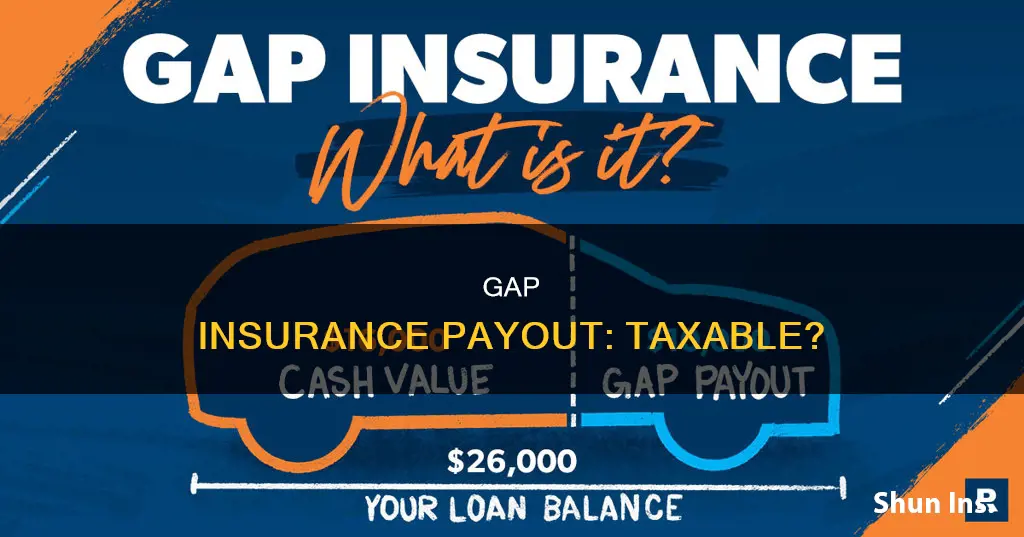

If your car is stolen or deemed a total loss, gap insurance can help bridge the gap between the amount you owe on your car loan and the vehicle's worth. However, the question remains: is the gap insurance payout taxable? The short answer is no. When a vehicle is damaged or stolen, and an auto insurance payout is made to either repair the vehicle or pay out its actual cash value, the insurance company is only making you whole and not profiting you. Therefore, you are not taxed on this money as income. The basic rule is that if you don't profit from your car insurance settlement, you won't be taxed.

| Characteristics | Values |

|---|---|

| Is a gap insurance payout taxable? | No |

| Basic rule for taxation | If you don't profit from your car insurance settlement, you won't be taxed |

| Average annual cost of gap insurance | $61 |

What You'll Learn

Gap insurance payouts are not taxable

Gap insurance is an optional form of auto insurance that covers the difference between the amount owed on a car loan or lease and the actual cash value of the vehicle if it is stolen or totaled. This type of insurance is designed to protect car owners from financial loss due to depreciation. When a car is stolen or totaled, the insurance company will pay the lender the actual cash value of the car, minus any deductible. If the owner still owes more on the loan than the insurance payout, gap insurance can cover the difference.

Gap insurance is typically purchased in addition to comprehensive and collision insurance, which are often required when buying or leasing a new vehicle. Comprehensive and collision insurance cover the cost of repairs or replacement of the vehicle in the event of an accident, theft, or other covered incident. However, they only pay out up to the current value of the vehicle, which may be less than the outstanding loan or lease amount.

It is important to note that gap insurance does not cover the cost of repairs or maintenance, such as engine or transmission failure. It also does not cover injuries, death, or funeral costs resulting from an accident. Additionally, gap insurance is not necessary if the car owner does not have a loan or lease on the vehicle.

In summary, gap insurance payouts are not taxable because they are considered compensation for a loss rather than income. Gap insurance provides valuable financial protection for car owners who owe more on their vehicle than its current value, helping to minimize potential losses in the event of a total loss.

Double Insuring Vehicles: Legal or Not?

You may want to see also

Gap insurance covers the difference between the value of a car and the loan amount

Gap insurance is a type of optional car insurance that covers the difference between the value of a car and the loan amount in the event of a total loss or theft. It is designed to protect drivers from being stuck with paying off a loan or lease on a vehicle that they can no longer drive.

For example, if a driver owes $25,000 on their loan and their car is only worth $20,000, gap insurance will cover the $5,000 difference, minus any deductible. This type of insurance is especially useful for those who have made a small down payment on their vehicle, have a long-term loan, or own a car that depreciates quickly.

Gap insurance is not required by state law, but it may be mandatory according to the terms of a driver's financing agreement or if they are leasing a car. It can usually be purchased directly from a dealership, lender, or lessor for a one-time cost of $400 to $700, or from an insurance company for $20 to $40 per year.

When deciding whether to purchase gap insurance, drivers should consider their financial situation and the value of their vehicle. If the amount owed on the loan is less than the car's value, or if the driver can afford to pay the difference, then gap insurance may not be necessary. Additionally, drivers should keep in mind that gap insurance does not cover engine or transmission failure, injuries, death, or funeral costs.

Vehicle or Person: Who's Insured?

You may want to see also

It is optional and covers theft or total loss

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It is designed to protect you from depreciation, which occurs as soon as you buy your car and it starts to lose value. If your car is stolen or written off, gap insurance covers the difference between what your standard insurance will pay (the current market value of the vehicle) and the amount you owe on your loan or lease. This is particularly useful if you have only made a small down payment, have a long financing term, or have rolled over negative equity from an old car loan.

For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap insurance will cover the $5,000 gap, minus your deductible.

Gap insurance is available from car insurers and dealers, and it can also be included as part of a loan or lease payoff coverage. It is important to note that gap insurance does not cover other property or injuries resulting from an accident, nor does it cover engine or transmission failure, or other repairs.

In terms of taxation, if your car is stolen and you receive a payout from your car insurance company, you are not required to report it on your taxes as income. This is because the insurance company is only "making you whole" and not putting you in a better financial situation. Therefore, you are not taxed on this money.

Security Insurance Bond: Vehicle Protection

You may want to see also

It does not cover engine failure or repairs

Generally, insurance payouts are not taxable. When a vehicle is damaged or stolen, and an auto insurance payment is made to either repair the vehicle or pay out its actual cash value, the insurance company is only “making you whole” and not putting you in a better financial situation, so you are not taxed on this money as income.

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the gap between a vehicle’s actual cash value and the outstanding balance on a loan or lease. For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap coverage covers the $5,000 gap, minus your deductible.

Gap insurance does not cover engine failure or other repairs. It only pays out after a total loss of your vehicle, such as an auto accident or theft of your car. Mechanical issues on their own are not covered by car insurance or gap insurance. Gap insurance also does not cover transmission failure or any other mechanical repairs.

Gap insurance is designed for people who finance or lease their vehicles. It is not required by law, but it is often required by lenders or lessors. It is a good idea if you have a long financing term for your vehicle, as the longer your vehicle is financed, the higher your chance of owing more on the vehicle than it is worth. Gap insurance can also be a good idea if you plan to put a lot of miles on your vehicle, which can speed up depreciation.

AAA and Salvage Vehicle Insurance

You may want to see also

It is worth it if you owe more than your car is worth

If you owe more on your car loan than your car is worth, gap insurance can be a good idea. This type of insurance is designed to bridge the financial gap for drivers whose car loan balance is more than the value of their vehicle if it is stolen or written off.

Gap insurance is particularly useful if you:

- Made a small down payment (less than 20%)

- Have a long finance period (5 years or more)

- Bought a vehicle that depreciates quickly

- Rolled over negative equity from an old car loan into a new loan

For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap insurance will cover the $5,000 difference, minus your deductible.

The cost of gap insurance varies but is usually inexpensive. If added to a car insurance policy that includes collision and comprehensive insurance, it typically increases your premium by around $40 to $60 per year. It's worth noting that gap insurance won't cover other property or injuries resulting from an accident, nor will it cover engine or transmission failure or other repairs.

Gap Insurance: Dealerships' Secret Weapon

You may want to see also

Frequently asked questions

No, you are not required to report a gap insurance payout on your taxes as income.

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the depreciated value of the car and the loan amount owed.

Gap insurance is worth considering if you've made a low down payment (less than 20%) on your car or if you have a long payoff period.

You can drop gap insurance when your loan balance is equal to or lower than your vehicle's value.