior citizens | Extremely difficult |

| Average number of uninsured drivers | 25% |

What You'll Learn

Michigan's No-Fault Insurance System

Michigan is a No-Fault state for auto accidents. The Michigan No-Fault Insurance law was passed in 1973 to ensure that car accident victims receive the help they need without delay and regardless of who is at fault. This system is unique to Michigan and around a dozen other states.

If you are injured in a car accident in Michigan, your own car insurance will cover your medical bills and other out-of-pocket losses, regardless of who caused the crash. This is called Personal Injury Protection (PIP) coverage. PIP benefits are also available to family members living with the policyholder, any passengers or pedestrians without their own no-fault policy, and any motorcyclists injured in an accident involving the policyholder's car.

The benefits provided by PIP coverage include:

- All costs of medical care made necessary by the accident

- Wages lost due to the injury (up to 85% of income, for up to three years)

- Up to $20 per day in "replacement services" (e.g. for someone to perform household chores)

Other Key Features of Michigan's No-Fault Insurance System

- Michigan's No-Fault Insurance law requires drivers to have unlimited PIP coverage. This is a key reason why insurance premiums in the state are so high.

- Michigan has the second-highest number of uninsured drivers in the country, with almost 26% of drivers lacking auto insurance.

- Michigan has a high rate of insurance fraud, with around 10% of no-fault insurance claims being fraudulent.

- Michigan law requires auto insurance companies to reimburse claims within 30 days, which may not give them enough time to scrutinize claims properly.

- Michigan has a high rate of personal injury lawsuits, with a 130% increase in the past ten years.

GEICO Auto Insurance: Understanding Medical Expense Coverage

You may want to see also

High Rate of Insurance Fraud

Michigan has one of the highest rates of insurance fraud in the country, with around 10% of no-fault insurance claims estimated to be fraudulent. This has contributed to making Michigan the most expensive state for auto insurance.

Types of Auto Insurance Fraud

Auto insurance fraud can be committed in several ways, including:

- Lying about accidents or providing false information when applying for insurance, as in the case of Andrea, who hid the fact that she had an accident while uninsured and then filed a claim for it after purchasing insurance.

- Submitting false claims, such as when Mike claimed that he was driving during an accident when, in reality, the accident occurred while his unlicensed son was driving.

- Exaggerating injuries to receive larger settlements, as Austin did when he claimed his neck and back were injured and sought unnecessary medical treatment.

- Faking vehicle theft, as Megan did when she asked a "friend" to get rid of her SUV, which needed expensive repairs, and then reported it stolen so that her loan would be paid off by the insurance company.

Impact of Insurance Fraud

Insurance fraud has significant negative consequences for both insurance companies and policyholders. It leads to increased premiums for honest policyholders as insurers pass on the losses incurred from fraudulent claims. Additionally, it affects the reputation and profitability of insurance companies.

Preventing and Reporting Insurance Fraud

To combat the high rate of insurance fraud, Michigan has established a Fraud Investigation Unit within the Department of Insurance and Financial Services. This unit works to prevent and prosecute criminal and fraudulent activities in the insurance and financial services markets. Suspected insurance fraud can be reported to the Department of Insurance and Financial Services (DIFS) by calling their hotline, sending an email, or using their website.

Marital Status and Car Insurance: The DMV Connection

You may want to see also

High Number of Uninsured Drivers

Michigan has one of the highest numbers of uninsured drivers in the US. Around 20% of Michigan drivers—or 1 million drivers—lack auto insurance, which is nearly 13% higher than the national average. In some cities, such as Detroit, over half of all drivers are estimated to be uninsured.

The high rate of uninsured drivers in Michigan has a significant impact on insured drivers. When an uninsured driver is at fault in an accident, the other party's insurance provider typically covers the property damage and medical expenses through uninsured motorist insurance. This means that insurance companies pass on the cost to those with insurance to compensate for potential losses.

Uninsured motorist coverage (UM) is available in Michigan and provides legal protection for those injured in accidents caused by uninsured drivers. UM coverage is not mandatory but is highly recommended by auto accident attorneys and insurance agents. It is relatively inexpensive, costing around $3 to $6 per month for a policy covering injuries up to $25,000 per person and $50,000 per accident.

The problem of uninsured drivers in Michigan is a serious issue that can have significant financial implications for both insured and uninsured drivers.

Auto Insurance Payments: Tax Deductible?

You may want to see also

Frequent Personal Injury Lawsuits

Michigan has the highest auto insurance benefits and costs in the country. The state's auto insurance average annual premium was $2,610 in 2019, 45% more than the rest of the US. In Detroit, the average premium is $5,414 per year, about 74% higher than the national average.

The high costs of car insurance in Michigan are due to several factors, including the state's insurance law, a large number of lawsuits, and a high rate of auto insurance fraud. Michigan transitioned to a no-fault system in 1972, meaning that insurance providers had to cover accidents even if they were the insured person's fault. The state also has high minimum coverage requirements, including unlimited personal injury protection (PIP) coverage.

One of the main reasons for the high cost of auto insurance in Michigan is the frequent occurrence of personal injury lawsuits. According to mlive.com, the number of personal injury lawsuits in Michigan increased by 130% in the last 10 years. Drivers and medical providers often sue auto insurers over unpaid no-fault claims. The state's no-fault system allows individuals to file for a personal injury lawsuit in case of serious injury.

In addition to the frequent personal injury lawsuits, other factors contributing to the high cost of auto insurance in Michigan include the high rate of uninsured drivers, high median healthcare costs, and short processing time for claims.

To address the high cost of auto insurance in Michigan, the state has implemented several reforms, including giving drivers the option to choose their PIP medical coverage level and establishing a Fraud Investigation Unit to investigate criminal and fraudulent activity related to insurance and financial markets.

Motor Vehicle Insurance: Protection and Peace of Mind

You may want to see also

High Minimum Insurance Requirements

Michigan has some of the highest auto insurance rates in the country, and this is due in part to its high minimum insurance requirements. The state operates under a no-fault insurance system, which means your insurer covers your injuries and losses regardless of who caused the accident, up to your coverage limit.

Michigan's minimum insurance requirements include:

- Bodily injury liability of $50,000 per person and $100,000 per accident.

- Property damage liability of $10,000 per accident.

- Unlimited personal injury protection (PIP) per person.

- Property protection insurance (PPI) with a minimum of $1 million in coverage.

The no-fault system and unlimited PIP coverage are significant factors in Michigan's high insurance costs. PIP coverage helps pay for medical bills and lost wages, and the unlimited benefit option in Michigan is more expensive than in other states. The no-fault system also means that insurance companies must cover these costs regardless of who is at fault, leading to higher premiums for consumers.

In addition to the no-fault system and PIP coverage, other factors contribute to Michigan's high minimum insurance requirements. The state has a high rate of uninsured drivers, estimated at around 20%-26%, which leads to higher premiums for insured drivers. Michigan also has a high rate of insurance fraud, with about 10% of no-fault insurance claims being fraudulent. This further increases costs for insurance companies, which are passed on to consumers.

While Michigan's minimum insurance requirements are comprehensive, there are some optional coverages that residents may want to consider, including collision and comprehensive insurance. These coverages are not legally required but can provide added protection for drivers. Overall, Michigan's high minimum insurance requirements reflect the state's efforts to ensure that motorists are adequately protected in the event of an accident.

Correcting Auto Insurance History: Your Guide to Success

You may want to see also

Frequently asked questions

Michigan is a no-fault state, which means drivers must have personal injury protection (PIP) coverage that covers financial losses regardless of who is at fault in an accident. Michigan also has a high rate of uninsured drivers and insurance fraud, which contributes to higher premiums for insured drivers.

The average cost of auto insurance in Michigan is $5,471 for a full coverage policy, making it the most expensive state for auto insurance.

In addition to the no-fault system and high rate of uninsured drivers and insurance fraud, Michigan has extensive minimum coverage requirements, including unlimited PIP coverage. The state also has a high number of personal injury lawsuits, which drives up the cost of insurance.

Yes, in 2019 the Michigan legislature passed a law to reduce the cost of auto insurance by allowing drivers to opt out of unlimited PIP coverage and choose from six levels of coverage. However, the majority of drivers (79.9%) are still opting for unlimited PIP coverage, which may be due to the high cost of healthcare in the US.