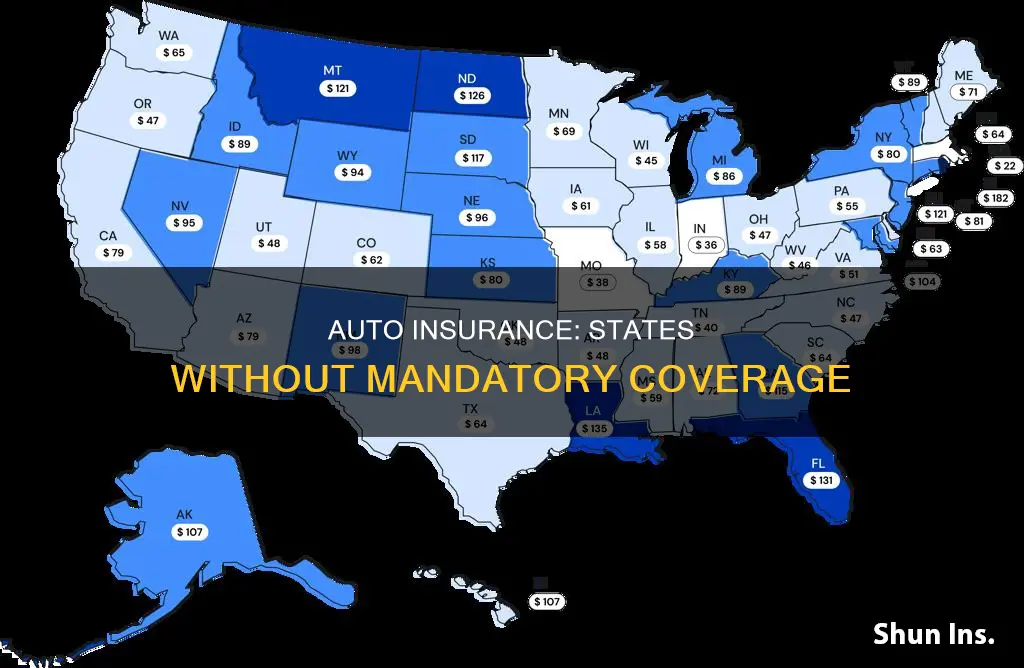

Nearly every state in the US requires drivers to have some level of auto insurance. However, there are a few exceptions. As of July 1, 2024, New Hampshire is the only state that does not require drivers to have auto insurance. Prior to that date, Virginia was also on that list, as drivers in the state could choose to pay a fee instead of carrying auto insurance. Mississippi is another state that doesn't require auto insurance, but it offers vehicle owners the option to post cash bonds. While auto insurance may not be mandatory in these states, residents are still responsible for any bodily injuries or property damage they cause in an accident.

| Characteristics | Values |

|---|---|

| States that don't require car insurance | New Hampshire, Virginia, Mississippi |

| Alternative to insurance in Virginia | Pay an uninsured motor vehicle fee of $500 per year to the state |

| Alternative to insurance in New Hampshire | Provide cash or securities in the liability amounts, post cash bonds, or hold savings accounts to cover liability limits |

| Alternative to insurance in Mississippi | Post cash bonds |

What You'll Learn

- New Hampshire is the only state where auto insurance is optional

- Virginia allows drivers to opt out of insurance if they pay a $500 fee

- Virginia and New Hampshire drivers are still liable for damages

- New Hampshire requires proof of financial responsibility

- Virginia and New Hampshire have some of the lowest rates of uninsured motorists

New Hampshire is the only state where auto insurance is optional

In the United States, auto insurance is required in nearly every state. As of July 1, 2024, New Hampshire is the only state where drivers are not legally required to have auto insurance. Virginia is another state that previously allowed drivers to forgo insurance by paying an uninsured motorist fee. However, as of July 2024, Virginia now requires drivers to have at least some form of auto insurance.

In New Hampshire, driving without insurance is completely legal. However, it is important to note that drivers must still adhere to certain liability requirements. New Hampshire residents must meet the state's Motor Vehicle Financial Responsibility Requirements, which total $100,000 per registered vehicle. This includes a $25,000 bodily injury liability limit for accidents involving one person, a $50,000 bodily injury liability limit for accidents involving two or more people, and $25,000 worth of property damage liability.

Drivers in New Hampshire can prove they have the required funds by obtaining a receipt from the state treasurer, confirming the deposit of the necessary amount into a banking account. This receipt must then be sent to the New Hampshire Department of Safety. Alternatively, drivers who cannot fulfill the Financial Responsibility Requirements with their own funds will need to satisfy them with a standard auto insurance policy.

While New Hampshire offers more flexibility when it comes to auto insurance requirements, it is important to consider the risks and consequences of driving without insurance. In the event of an accident, uninsured drivers may face financial challenges in covering property damage and bodily injury expenses.

Furthermore, while New Hampshire may not require auto insurance, it is essential to understand that there are situations where purchasing insurance is mandatory. For example, drivers with a history of driving while intoxicated (DWI) or leaving the scene of an accident may be required to obtain an SR-22 form and maintain auto insurance.

In summary, while New Hampshire stands out as the only state where auto insurance is optional, it is crucial for drivers to be aware of the financial responsibilities and potential risks associated with driving without insurance.

Auto Insurance: Understanding the Average Cost and Coverage

You may want to see also

Virginia allows drivers to opt out of insurance if they pay a $500 fee

In the United States, nearly every state requires drivers to have some level of auto insurance. As of July 1, 2024, New Hampshire is the only state that does not mandate auto insurance. Prior to that date, Virginia was the second state that did not require auto insurance.

Virginia allows drivers to opt out of auto insurance if they pay an annual $500 uninsured motor vehicle fee to the Virginia Department of Motor Vehicles (DMV). This fee does not provide any insurance coverage, and drivers are still personally liable for any damage or injuries caused in an accident. This option is available to all registered vehicles in the state.

Drivers in Virginia must carry proof of insurance in their vehicles at all times. If a driver cannot provide proof of insurance, they may be penalised with a Class 3 misdemeanour, a suspension of their driver's license, vehicle registration, and license plates. There may also be a fine if the uninsured motorist fee has not been paid.

If a driver in Virginia chooses to opt out of insurance and causes an accident, they are held responsible for all property damage, injuries, and other accident-related expenses. The accident victim may request the court to set up a payment plan or garnish the driver's salary if they are unable to cover the damages upfront. The driver at fault can also be the target of a personal injury lawsuit from the victim.

To avoid penalties for driving without insurance in Virginia, drivers must avoid any gaps in their insurance coverage, temporarily deactivate their license plate, or pay the $500 uninsured registration charge.

Gap Insurance: Texas Car Protection

You may want to see also

Virginia and New Hampshire drivers are still liable for damages

While Virginia and New Hampshire are the only two states that don't require drivers to have car insurance, motorists are still liable for any damages resulting from a car accident. In Virginia, drivers can pay an annual $500 fee to the state to drive without insurance. However, this does not provide any accident coverage, and the driver who caused the accident is still financially responsible for all damages. In New Hampshire, residents are responsible for up to $50,000 in liability and $25,000 in property damage.

In both states, drivers who cannot pay for damages may have their licenses and registrations suspended. Additionally, drivers in Virginia and New Hampshire must still comply with other insurance requirements, such as providing proof of financial responsibility and carrying insurance cards in their vehicles.

The minimum insurance requirements in Virginia include bodily injury liability coverage of $30,000 per person and $60,000 per accident, as well as property damage liability coverage of $20,000 per accident. On the other hand, New Hampshire residents can either purchase insurance or demonstrate that they meet the state's Motor Vehicle Financial Responsibility Requirements, which total $100,000 per registered vehicle.

While it may seem like a good idea to skip car insurance in these states, it's important to remember that the costs of an accident can quickly add up. Even a minor fender bender can result in medical expenses and legal fees that far exceed the savings from not having insurance. Therefore, it's generally recommended to have at least the minimum required insurance coverage to protect yourself financially in the event of an accident.

Monthly Costs of Progressive Auto Insurance Explained

You may want to see also

New Hampshire requires proof of financial responsibility

New Hampshire is the only US state that doesn't require drivers to carry auto insurance. However, drivers in the state are still required to show proof of financial responsibility in the event of an at-fault accident. This means that drivers must be able to provide sufficient funds to cover damages resulting from accidents that occur in the state and arise out of the ownership, maintenance, control, or use of a motor vehicle. The amount of proof one must provide is $25,000 for bodily injury or death to one person, $50,000 for bodily injury to two or more people in any one accident, and $25,000 for injury to or destruction of property.

There are two ways to prove financial responsibility in New Hampshire. The first is by purchasing and maintaining an auto insurance policy from an insurance company. The second is by depositing money or securities with the state treasurer. If a person is required to have auto insurance, the policy must cover a minimum of $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $25,000 in property damage coverage. The policy must also include at least $1,000 of medical payments coverage and uninsured and underinsured motorist coverage.

While auto insurance is not mandatory in New Hampshire, residents are still responsible for damages resulting from a car accident: up to $50,000 for liability and $25,000 for property damage. Drivers who cannot pay for damages can expect to have their licenses and registrations suspended. Therefore, it is recommended that drivers in New Hampshire purchase liability coverage and keep proof of it in their vehicles at all times.

Auto Insurance Agents: Their Roles and Responsibilities Explained

You may want to see also

Virginia and New Hampshire have some of the lowest rates of uninsured motorists

Nearly all US states require drivers to have some level of auto insurance. As of July 1, 2024, New Hampshire is the only state that does not require auto insurance. Virginia is the only other state that doesn't require auto insurance, but only if drivers pay an uninsured motorist fee.

Virginia requires the minimum coverage limits set forth in the Code of Virginia § 46.2-472. The minimum amount of Virginia auto insurance coverage is $25,000 per person, with a total maximum of $50,000 per incident, and up to $20,000 for damage to another person's property.

In New Hampshire, drivers must demonstrate that they meet the Motor Vehicle Financial Responsibility Requirements, which total $100,000 per registered vehicle: $25,000 bodily injury liability limit for accidents involving one person, $50,000 bodily injury liability limit for accidents involving two or more people, and $25,000 worth of property damage liability.

Home and Auto Insurance: Best Value Bundles

You may want to see also

Frequently asked questions

Only two states don't require auto insurance: New Hampshire and Virginia.

In New Hampshire, driving without insurance is legal, but drivers must meet certain liability requirements. These include $25,000 for bodily injury liability per person, $50,000 for bodily injury liability per accident, and $25,000 for property damage liability. Drivers can prove they have the required funds by depositing the money into a banking account and sending the receipt to the New Hampshire Department of Safety.

In Virginia, drivers can choose to pay an annual $500 Uninsured Motor Vehicle fee instead of carrying auto insurance. This fee does not provide any coverage, and drivers who cause an accident are still financially responsible for all damages.

If you don't have the required auto insurance in a state that mandates it, you may face fines, license suspension, increased insurance costs, and other penalties.

The main reason that auto insurance is mandatory in most states is to protect the victims of accidents. If you're at fault in an accident and don't have insurance, you may not be able to cover the costs of damages to the other driver and their vehicle.