Vehicle insurance premiums are influenced by the number of miles driven, with higher mileage resulting in higher rates. This is because the likelihood of accidents increases with more time spent on the road. Insurance companies often offer low-mileage discounts, pay-per-mile policies, or usage-based insurance to incentivise safer driving behaviours and reduce premiums for those who drive less. The definition of low mileage varies by insurer, but it generally refers to driving less than 7,500 to 10,000 miles annually.

What You'll Learn

Mileage-based insurance and reimbursement

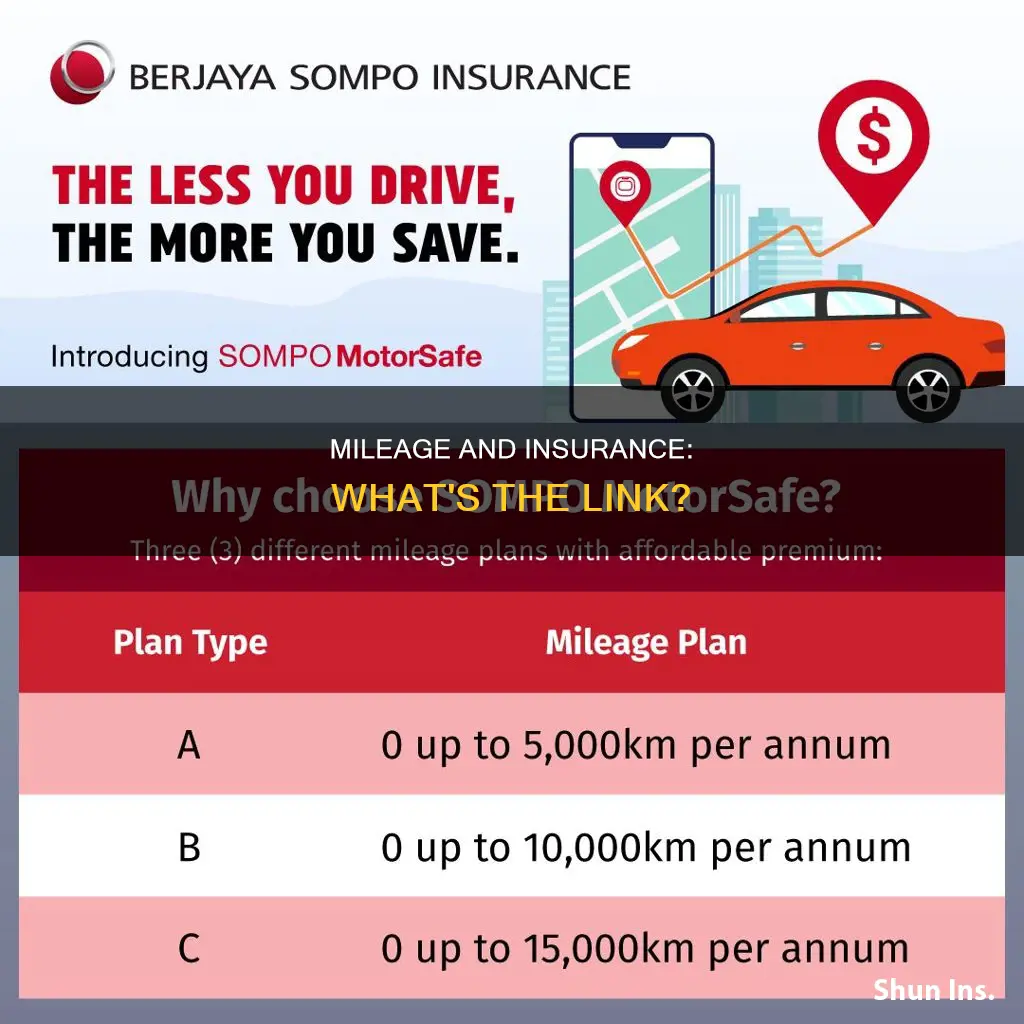

Mileage-based insurance, also known as pay-per-mile insurance, is an alternative to traditional auto insurance that is designed for people who don't drive very often. This type of insurance allows customers to pay a base monthly rate that remains constant, as well as a monthly mileage rate that can change depending on how much they drive. The more you drive, the higher your monthly rate will be.

Pay-per-mile insurance is different from low-mileage discounts offered by some auto insurers, which offer a percentage off the cost of a traditional policy. Instead, pay-per-mile insurance determines your rate based on how far you drive. This type of insurance is best suited for people who rarely use their cars, such as those who take public transportation or walk, or who have a second vehicle that they rarely use.

According to data from the U.S. Department of Transportation's Federal Highway Administration, Americans drive around 13,000-13,500 miles per year on average. Insurance companies consider 12,000 miles per year to be lower than average, and some insurers consider 10,000 miles or fewer to be low mileage. If you drive less than this amount, you may be able to save money with pay-per-mile insurance.

To track your mileage, insurance companies use technology known as "telematics". This can be in the form of an app or a device that plugs into your car's diagnostic port. Some companies, like Mile Auto, let you buy pay-per-mile insurance without using a plug-in device; instead, you send them a photo of your odometer once a month.

In addition to pay-per-mile insurance, some organizations offer mileage reimbursement to their employees when they use their personal vehicles for work. This is meant to cover expenses such as gas, oil changes, maintenance, tires, insurance, taxes, registration, and depreciation. However, mileage reimbursement may not always effectively cover all these expenses, especially for low-mileage drivers. A better approach may be to pay a fixed monthly stipend for predictable expenses like depreciation, insurance, taxes, and registration, and a smaller mileage reimbursement rate for expenses tied directly to business mileage. This is known as the fixed and variable rate reimbursement, or FAVR.

Fleet Vehicle Insurance: What Changes?

You may want to see also

Low-mileage insurance

There are a few different ways to get low-mileage insurance:

- Low-mileage Discounts: Some insurance companies offer reduced rates for people who drive fewer than 7,500 or 8,000 miles per year. This is usually around 21 to 22 miles per day. Examples of companies that offer this discount include USAA, Safeco Insurance, American Family Insurance, Farm Bureau, and PEMCO.

- Pay-per-mile Insurance: With this type of insurance, you pay a base rate plus an additional amount based on how many miles you drive. Some companies that offer this type of insurance include Metromile, Allstate Milewise, and Nationwide SmartMiles.

- Usage-based Insurance (UBI): This type of insurance uses a telematics device or app on your phone to monitor your driving habits, including mileage, in-car phone use, braking habits, and speeding. While mileage is usually a main factor in determining your discount, these programs also take into account your driving behaviour. Examples of UBI programs include Progressive Snapshot, Esurance DriveSense, and Liberty Mutual RightTrack.

The amount you can save with low-mileage insurance depends on a number of factors, including your driving record, location, insurer, and any discounts or programs available. According to one source, motorists who drive 6,000 miles per year pay $1,973 annually for car insurance on average, which is $100 less than the national average rate of $2,068 for those who drive 12,000 miles per year.

Another source estimates that drivers who drive 2,500 miles per year can save around $947 with a pay-per-mile program compared to standard insurance. Similarly, Nationwide SmartMiles estimates that a driver who pays $133 per month on a traditional policy could pay $95 per month by driving 500 miles monthly.

How to Get Low-Mileage Insurance

To get low-mileage insurance, you'll need to determine if you meet the eligibility requirements, which typically involve driving fewer than 7,000 or 8,000 miles per year. You can calculate your current average mileage by setting your car's odometer to zero and then noting the number of miles travelled over the next week. To get the current annual average mileage, multiply the obtained odometer value by 52.

Once you've calculated your average mileage, you can reach out to insurers to ask for quotes and see if you qualify for low-mileage insurance. It's important to note that low-mileage insurance may not be available in all states, so be sure to check with the insurance company.

Borrowed Cars: Am I Covered?

You may want to see also

Pay-per-mile insurance

With pay-per-mile insurance, customers pay a daily or monthly base rate, plus a per-mile fee of about 2-10 cents. The base rate and per-mile fee are calculated using standard rating factors, including driving record, age, gender, ZIP code, and vehicle.

Most pay-per-mile insurance policies use a device that tracks your mileage, or a mobile app. The device typically plugs into your vehicle's onboard diagnostic port under the dashboard, although the app usually captures the same data using GPS.

Some pay-per-mile insurance policies also include features that may help you save more on your premiums, such as feedback on your driving habits and tips on how to improve.

- Allstate: Milewise

- Metromile

- Mile Auto

- Nationwide: SmartMiles

- Noblr

- Progressive: Snapshot

- State Farm: Drive Safe and Save

Vehicle Insurance: India to Bhutan

You may want to see also

Telematics and tracking

Telematics insurance, also known as usage-based insurance, pay-as-you-drive insurance, or pay-per-mile insurance, offers discounted rates to safer-than-average drivers or those who drive fewer miles.

Telematics insurance programs use in-car monitoring devices or smartphone apps to track driving habits and mileage. This data is then used to calculate insurance rates. The two main types of telematics programs are safe driving programs and pay-per-mile programs.

Safe driving programs, such as Progressive's Snapshot, Geico's DriveEasy, and State Farm's Drive Safe & Save, track driving behaviours such as speed, acceleration, braking, cornering, phone use, time of day, and location. These programs offer discounts or lower rates to drivers who exhibit safe driving habits.

On the other hand, pay-per-mile programs, such as Allstate's Milewise and Nationwide's SmartMiles, primarily base their rates on the number of miles driven. These programs are designed for low-mileage drivers and offer a base rate plus a per-mile rate.

Telematics insurance programs are typically opt-in and can provide benefits such as lower rates for safe drivers, more accurate data for insurance companies, and incentives to drive less. However, there are also potential drawbacks, including privacy concerns, higher rates for risky drivers, and the possibility of losing existing discounts.

Reinstating Car Insurance in PA: A Guide

You may want to see also

Discounts and savings

While mileage does affect car insurance rates, there are several ways to save on car insurance. Here are some tips to help you get discounts and save money:

- Shop around for car insurance: Prices vary from company to company, so it's worth getting quotes from multiple insurers and comparing their rates. Don't just look at the price; also consider the company's reputation and the quality of their customer service.

- Compare insurance costs before buying a car: Insurance premiums are based on factors such as the car's price, repair costs, safety record, and theft risk. Insurers often offer discounts for features that reduce the risk of theft or personal injury, or for cars known to be safe. Research the insurance costs for different vehicles before making a purchase.

- Increase your deductible: Opting for a higher deductible can significantly lower your premium. Just make sure you have enough money set aside to cover the higher deductible in case of a claim.

- Reduce optional insurance on older cars: If your car is older and worth less than a certain threshold (typically around 10 times the insurance premium), it may not be cost-effective to maintain collision and comprehensive coverage. Evaluate the value of your car and consider dropping these optional coverages if they're no longer necessary.

- Bundle your insurance policies: Many insurers offer discounts if you purchase multiple types of insurance from them, such as homeowners and auto insurance, or if you insure more than one vehicle. Longtime customers may also be eligible for loyalty discounts. Compare the costs of bundling with those of buying insurance separately to find the most cost-effective option.

- Maintain a good credit history: Building a solid credit history can lead to lower insurance costs. Insurers often use credit information to price auto insurance policies, as research shows that people who manage their credit effectively tend to make fewer claims. Regularly check your credit record to ensure all information is accurate and reflects your good credit.

- Take advantage of low-mileage discounts: Some companies offer discounts for motorists who drive less than the average number of miles per year. This includes drivers who carpool to work. If you're driving less, be sure to inform your insurer and ask about any low-mileage discounts they offer.

- Ask about group insurance: Some insurers offer reduced rates for drivers who get insurance through a group plan from their employers or certain professional, business, or alumni groups. Check with your affiliated organizations to see if they have any partnerships or discounts with insurance companies.

- Seek out other discounts: There are various other discounts that your insurer may offer. For example, some companies provide discounts for drivers with a clean driving record (no accidents or moving violations), those who've taken a defensive driving course, or young drivers who are good students or have completed a driver's education course. Ask your insurer about any potential discounts you may qualify for, but remember that the final cost of your policy is what matters most.

- Improve your driving record: Speeding tickets, accidents, and other traffic violations can significantly increase your insurance premiums. If you receive a ticket, consider taking a defensive driving course or traffic school to reduce the number of points on your driving record.

- Drop unnecessary car insurance: If your car is older and not worth much, consider dropping collision and comprehensive insurance, which cover damage to your vehicle. Instead, set aside the money you would have spent on premiums for repairs or a down payment on a newer car.

- Choose a car that's cheap to insure: When buying a new car, compare insurance rates for different models. Safe and moderately priced vehicles, such as small SUVs, tend to have lower insurance premiums than expensive or flashy cars.

- Consider usage-based insurance: If you're comfortable with your driving behavior being tracked, usage-based or pay-per-mile insurance can be a great way to save money. These programs typically involve using an app or installing a device in your car to transmit data to the insurance company. They offer discounts or reduced rates for safe driving habits.

Criminal Enterprise Vehicles: Insured?

You may want to see also

Frequently asked questions

The more miles you drive, the higher your insurance premium will be. This is because the more you drive, the more likely you are to be involved in an accident and need to file a claim.

Some insurance companies use telematics technology, which tracks your mileage through an app or a device installed in your car's diagnostic port. Other companies may ask you to take a photo of your odometer at regular intervals.

Low-mileage car insurance is a type of insurance where your premium is based on the number of miles you drive each month. You usually pay a flat monthly rate plus a small per-mile fee.

Insurance companies usually consider "low mileage" to be less than 7,500 miles per year, but this can vary depending on the provider.