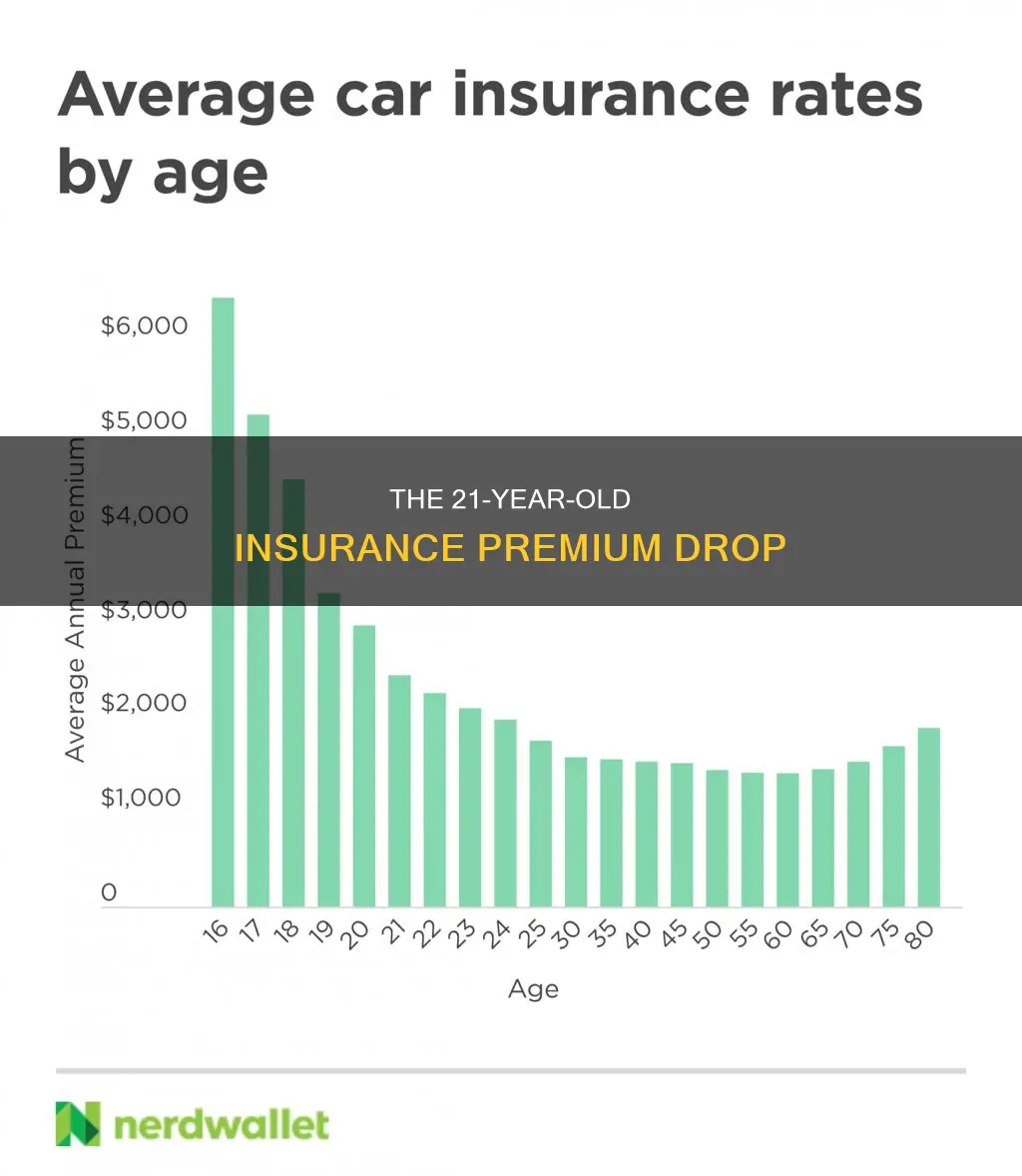

Auto insurance rates typically decrease as drivers age, with the most significant reductions occurring when drivers hit 18 or 19 years old. This is because younger drivers are considered riskier to insure due to their inexperience. As drivers gain more experience, their insurance rates tend to go down. By the time a driver reaches their early 20s, they may notice a significant reduction in their premiums, and rates usually continue to decline as they age, particularly after passing the age of 25. However, it's important to note that insurance rates are influenced by various factors, including driving record, credit score, vehicle type, and location, and age is just one of the considerations.

| Characteristics | Values |

|---|---|

| Do auto insurance rates go down at 21? | No, auto insurance rates are generally highest for teens and young adults. They tend to decrease as drivers get older and gain more experience. |

| Average annual cost | $2,014 for a full coverage policy and $622 for a minimum coverage policy |

| Cheapest insurance companies for 25-year-olds | Nationwide, GEICO, and Progressive |

| Average rate for 25-year-olds | $612 for a six-month policy at Nationwide |

| Average rate for 21-year-olds | $766 more per year than at age 25 |

What You'll Learn

- Auto insurance rates typically decrease as you age

- The biggest drop in rates is usually between the ages of 18 and 19

- Rates continue to decline after age 25

- Drivers with a history of accidents or violations will usually pay higher rates

- You may be able to get a lower rate by switching insurance companies

Auto insurance rates typically decrease as you age

According to Progressive, the average premium per driver tends to decrease significantly from ages 19 to 34, then stabilise or decrease slightly from 34 to 75. At 75, the average premium begins to trend upward, as seniors may be more prone to accidents due to physical, cognitive, or visual impairments.

While age is a significant factor in determining insurance rates, other considerations include gender, marital status, location, vehicle type, driving record, annual mileage, and credit history. These factors, in conjunction with age, contribute to the calculation of insurance premiums, which vary across individuals.

Carmax Gap Insurance: What You Need to Know

You may want to see also

The biggest drop in rates is usually between the ages of 18 and 19

Auto insurance rates are largely determined by the driver's age and gender. Younger drivers, especially teens, are considered to be riskier to insure due to their inexperience behind the wheel. As a result, they often face higher insurance premiums. However, as drivers age, their insurance rates tend to decrease. The biggest drop in rates is usually between the ages of 18 and 19, with an average savings of $1,595 per year when a driver turns 19. This is because, as drivers gain more experience, they are less likely to be involved in accidents or make claims, making them cheaper to insure.

The difference in premiums between genders also narrows as drivers get older. While male drivers aged 18 pay 15% more than their female counterparts on average, at age 50, males only pay $8 more per year for full coverage. By the time drivers reach their early 20s, insurance rates have usually decreased significantly. This trend continues as drivers age and gain more experience, provided they maintain a clean driving record.

It is important to note that age is not the only factor influencing insurance rates. Other factors include driving history, credit score, and the state in which the driver lives. Additionally, not all states permit age as a rating factor, and some states prohibit the use of gender as a rating factor.

Gap Insurance: NMAC Refund Policy Explained

You may want to see also

Rates continue to decline after age 25

While auto insurance rates tend to decrease as you get older, there is no guarantee that your premium will be cut on your 25th birthday. However, at age 25, you are likely to see a drop in your insurance premium as you are now considered less risky. According to Progressive, rates drop by 9% on average at age 25. This is because drivers under the age of 25 are statistically more likely to cause accidents and file insurance claims.

After you turn 25, auto insurance rates will continue to decrease as you get older, up until about age 75 when they start increasing again. The downward trend of insurance premiums usually comes to an end as drivers reach their 70s. This is due to risk factors associated with senior drivers, such as aging-related factors like vision or hearing loss and slowed response time, which make them more likely to get into accidents.

Factors that affect auto insurance rates

- Marital status: Married policyholders typically pay less on their premiums than single people.

- Location: Drivers in urban areas tend to pay more than suburban and rural drivers due to higher rates of accidents, theft, and vandalism.

- Vehicle type: Insurance companies rate different car models based on factors like their likelihood of theft, safety features, and repair costs.

- Driving record: If you've been in an accident or have a history of traffic violations, insurers will view you as more likely to file a claim, resulting in higher premiums.

- Annual mileage: The more you drive, the more likely you are to get into an accident, which can negatively impact your rate.

- Credit history: Auto insurance companies in most states are allowed to use your credit history to help determine your rates.

Ways to lower auto insurance costs

- Shop around for a better rate by getting quotes from different insurance companies.

- Adjust coverage and deductibles by cutting extra coverage that you don't need and increasing the deductible on your collision and comprehensive coverage policies.

- Bundle your auto insurance with other types of insurance policies such as renters, homeowners, life, or motorcycle insurance.

- Take a defensive driving course, as some insurance companies offer discounts for this.

- Improve your credit score, as insurance companies may calculate a credit-based insurance score to determine your rate.

Jeep Leases: Gap Insurance Included?

You may want to see also

Drivers with a history of accidents or violations will usually pay higher rates

Auto insurance rates are highly individualized and depend on a number of factors, including location, the type of vehicle insured, a policyholder's insurance score, and a driver's age. Driving history is one of the components that insurers consider when determining premiums.

The increase in insurance rates due to accidents or violations is based on the assumption that drivers with a history of such incidents are more likely to be involved in future accidents. The severity of the incident also plays a role, with more serious violations resulting in higher increases. For example, a single speeding ticket can increase rates by 23% on average, while rates tend to double after an accident, and a DUI can lead to an 83% increase in rates.

The impact of accidents and violations on insurance rates can vary by state and insurance company. Some states allow insurance companies to consider up to 10 years of driving history, while others limit it to three years. Therefore, it is important for drivers to be aware of the specific regulations in their state and the policies of their insurance company.

In addition to the financial implications, having a history of accidents or violations can also lead to other consequences. Multiple violations can result in a driver being classified as high-risk, which may lead to higher insurance rates or even a lack of coverage from certain companies.

Auto-Renewal Insurance: Can You Cancel?

You may want to see also

You may be able to get a lower rate by switching insurance companies

Car insurance rates typically decrease as drivers age and gain more experience behind the wheel. However, if you're looking for more immediate ways to lower your auto insurance rate, switching insurance companies may be a viable option. Here are some reasons why switching insurance providers could help you get a lower rate:

Cheaper Policy Options:

The most obvious reason to switch insurance companies is to find a cheaper policy. By regularly comparing car insurance quotes from various insurers, you can identify more competitive rates that better fit your budget. This is especially true if your circumstances have changed, such as adding a new driver to your policy, getting married or divorced, improving your credit score, or relocating to a different address or state.

Better Service and Coverage:

While price is important, it's not the only factor to consider. Switching insurance companies can also lead to improved customer service and better coverage options. Some companies may offer stronger service standards, more efficient claims processes, and more comprehensive coverage for similar or lower rates.

Potential Discounts:

Car insurance discounts can significantly reduce your premium. By switching insurance companies, you may become eligible for various discounts such as safe driver discounts, good student discounts, defensive driving course discounts, or even discounts for bundling your auto coverage with home insurance.

Credit Score Improvements:

In most states, credit history plays a significant role in determining car insurance premiums. If you've been working on improving your credit score, switching insurance companies could result in substantial rate reductions. Companies will reward you with lower rates if your credit score has increased since you first signed up for insurance.

Changes in Vehicle Ownership or Policy Details:

If you've added or removed a vehicle from your policy or made other changes to your auto insurance details, it's a good idea to shop around for new providers. Changes in your policy details may qualify you for better rates with different insurance companies.

No Significant Downsides:

Switching car insurance companies typically comes with minimal downsides. You won't face penalties, negative impacts on your credit score, or difficulties in finding coverage with a new provider. While a short-rate penalty or loyalty discount with your current provider might deter you from switching, these instances are relatively uncommon.

Remember, it's recommended to compare car insurance quotes at least once a year to ensure you're getting the most competitive rates. By switching insurance companies, you may be able to lower your auto insurance rate and find a provider that better suits your needs.

Auto Insurance: Stolen Item Coverage

You may want to see also

Frequently asked questions

No, auto insurance rates tend to decrease when a driver turns 25.

Drivers under the age of 25 are statistically more likely to cause an accident and file an insurance claim. Therefore, they are considered riskier to insure and are charged higher premiums.

Other factors that impact auto insurance rates include marital status, location, vehicle type, driving record, annual mileage, and credit history.

To get cheaper auto insurance, you can shop around for a better rate, adjust coverage and deductibles, bundle your auto insurance with other policies, take a defensive driving course, or improve your credit score.