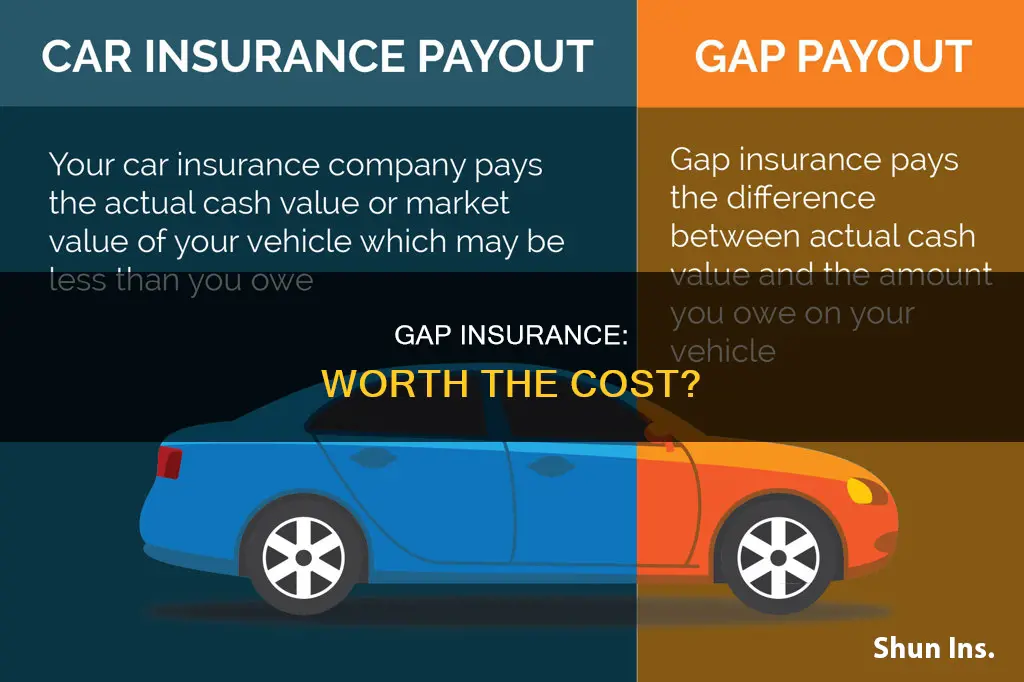

Guaranteed asset protection (GAP) insurance is an optional auto insurance add-on that covers the difference between the amount owed on a car loan and the car's actual cash value (ACV) in the event of theft or a total loss. GAP insurance is worth considering if you have a long finance period, made a small down payment, or purchased a vehicle that depreciates quickly. It's also a good idea if your lease or loan agreement requires it. However, if you own your car outright or owe less than its ACV, GAP insurance is unnecessary.

| Characteristics | Values |

|---|---|

| What is GAP insurance? | Guaranteed Asset Protection insurance. It covers the difference between the compensation received after a total loss of a vehicle and the amount still owed on the loan. |

| When is it useful? | When the current value of the vehicle is less than the balance of the loan. When the down payment is less than 20% of the car's value. When the loan period is more than 5 years. When the vehicle is leased. When the vehicle is expected to depreciate faster than average. |

| When is it not useful? | When the down payment is more than 20% of the car's value. When the loan period is less than 5 years. When the vehicle is expected to hold its value better than average. |

| Cost | $20-$60 per year when added to an existing car insurance policy. $200-$700 per year when purchased independently. |

| Where to buy? | From an insurance company or from a dealership/lender. |

What You'll Learn

When to buy gap insurance

Gap insurance is an optional coverage that pays the difference between what your vehicle is worth and how much you owe on your car loan at the time it’s stolen or totaled. This type of insurance is useful when you owe more on your car than its current value.

You should consider buying gap insurance if any of the following apply to you:

- You made a low down payment (less than 20%, for example) on a large loan.

- You have a long-term loan (for example, a term that is 60 months or longer).

- You have a car that depreciates in value quickly, like a sports car or an electric vehicle.

- You carried over negative equity from a past car loan into your current car loan.

You don't need gap insurance if:

- You don't have a car loan or lease.

- The amount you owe is less than the car’s value, or only a little more.

- You can afford to pay the difference between the amount owed and the car’s value.

When not to buy gap insurance

Gap insurance is likely not worth it if you have already paid off most of the loan balance, if you made a significant down payment, if the cost of the policy is close to the gap itself, or if you could pay for the gap yourself should your car be stolen or totaled.

RV Insurance: What You Need to Know

You may want to see also

When gap insurance is unnecessary

Gap insurance is unnecessary if you don't have a car loan or lease. If you own your car outright, you don't need gap insurance.

Gap insurance is also unnecessary if you made a substantial down payment on your car, such as 20% or more. In this case, you likely won't owe more than the car is worth, so there wouldn't be a "gap" to cover.

Additionally, if you plan to pay off your car loan in a short period, such as less than five years, you may not need gap insurance. The longer the loan period, the more likely it is that the car's value will depreciate to a point where you owe more than its worth.

Finally, if you have a vehicle that historically holds its value or depreciates slower than average, gap insurance may be unnecessary. In this case, the risk of owing more than the car's value is lower, so the need for gap insurance is reduced.

It's important to periodically check your loan balance and compare it to your car's value. If your loan balance is less than or close to the car's value, you may no longer need gap insurance, as there would be little to no gap to cover in the event of a total loss.

Fleet Insurance: Vehicles Count

You may want to see also

How much does gap insurance cost?

The cost of gap insurance depends on where you buy it from and how you choose to pay for it. If you buy gap insurance from a dealership, it can cost hundreds of dollars a year. If you add it to an existing car insurance policy, it will increase your premium by around $40 to $60 per year. Some insurers charge an average of $20 to $40 per year for gap insurance when bundled with an existing insurance policy. This typically only increases your comprehensive and collision insurance cost by about five to six per cent. If you want to buy a standalone gap insurance policy, you can expect to pay between $200 and $300.

If you take out a loan to purchase your car, lenders will often offer the option to add gap insurance to the agreement. This is usually a one-time flat rate, which ranges from $500 to $700. You will also pay interest on this sum as it will be rolled into your loan.

CPI and Gap Insurance: What's the Difference?

You may want to see also

Where to buy gap insurance

When buying a new car, you can purchase gap insurance from the dealer or your auto insurance company. It is usually optional if you are financing a purchase, but it might be mandatory if you are leasing a vehicle.

Buying gap insurance from a dealer

When you buy or lease a car, the dealer will likely ask if you want to purchase gap insurance when you discuss your financing options. Buying gap insurance from a dealer can be more expensive if the cost of the coverage is bundled into your loan amount, which means you would be paying interest on your gap coverage. Gap products you get from a car dealer or bank might not be insurance. In this case, you would need to read the information that comes with the product to know how to get help if you need it.

Buying gap insurance from an auto insurer

You can typically add gap coverage to an existing car insurance policy or a new policy, as long as your loan or lease has not been paid off. Buying gap insurance from an insurance company may be less expensive, and you won't pay interest on your coverage. If you already have car insurance, you can check with your current insurer to determine how much it would cost to add gap coverage to your existing policy. Note that you need comprehensive and collision coverage in order to add gap coverage to a car insurance policy.

You can buy gap insurance in Texas either from an insurance company or through your dealership as a standalone policy. Not all insurers are authorized to offer gap insurance in Texas, but you can get quotes from your auto insurance company. Coverage directly from insurers is often less expensive—often around several dollars per month—particularly if the coverage is added to an existing policy.

The following insurance companies are currently authorized to provide gap insurance coverage in Texas:

- American Modern Home Insurance Co.

- American National Property and Casualty Co.

- American Security Insurance Co.

- Balboa Insurance Co.

- Continental Casualty Co.

- Courtesy Insurance Co.

- Financial American Property and Casualty Insurance Co.

- First Colonial Insurance Co.

- Great American Insurance Co.

- Great American Insurance Company of New York

- Ironshore Indemnity Inc.

- Landcar Casualty Co.

- Lyndon Property Insurance Co.

- Markel Insurance Co.

- MIC Property and Casualty Insurance Corp.

- Old Republic Insurance Co.

- Old United Casualty Co.

- Securian Casualty Co.

- Sentruity Casualty Co.

- Service Lloyds Insurance Co.

- Spinnaker Insurance Co.

- State National Insurance Co.

- Transamerica Casualty Insurance Co.

- United Financial Casualty Co.

- Universal Underwriters Insurance Co.

- Work First Casualty Co.

Other places to buy gap insurance

- Local credit unions

- StateFarm

- Progressive

- Allstate

- Nationwide

- Travelers

U.S.A.A. Vehicle Insurance: Cheaper Option?

You may want to see also

How gap insurance works

Gap insurance, or guaranteed asset protection, is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the amount you owe on your auto loan and the amount the insurance company pays if your car is stolen or totalled.

Gap insurance comes into play if your vehicle is financed and you make a total loss claim — either after your vehicle is totalled (the cost of the repairs would be more than the car is worth) or if it is stolen. When you submit a total loss claim, your insurer will pay a maximum of the actual cash value (ACV) of your vehicle. In some cases, the amount you still owe in car payments can exceed your car’s ACV. This is known as having negative equity or being upside down on your loan. Gap insurance helps you pay off the loan in this situation. Remember, the loan doesn’t disappear just because your car is totalled.

As soon as you drive a new car off the lot, its value starts depreciating. If your new car is totalled within the first few years, you could owe the bank more than what your car is worth. Gap insurance covers this difference.

You can get gap insurance from most major car insurance companies, though not all offer it. You can also get gap coverage from your dealership or auto lender when you purchase the vehicle. However, you’ll pay slightly more this way because the cost is added to your auto loan payments with interest.

AXA's Comprehensive GAP Insurance

You may want to see also

Frequently asked questions

"Gap" stands for "guaranteed asset protection" or "guaranteed auto protection".

Gap insurance is purchased in addition to a full-coverage policy. You may want gap insurance if your vehicle is financed, especially if you made a small down payment.

If your vehicle is totalled, your insurance provider will pay out a maximum of your car's actual cash value. If you have gap insurance, it will cover the difference between the actual cash value and the amount you still owe.

The cost of gap insurance varies but is usually inexpensive. If you buy gap insurance from a dealership, it can cost hundreds of dollars a year. If you add it to an existing car insurance policy, it typically increases your premium by around $40 to $60 per year.