If your auto insurance claim has been denied, it can put you and your family under significant financial strain. It's important to first understand the reason for the denial before taking any further steps. Denials often occur due to stipulations in your policy that you may not be aware of. For example, your claim may be denied if your policy has lapsed due to non-payment of premiums, or if the event is not considered a covered loss according to your policy.

If you feel that your auto insurance claim has been unfairly denied, you do have the option to appeal the decision. Most insurance companies have a process in place for this, and you can contact them or your agent directly to request information about appealing. Appealing a denied claim can be a complex and time-consuming process, and it may be beneficial to hire a lawyer to help you with your appeal.

| Characteristics | Values |

|---|---|

| Can you appeal a denied auto insurance claim? | Yes |

| What to do if your auto insurance claim is denied? | Understand the reason for the denial, gather evidence, draft an appeal letter, consider hiring an attorney |

| How to appeal a denied auto insurance claim? | Submit a letter asking for an appeal, document the evidence, consider hiring legal counsel |

What You'll Learn

Understand the reason for the denial

Understanding the reason for the denial of an auto insurance claim is crucial for determining the next steps and planning your appeals process. Here are some common reasons why auto insurance claims are denied:

Lapsed Insurance Policy

If you fail to pay your insurance premium on time, your coverage may lapse, meaning you don't have an active policy to file a claim against. Paying your auto insurance premiums on time is essential to ensure you have coverage when needed. Choosing state minimum liability limits to save on premiums may backfire if you're involved in an accident with significant injuries or expensive property damage, as your coverage limits may not be sufficient.

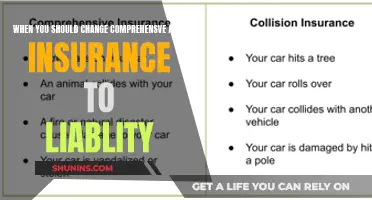

Inadequate Coverage

The type of coverage you select determines whether the insurer will cover your claim. For instance, if you lack collision coverage, the insurer won't pay for repairs to your car after an accident. Similarly, if you don't have comprehensive coverage and your car is damaged by an event like a fire or a falling tree, your claim will likely be denied.

Violation of State Law

Insurance providers may deny your claim if you violate state laws or driving regulations. This includes driving without a valid license, driving under the influence, or driving without valid auto insurance. The insurer may also deny your claim if they believe the accident was avoidable.

Miscellaneous Reasons

Insurers may deny your claim due to circumstantial evidence or doubts about the legitimacy of your claim. For example, failing to report the accident immediately or not seeking prompt medical attention may raise suspicions about the validity of your claim. Additionally, misrepresenting information when obtaining your quote or lying during the claim process can lead to a denial.

Fault or Partial Fault in the Accident

If you are found to be at fault or partially at fault for the accident, your claim may be denied. The specific threshold for denying a claim varies by state. For instance, in Texas, your claim may be denied if you are found to be more than 51% at fault for the collision.

Failure to Submit Necessary Information

Insurance companies may deny your claim if you fail to provide proof of fault, proof of your losses, or necessary medical records to support your claim. It's important to understand the requirements and deadlines for submitting all the necessary information to support your claim.

Auto Insurance Brokers: Worth the Hassle?

You may want to see also

Gather evidence to support your appeal

Gathering evidence is a crucial step in appealing a denied auto insurance claim. Here are some detailed instructions on how to gather evidence to support your appeal:

- Review the documentation: Go through the documentation provided by the insurance company, including the claim denial letter and your insurance policy. Understand the reasons for the denial and identify the specific areas of dispute.

- Collect relevant evidence: Gather evidence that supports your case and contradicts the insurance company's decision. This can include police reports, eyewitness statements or testimonies, photographs of the accident scene, medical reports, and any other supporting documentation.

- Organise and analyse the evidence: Go through the evidence you have collected and analyse it thoroughly. Identify the key points and arguments that support your appeal. Look for any inconsistencies or discrepancies between the insurance company's decision and the evidence you have gathered.

- Make copies: Make copies of all the evidence you have gathered. This will allow you to provide the insurance company with a complete set of documents while keeping the originals for your records.

- Prepare a summary: Create a concise summary of the evidence, highlighting the most important points and how they support your appeal. This will help you present your case clearly and effectively.

Remember, the goal of gathering evidence is to demonstrate that the insurance company's decision to deny your claim was incorrect or unjustified. By presenting a well-organised and compelling set of evidence, you can strengthen your appeal and improve your chances of a successful outcome.

Insurance Contact Gaps: What You Need to Know

You may want to see also

Draft an appeal letter

The first step in writing an appeal letter is to gather all the information related to your claim. This includes the original claim form, any supporting documentation, and the letter of rejection from the insurance company. Make sure to read over the letter your insurer sent when they denied your insurance claim. Review the reason for the rejection and identify any errors or missing information so you can address these points in your letter.

Contact your insurance company to ask them for more information about the denial. Make sure you understand the correct process and deadlines for filing an appeal.

Next, organise the information you have gathered in a logical and easy-to-understand manner. This will make it easier for the insurance company to review your appeal and understand your case. Organise your information as follows:

- Insurer's reason for error

- Your proposal for amending the error

- Any supporting evidence and/or documentation

Keep in mind that an appeal letter is a formal document and should be written in a polite and professional manner. Begin the letter by addressing the insurance company and the person who denied your claim. State the reason for your letter and provide a brief overview of your case.

Maintain a calm and respectful tone throughout the letter. Although you may be frustrated with the rejection, avoid letting that emotion come across in your writing. Ask a friend or family member to read over the letter before you send it to ensure your tone is polite and respectful.

Include copies of any supporting documentation that you have gathered, such as medical records, diagnoses, bills, and test results. Make sure to reference these documents in the letter and explain how they support your claim. Don't forget to retain a copy of these documents for your own records.

If your claim was denied due to an error or omission on your part, explain this in the letter and take ownership of the mistake. Denying responsibility for the error will not help your chances of a successful appeal. Do your best to provide any additional information or explanation that may help clarify the situation.

Formally request that the insurance company review your case and provide an explanation of their decision. Indicate that you are willing to provide any additional information or documentation if needed.

Conclude the letter by thanking the insurance company for their time and consideration. Provide your contact information, including your telephone number and email address, in case the insurance company needs to reach out to you.

After you have sent the appeal letter, follow up with the insurance company by telephone or email to inquire about the status of your case. It's also a good idea to keep detailed notes of any correspondence or conversations you have with the insurance company.

Bundling Home and Auto Insurance: Progressive's Benefits

You may want to see also

Consider hiring an attorney

If you are uncomfortable navigating the appeals process or want an expert's opinion, consider hiring an attorney. They can review your case and supporting documents to draft a demand letter requiring the insurance company to respond and defend its claim denial. While it may cost you money upfront, it could be a worthwhile expense to have the claim denial overturned if you feel your insurer made the wrong decision.

An attorney can help you understand the language given to you by the insurance company about the denial itself. Once you know this, you may be in a better position to gather the evidence and fight back to get the support you need.

A lawyer can also help you understand the legal jargon and technicalities that may affect your claim. They can also help you deal with auto insurance companies and guide you through the claim process after your insurance claim has been denied.

Most lawyers provide free advice before you hire them for your insurance claim, so it makes sense to at least contact them before you proceed with your claim and talk to any representative of the insurance company.

Broad Form Auto Insurance: What's Covered?

You may want to see also

Submit a letter asking for an appeal

If your auto insurance claim has been denied, you can submit a letter to appeal the decision. Here are the steps to follow when submitting an appeal letter:

Step 1: Gather Relevant Information

Collect all the information related to your claim, including the original claim form, supporting documentation, and the letter of rejection from the insurance company. Review the reason for the rejection and identify any errors or missing information. Contact your insurance provider to ask for more information about the denial and understand the process and deadlines for filing an appeal.

Step 2: Organize Your Information

Arrange your information in a clear and logical manner. This will make it easier for the insurance company to understand your case. Organize your information by including the insurer's reason for the error, your proposal to amend the error, and any supporting evidence or documentation.

Step 3: Write a Polite and Professional Letter

Address the insurance company and the person who denied your claim. State the reason for your letter and provide an overview of your case. Maintain a calm and respectful tone throughout the letter. Ask a friend or family member to review your letter to ensure that your tone is polite and professional.

Step 4: Include Supporting Documentation

Include copies of any supporting documentation, such as medical records, photographs, eyewitness reports, police reports, and other relevant evidence. Reference these documents in your letter and explain how they support your claim. Be sure to retain copies of these documents for your records.

Step 5: Explain the Error or Omission

If your claim was denied due to an error or omission, take ownership of it in your letter. Explain the situation and provide additional information or clarification if needed.

Step 6: Request a Review

Formally request that the insurance company review your case and provide an explanation for their decision. Indicate your willingness to provide any additional information or documentation to support your appeal.

Step 7: Conclude the Letter

End your letter by thanking the insurance company for their time and consideration. Provide your contact information, including your telephone number and email address, so that they can easily reach you if needed.

After sending your appeal letter, be sure to follow up with the insurance company to inquire about the status of your case. Keep detailed notes of any correspondence or conversations you have with the insurance company.

Kentucky: Dropping PIP on Auto Insurance

You may want to see also

Frequently asked questions

A claim denial letter is a formal notice from an insurance company informing a policyholder that their claim has been denied. This letter typically outlines the reasons for the denial and may provide information on how to appeal the decision.

Depending on the circumstances surrounding your car insurance claim, several factors could lead to your claim being denied. Police reports, eyewitness statements, accident scenarios, and more can influence the outcome of a submitted auto insurance claim. In some cases, a claim could even be denied due to bad faith or misrepresentation of the facts.

You can appeal the decision if you feel an error has been made in the car insurance company's claim denial. Most insurance companies have a process in place for you to contest a denied claim. Here are some steps to consider taking in appealing an auto insurance claim decision:

- Gather evidence: Review any documentation provided by the insurance company and gather any evidence you need to appeal. This could include police reports, eyewitness information, photographs, medical reports, and other supporting evidence.

- Draft an appeal letter: This letter will spell out why you disagree with the insurance company's decision. Make sure you explain why each piece of information was provided, referencing policy information and the claims denial letter as needed.

- Consider hiring an attorney: If you are not comfortable taking these steps or want an expert's opinion, it may be a good idea to hire an attorney. They can review the case and supporting documents to draft a demand letter requiring the insurance company to respond and defend its claim denial.

While it is not necessary to have a lawyer draft your insurance claim appeal letter, it all depends on your personal preference. If you don’t want to incur the additional expense, you may consider drafting the appeal letter yourself. When writing, it could be helpful to review your policy in-depth to pinpoint exactly where you disagree with your provider’s decision to deny your claim. Stick to the facts and try to provide as much specific information as possible.