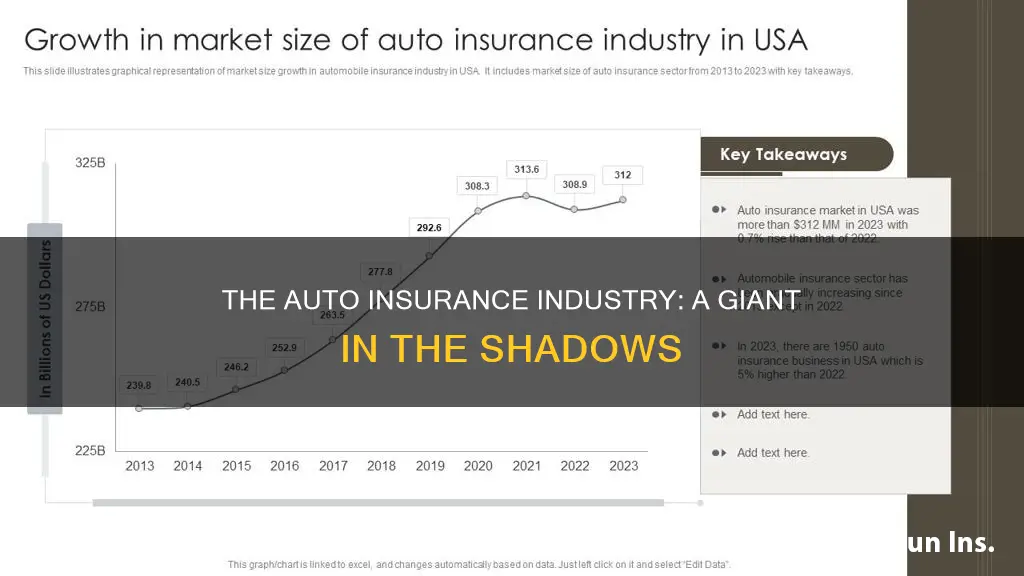

The auto insurance industry is huge. In 2020, the estimated revenue for the automobile insurance industry was $288.4 billion. The global auto insurance market was valued at $739.30 billion in 2019 and is projected to reach $1.06 trillion by 2027, growing at a CAGR of 8.5% from 2020 to 2027. The industry is growing due to the rise in demand for personal vehicles worldwide, an increase in the number of road accidents, and the implementation of stringent government regulations for the adoption of auto insurance.

What You'll Learn

The auto insurance industry is projected to reach $1.06 trillion by 2027

North America dominated the auto insurance market in 2019 due to the presence of major market players and a high purchase of cars in the region. However, the Asia-Pacific region is expected to witness the highest growth rate during the forecast period due to the increased adoption of mobile telematics technology in developing nations such as China and India.

The auto insurance market is segmented into different categories, including coverage type, distribution channel, vehicle age, and application. Third-party liability coverage accounted for the largest market share in 2019, while the direct response is projected as one of the most lucrative segments in terms of distribution channels. The personal segment held the largest share in 2019 based on application, while the commercial segment is expected to grow significantly during the forecast period.

The auto insurance industry is dynamic and constantly evolving. The increasing penetration of technologies such as GPS, telematics, artificial intelligence, and data analytics is providing innovative opportunities for insurers to enhance the customer experience and provide seamless coverage at the point of purchase. Additionally, the rise in demand for third-party liability coverage in emerging economies is expected to drive market growth.

However, it is important to note that the auto insurance market faces challenges, such as the adoption of autonomous vehicles, which may hamper its growth. According to KPMG, the auto insurance sector is projected to shrink by more than 70% by 2050 due to the increasing safety of autonomous technology, shifting liability to manufacturers, and the rapid adoption of mobility-on-demand services.

Uber's Commercial Auto Insurance Costs

You may want to see also

In 2020, the industry was worth $288.4 billion

In 2020, the auto insurance industry was worth $288.4 billion in estimated revenue. This figure reflects the current price of car insurance and the overall national increase in car insurance premiums. The auto insurance industry is a significant market, with over 500 providers in the US alone, and it is constantly evolving and growing.

The auto insurance industry's size can be attributed to several factors. One of the primary driving forces is the increase in accidents globally, which has led to a rise in the demand for auto insurance to cover financial losses in the event of accidents or theft. In addition, the implementation of strict government regulations mandating the adoption of auto insurance has significantly contributed to the market growth. The rise in automobile sales worldwide due to the increase in consumer per capita income is another critical factor.

The auto insurance industry is expected to continue growing and evolving. The advancement and integration of technology, such as autonomous vehicles and digital financial services, will play a significant role in shaping the industry's future. The development of applications that provide consolidated information about insurance providers and prices will also boost market growth. Additionally, the online availability of vehicle insurance will enable customers to purchase and renew policies from the comfort of their homes, further driving the market.

The auto insurance industry is projected to reach a value of about $865.83 billion in 2023, with a forecasted compound annual growth rate (CAGR) of 7.1% from 2024 to 2032. This growth is attributed to the rising demand for personal vehicles and the increasing focus on protecting vehicles from damage. The market is estimated to reach nearly $1,605.23 billion by 2032.

Illinois: Print Your Own Insurance Cards

You may want to see also

The industry is being revolutionised by technology

The auto insurance industry is vast, with a global market size of $739.30 billion in 2019, projected to reach $1.06 trillion by 2027. It is being revolutionised by technology, with new trends and advancements causing a shift in the industry.

Automated Driving

The introduction of autonomous vehicles (AVs) is a significant development, with the potential to transform the insurance market. As vehicles become more autonomous, the responsibility for accidents may shift from drivers to technology, hardware, or software providers. This will prompt a paradigm shift in liability within the auto insurance landscape, requiring clarity on liability assignments, new insurance products, and claims processes specific to autonomous technology.

Vehicle Connectivity and Telematics

The increasing connectivity of vehicles, enabled by wireless technology, allows for a seamless and passive customer experience. This technology provides a wealth of data, including mileage, GPS, accelerometer readings, collision warnings, steering wheel position, seat belt use, and camera captures. This data can be used to enhance risk assessment, improve safety, and provide more accurate pricing for consumers.

Electric Vehicles

The shift towards electric vehicles (EVs) will introduce changes to insurance, including new coverages and consequences for claims handling. EVs are seen as an enabling platform for autonomous driving and connectivity, with their direct-to-consumer sales model offering further potential for disruption. The high cost of manufacturing intricate components and specialised repairs for EVs may also lead to an increase in insurance premiums.

Advanced Technologies

Insurers are embracing advanced technologies such as artificial intelligence (AI), geospatial analytics, predictive analytics, and telematics to enhance their operations. These technologies improve risk assessment, enable more accurate pricing, streamline claims processes, and provide a more personalised experience for customers.

Insurtech Companies

The emergence of insuretech companies is disrupting the industry, offering consumers more time and cost savings. These companies utilise technology to provide innovative products and services, challenging the traditional insurance business model.

The auto insurance industry is undergoing significant changes, and technology plays a pivotal role in shaping its future. These advancements offer opportunities for innovation, improved safety, and enhanced customer experiences.

Vehicle Insurance: MID Registration

You may want to see also

The rise in demand for personal vehicles is boosting the industry

The auto insurance industry is huge, with a global market size of $739.30 billion in 2019, projected to reach $1.06 trillion by 2027. The rise in demand for personal vehicles is boosting the industry, and this demand is being met by a growing number of car manufacturers.

The global auto market is experiencing a significant increase in the sales of personal vehicles, with more passenger cars being produced than commercial vehicles. This is due to several factors, including rising disposable income, population growth, and an increase in the number of wealthy individuals. As a result, the demand for auto insurance is also increasing.

The rise in demand for personal vehicles is driven by several factors, including:

- Growing disposable income: In regions such as North America and the Asia Pacific, rising disposable income is increasing the demand for personal vehicles. This trend is particularly prominent in developing countries such as China and India, where the economic strength is expected to provide lucrative opportunities for market growth.

- Population growth: The increasing global population, particularly in regions like the Asia Pacific, is driving the demand for personal vehicles.

- Increase in wealthy individuals: The growing number of wealthy individuals has led to an increase in the purchasing power of essential and luxury items, including personal vehicles. This trend is expected to contribute to the expansion of the auto insurance industry.

- Technological advancements: Advancements in technology, such as autonomous vehicles (AVs) and electric vehicles (EVs), are transforming the automotive industry. The integration of advanced safety features, such as parking sensors and lane-departure warnings, enhances the appeal of personal vehicles. However, these technologies also contribute to rising repair costs, which can influence insurance rates.

The rise in demand for personal vehicles is boosting the auto insurance industry, and this trend is expected to continue in the coming years. The increasing sales of personal vehicles provide a larger customer base for auto insurance companies, driving the growth of the industry.

Auto Insurance and Employment: What's the Connection?

You may want to see also

The Asia-Pacific region is expected to witness significant growth

The auto insurance industry is huge, with a global market size of USD 652.5 billion in 2021, projected to reach USD 1,383 billion by 2030. The Asia-Pacific region is expected to witness significant growth during the forecast period, with a CAGR of 10.4%. This growth is driven by several factors, including:

- Rising economies and a growing middle class: The Asia-Pacific region is home to several developing countries with rising economies and a growing middle-class population. This increase in disposable income leads to a rise in car sales and the demand for auto insurance.

- Mandatory auto insurance requirements: In some countries within the region, such as India, auto insurance is mandated by law at the time of vehicle registration. This has brought many uninsured vehicles into the insurance domain, increasing the demand for auto insurance policies.

- Adoption of technology: The increasing adoption of mobile telematics technology by auto insurance companies in developing countries such as China and India is expected to drive market growth.

- Growing demand for auto insurance products and services: Auto insurance companies in the region have the opportunity to expand their offerings to meet the growing demand for medical coverage, comprehensive coverage, and third-party liability coverage.

- Increasing traffic accidents and vehicle sales: The rise in traffic accidents and vehicle sales in the region also contributes to the growth of the auto insurance market.

The Asia-Pacific auto insurance market is expected to reach USD 441 billion by 2030, making it a significant contributor to the global auto insurance industry's growth.

Youth Auto Insurance Discounts: Unlocking Affordable Coverage

You may want to see also

Frequently asked questions

There are more than 500 car insurance providers in the U.S., each with their own prices and policies. There are even more companies within the industry providing additional services such as rate comparisons.

The global auto insurance market is estimated to be worth USD 865.83 billion in 2023.

The auto insurance market is projected to reach USD 1,223.5 billion by 2030, growing at a CAGR of around 7.2%.

The average car insurance premium in the United States is $1,548.

The Asia Pacific region is projected to have the highest growth rate, with a CAGR of 10.2%.