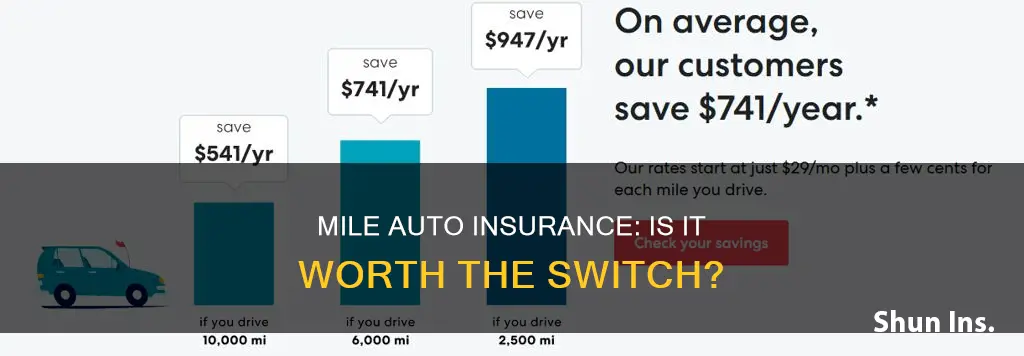

Mile Auto Insurance is a pay-per-mile car insurance company that offers affordable coverage for low-mileage drivers. The company is rated A (excellent) by the Better Business Bureau (BBB) but has mixed reviews from customers. Some praise the company for its low rates, good customer service, and simple claims process, while others complain about issues with billing, claims handling, and cancellation. Overall, Mile Auto Insurance can be a good option for those who don't drive a lot and are looking for affordable coverage, but it's important to do your research and read through both the positive and negative reviews before making a decision.

What You'll Learn

Mile Auto's customer service

Mile Auto Insurance is a pay-per-mile car insurance company. They do not require any devices to be installed in the vehicle to track mileage. Instead, they use a system called MVerity, which sends monthly email and text reminders for customers to submit their odometer reading. Customers have three days to submit their reading, after which they will be charged as if they drove 75 miles per day for the month.

Reviews of Mile Auto's customer service are mixed. Some customers have praised the company for their helpful and pleasant staff, while others have complained about issues with billing, claims, and policy cancellations. There have also been reports of long wait times and difficulty reaching a representative.

Overall, Mile Auto's customer service seems to be a bit of a lottery, with some customers having positive experiences and others facing significant challenges.

Auto Insurance: Is $100,000 Enough Coverage for You?

You may want to see also

Mile Auto's claims process

Mile Auto Insurance does not detail its claims process beyond how to file a claim. However, customers can file a claim with Mile Auto's claims team by calling 1 (888) 645-3001. The claims team is available 24/7 to assist policyholders.

An independent insurance agent can file claims for you and keep you updated through every step of the process.

Auto Insurance Claims: USAA Rates After an Incident

You may want to see also

Mile Auto's billing and payment methods

Mile Auto Insurance is a pay-per-mile auto insurance company. This means that customers are charged a base rate and then a rate per mile on top of that. Mile Auto Insurance does not have a web portal, but customers can log in to their online dashboard to update their billing information.

When you first sign up for Mile Auto Insurance, you will be charged a prepayment that will be applied as a credit to your next five bills. This means that your first five monthly bills will be calculated using the following equation:

> Base rate + (per-mile rate x miles driven that month) – (prepayment amount/5) = monthly charge for the first five bills

After your first five bills, you will no longer receive a credit, and your bill will only be calculated from your base rate + per-mile rate x miles driven that month.

Your billing cycle begins on your policy's effective date, and this date will be your billing date for every remaining month of your policy. For example, if your policy starts on May 22nd, your billing date will be June 22nd, July 22nd, and so on. Your monthly bill will be due two days following your monthly effective date.

If you need to change your credit card information, you can log in to the online dashboard and head to the billing section. If Mile Auto Insurance doesn't receive your payment by the due date, they will notify you via email and continue to try and charge the card on file. If the card continues to be denied after two failures, they will stop attempting to charge it and send you another email with a potential cancellation date for your policy.

While Mile Auto Insurance does not specify a claims response time frame, some customers have praised the company for its helpful customer service. However, other customers have complained about issues with billing and claims, with some reporting that their policies were cancelled without notification.

Gap Insurance: Worth the Cost?

You may want to see also

Mile Auto's pros and cons

Mile Auto Insurance Pros:

- Offers affordable auto insurance.

- Rated "A" (excellent) by the Better Business Bureau (BBB).

- Good customer feedback.

- Does not require any devices to live in your vehicle while you drive.

- Does not track your driving habits or behaviours.

- Easy to submit your odometer readings.

- Good customer service.

Mile Auto Insurance Cons:

- Not accredited by the BBB.

- Only one type of coverage offered.

- Not rated by AM Best.

- Hours not specified.

- Some customers have reported issues with claims processing and poor customer service.

- Some customers have reported issues with policy cancellation and unexpected charges.

- Some customers have reported issues with the accuracy of mileage tracking and billing.

BMW Leases: GAP Insurance Standard?

You may want to see also

Mile Auto's availability and accessibility

Mile Auto Insurance is available in the following states: Arizona, Georgia, Illinois, and Oregon. As of March 2024, the Mile Auto website also lists California, Illinois, Ohio, Pennsylvania, Tennessee, and Wisconsin as states where coverage is available. However, a customer service representative stated that these states are awaiting approval and did not provide a timeline for when they would be added.

Mile Auto Insurance can be contacted by calling 888-645-3001, Monday through Friday from 9 AM to 6 PM. Alternatively, customers can email the company at [email protected] or fill out a contact form on the Mile Auto website.

Mile Auto Insurance is a pay-per-mile car insurance company. Customers can save 30-40% off their standard insurance rates by switching to Mile Auto. The company does not require any devices to be installed in the vehicle to track mileage. Instead, they use a system called MVerity, which sends monthly email and text reminders for customers to submit their odometer reading. Customers have three days to submit their odometer reading each month.

Mile Auto Insurance has a rating of "A" (excellent) from the Better Business Bureau (BBB) but is not currently accredited by the organization. The company is also not rated by AM Best.

Choosing the Right Auto Insurance Deductible: Finding the Sweet Spot

You may want to see also

Frequently asked questions

Yes, Mile Auto Insurance is good for low-mileage drivers as it is a pay-per-mile insurance company. This means that you only pay for the miles that you drive. Mile Auto Insurance is highly rated by the BBB and has mainly positive customer reviews.

The pros of Mile Auto Insurance are that it offers affordable auto insurance, it is highly rated by the BBB, and it has good customer feedback. The cons are that it is not accredited by the BBB, it only offers one type of coverage, it is not rated by AM Best, and its hours are not specified.

Mile Auto Insurance will send you monthly email and text reminders for you to submit your odometer reading. You can click on a link in the reminders to submit a photo of your odometer.