Whether or not you can make a claim on your parents' auto insurance depends on several factors, including your age, living situation, and vehicle ownership. Generally, if you live with your parents or are a college student still dependent on them, you can be added to their auto insurance policy as a listed driver. This is often a cost-effective option, as young and new drivers typically face higher insurance premiums. However, if you own the car, you will likely need a separate insurance policy, and if you move out and establish your own residence, you will typically need to purchase your own insurance plan.

| Characteristics | Values |

|---|---|

| Can I be on my parents' car insurance? | Yes, if you live in the same household |

| Can I drive my parents' car without insurance? | Yes, if you have their permission |

| Can I drive my parents' car if I'm not on their insurance? | Yes, if you live in the same household and they name you on their policy |

| Can I be on my parents' car insurance if I don't live with them? | Yes, but only if your primary address is still your parents' home |

| Can I be on my parents' car insurance if I own the car? | No, you need your own insurance policy |

| Can I be on my parents' car insurance if I go away to college? | Yes, if you are still dependent on your parents and come home during school breaks |

| Can I be on my parents' car insurance if I'm married? | Yes, if you and your spouse live in your parents' home |

| Can I drive my parents' car in another state? | Yes, as long as you are also listed on the insurance policy for that vehicle |

What You'll Learn

If you live with your parents

However, if you own your own car, you will usually need to have your own auto insurance policy. This is especially true if you don't live with your parents. If you co-own a vehicle with your parents but don't live at home, your parents may need to be added to your insurance policy. Their driving profiles would not influence your insurance rate, but as co-owners, their names would need to be on your insurance policy paperwork.

If you are a full-time college student, you can typically remain on your parents' insurance policy even if you don't live with them, as long as your primary address is still your parents' home. If you take a car to college, it's likely that you will need to be added to your parents' policy.

It's important to note that if you are a regular driver of your parents' car, it's a good idea to be added to their insurance policy. While most insurance policies cover permissive use, which means you can drive their car with their permission, there may be limits on how often you can borrow the car. For example, you might only be allowed to drive it up to 12 times a year without being listed on their policy. If you get into an accident and are not listed on their insurance, there's a chance the insurance company will not cover the damages.

Married? Expect Lower Auto Insurance Premiums

You may want to see also

If you co-own a car with your parents

Being added to your parents' car insurance policy can offer several benefits. It is often cheaper for a young or new driver to be added to a parent's policy than to purchase an individual policy. Being added to your parent's policy can also help maximize multi-driver and multi-vehicle discounts. Additionally, being a named driver ensures you are covered every time you drive the car, eliminating uncertainties associated with permissive use clauses.

It is important to note that adding a young driver to a car insurance policy can increase the premium for the policyholder. The amount of increase will depend on various factors, such as the number of young drivers in the house, their age, gender, the types of cars the family owns, and their driving records.

If you are unsure whether you can be added to your parents' car insurance policy, it is essential to contact their insurance company and find out. Driving without proper insurance coverage can have serious repercussions.

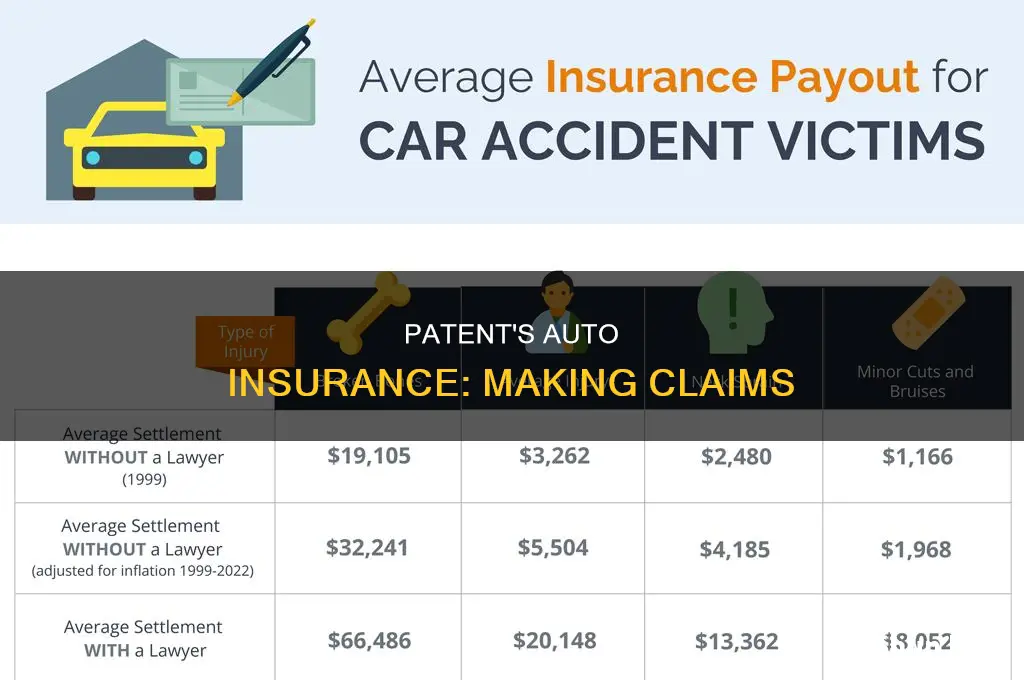

Lawyer's Role in Auto Insurance Claims

You may want to see also

If you're a college student

There are benefits to staying on your parents' policy, as it is usually more affordable, and you are covered when driving each other's cars. It is also easier to manage a single policy, and you are covered during school breaks when you return home. Additionally, remaining on your parents' policy helps you build a record of uninterrupted insurance coverage, which can reduce premiums when you eventually obtain your own policy. Some insurance companies offer student-specific discounts, such as good student discounts for full-time students with a certain GPA, or distant student discounts for those attending a school over 100 miles away.

However, there are also circumstances in which it may be beneficial to be removed from your parents' policy. If you will not be taking a car to college and will have no regular access to a car, removing yourself from the policy could save your parents money. In this case, you should still ensure you are covered by your parents' insurance when you return home for breaks and need to drive.

Ultimately, the decision to stay on or be removed from your parents' car insurance policy depends on various factors, including your residence, vehicle ownership, and usage. It is important to consult with your insurance provider to determine the best option for your specific situation.

AAA: Gap Insurance Coverage?

You may want to see also

If you're married and live with your parents

If you and your spouse live with your parents and drive their vehicles, you can stay on their car insurance policy as listed drivers. In this case, your parents would need to add you and your spouse to their policy. This may cause their insurance rates to increase.

On the other hand, if you or your spouse owns a vehicle, you have the option to insure it on your parents' policy or purchase your own separate policy. All drivers sharing the same permanent residence should be listed on each policy.

It's important to note that once you and your spouse move out of your parents' home, you will need to purchase your own auto insurance plan.

Creating False Vehicle Insurance

You may want to see also

If you're a high-risk driver

First, it's important to understand that auto insurance policies typically cover the car itself rather than the specific driver. This means that if you have permission to drive your parents' car, their insurance will usually provide coverage in the event of an accident. However, there are some exceptions to this.

One important factor is the concept of "permissive use." This refers to situations where someone who doesn't live with your parents borrows their car with permission. Most insurance policies cover permissive users, but this coverage is often limited. For example, your parents' policy may only allow you to drive their car a certain number of times per year, such as 12 times, before you need to be added to their policy. Additionally, permissive use may not cover high-risk drivers, including inexperienced or teen drivers.

If you live with your parents and drive their car regularly, it's best to be added to their insurance policy to ensure consistent coverage. Being a named driver on their policy eliminates uncertainties associated with permissive use clauses and ensures you're covered every time you drive. This is especially important if you're a high-risk driver, as insurance companies often have exceptions for permissive users who are considered high-risk.

Another factor to consider is your address. Auto insurance policies are typically based on households, so you generally need to share a permanent address with your parents to be covered by their policy. If you've moved out and have a new permanent address, you'll likely need to purchase your own separate policy. However, if you're away at college but still technically live in your parents' home, you can usually remain on their policy.

It's also worth noting that some insurance companies may increase premiums if high-risk drivers are added to a policy. In this case, it might be more cost-effective for you to purchase your own insurance. Shopping around and comparing quotes from different insurance providers can help you find the best rates.

Finally, if you're considered a high-risk driver due to factors such as inexperience, accidents, or driving violations, there are steps you can take to improve your standing. Maintaining a clean driving record, taking a defensive driving course, and improving your credit score can all help lower your risk profile over time.

In summary, while it's possible to be covered by your parents' auto insurance as a high-risk driver, it's important to review their policy carefully, understand any limitations or exceptions, and take the necessary steps to ensure you have adequate coverage.

Parents' Auto Insurance: How Long Can I Stay?

You may want to see also

Frequently asked questions

Yes, but only if your primary address is still your parents' home.

Yes, you can stay on your parents' car insurance if you go away to college.

If you get married and you and your spouse live in your parents' home, you can both be on their policy as you are considered members of the household.

You can usually remain on your parent's insurance if they are listed as a co-owner and you still live with them.

Yes, but there's no reason to do so. It's expensive, and filing claims on the same car with two different insurers constitutes fraud.