Yes, you can cancel your auto insurance at any time in Canada. However, it's important to be aware of the potential financial implications. Cancelling mid-policy or mid-term can result in cancellation fees and other charges. These fees can vary depending on the insurance provider and the time remaining on your policy. To avoid unnecessary costs, it is recommended to cancel during your renewal period. When cancelling your auto insurance, it is important to initiate the process by contacting your insurance provider, understanding the terms and conditions, and obtaining written confirmation of the cancellation.

| Characteristics | Values |

|---|---|

| Can I cancel my car insurance at any time in Canada? | Yes |

| Is there a cancellation fee? | Yes, if cancelled before the renewal date |

| How much is the cancellation fee? | Depends on the provider and the time remaining on the policy term |

| What is the best time to cancel car insurance? | Renewal time |

| What is the cancellation process? | Contact the insurance provider, submit a request in writing, get a written confirmation |

| What information is needed to cancel the policy? | Personal information, new insurance details, proof of plate forfeiture or bill of sale |

| What happens after the policy is cancelled? | Refund of premiums, loss of insurance coverage, impact on future policies |

What You'll Learn

Cancelling mid-term vs. at renewal

You can cancel your car insurance at any time in Canada, but there are financial implications to cancelling mid-term that you should be aware of.

Cancelling mid-term

Cancelling your insurance before the renewal date is possible, but it may not make financial sense to do so. Cancelling mid-term can result in cancellation and administrative fees, which vary depending on the terms and conditions of your agreement. For example, if you cancel in month six, you will pay more in cancellation fees than if you cancel in month nine.

In addition to cancellation fees, you may also lose loyalty discounts, accident forgiveness, and other perks and discounts. You may also be required to pay a down payment and administration fees for setting up a new policy.

Cancelling at renewal

Cancelling your current plan upon renewal is common and is one of the main ways to avoid cancellation fees. During your annual renewal period, you have the opportunity to explore other options and discuss new options with your current provider.

Cancelling without charges

The only way to cancel your car insurance without incurring charges is to do so on your policy expiry date or policy renewal date.

Auto Insurance: Why the Rising Rates?

You may want to see also

Short-rate vs. pro-rata cancellations

Yes, you can cancel your car insurance policy at any time in Canada. However, doing so before the renewal period may result in cancellation fees and other charges.

When it comes to refunds after cancelling your policy, insurance companies typically use one of two methods: short-rate or pro-rata.

Pro-rata cancellation

With the pro-rata cancellation method, the refund amount is calculated based on the remaining length of the policy. This means that the insured party only pays for the number of days the insurance contract was in effect. Pro-rata cancellations are usually applied when the insurance company initiates the cancellation and, in some cases, when the insured party does.

Short-rate cancellation

The short-rate cancellation method is similar to pro-rata but includes a penalty to discourage early cancellation. This results in a smaller refund for the insured party. From the insurance company's perspective, the short-rate cancellation penalty covers their administration costs and balances the money collected with their chances of paying for a loss.

Short-rate cancellations are applied when the insured party cancels the policy mid-term. The penalty for short-rate cancellations often decreases the closer you are to the end of the policy term.

Different insurance policies use different methods for determining the short-rate penalty amount. Some policies charge a set percentage of the unearned premium amount as a penalty, while others use a short-rate table found in the policy document.

Mercury Gap Insurance: What's Covered?

You may want to see also

Cancelling without charges

The best time to cancel your car insurance without incurring additional charges is during your policy's renewal period. This is because insurance companies typically charge a penalty fee for cancelling before the end of the term. This is known as a "short-rate cancellation fee".

Short-rate cancellation fees are calculated based on the percentage of the total insurance premium for the year, which is higher than the per-day amount. The fee decreases the closer you get to the end of the policy term. Therefore, if you cancel during the renewal period, you can avoid this fee altogether.

In addition to short-rate cancellation fees, there may be other charges to consider when cancelling your insurance policy early. For example, some companies may require a cancellation fee and an administrative fee. Also, if you have made monthly payments, these may not stop immediately and you could be charged for the next payment.

Therefore, to avoid charges, it is best to cancel on your policy's expiry or renewal date. It is also worth noting that some insurance companies may agree to cancel your policy without charges in certain situations, such as if you are moving to a different province.

Insuring Your Vehicle: Year-Round Necessity

You may want to see also

Cancelling with an open claim

Yes, you can cancel your car insurance policy in Canada even if you have an open claim. However, there are a few important things to keep in mind when doing so. Firstly, you will still need to complete the open claim. This means that you will need to continue with the claims process and provide any necessary information or documentation to your insurance company. Additionally, you may be subject to a cancellation fee for ending your policy early. This fee can vary depending on the terms and conditions of your insurance provider and the timing of your cancellation. It's important to review the specifics of your policy to understand the potential financial implications of cancelling mid-term.

When it comes to the impact of an open claim on your ability to cancel, it's crucial to consider the reason for the claim. If you were found to be at fault for an accident, you may not be able to cancel your policy until the claim is fully resolved with the other party. This is especially important if there are injuries involved, as the claims process can be lengthy in such cases. Even if you cancel your policy, the incident will still be listed on your driving record, and your insurance company will have a record of the claim.

It's worth noting that making a claim may increase your premiums in the future or when you renew or change your policy. Insurance companies may view policy cancellations as a risk factor, which could also affect your premiums or eligibility for coverage down the line. Therefore, it's essential to carefully consider the financial and practical implications before deciding to cancel your car insurance policy with an open claim.

Insurers Return Premiums Amidst Pandemic

You may want to see also

Alternatives to cancelling

Yes, you can cancel your car insurance at any time in Canada. However, it is important to consider the alternatives to cancelling your insurance, as there may be more cost-effective options that still provide you with adequate coverage. Here are some alternatives to cancelling your car insurance policy:

- Increase your deductible: By increasing your deductible, you can lower your insurance premiums. However, it is important to remember that this means you will have to pay more out of pocket in the event of a claim.

- Adjust your coverage: If your car is older, you may not need comprehensive or collision coverage. You can also consider decreasing your third-party liability coverage to the minimum requirement, which is $50,000 in Quebec and a minimum of $200,000 in other provinces.

- Opt for pay-as-you-go coverage: With pay-as-you-go insurance, you only pay for a set number of kilometres per year, starting at 1,000 and going up to 12,000 kilometres. This can be a more flexible and affordable option if you don't drive frequently.

- Look for discounts: Many insurance companies offer discounts for various reasons, such as bundling multiple policies, being a safe driver, or installing winter tires and anti-theft devices. Check with your insurance provider to see if you are eligible for any discounts.

- Reduce your coverage amount: Instead of cancelling your policy entirely, you can reduce your coverage amount to lower your premiums. This can be a good option if you are facing financial difficulties but still want to maintain some level of insurance protection.

- Pause your car insurance policy: If you are not using your car for an extended period, you may be able to pause your car insurance policy temporarily. This can be a good way to save money without completely cancelling your coverage.

Remember, it is important to carefully consider your options and consult with a professional before making any decisions about your car insurance.

Police Cars: Insured?

You may want to see also

Frequently asked questions

Yes, you can cancel your auto insurance at any time in Canada. However, there may be a cancellation fee, especially if you're cancelling before your policy comes up for renewal.

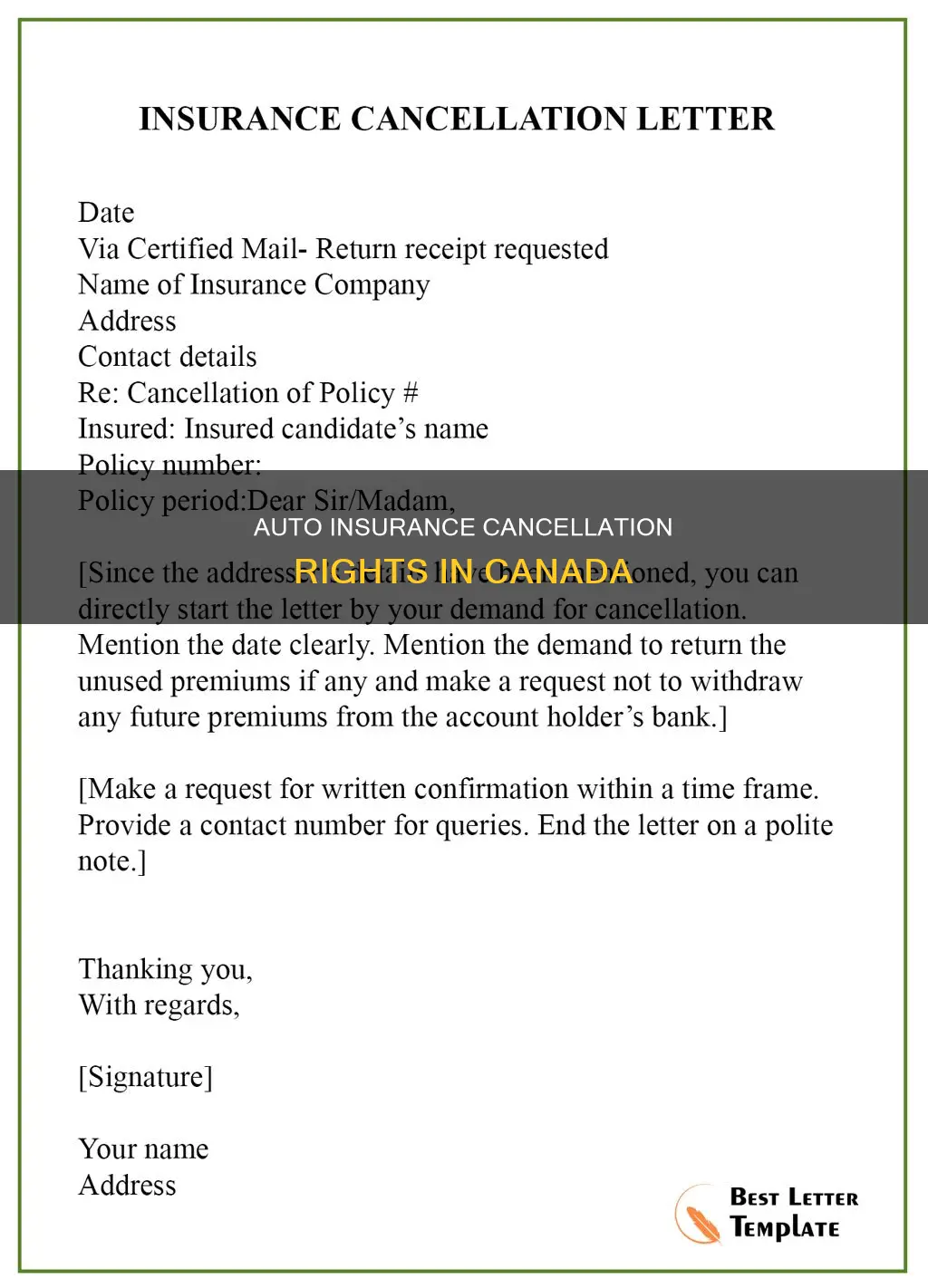

To cancel your auto insurance, you must contact your insurance provider. Some insurance providers may require you to submit a request in writing. You can do this by post or email, or by calling them.

Cancelling your auto insurance can have various implications. You may be eligible for a refund on your premiums, depending on the terms of your policy and the time of cancellation. However, your insurance provider may charge a cancellation fee. Once your policy is cancelled, your insurance coverage will cease, and you will no longer be covered for any incidents.