Many individuals who receive Medicaid may wonder if they can continue their coverage if they receive health insurance through their employer. This is a common concern for those transitioning from unemployment or underemployed situations to employment. The answer depends on several factors, including the state's Medicaid policies, the type of employer-provided insurance, and the individual's income and assets. In some cases, individuals may be able to keep Medicaid if their employer's insurance is not sufficient or affordable, or if they meet specific income guidelines. However, it's important to understand the specific rules and requirements of your state's Medicaid program to determine the best course of action.

What You'll Learn

- Eligibility and Enrollment: Understanding Medicaid eligibility and the process of enrolling in a new health plan

- Coverage Comparison: Comparing Medicaid benefits with employer-provided insurance to make an informed decision

- Cost and Affordability: Evaluating the financial impact of switching insurance plans

- Network and Providers: Checking if your job's insurance covers your preferred doctors and hospitals

- Transition Process: Learning about the steps to switch from Medicaid to employer insurance

Eligibility and Enrollment: Understanding Medicaid eligibility and the process of enrolling in a new health plan

Medicaid eligibility and the process of transitioning from Medicaid to a new health plan can be complex, especially when you're considering a job offer that includes insurance benefits. Here's a detailed guide to help you understand your options and navigate the process:

Eligibility for Medicaid: Medicaid eligibility is primarily based on income and financial resources. The federal government sets guidelines, and states have the flexibility to adjust these standards. Generally, eligibility is determined by comparing your household income to the federal poverty level (FPL). If your income falls below a certain threshold, you may qualify for Medicaid. Factors like household size, pregnancy, disability, and age also play a role in eligibility determinations. It's important to note that Medicaid eligibility rules can vary between states, so it's crucial to check your state's specific criteria.

Enrolling in a New Health Plan: When you secure a job that offers insurance, you'll need to consider the enrollment process. Here's a step-by-step approach:

- Understand Your Options: Review the health insurance plan offered by your employer. Understand the coverage, network, and any associated costs. Compare this plan to your current Medicaid benefits to assess the differences and determine if it meets your healthcare needs.

- Check Eligibility for Continuation: In some cases, you may be eligible to continue your Medicaid coverage even after starting a new job. This is known as "Medicaid Continuity of Coverage." Contact your state's Medicaid agency to inquire about your eligibility for continuation. They will guide you through the process, which may involve providing updated income and household information.

- Enroll in the New Plan: If you decide to enroll in your employer's health plan, follow these steps:

- Contact your employer's human resources department to understand the enrollment process and deadlines.

- Gather the necessary documentation, such as proof of income, household information, and any required forms.

- Complete the enrollment process, which may involve selecting a plan, choosing a primary care physician, and providing personal and financial details.

- Ensure you understand the coverage start and end dates to avoid any gaps in insurance.

Transition Period: During the transition, it's essential to maintain continuous healthcare coverage. If you qualify for Medicaid continuity, you can keep your Medicaid coverage temporarily while you enroll in the new plan. Once enrolled, you'll need to notify the Medicaid agency to update your status.

Remember, the process can vary depending on your state's regulations and your specific circumstances. It's always advisable to consult with a healthcare navigator or your state's Medicaid office for personalized guidance. They can provide accurate information regarding your eligibility, enrollment options, and any financial assistance programs available to ensure you have the necessary healthcare coverage.

Oral Surgery and Insurance: Navigating Coverage and Costs

You may want to see also

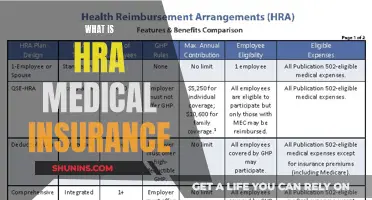

Coverage Comparison: Comparing Medicaid benefits with employer-provided insurance to make an informed decision

When you're considering whether to keep your Medicaid coverage or switch to employer-provided insurance, it's crucial to compare the benefits of both options. Here's a detailed comparison to help you make an informed decision:

Medicaid Benefits:

- Comprehensive Coverage: Medicaid typically offers a wide range of benefits, including medical, dental, vision, and sometimes even prescription drug coverage. This comprehensive approach ensures that you have access to various healthcare services.

- Low or No Cost: One of the most significant advantages of Medicaid is that it often provides coverage at little to no cost to you. This is particularly beneficial for individuals with low incomes or those who cannot afford private insurance premiums.

- Specialized Care: Medicaid often covers specialized medical services that might be challenging to access through private insurance. This includes coverage for pre-existing conditions, mental health services, and long-term care.

- Eligibility Criteria: Medicaid eligibility is based on income and other factors, ensuring that those who need it most can access the coverage.

Employer-Provided Insurance:

- Employer Contribution: One of the primary advantages of employer-provided insurance is that your employer may contribute to the premium, reducing your out-of-pocket costs. This can be a significant financial benefit.

- Customized Plans: Employers often offer a range of insurance plans, allowing you to choose the coverage that best suits your needs. This customization can include different deductibles, copayments, and coverage limits.

- Additional Perks: Many employers provide additional benefits like flexible spending accounts (FSAs) or health savings accounts (HSAs), which can help you save on healthcare expenses.

- Network of Providers: Employer-provided insurance usually has a network of healthcare providers, making it convenient to find doctors, specialists, and hospitals within the network.

Making the Decision:

When comparing Medicaid and employer-provided insurance, consider your current financial situation, healthcare needs, and long-term goals. If you have a stable income and prefer the flexibility of customized coverage, employer-provided insurance might be preferable. However, if cost is a significant concern or if you require specialized care, Medicaid could be a more suitable option.

It's essential to review the specific details of both plans, including any limitations or exclusions, to make an informed choice. Additionally, consider consulting with a healthcare advisor or insurance specialist who can provide personalized guidance based on your unique circumstances.

Motorcycle Insurance: Medical Bill Coverage Explained

You may want to see also

Cost and Affordability: Evaluating the financial impact of switching insurance plans

When considering the switch from Medicaid to a job-provided insurance plan, it's crucial to evaluate the financial implications to ensure you make an informed decision. Here's a detailed breakdown of the cost and affordability factors to consider:

Understanding Your Current Coverage: Begin by understanding the specifics of your Medicaid coverage. Medicaid provides essential healthcare coverage for low-income individuals and families. It typically covers essential health services, including doctor visits, hospitalization, emergency care, and prescription drugs. Knowing the extent of your current coverage is vital to assess the potential gaps that may arise when switching.

Job-Provided Insurance Plan: Your employer's insurance plan is a significant factor in this decision. These plans often offer a range of coverage options, including health, dental, and vision insurance. Evaluate the plan's benefits, including deductibles, copayments, and out-of-pocket maximums. Understanding these costs is essential to gauge the financial impact on your monthly budget.

Cost Comparison: A comprehensive cost comparison is essential. Calculate your monthly expenses under both Medicaid and the job-provided plan. Consider the following:

- Premiums: Determine if there's a premium associated with the job-provided plan and how it compares to the cost of Medicaid.

- Deductibles and Copayments: These are out-of-pocket expenses. Assess if the plan's deductibles and copayments are manageable and if they align with your financial situation.

- Prescription Drug Coverage: If you require medication, compare the prescription drug coverage and costs between the two plans.

- Additional Benefits: Consider any additional benefits like vision, dental, or mental health services offered by the job-provided plan.

Financial Impact: Switching insurance plans can significantly impact your finances. Here's how:

- Monthly Premiums: If the job-provided plan has a higher premium, it may increase your monthly expenses.

- Out-of-Pocket Costs: Higher deductibles or copayments can lead to increased out-of-pocket expenses, potentially affecting your savings or emergency funds.

- Prescription Drug Costs: Ensure the plan covers your required medications adequately and at a reasonable cost.

- Long-Term Financial Planning: Consider the long-term financial implications. Will the switch provide better coverage and savings in the long run?

Assistance and Subsidies: Remember that financial aid and subsidies are available to help with insurance costs. Research government programs or employer-provided assistance that can make insurance more affordable. These programs can significantly reduce the financial burden, making a switch more feasible.

Making an informed decision about insurance coverage requires a thorough understanding of your current situation and the potential changes. By carefully evaluating the costs and benefits, you can choose the plan that best suits your financial needs and ensures adequate healthcare coverage.

Chen Medical's Insurance Coverage: A Comprehensive Guide

You may want to see also

Network and Providers: Checking if your job's insurance covers your preferred doctors and hospitals

When you're considering whether to keep your Medicaid coverage while taking on a job that offers insurance, it's crucial to understand the details of your new employer's health plan. One of the most important aspects to check is whether your preferred doctors and hospitals are included in the network of providers covered by your job's insurance. Here's a step-by-step guide to help you navigate this process:

Understand Your Job's Insurance Plan: Start by reviewing the details of the health insurance plan provided by your employer. Most companies provide this information in a summary or benefits package. Look for the following key details:

- Network of Providers: Check if the plan has a network of preferred providers, including doctors, specialists, and hospitals. These networks are often designed to offer more affordable care and may have negotiated rates with the providers.

- In-Network vs. Out-of-Network: Understand the difference between in-network and out-of-network services. In-network services are typically more cost-effective, while out-of-network services may be more expensive and might not be fully covered.

- Coverage Limits: Review the coverage limits and exclusions to know what is and isn't covered under the plan.

- Identify Your Preferred Providers: Make a list of your regular doctors, specialists, and hospitals that you are comfortable with and have a history of using. This could include primary care physicians, dentists, and any specialists you regularly see.

- Check the Network: Contact your employer's human resources department or the insurance provider directly to inquire about the network of providers. They should be able to provide you with a list of in-network doctors and hospitals. You can also log in to your online account with the insurance provider to access this information.

- Verify Coverage for Specific Providers: Once you have the list of in-network providers, contact each of your preferred doctors and hospitals to verify their participation in the network. Ask about their specific insurance plans and coverage policies. Some providers might accept multiple insurance plans, while others may have specific agreements with certain insurers.

- Understand the Impact on Medicaid: If your preferred providers are not in your job's insurance network, you might need to consider alternative options. You could explore the possibility of staying on Medicaid, especially if your income and family size qualify you for continued coverage. Alternatively, you might consider switching to a different plan that includes your preferred providers.

- Compare Costs: Compare the costs of using in-network providers versus out-of-network providers. In-network services are generally more affordable, and your job's insurance plan might have lower copayments and deductibles for these services. Understanding these costs will help you make an informed decision about your healthcare coverage.

By carefully checking the network of providers and verifying their participation in your job's insurance plan, you can ensure that you continue to receive the care you need from your preferred doctors and hospitals while also managing your healthcare costs effectively.

Chiropractic Care: Understanding Insurance Coverage and Costs

You may want to see also

Transition Process: Learning about the steps to switch from Medicaid to employer insurance

The transition from Medicaid to employer-provided insurance can be a complex process, but understanding the steps involved is crucial for a smooth switch. Here's a detailed guide to help you navigate this transition:

- Verify Your Eligibility: Before making any changes, ensure you understand your eligibility for both Medicaid and the employer-offered plan. Medicaid eligibility criteria vary by state and can depend on factors like income, family size, and disability status. Check with your state's Medicaid office to confirm your eligibility and the specific requirements. Similarly, review the employer's insurance plan details to understand its coverage, benefits, and any associated costs.

- Open Enrollment Period: Employers often provide insurance during specific enrollment periods, typically an annual open enrollment season. Pay attention to these dates as they are crucial for making changes to your coverage. If you miss the open enrollment period, you might have to wait until the next one to make adjustments. During this period, you can typically enroll in, change, or drop coverage.

- Notify Medicaid and Employer: Inform Medicaid of your intention to switch to employer insurance. They may require documentation from your employer to confirm your new coverage. It's essential to provide accurate and timely information to avoid any potential issues with your Medicaid status. Simultaneously, notify your employer's HR department about your decision. They will guide you through the process of enrolling in their insurance plan, which may involve filling out forms and providing necessary documentation.

- Understand the Transition Process: The transition process can vary depending on your employer's policies and your state's regulations. In some cases, you might be able to keep your Medicaid coverage until the end of the current period, while in others, you may need to cancel it immediately. Your employer's HR team should provide clear instructions on the transition timeline and any necessary steps to ensure a seamless switch.

- Review and Compare Plans: Take time to compare the benefits, coverage, and costs of both Medicaid and the employer-offered plan. Consider factors like copayments, deductibles, prescription drug coverage, and any additional perks. Understanding the differences will help you make an informed decision and ensure you receive the best coverage for your needs.

- Enroll and Update: Once you've made your choice, follow the employer's enrollment procedures to activate your new insurance coverage. This may involve providing personal and financial information, selecting coverage options, and paying any required premiums. Update your Medicaid provider with the new information to ensure a smooth transition without any gaps in coverage.

Remember, each state and employer may have unique requirements, so it's essential to seek specific guidance tailored to your situation. Being proactive and well-informed will make the transition process less stressful and more manageable.

Unraveling Hair Transplant Coverage: Medical Insurance Insights

You may want to see also

Frequently asked questions

Yes, you can still be eligible for Medicaid even if your new job offers health insurance. Medicaid eligibility is based on income, household size, and other factors, and it is designed to provide healthcare coverage to those who may not have access to employer-sponsored insurance. The specific rules and guidelines for Medicaid eligibility vary by state, so it's important to check with your state's Medicaid office to understand your options.

The transition process can vary depending on your circumstances. If your job's insurance plan is considered "affordable" and provides essential benefits, you may be required to notify the Medicaid program and potentially pay a premium to continue your Medicaid coverage. In some cases, you might be able to keep both plans temporarily, but eventually, you'll need to choose one. It's crucial to review the details of your new job's insurance and understand the implications for your Medicaid coverage.

Yes, income limits play a significant role in Medicaid eligibility. The income thresholds can vary by state and family size. If your income exceeds the set limits, you may no longer qualify for Medicaid. However, some states offer a "Medicaid Buy-In" program, allowing individuals to purchase Medicaid coverage if their income is above the standard eligibility threshold but below a certain limit. It's essential to assess your financial situation and consult with Medicaid officials to determine your eligibility.

In some cases, you might be able to keep both coverage types temporarily, especially if your job's insurance plan doesn't cover all your medical needs. However, this is often a short-term solution, and you'll eventually need to choose one. Medicaid and employer-sponsored insurance may have overlapping coverage, and keeping both might lead to double-dipping, which could result in penalties. It's best to review the details of both plans and consider your healthcare needs to make an informed decision.