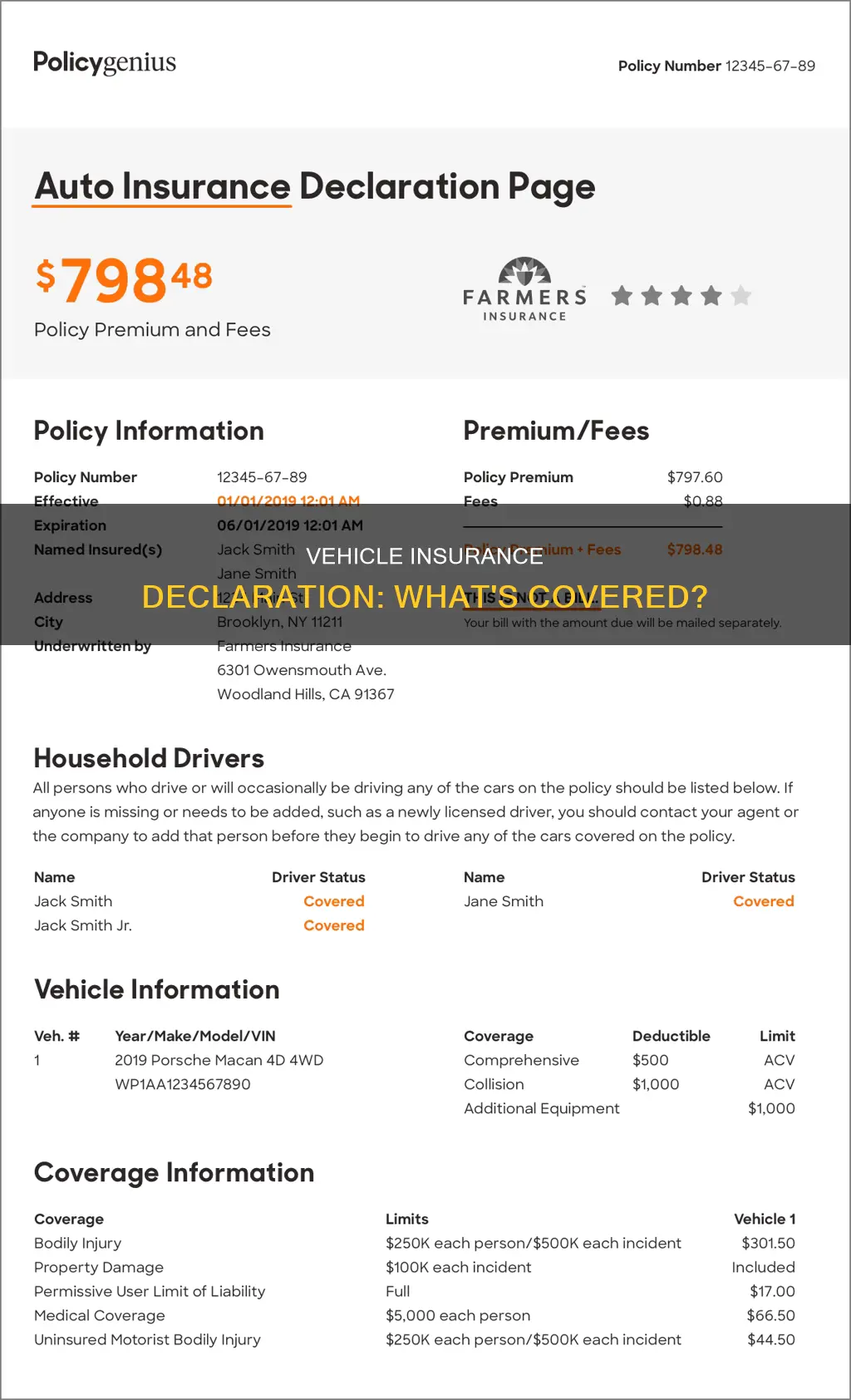

A vehicle insurance declaration, also known as a dec page, is a summary of your auto insurance policy. It provides important information such as when your coverage starts and ends, what cars and people are covered, the types of coverage you have, and the cost. This document is usually 1-2 pages long and can be accessed through your insurance company's website or mobile app, or by contacting your insurer directly. It is not the same as proof of insurance, which is typically a separate document or insurance card.

| Characteristics | Values |

|---|---|

| Purpose | Summarises key aspects of your car insurance policy |

| Coverage | Who and what is covered, including drivers, vehicles, and types of coverage |

| Limits | Maximum amounts insurer will pay for a covered claim |

| Deductibles | Amount subtracted from a claim payout |

| Discounts | Any discounts applied to the policy |

| Premium | Price paid for auto insurance |

| Policy Details | Policy number, effective date, agent information, policyholder details, vehicle details, coverage details, policy period |

| Proof of Insurance | Not typically used as proof of insurance, but provides details on coverage amounts and policy expiration |

What You'll Learn

What a vehicle insurance declaration page is

A vehicle insurance declaration page is a summary of your auto insurance policy. It provides a concise overview of the key details of your insurance policy, including what you're covered for and how much you're paying. It is usually one or two pages long and can be a stand-alone document or the beginning of your entire auto insurance policy.

The declaration page includes important information such as the policy number, the date coverage starts and ends, the names of all insured drivers, the vehicles covered, the types of coverage, coverage limits and deductibles, and the premium amount. It may also include agent information, policyholder details, lender information, and any discounts applied to the policy.

The purpose of the declaration page is to provide a quick reference to your policy. It can be useful if you need to understand your coverage, compare quotes from different insurers, or file a claim. However, it is not considered proof of insurance and should not be used as such.

You can usually access your declaration page by logging into the insurance company's website or mobile app, or by contacting your insurer or agent directly. It is recommended to keep a copy of your declaration page easily accessible for quick reference.

Insurance Coverage for Stolen Vehicles

You may want to see also

What a vehicle insurance declaration page includes

A vehicle insurance declaration page is a summary of your auto policy, usually one or two pages long. It may be a stand-alone document or the beginning of your entire auto insurance policy. It provides important information related to your policy, such as:

Policy and Personal Information

This includes the policy number, the date coverage goes into effect, and the expiration date. You should also see your agent's name and contact information if you bought your policy through an agent. Your name, address, and phone number will also be listed.

Insured Drivers

The declaration page lists the names of all insured drivers, including the policyholder and any additional drivers covered under the same policy.

Vehicles Covered

All cars covered by your auto insurance policy are listed, identified by make, model, year, and Vehicle Identification Number (VIN). The average mileage of the covered vehicle(s) may also be included.

Coverage Details

The declaration page outlines how you're protected if you need to file a claim. This includes the types of coverage included in the policy, such as bodily injury liability insurance or collision insurance, and their limits and deductibles. It will also break down how much you pay for each coverage type and any discounts you qualify for.

Policy Period

The declaration page will show the policy period, including the start date and the expiration date for your coverage.

Loss Payee

If you finance your vehicle, the lender's information will be included as they are entitled to compensation in the event of a loss.

Discounts

Any discounts applied to your policy will be listed, such as multi-policy, multi-vehicle, good driver, or student discounts.

Premium

The declaration page will show the total six-month or yearly premium for your entire policy, as well as individual premiums for each coverage type.

While the exact information included may vary slightly, a vehicle insurance declaration page provides a comprehensive summary of your auto insurance policy, allowing you to understand your coverage and costs at a glance.

Switching Vehicles: Geico Insurance Guide

You may want to see also

How to get a vehicle insurance declaration page

A car insurance declaration page is a summary of your auto policy, usually in one or two pages. It provides important information about your policy, such as when your coverage starts and ends, what cars are covered, the types of coverage you're paying for, and their limits and deductibles. It also includes a breakdown of how much you pay for coverage and any discounts you qualify for.

Purchase a Car Insurance Policy:

After buying a car insurance policy, your insurer will typically provide you with an insurance declarations page. This document is meant to give you a quick summary of your auto policy.

Check Your Mail:

Most insurance companies will mail or email your declaration page upon signing up for a new policy or renewing an existing one. Keep an eye out for this important document in your physical or digital mailbox.

Access Your Online Account:

Many insurance providers allow you to access your insurance declarations page online. Log in to your account on their website or mobile app and navigate to the documents section. You may find your declaration page there.

Contact Your Insurer:

If you need an extra copy or can't find your original declaration page, you can always reach out to your insurance provider directly. Call, email, or use their online support to request a copy of your insurance declarations page.

Review and Compare:

Once you have your declaration page, review it carefully to ensure all the information is accurate. It's a good idea to keep it handy for future reference, especially when you need a reminder of your coverage details or when shopping around for a new policy.

It's important to note that the declaration page is not proof of insurance for law enforcement or the DMV. For that, you'll need to keep your auto insurance ID card with you, either physically or digitally.

Insurance Coverage: Driver or Car?

You may want to see also

Who needs a vehicle insurance declaration page

A vehicle insurance declaration page is a summary of your auto policy, usually in one or two pages. It is a document that outlines the key details of your insurance policy. It is a useful document to have on hand for quick reference in case of an accident or other incidents. It is also useful when it comes to renewing your policy, as you can use it to compare your current policy details to quotes from other insurers.

Anyone who has car insurance should keep a copy of their auto declarations page easily accessible. This includes anyone who drives a car and has taken out car insurance. The declaration page is a useful summary of the policy and can be used to understand what is covered and what the limits are. It is also a good idea for anyone who has bought a car and needs to provide proof of insurance.

The declaration page is also useful for anyone who wants to review their policy. For example, if you have paid off your auto loan, you can check that your lender is no longer listed on your policy. Or, if you want to change your coverage limits, you can refer to the declaration page to understand your current level of coverage.

The declaration page is also a useful document for anyone who wants to shop around for a new policy. It can be used to compare your current policy with quotes from other insurers.

Montana: Insure to Register

You may want to see also

When to use a vehicle insurance declaration page

A vehicle insurance declaration page is a summary of your auto policy, usually one or two pages long. It provides important information about your policy, such as the make and model of covered cars, coverage amounts and limits, and insurance agent or company contact information.

When Buying a New Policy

When you first buy your policy, it is a good idea to review your declaration page to ensure that all the information is accurate. This includes details such as the policy period, covered drivers, vehicles, coverage types, limits, deductibles, and discounts. By carefully reviewing the declaration page, you can confirm that your policy meets your needs and that there are no errors or omissions.

As a Quick Reference

Your vehicle insurance declaration page serves as a handy quick reference guide to your policy. It provides an overview of the most important information, such as coverage details, policy period, and cost. If you ever need to remind yourself of what coverage you have, the declaration page is the perfect place to start. It is a concise summary that outlines the key aspects of your policy.

When Shopping for a New Policy

If you are considering switching insurance providers or comparing different policies, having your current vehicle insurance declaration page can be very useful. It allows you to easily compare coverage types, limits, and costs across different insurers. This information can help you make an informed decision when shopping for a new policy and ensure that you are getting the best value for your money.

When Filing a Claim

In the event that you need to file an insurance claim, your vehicle insurance declaration page will be essential. It outlines the coverage types, limits, and deductibles that apply to your policy. This information will help you understand what is covered by your insurance and what steps you need to take to initiate the claims process. It is always a good idea to familiarise yourself with the declaration page before an incident occurs so that you know what to do in case of an emergency.

When Providing Proof of Insurance

While the vehicle insurance declaration page is not typically considered proof of insurance for law enforcement or the DMV, it can be used as confirmation of your coverage details. For example, if you are buying a car and need to provide proof of insurance to the seller or lender, your declaration page can be presented as evidence of your active policy. However, for law enforcement purposes, it is recommended to keep a physical or digital insurance card in your vehicle.

Vehicle Damage: What Insurance Covers?

You may want to see also

Frequently asked questions

A vehicle insurance declaration is a summary of your auto policy, usually in one or two pages. It provides important information related to your policy, such as the types of coverage you have, coverage limits and deductibles, and a breakdown of how much you pay for coverage and any discounts you qualify for.

A vehicle insurance declaration includes the policyholder's name, address, and phone number, as well as the year, make, model, vehicle identification number (VIN), and average mileage of the covered vehicle(s). It also includes the policy number, the date coverage starts and ends, agent information, and the types of coverage included in the policy.

When you purchase or renew an auto insurance policy, your insurer will typically send you a vehicle insurance declaration via email, mail, or fax. You may also be able to access it through the insurer's website or mobile app, or by contacting your insurer or agent directly.