Broad form auto insurance is a type of insurance coverage that is tied to the driver, not the vehicle. It is a basic form of insurance that only covers one driver and provides minimal coverage for injury and property damage to others. It does not cover the driver or their passengers' injuries, nor does it cover collision damage to the driver's car. This type of insurance is typically cheaper than standard insurance but is not available in all states and may not meet the minimum insurance requirements.

| Characteristics | Values |

|---|---|

| Type of Insurance | Liability Insurance |

| Coverage | Minimal |

| Number of People Covered | One |

| What is Covered | Injury and Property Damage to Others |

| What is Not Covered | You, Your Passengers, and Your Car |

| Deductible | Yes |

| Premium | Lower than Standard Insurance |

| Available in | 11 States: CO, DE, ID, IA, MD, MS, NE, NV, OH, TN, and WA |

| Best for | People with Older Cars, Infrequent Drivers, Single-Person Households, People with Additional Standard Insurance |

What You'll Learn

Broad form insurance is a type of liability insurance that only covers one driver

Broad form insurance is tied to the driver, not the vehicle. This means that the policy covers the driver, not the car, and the vehicle is only covered when it is being driven by the person insured on the policy. This type of insurance is suitable for drivers who don't allow anyone else to drive their car. With broad form insurance, drivers can have one policy that covers multiple cars without paying a higher premium.

Broad form insurance typically covers bodily injury and property damage liability. It provides protection if the insured is legally responsible for an accident causing injury or damage to another person or their property. However, it is important to note that broad form insurance usually does not cover the insured's vehicle for damages or theft. Additionally, it does not cover the insured's personal injuries or the injuries of their passengers.

Broad form insurance is a good option for those seeking minimal liability coverage and who have the financial resources to pay out of pocket for other losses. It is also a good choice for those who don't own a vehicle or only occasionally drive other people's vehicles. However, it is important to remember that there is a significant risk of financial loss associated with broad form coverage due to its limited nature.

Overall, broad form insurance can be a cost-effective option for drivers who meet certain criteria, but it is not sufficient for most people's insurance needs.

Aetna Insurance: Understanding the Gap Phase

You may want to see also

It is only available in 11 US states

Broad form insurance is a type of insurance that extends beyond the basics to include rare events that may be of serious risk to the insured. This type of insurance usually requires the policyholder to pay a higher premium and often a deductible. Broad form insurance can be applied to nearly all forms of insurance, including auto insurance.

Broad form auto insurance is a very limited type of liability auto insurance coverage that insures a specific driver, not a car. It is not available in every US state and may not meet the state's insurance requirements. It is currently only available in 11 US states: Colorado, Delaware, Idaho, Iowa, Maryland, Mississippi, Nebraska, Nevada, Ohio, Tennessee, and Washington.

In these 11 states, broad form auto insurance satisfies the minimum requirements for auto insurance, covering damages caused while driving an owned or borrowed car. This type of insurance is popular among high-risk drivers and those who own multiple older cars and don't allow anyone else to drive them. It is also a good option for those who don't drive very often, don't have passengers typically, or own a low-value vehicle.

However, it's important to note that broad form auto insurance does not cover the insured driver's own injuries or property damage. It also does not cover damages typically covered by comprehensive coverage, including theft, vandalism, and weather-related damage.

Vehicle Insurance: Extended Validity or Not?

You may want to see also

It is not a good choice for most people

Broad form auto insurance is not a good choice for most people because it offers very limited coverage. While it is true that it is a cheaper option, it only covers one driver with minimum liability coverage. This means that anyone else operating the insured's car will not be covered. Due to this high level of risk, broad form insurance is only available in a handful of states.

Broad form insurance is also not a good choice for most people because it does not cover the insured driver's injuries or collision damage to their car. This means that if the insured driver crashes their own car, their policy will only cover damage to the other driver's vehicle and the other driver's injuries. The insured will be responsible for covering their own injuries and damage to their own vehicle.

Broad form insurance also does not cover comprehensive or collision damage to the insured's vehicle. This means that if the insured driver is in an accident, they will not be covered for any non-collision damage to their car, such as theft, vandalism, fire, acts of nature, or weather-related damage.

Additionally, broad form insurance does not cover other drivers operating the insured's vehicle. So, if someone else is driving the insured's car and gets into an accident, the broad form policy will not provide any coverage.

Broad form insurance may be a good option for those seeking minimal liability coverage who have the financial resources to pay out of pocket for other losses. However, for most people, the gaps in coverage are too significant to make this a viable option.

Insurance Total Loss: What's Next?

You may want to see also

It does not cover damage to the insured's vehicle

Broad form auto insurance is a type of insurance that covers only one driver. It is important to note that this type of insurance does not cover damage to the insured's vehicle. This means that if the insured person is in an accident, they will be responsible for repairing or replacing their own car.

Broad form insurance is a very basic form of liability insurance that typically only meets the minimum state requirements. It is designed to cover the driver, not the car, which means that the insured person is only covered when driving. This is in contrast to traditional insurance policies, which typically cover the vehicle regardless of who is driving.

Because broad form insurance only covers the named driver, it is not suitable for households with multiple drivers. It is also not suitable for people who want their passengers to be covered by their insurance. In the event of an accident, the insured person would be responsible for any injuries sustained by their passengers.

Broad form insurance also does not cover damage to the insured's vehicle in the event of a collision. This means that if the insured person is found to be at fault for an accident, they will have to pay for the repairs or replacement of their own vehicle out of their own pocket. This is a significant limitation of broad form insurance and it is important for potential customers to be aware of this exclusion.

Broad form insurance is a cheaper option than standard insurance policies, but it offers much less coverage. It is only available in a limited number of states and may not meet the minimum insurance requirements in some states. It is important for drivers to carefully consider their needs and the limitations of broad form insurance before deciding if it is the right choice for them.

Vehicle Ownership: Insurance Costs After Paying Off Loans

You may want to see also

It is the cheapest auto insurance available

Broad form auto insurance is often the cheapest auto insurance available. It is a type of liability insurance that only covers one driver. It is important to note that broad form insurance is not available in all states and may not meet the minimum insurance requirements in some states.

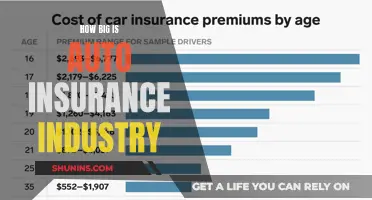

Broad form insurance is significantly cheaper than standard insurance because it offers much less coverage. It is a basic insurance option that provides minimal liability coverage for one driver. This means that only the driver's liability costs are covered, and any other drivers operating the insured's car will not be covered. This type of insurance is best suited for those who do not have family members or dependents and do not allow anyone else to drive their car.

Broad form insurance is ideal for those who own an older car, do not drive much, and have the funds to pay for any damages out of pocket if needed. It is also a good option for those who own multiple cars, as they can insure multiple cars under one policy without paying a higher premium.

While broad form insurance can help keep insurance costs low, it is important to consider the limitations. It does not cover the insured driver's injuries or property damage, and it excludes claims that would typically fall under collision coverage, personal injury coverage, and uninsured or underinsured motorist coverage.

Overall, broad form auto insurance can be a good option for those seeking minimal liability coverage and looking for the cheapest insurance option available.

Gap Insurance: Partial Payment Explained

You may want to see also

Frequently asked questions

Broad form auto insurance is a type of liability insurance that covers only one driver. It is a cheaper option but offers less coverage and is only available in 11 US states.

Broad form insurance covers injury and property damage to others, but only when the policyholder is at fault and is the driver. It does not cover the policyholder's own injuries or damage to their own vehicle.

Broad form insurance is a good option for those who don't drive often, don't have passengers, own multiple vehicles, or own a low-value vehicle. It is also a good option for those who can afford to pay out of pocket for any damages that go beyond the limits of the policy.

Standard insurance is the most common type of insurance. Broad form insurance is cheaper than standard insurance but offers significantly less coverage. Limited insurance is cheaper than both broad and standard insurance but will not meet state minimum requirements.