Comparing Auto Insurance in Massachusetts

Massachusetts law requires vehicles to be insured before they can be registered in the state. The state's average car insurance rate is $1,399 per year, which is lower than the national average of $1,543 per year. The cost of car insurance in Massachusetts varies depending on factors such as age, driving history, vehicle type, and location.

How to Compare Auto Insurance in Massachusetts

To compare auto insurance in Massachusetts, it is recommended to first determine the types and amounts of coverage needed. Once you know what you need, you can obtain premium quotes from several companies, either by working with insurance agents or by contacting insurance companies directly. When comparing quotes, make sure you are getting prices for the same coverage. In addition to price, other factors to consider when deciding on an insurance company include discounts, claims handling, location, and the company's financial health.

Auto Insurance Requirements in Massachusetts

Massachusetts has specific requirements for auto insurance that drivers must meet. The state mandates that vehicle owners have valid car insurance with certain levels of bodily injury liability, property damage liability, uninsured motorist bodily injury, and personal injury protection (PIP) coverage. Massachusetts is a no-fault state, meaning that each driver's insurance will cover their own medical bills in the event of an accident, regardless of who is at fault.

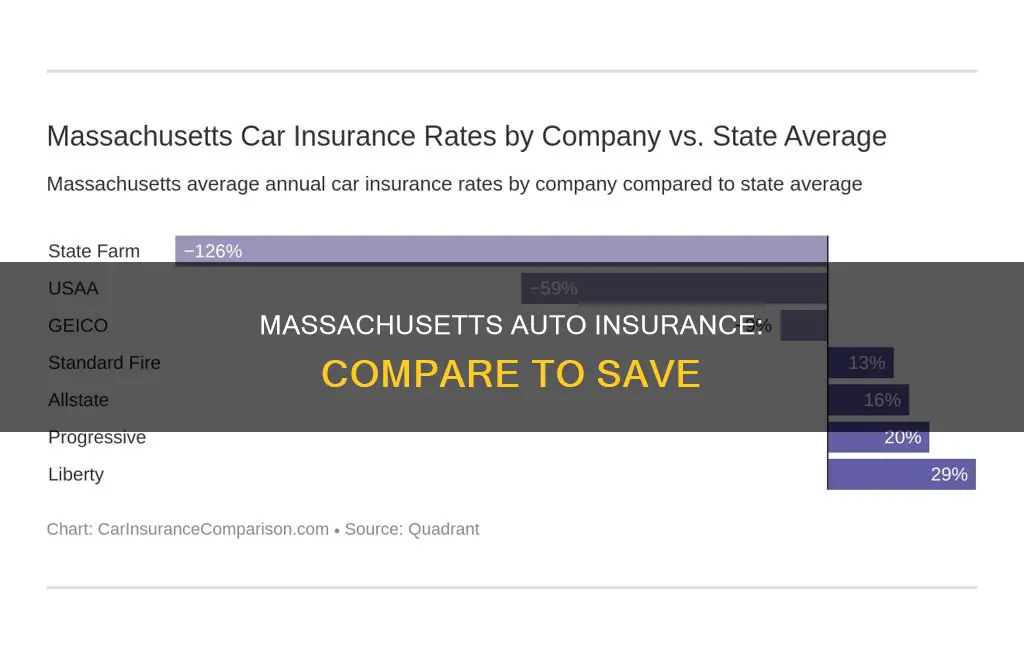

Auto Insurance Companies in Massachusetts

There are several auto insurance companies offering coverage in Massachusetts, including Geico, Amica, Progressive, Allstate, Travelers, and Arbella. The best company for you will depend on your individual needs and preferences. It is recommended to shop around and compare quotes from multiple companies to find the most suitable coverage at a competitive price.

| Characteristics | Values |

|---|---|

| Cheapest car insurance company | Geico |

| Cheapest car insurance company for teens | USAA |

| Cheapest car insurance company for young adults | Geico |

| Cheapest car insurance company for adults | Safety |

| Cheapest car insurance company for seniors | Geico |

| Cheapest car insurance company for good drivers | Geico |

| Cheapest car insurance company after a speeding ticket | Geico |

| Cheapest car insurance company after an accident | Geico |

| Cheapest car insurance company after a DUI | Geico |

| Cheapest car insurance company for military families | USAA |

| Cheapest car insurance company for drivers with poor credit | Geico |

| Average car insurance cost in Massachusetts | $1,399 per year |

| Cheapest car insurance company for minimum coverage | Geico |

| Cheapest car insurance company for high coverage | Geico |

What You'll Learn

Minimum insurance requirements in Massachusetts

In Massachusetts, drivers are legally required to carry minimum coverage auto insurance to drive a vehicle. This law is in place to ensure that motorists can pay for any damages or injuries they may cause in an accident, protecting them from potential lawsuits and ensuring that the injured party does not incur unmanageable expenses.

The minimum amounts of insurance coverage required in Massachusetts are as follows:

- $20,000 for bodily injury liability per person and $40,000 per accident. This coverage protects you, or someone you allow to drive your car, from legal liability if you accidentally injure or cause the death of someone else while operating your car. It is important to note that this coverage only applies to accidents that occur in Massachusetts and does not cover the injury or death of a passenger in your car.

- $5,000 for property damage liability per accident. This coverage pays for damage to another person's property when you, a household member, or another driver you allow to use your car causes accidental damage.

- $20,000 per person and $40,000 per accident in uninsured motorist bodily injury coverage. This coverage protects you, your household members, and passengers if they are injured by an uninsured or unidentified ("hit and run") driver.

- $8,000 per person and per accident in personal injury protection (PIP). Massachusetts is a no-fault state, which means that no matter who causes the accident, PIP will cover medical expenses, up to 75% of lost wages, and replacement services for you, anyone you let drive your car, anyone living in your household, passengers in your vehicle, and pedestrians.

It is important to note that these are the minimum insurance requirements in Massachusetts, and most drivers choose to purchase additional coverage to protect themselves adequately. The minimum coverage may not be sufficient in the event of a serious accident or significant property damage.

Gap Insurance: Nissan Lease Protection

You may want to see also

Cheapest car insurance in Massachusetts

Yes, you can compare auto insurance in Massachusetts. The average cost of car insurance in Massachusetts is $1,673 annually for full coverage and $460 for minimum coverage. These averages are significantly lower than the national average premiums, which are $2,278 annually for full coverage and $621 for minimum coverage.

The cheapest car insurance in Massachusetts is offered by Geico, costing $60 per month for liability insurance and $151 per month for full coverage. The company offers several discounts that significantly drive down the cost of car insurance for drivers in the state.

The next cheapest car insurance in Massachusetts is offered by Farmers, costing $41 per month for minimum liability and $160 per month for full coverage. Farmers offers helpful discounts for drivers in the Bay State, such as multi-vehicle policies and discounts for young drivers.

The Hanover offers the cheapest liability coverage in the state of Massachusetts, costing $35 per month. The company also offers a Platinum Experience, which includes a wide range of protection options and benefits such as 24/7 online self-service tools and flexible payment plans.

Progressive is a good option for Massachusetts drivers looking for usage-based insurance. The company’s Snapshot® program personalizes car insurance rates by monitoring your driving habits. Progressive is the cheapest full-coverage car insurance provider in Massachusetts, costing $148 per month or $1,776 per year on average.

Allstate offers standard coverage and also provides roadside coverage, Ride For Hire®, and rental reimbursement. It’s also possible to get cheaper rates through the company’s many discounts. Allstate is a great option for those who prefer in-person service as the company operates through local insurance agents.

How to Get Cheap Car Insurance in Massachusetts

The best way to find the cheapest rates in Massachusetts is to compare rates from multiple providers and look for deals in your area. You can also ask an insurance agent about discounts you might qualify for.

Auto Insurance Costs: What's the Damage?

You may want to see also

Best car insurance in Massachusetts

Yes, you can compare auto insurance in Massachusetts. Here is a list of the best car insurance in Massachusetts:

One of the largest auto insurers in the nation, Travelers provides a wide range of coverage types, including gap insurance and premier new car replacement. This insurer also offers a diverse set of discounts that reward automatic payments, safe driving, customer loyalty and more.

Best budget auto insurance in Massachusetts: Geico

Out of the 10 Massachusetts car insurance companies we evaluated with a 4.5-star ranking or above, Geico is the cheapest. This insurer offers top-tier coverage and customer service on a budget, which might explain why New England respondents ranked it as the top insurer for overall customer satisfaction in J.D. Power’s 2023 U.S. Insurance Study.

The largest auto insurer in Massachusetts, Mapfre boasts the lowest number of customer complaints to state regulators relative to its market share. This Spain-based insurer offers a wide variety of coverage options and add-ons, including accident forgiveness and a disappearing deductible, which decreases your deductible for each year you maintain a clean driving record.

Best Massachusetts auto insurance for ease of use: Farmers and Progressive

Farmers and Progressive share the top spot for the best auto insurance in Massachusetts for ease of use. With 4.5 NerdWallet star ratings, they both offer plenty of discounts and options for policyholders to personalize their coverage.

Best for giving back: Arbella

Although it is a regional insurer, Arbella offers an impressive selection of add-on coverage (like a snowplow endorsement) with options that are uniquely tailored to the states where it operates. It also boasts a solid list of discount opportunities. If you want your premium to feel more meaningful, you may appreciate that Arbella prioritizes community engagement and efforts, partnering with local organizations that include the Boston Bruins Kid Captain program, Special Olympics Massachusetts and many others.

Best for safe drivers: Allstate

Allstate offers rewards programs for safe drivers, including Allstate's Deductible Rewards program, Safe Driving Club and the Drivewise program. Each has the potential to help drivers save money on their car insurance with Allstate. The Deductible Rewards program allows you to earn money off your deductible for each year you drive without an auto accident. The Safe Driving Club, also called Allstate's Safe Driving Bonus program, allows drivers to earn a savings bonus on their car insurance every six months they go without an accident. Finally, the Drivewise program is a free system for real-time monitoring of driving habits that can result in discounts as a reward for safe driving.

DVLA: How to Check Your Car Insurance Status

You may want to see also

Car insurance for high-risk drivers

Yes, you can compare auto insurance in Massachusetts. In fact, there are several websites dedicated to helping you find the best car insurance for your needs. These sites compare rates from multiple insurers to find the cheapest option for you.

As a high-risk driver, you may find it challenging to secure car insurance. However, there are still options available to you. High-risk drivers are typically defined as those with a history of accidents or violations, a lack of driving experience, or no history of auto insurance. If an auto insurance company declines to offer you a policy, you may still be able to obtain coverage from a different insurer, as each company has its own criteria for determining risk.

High-risk drivers often face higher insurance rates than low-risk drivers, and your premiums may be influenced by factors such as your age, driving record, credit score, marital status, vehicle type, and chosen coverage. Here are some tips to help high-risk drivers secure more affordable car insurance:

- Increase your deductible: Raising your auto insurance deductible will lower your premium, but you will have to pay more out of pocket for repairs or a total loss.

- Complete a safe driving course: Many insurance companies offer discounts for completing an approved safe driving course, which can also improve your driving skills and reduce the risk of accidents.

- Improve your credit score: In most states, your credit score is a factor in determining your insurance rate. Improving your credit score can help you secure better rates, even with a less-than-perfect driving record.

- Consider pay-per-mile insurance: If you don't drive frequently, usage-based insurance programs can save you money by charging you based on your actual mileage.

- Use a telematics program: Telematics programs monitor your driving habits and can lower your rates if you practice safe behaviours. However, unsafe driving can also lead to higher rates.

- Shop around for coverage: Comparing quotes from multiple providers is crucial in finding the most affordable high-risk auto insurance.

- State Farm: $2,464

- USAA: $2,025

- Nationwide: $2,071

- Geico: $2,267

- Progressive: $2,357

- Travelers: $2,407

Renters Insurance: Auto Theft Protection

You may want to see also

Car insurance discounts

Driver History Discounts

If you have a clean driving record, meaning your driving history is free from accidents, speeding tickets, and other violations, your insurer will see you as a low-risk driver and offer you lower premiums. Most insurers will offer a discount if you’re a “good driver,” which generally means not having any accidents or traffic violations in the past three to five years. Some insurers, like State Farm, offer "accident-free" and "good driver" discounts separately.

You may also receive an auto insurance discount if you complete a defensive driving course, which teaches you tactics to become a safer driver. In some cases, only drivers 55 or older qualify for this discount.

Affiliation Discounts

Your job, school, or clubs you’re associated with could help lower your car insurance bill. Some insurers grant special car insurance discounts for alumni from certain universities, Greek life alumni, and members of professional organizations like the American Library Association. If you’re a federal employee or you’re in the armed forces, a veteran, or related to someone in the military, you may qualify for a discount.

Vehicle-Related Features Discounts

While new cars, cars with safety add-ons, and electric vehicles can have high price tags, you can help offset the cost with a discount from your insurer. You might need certain insurance coverage to qualify, and the discount may apply to those portions only. Some carriers, like Travelers, will give you a discount regardless of whether you own or lease.

Many companies have discounts if your car is 3 years old or newer, and you might have to meet specific criteria. For instance, Allstate stipulates that the car must be the current or previous year’s model, and you must be its first owner.

Personal Traits Discounts

You could also earn a car insurance discount if you own a house, even if you don’t buy homeowners insurance from your auto insurer.

Customer Loyalty Discounts

Insurers reward loyalty with discounts for longtime customers and those who have multiple policies or cars insured under the same policy. Some insurers reward drivers who continue to renew policies with them. Most insurers offer a discount if you have multiple vehicles insured with their company. Certain companies, such as Progressive, let you add cars you don’t own to your policy, as long as the vehicles are parked at your address.

Policy-Related Discounts

Policy-related car insurance discounts are some of the easiest to qualify for. They are earned based on how you buy and pay for your policy. Do you have trouble remembering to pay your bills? Switching to automatic payments could score you a discount. Before using auto-pay, make sure you’ll have enough funds in your account each month to cover your insurance costs.

You can also get a discount for paying your entire policy upfront, whether it’s a six-month or yearlong policy. If you need to cancel your policy later, most insurers will refund you for any remaining months’ worth of premiums. One of the easiest ways to earn a discount is by switching to electronic statements, which eliminates getting a monthly bill in the mail.

Canceling Auto Insurance Claims: Is It Possible?

You may want to see also

Frequently asked questions

All vehicles registered in Massachusetts must carry auto insurance. The minimum coverage requirements include bodily injury liability, property damage liability, uninsured motorist bodily injury, and personal injury protection (PIP).

Yes, Massachusetts is a no-fault state. This means that no matter who is at fault in an accident, each driver's insurance policy will cover their own medical bills.

First, determine what types of coverage you need and how much of each type. Then, get premium quotes for that coverage from several companies by working with insurance agents or contacting insurance companies directly.