In the UK, it is illegal to drive on any public road without valid insurance. The penalties for doing so can be severe, including penalty points on your license, fines, driving bans, and even the seizure and destruction of your vehicle. To check if your vehicle is insured, you can use the ask MID service to search the Motor Insurance Database (MID) for free using your vehicle registration number. This database is a national register of all insured vehicles in the UK and is available to insurance companies, police, and the DVLA.

| Characteristics | Values |

|---|---|

| Website | ask MID |

| Website URL | https://enquiry.navigate.mib.org.uk/checkyourvehicle |

| Is it free? | Yes |

| Additional details | A small fee is required |

| National register of all insured vehicles in the UK | Motor Insurance Database (MID) |

What You'll Learn

How to check if your vehicle is insured

In the UK, it is illegal to drive on any public road without valid insurance. The penalties for doing so can be severe, including penalty points on your license, fines, driving bans, and even the police seizing and destroying your vehicle. Therefore, it is important to check if your vehicle is insured.

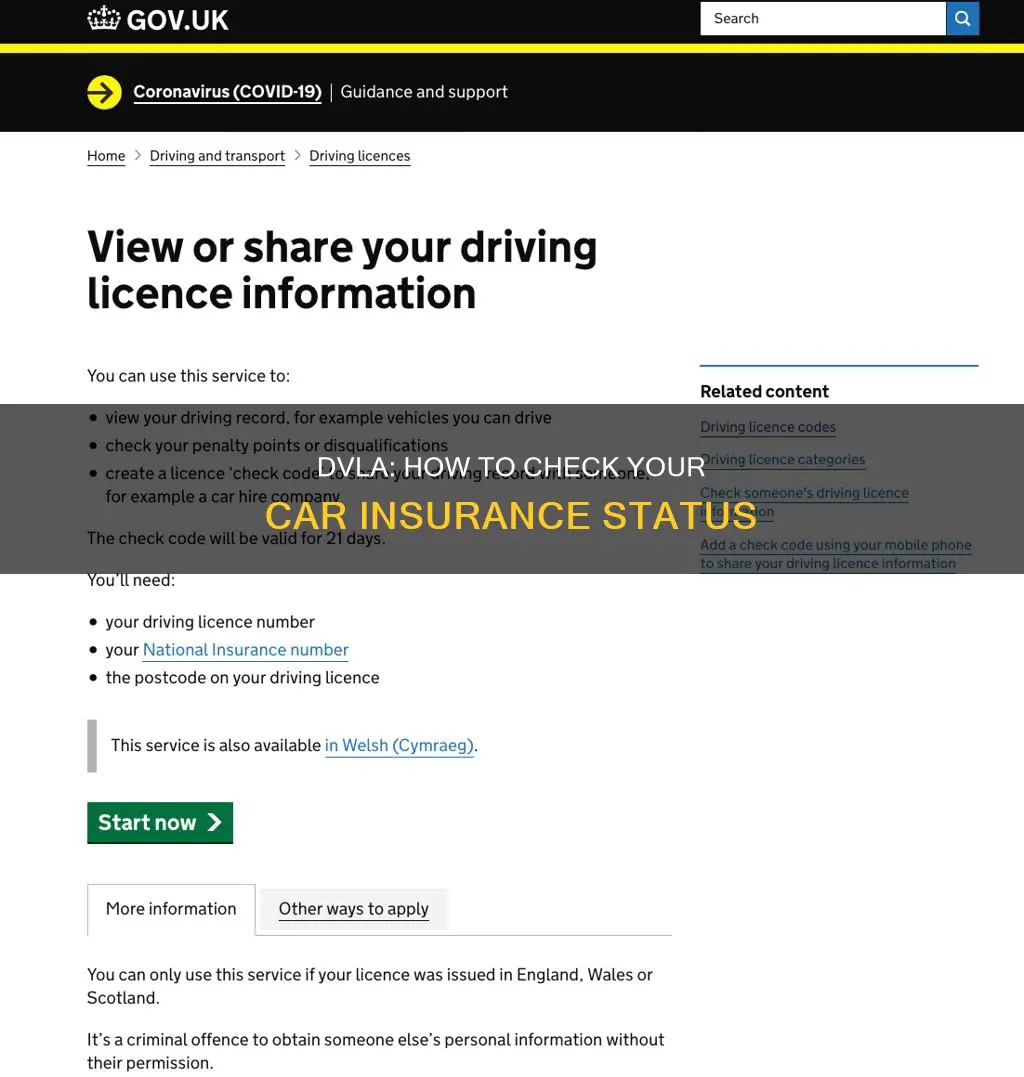

The easiest way to find out whether your car is insured is to check your registration number against the Motor Insurance Database (MID). This is a national register of all the insured cars in the UK and is available to all registered insurance companies, as well as other authorities such as the police and the Driver and Vehicle Licensing Agency (DVLA). You can use the free askMID search tool to check if your vehicle is insured. All you need is your car registration number, and you will also need to declare that the car is registered, owned, or insured by you or your employer.

If you have forgotten your insurance details or lost your policy documents, you can also easily check who the insurance provider is, your renewal date, and other general information. You can search your email inbox for emails or a PDF certificate from an insurance provider relating to your car. You can also check your bank account or credit card statements for payments made to an insurance provider. If you used a comparison website, you can retrieve the old quote to see if it jogs your memory.

If your car is not insured, the Continuous Insurance Enforcement (CIE) scheme is set up to identify uninsured vehicles. If your car is flagged, you will be sent an Insurance Advisory Letter, informing you that you need to take action, along with a potential penalty from the DVLA.

Insurance Proof for Parking Permits

You may want to see also

What to do if your vehicle is uninsured

If your vehicle is uninsured, you could face a range of consequences, from fines to legal repercussions. Here are some steps to take and considerations to keep in mind if you find yourself in this situation:

Understand the risks and consequences

Firstly, it's important to be aware of the potential risks and consequences of driving without insurance. These can vary depending on your location and the specific circumstances, but generally include:

- Fines: You may have to pay a fine, which can range from $100 to $1,500 or more, depending on the state and your previous driving record.

- License suspension: Your driver's license may be suspended until you obtain car insurance.

- Vehicle registration suspension: Your vehicle registration may be suspended indefinitely until you can provide proof of insurance.

- Vehicle impoundment: In some states, such as California, your vehicle may be impounded if you are caught driving without insurance.

- Jail time: In some states, driving without insurance is a criminal offence that can result in jail time, especially for repeat offenders.

- Higher insurance rates: If you let your insurance lapse, you may be considered a higher-risk driver when you do purchase insurance, resulting in higher rates.

- Personal liability for damages: If you cause an accident while uninsured, you may be personally liable for all damages, including medical expenses and vehicle repairs for both yourself and the other driver.

Check your vehicle's insurance status

If you are unsure whether your vehicle is insured, you can use the ask MID service to check the Motor Insurance Database. This service is free for checking your own vehicle's insurance status.

Take steps to obtain insurance

If your vehicle is currently uninsured, you should take immediate steps to obtain insurance to avoid the risks and consequences mentioned above. Compare quotes from multiple insurance companies and consider using an insurer such as Geico or USAA, which offer lower rates for drivers who have been charged with driving without insurance.

Understand exceptions and special cases

It's worth noting that there are some exceptions to the requirement to have motor insurance for your vehicle. For example, if your vehicle is kept off the road and declared as off the road (SORN), you are not required to insure it. Additionally, there are special cases, such as when a vehicle is between registered keepers or registered as 'in trade' with the Driver and Vehicle Licensing Agency (DVLA), where different rules for insurance may apply.

Insuring Elderly Collector Vehicles

You may want to see also

How to check if someone else's vehicle is insured

In the UK, it is illegal to drive on any public road without valid insurance. The penalties for doing so can be severe, including penalty points on your license, a fine, and even a driving ban. If you are involved in an accident with an uninsured driver, you can check if their vehicle is insured.

To check if someone else's vehicle is insured, you can use the ask MID lookup service. This is a national register of all insured vehicles in the UK and is available to insurance companies and authorities such as the police and DVLA. You will need the vehicle registration number and, in the case of an accident, additional data fields. There may be a nominal fee for this service, depending on the detail of the information you require. If you only need the name of the insurance company, this is free of charge.

It is important to know your legal obligations before driving a vehicle on the road. Before driving, you must check that your vehicle is taxed, you have a valid MOT, and that you have the correct insurance in place.

Calculating Vehicle Insurance Costs

You may want to see also

What to do if you've forgotten your insurance details

If you've forgotten your insurance details, there's no need to panic. Here are some steps you can take to find out the information you need:

Check your emails

Most insurance companies send confirmation and essential policy details via email. Search your inbox for terms like "insurance", "car insurance", "van insurance", "policy", or "premium", and you should be able to find an email from your insurer. Your vehicle registration number may also be quoted in emails from your insurer, so try searching for that too.

Review your paperwork

Your insurer may have provided you with hard copies of your policy details and additional literature. Check through your files to see if you can locate these documents.

Contact your bank

If you have a standing order or direct debit set up for your insurance payments, your bank can confirm who you're insured with. You can also check your bank statements for payments made to an insurance provider.

Check the Motor Insurance Database (MID)

The MID is a national register of all insured cars in the UK. By entering your vehicle registration, you can find out if your car has a valid insurance policy. This service is free, but there is a small fee for additional details like the insurance provider's name and general policy information.

Retrieve an old quote

If you used a comparison website to get a quote, retrieving that quote may help refresh your memory.

Submit a Data Subject Access Request

You can submit a Data Subject Access Request to the MID to find out more information. However, you'll need to provide copies of your ID to prove your identity and address.

It's important to remember that driving without valid insurance can lead to severe penalties, including fines, penalty points on your license, and even having your vehicle seized or destroyed. Therefore, it's always best to ensure you have the correct details and insurance in place before driving.

Registering a Vehicle: Lapsed Insurance

You may want to see also

The legal obligations of driving a vehicle

Driving a vehicle comes with several legal obligations that must be adhered to. These obligations fall under different categories, including driver requirements, vehicle requirements, and legal obligations when selling a vehicle.

Driver Requirements:

- Drivers must have a valid driving licence and be of the minimum driving age.

- They must meet the minimum eyesight rules and, if learning to drive, be supervised by a qualified driver (except when riding a motorcycle).

- L plates must be displayed, or D plates in Wales.

- Drivers must inform the DVLA of any changes to their personal details, such as name or address changes, as well as any medical conditions they have or develop.

- If a driver has any driving convictions, these must be disclosed to the DVLA, especially when applying for a passenger-carrying vehicle (PCV) licence.

Vehicle Requirements:

- Vehicles must be registered with the DVLA and have up-to-date vehicle tax.

- They must have a current MOT certificate if required.

- Vehicles must be roadworthy and safe to drive, with regular checks to ensure they are in good mechanical condition.

- A minimum of third-party insurance is required to cover the use of the vehicle.

Legal Obligations When Selling a Vehicle:

- Sellers must provide correct information to the buyer and submit accurate information to the DVLA.

- The log book (V5C) must be updated before the sale, including any changes to the address or name.

- If the vehicle is staying in the UK, the seller gives the green 'new keeper' slip from the log book to the buyer.

- For vehicles taken abroad, the seller fills in the 'permanent export' section of the V5C and sends it to the DVLA, providing the buyer's details.

- The seller must always inform the DVLA of the sale, transfer, or purchase of a vehicle, including the full name and address of the buyer, to ensure a smooth process for any vehicle tax refund claims.

Company Cars: SR22 Insurance Impact

You may want to see also

Frequently asked questions

You can check if your vehicle is insured by searching for its registration number on the Motor Insurance Database (MID). This is a national register of all insured vehicles in the UK.

No, searching for your vehicle on the MID is free. However, there is a small fee if you want additional details such as the name of the insurance provider and specific policy details.

If your vehicle is not on the MID, it is not insured. Driving without insurance is illegal in the UK and can result in severe penalties.

You can check if your vehicle is insured, who your insurance provider is, and your renewal date by searching for your registration number on the MID. You can also search your emails for "car insurance", check your bank statements for payments to an insurance provider, or retrieve an old quote from a comparison website.

Driving without insurance is illegal in the UK and can result in serious penalties. If caught, the police have the power to seize and destroy your vehicle. You could also face an unlimited fine or a driving ban.