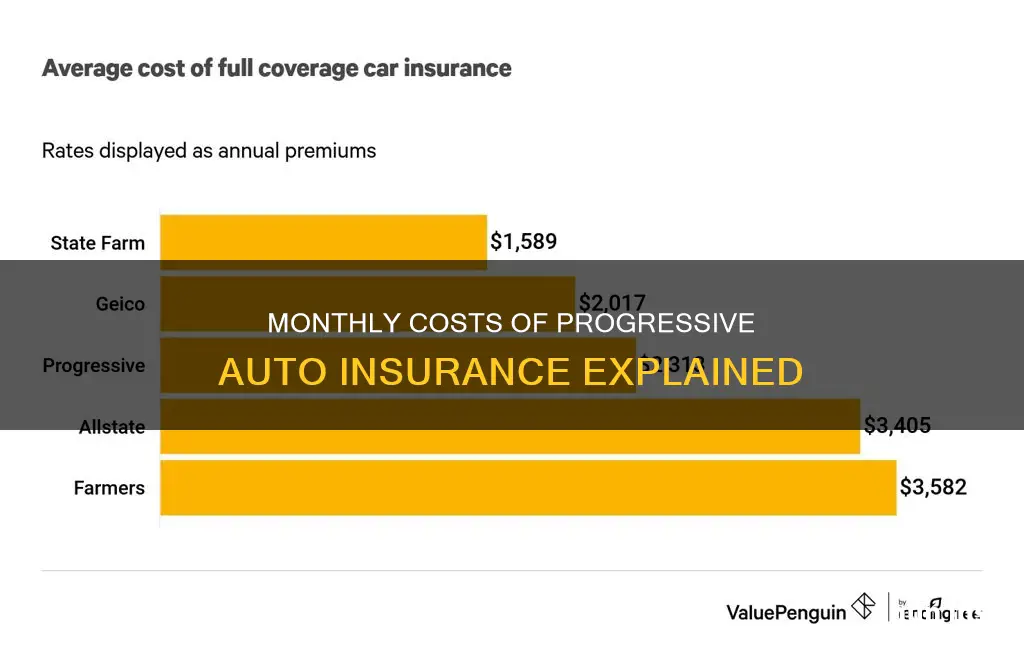

Progressive is one of the largest auto insurance companies in the United States, and its rates vary depending on factors such as age, location, driving record, vehicle type, and more. The average cost of Progressive car insurance is $116 per month or $1,390 per year for full coverage insurance, while the cost for minimum coverage is $63 per month or $750 per year. Progressive also offers various discounts and coverage options, such as liability coverage, collision coverage, comprehensive coverage, and personal injury protection, which can affect the monthly cost.

| Characteristics | Values |

|---|---|

| Average monthly cost | $79.83 in low-cost states, $105.36 in medium-cost states, and $157.27 in high-cost states |

| Average annual cost | $627 for minimum coverage and $2,008 for full coverage |

| Discounts | Multi-policy, multi-car, teen driver, good student, sign online, paperless, pay-in-full, automatic payments |

| Payment methods | Credit card, PayPal, online check, personal check, money order, electronic funds transfer (EFT) |

| Payment frequency | Monthly, every six months, or annually |

What You'll Learn

- Progressive's monthly insurance costs vary depending on factors such as age, location, driving record, and vehicle type

- Progressive offers a discount for paying the full six-month policy upfront, but also gives customers the option to pay monthly

- Progressive's basic liability coverage is the cheapest plan, costing between $50 and $150 per month

- Progressive's full-coverage policy includes collision coverage, comprehensive coverage, and personal injury coverage, costing on average between $1,200 and $1,300 per policy period

- Progressive's insurance rates are influenced by the customer's state of residence and the state's minimum policy limits

Progressive's monthly insurance costs vary depending on factors such as age, location, driving record, and vehicle type

Age is a significant factor in determining insurance rates, as younger drivers are considered higher-risk and tend to have more expensive premiums. Progressive offers a Good Student Discount to help offset the cost of insuring teen drivers. Additionally, drivers with a clean driving record tend to pay lower insurance premiums than those with accidents or violations on their record.

The type of vehicle being insured also impacts the cost of insurance. For example, insuring a sports car or a convertible may be more expensive than insuring a standard sedan. The value of the vehicle, the cost of repairs, and the likelihood of it being involved in accidents or insurance claims all contribute to the insurance rate.

Progressive offers various discounts to help customers save money on their insurance premiums. These include discounts for bundling home and auto insurance, paying in full, receiving and signing documents online, and electronic bill payment. The company also has a Snapshot® program that personalizes rates based on driving habits, rewarding safe drivers with lower premiums.

Auto Insurance Cards: Phone Numbers and Privacy Concerns

You may want to see also

Progressive offers a discount for paying the full six-month policy upfront, but also gives customers the option to pay monthly

Progressive offers a discount for customers who pay their six-month policy upfront. However, they also give customers the option to pay monthly. Progressive's monthly payment option is ideal for those who cannot afford to pay for the full six-month policy upfront. With the monthly payment option, customers can have their premium auto-drafted from their account on the same day every month until their policy is paid in full. Progressive's monthly payment option provides flexibility and convenience for customers who may be facing financial constraints.

Progressive's six-month policy discount rewards customers who pay their premium in full upfront. By offering this discount, Progressive incentivizes customers to make a long-term commitment and provides them with the benefit of a reduced rate. This option is suitable for customers who have the financial means to pay for the entire policy upfront and want to take advantage of the cost savings.

Progressive's car insurance rates vary depending on factors such as age, location, driving record, vehicle type, and more. The average cost of a liability-only policy ranges from $79.83 to $157.27 per month. Progressive also offers full-coverage insurance, which includes collision and comprehensive coverage. The cost of full-coverage insurance is typically higher than liability-only insurance.

Progressive provides various coverage options, including liability coverage, uninsured/underinsured motorist coverage, medical payments coverage, personal injury protection, comprehensive coverage, and collision coverage. Customers can tailor their protection by choosing different limits or deductibles based on their specific needs. Additionally, Progressive offers specialized coverage options, such as rental car reimbursement, roadside assistance, and trip interruption coverage.

Progressive also offers multiple discounts to help customers save money on their car insurance. These discounts include multi-policy discounts, multi-car discounts, teen driver discounts, good student discounts, sign online discounts, paperless discounts, and automatic payment discounts. By taking advantage of these discounts, customers can further reduce their car insurance costs.

Progressive Auto Insurance: Understanding the Credit Check Factor

You may want to see also

Progressive's basic liability coverage is the cheapest plan, costing between $50 and $150 per month

The cost of your Progressive auto insurance will depend on various factors, including your age, location, driving record, vehicle type, and usage. The company uses these factors to group customers and evaluate their claims experience to determine what to charge individuals. Progressive also offers a range of discounts that can help lower your premium, such as multi-policy, multi-car, teen driver, and good student discounts.

In addition to basic liability coverage, Progressive offers other types of insurance coverage, including collision coverage, comprehensive coverage, personal injury protection, and uninsured/underinsured motorist coverage. These coverages can protect you in different situations, such as accidents, injuries, vehicle damage, and more. You can also add specialised coverage for car rentals, roadside assistance, and more.

Progressive allows you to pay your car insurance monthly or in full, whichever fits your budget best. Paying in full for a six-month policy upfront can earn you a discount. The company also offers a Continuous Insurance Discount, honouring the time you have been with them or your previous insurance company without any gaps or cancellations in your insurance history.

Amazon Employee Perks: Auto Insurance Discounts and More

You may want to see also

Progressive's full-coverage policy includes collision coverage, comprehensive coverage, and personal injury coverage, costing on average between $1,200 and $1,300 per policy period

Progressive's full-coverage policy includes collision coverage, comprehensive coverage, and personal injury protection (PIP). Collision coverage pays to repair or replace your vehicle after an accident, regardless of who is at fault. Comprehensive coverage protects your vehicle from events outside of your control, including fire, theft, and vandalism. PIP is offered in some states and covers medical bills and related expenses for you and your passengers in the event of an accident, regardless of who is at fault.

The cost of Progressive's full-coverage policy will depend on various factors, including age, location, driving record, vehicle type, and usage. On average, Progressive charges between $1,200 and $1,300 per policy period for full coverage. This equates to a monthly cost of approximately $100 to $108, assuming a six-month policy period.

Progressive also offers several optional coverages and discounts that can impact the cost of your policy. For example, you can add coverage for rental cars, roadside assistance, and trip interruption. Progressive also offers a range of discounts, such as multi-policy, multi-car, teen driver, and good student discounts.

GEICO Auto Insurance: Is a VIN Number Necessary?

You may want to see also

Progressive's insurance rates are influenced by the customer's state of residence and the state's minimum policy limits

Progressive's insurance rates are influenced by a variety of factors, including the customer's state of residence and the state's minimum policy limits. The company offers insurance products in all 50 states, and rates may vary depending on the state's regulations, population density, and coverage requirements.

The state a customer lives in can significantly impact their car insurance rates. Each state has its own minimum car insurance requirements, and Progressive's rates are adjusted accordingly. For example, the average cost of a six-month liability-only policy from Progressive ranges from $79.83 per month in low-cost states to $157.27 per month in high-cost states. The specific states within these categories will influence the rates charged to customers residing in those states.

Additionally, state regulations and population density are crucial factors in determining insurance rates. States with higher population density tend to have higher rates due to increased risks of car accidents, theft, and vandalism. Progressive takes these factors into account when setting rates for customers in different states.

The customer's state of residence also influences the minimum policy limits offered by Progressive. The company evaluates the state's minimum liability coverage requirements, medical payments, personal injury protection, and uninsured/underinsured motorist coverage. These factors collectively shape the baseline insurance rates for customers in each state.

Progressive further refines its rates by grouping customers with similar characteristics and evaluating their claims experience. They consider factors such as age, driving record, vehicle type, credit history, and gender to determine an individual's insurance premium within the state-specific framework.

In summary, Progressive's insurance rates are shaped by a combination of state-specific factors, including minimum policy limits and regulations, as well as individual characteristics that influence the likelihood of claims. These factors collectively contribute to the monthly charges for Progressive auto insurance, ensuring that rates are tailored to the specific context of each customer and their state of residence.

Short-Term Insurance: Avoid Gaps, Stay Covered

You may want to see also

Frequently asked questions

Progressive auto insurance costs $116 per month or $1,390 per year for full coverage. The cost for minimum coverage is $63 per month or $750 per year.

The average cost of a liability-only policy from Progressive ranges from $79.83 to $157.27 per month.

The cost of Progressive auto insurance is influenced by various factors, including age, location, driving record, vehicle usage, accidents, vehicle type, and more.

Yes, Progressive gives you the option to pay monthly or in full, whichever suits your budget. Paying in full for a six-month policy upfront can earn you a discount.