Gap insurance is an optional type of auto insurance that covers the difference between a car's value and the amount owed on a loan or lease. It is designed to protect drivers who owe more on their car loan than the car is worth. This type of insurance is typically purchased when a driver has made a small down payment, has a long finance period, or has chosen a vehicle that depreciates quickly. Gap insurance can be purchased as an endorsement on an existing car insurance policy or as separate coverage from a dealer, but it is not mandatory and may not be necessary for all drivers.

| Characteristics | Values |

|---|---|

| Type of insurance | Auto insurance |

| Purpose | Protects financially when you owe money on a depreciated vehicle |

| When to buy | When you buy or lease a new car or truck |

| When to consider | When you've made less than a 20% down payment |

| When you've financed for 60 months or longer | |

| When you've leased the vehicle | |

| When you've purchased a vehicle that depreciates faster than average | |

| When you've rolled over negative equity from an old car loan into the new loan | |

| Who offers it | Car dealers |

| Car insurers | |

| Cost | Around $20 a year to the annual premium |

What You'll Learn

- Gap insurance covers the difference between the value of your vehicle and the amount you owe on your car loan or lease

- It is optional and applies if your car is stolen or deemed a total loss

- It is a good idea if you owe more on your car loan than the car is worth

- It is also worth considering if you have a long finance period

- You can purchase gap insurance as an endorsement on your car insurance policy, or buy separate coverage from the dealer

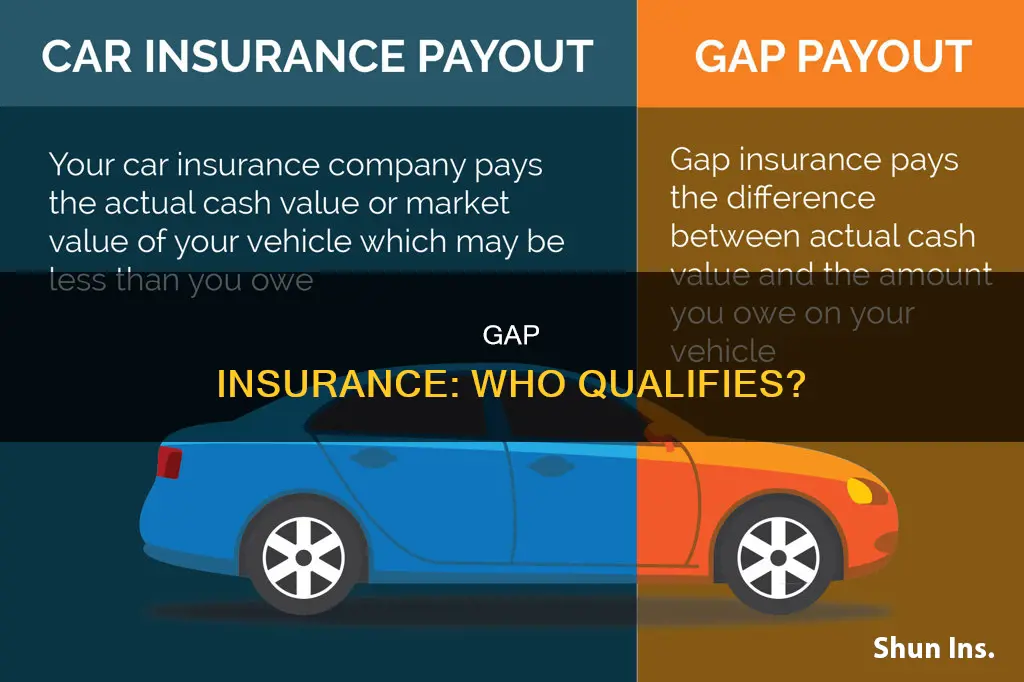

Gap insurance covers the difference between the value of your vehicle and the amount you owe on your car loan or lease

For example, let's say you finance a $25,000 car. A few months after purchasing the vehicle, it is in an accident and the insurance adjuster declares it a total loss. Your collision or comprehensive insurance will cover the loss, but the insurance adjuster determines that the actual cash value of your car is $20,000, while your loan balance is $24,000. In this case, you owe more on your loan than the car is worth, and you would be responsible for paying off the entire loan. A gap insurance policy would cover the remaining $4,000 that you would otherwise have to pay out of pocket.

Gap insurance is typically offered as an optional add-on product by car dealers, auto insurance companies, and direct lenders. It is important to compare prices and coverage before purchasing gap insurance, as the price can vary greatly. Additionally, gap insurance may be included in your financing agreement if you are leasing a vehicle. However, keep in mind that if you finance gap insurance into your loan, it will increase the total amount you pay in interest over time.

To qualify for gap insurance, you must have comprehensive and collision coverage on your policy. Gap insurance is intended for situations where your vehicle is stolen or totaled, and it does not cover costs related to vehicle repairs, personal injuries, or other accident-related expenses. It is designed to protect you from financial loss in the event of a total loss, not for ongoing repairs or maintenance.

Vehicle Insurance Declaration: What's Covered?

You may want to see also

It is optional and applies if your car is stolen or deemed a total loss

Gap insurance is an optional form of auto insurance that applies if your car is stolen or deemed a total loss. It is designed to cover the "gap" between the amount you owe on your car loan and the car's actual cash value (ACV) or market value. This scenario can occur because cars depreciate quickly, losing up to 20% of their value within the first year of ownership.

If your car is stolen or written off in an accident, your standard insurance policy will reimburse you based on the car's ACV or market value at the time of the incident. This reimbursement may be less than the amount you still owe on your car loan, leaving you with a financial gap to cover.

Gap insurance covers this difference, paying off the remaining loan amount so that you don't have to. This protection can be especially valuable if you owe more on your car loan than the car is worth, which can happen if you:

- Made a small down payment or no down payment at all.

- Have a long financing term.

- Purchased a vehicle that depreciates faster than average.

- Rolled over negative equity from an old car loan into a new one.

It's important to note that gap insurance doesn't cover your insurance deductible, additional charges related to your loan (such as finance or excess mileage fees), or engine failure/other repairs. It also won't cover theft if your comprehensive insurance doesn't.

Vehicle Removal: Insurance Coverage?

You may want to see also

It is a good idea if you owe more on your car loan than the car is worth

Gap insurance is a type of optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the depreciated value of the car and the loan amount owed. This type of insurance is particularly useful if you owe more on your car loan than the car is worth.

When you buy a new car, it starts to depreciate in value as soon as it leaves the car lot. Most cars lose 20% of their value within a year. Standard auto insurance policies only cover the depreciated value of a car, which is its current market value at the time of a claim. This means that in the early years of owning a new car, the amount of the loan may exceed the market value of the vehicle itself.

Gap insurance can be a good idea if you owe more on your car loan than the car is worth because it will protect you financially in the event of an accident or theft. It covers the difference between what your vehicle is worth and how much you owe on your car loan. This can save you from having to pay off the remaining loan balance yourself.

For example, let's say you still owe $25,000 on your car loan, but your car is only worth $20,000. If your car is stolen or totalled, your standard insurance will only pay out the current value of the car, which is $20,000. With gap insurance, the remaining $5,000 on your loan will be covered, so you don't have to pay it out of pocket.

It's important to note that gap insurance doesn't cover other property or injuries resulting from an accident, nor does it cover engine or transmission failure, or other repairs. Additionally, it doesn't cover your insurance deductible, so you will still be responsible for paying that amount.

Overall, if you owe more on your car loan than your car is worth, gap insurance can provide valuable financial protection and help you avoid being upside down on your loan in the event of a total loss.

Gap Insurance Payout: Taxable?

You may want to see also

It is also worth considering if you have a long finance period

When you buy a new car, it starts to depreciate in value as soon as it leaves the car lot. Most cars lose 20% of their value within a year. If you finance or lease a vehicle, this depreciation leaves a gap between what you owe and the car's value. This is where gap insurance comes in.

Gap insurance is worth considering if you have a long finance period because the longer your vehicle is financed, the higher your chance of owing more on the vehicle than it's worth. Long-term loans almost guarantee that the car buyer will have negative equity for some period. The average car loan today has a 72-month term, and the more time it takes to pay off a loan, the longer it takes for loan payments to catch up with the car's depreciating value.

Gap insurance covers the difference between what a car is worth and what the driver owes on their auto loan or lease if the car is totaled or stolen. Without gap insurance, drivers can be stuck paying the remaining loan or lease balance on a vehicle that they can no longer drive.

Post-Accident Vehicle Safety Checks

You may want to see also

You can purchase gap insurance as an endorsement on your car insurance policy, or buy separate coverage from the dealer

Gap insurance is an optional coverage that pays the difference between what your vehicle is worth and how much you owe on your car loan at the time it's stolen or totalled. This type of insurance is also known as guaranteed asset protection.

You can purchase gap insurance as an endorsement on your car insurance policy or buy separate coverage from the dealer. It is worth comparing the costs of both options to see which one is the best fit for your needs. Buying gap insurance through your auto insurer can be a smarter option as it is hundreds of dollars cheaper on average. However, not all car insurance companies provide gap coverage, so you may need to switch companies.

When you buy gap insurance from a dealer, it is usually rolled into your loan payments. This means you will be paying interest on the cost of your gap insurance over the life of the loan, making the coverage far more expensive.

Nationwide Insurance: Gap Coverage Options

You may want to see also

Frequently asked questions

Gap insurance, or guaranteed asset protection, is an optional add-on coverage that pays the difference between what a vehicle is worth and how much is owed on it at the time it is stolen or totaled.

Gap insurance is a good option for drivers who owe more on their car loan than the car is worth, drivers whose car loan or lease agreement requires gap insurance, and drivers who want protection against depreciation.

Gap insurance covers the difference between a vehicle's value and the amount owed on a car loan or lease in the event of a total loss. It does not cover other property or injuries resulting from an accident, nor does it cover engine failure or other repairs.

The cost of gap insurance depends on factors such as the vehicle's value, the state of residence, and the driver's previous insurance claims. It is typically inexpensive, with insurers charging an average of $20-$40 per year when bundled with an existing policy, and $200-$300 when purchased independently.