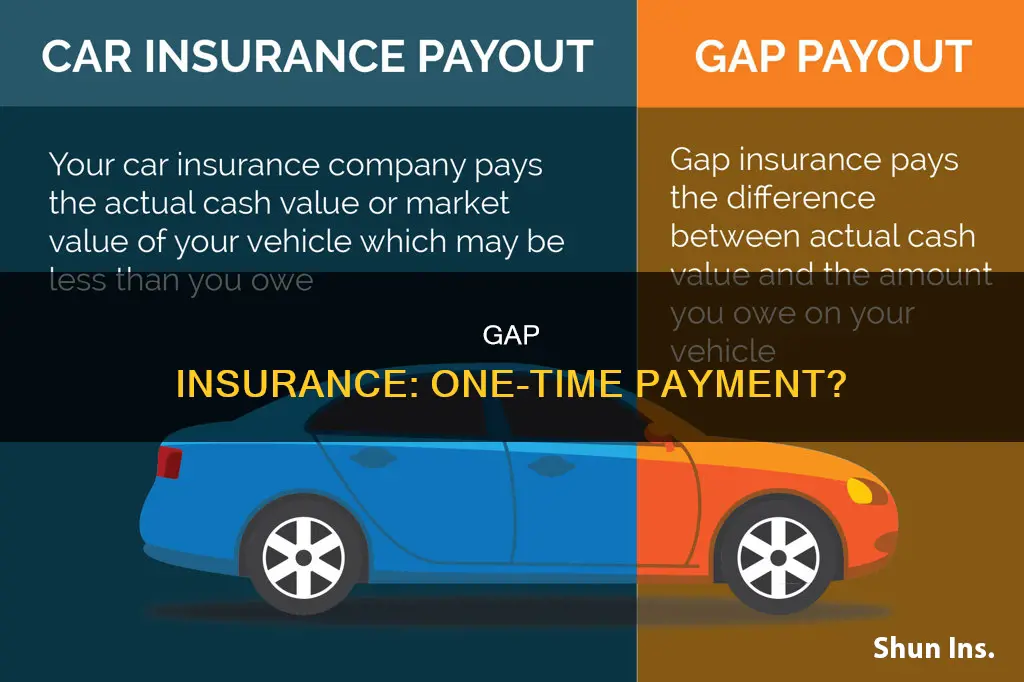

Gap insurance is an optional type of car insurance that covers the difference between what a car is worth and what the driver owes on their auto loan or lease if the car is stolen or declared a total loss. In other words, it covers the gap between what the driver owes and the car's value. This type of insurance is particularly useful for those who have made a small down payment, leased their car, or have a car that depreciates quickly. Gap insurance can be purchased from car insurance companies, loan providers, or dealerships, with costs varying depending on the provider.

| Characteristics | Values |

|---|---|

| Type of insurance | Optional |

| What it covers | The difference between what a car is worth and what the driver owes on their auto loan or lease if the car is totaled or stolen |

| When to buy it | When you owe more on your car loan or lease than your car is worth |

| When to drop it | When your car loan is less than the current value of your car |

| Cost | $3-$40 per month when added to a car insurance policy; $400-$700 when purchased from a dealership |

What You'll Learn

- Gap insurance covers the difference between the compensation received and the amount still owed on a car loan

- It is optional but often required by lenders and lessors

- It is worth it if you owe more on your car loan than the car is worth

- It can be purchased directly from a dealership or lender, or added to an existing insurance policy

- It can be cancelled when the loan balance is less than the car's value

Gap insurance covers the difference between the compensation received and the amount still owed on a car loan

Gap insurance is an optional type of car insurance that covers the difference between the compensation received and the amount still owed on a car loan. This type of insurance is useful when a driver's car is stolen or deemed a total loss, and the insurance payout does not cover the remaining loan or lease balance.

Gap insurance is designed to protect drivers from the financial burden of having to pay off a car loan or lease for a vehicle that they can no longer drive. It is particularly useful for those who have made a small down payment on a car loan, leased their car, or have a car that depreciates quickly.

When a car is stolen or totaled, standard insurance policies will only cover the actual cash value of the car at the time of the incident. Gap insurance steps in to cover the remaining balance on the loan or lease, ensuring that the driver does not owe any additional money.

The cost of gap insurance varies depending on where it is purchased. Dealerships and banks typically charge a one-time lump sum of up to $700 for gap insurance, which is then added to the auto loan and accrues interest over time. On the other hand, insurance companies often charge a few dollars a month or around $20 to $60 per year for gap insurance coverage.

While gap insurance is not required by state law, it may be required by lenders or leasing companies. It is worth considering gap insurance if there is a significant difference between the car's value and the amount owed, if the driver has a long-term loan, or if they have made a small down payment.

Electric Vehicle Insurance: Cheaper?

You may want to see also

It is optional but often required by lenders and lessors

Gap insurance is an optional type of car insurance that covers the difference between what a car is worth and what the driver owes on their auto loan or lease if the car is stolen or declared a total loss. While it is not required by state law, it is often required by lenders and lessors.

Gap insurance is intended to protect both drivers and lenders or lessors. For drivers, if their car is stolen or declared a total loss, gap insurance will cover the difference between the car's value and the amount they still owe on their loan or lease. This means that the driver won't be left paying off a loan or lease for a car that they can no longer drive.

For lenders and lessors, gap insurance helps to protect them from car owners who walk away from a loan or lease if their car is stolen or declared a total loss. It also ensures that the driver will be able to pay for the vehicle even if it is totaled before the lease or loan ends.

Gap insurance can usually be purchased directly from a dealership, lender, or lessor for a one-time cost of about $400 to $700. However, many traditional car insurance companies also offer gap insurance for just $20-$40 per year. It is important to note that gap insurance is only available to the first owner of a car with a recent model year.

When deciding whether or not to purchase gap insurance, it is essential to consider your financial situation. If you have a low down payment, a long-term loan, or a car that depreciates quickly, gap insurance may be a good idea. On the other hand, if you have already paid off most of the loan, made a significant down payment, or could afford to pay the gap yourself, gap insurance may not be necessary.

Lower Vehicle Insurance: Discounts and Deductibles

You may want to see also

It is worth it if you owe more on your car loan than the car is worth

Gap insurance is an optional, supplemental auto insurance policy that covers the difference between the insured current value of a vehicle and the outstanding loan or lease balance in the event of a total loss. In other words, it covers the "gap" between what a car is worth and what the driver owes on their auto loan or lease. This type of insurance is worth considering if you owe more on your car loan than the car is worth.

When you buy a new car, its value starts to decrease, sometimes significantly. If you finance or lease a vehicle, this depreciation can leave a gap between what you owe and the car's value. For example, if you finance $30,000 for a new car and have been making all your payments, but after a few years, it's only worth $20,000, yet you still owe $25,000 on your loan, representing a $5,000 gap. If the vehicle is totalled, your insurer would pay you $25,000 (minus your deductible) without gap insurance. However, with gap insurance, you would receive the extra $5,000 needed to pay off your loan.

Gap insurance is worth considering if you lease your car, made a lower down payment on a new car (less than 20% of the sale price), have a longer financing term for your vehicle, want protection against depreciation, or have a loan rollover. It is not required by any insurer or state but may be required by some leasing companies.

You can typically buy gap insurance from car insurance companies and banks or credit unions. The cost varies by insurer, with an average of $61 per year, according to Forbes Advisor's analysis. It is much cheaper through a car insurance company than a car dealership, where it is typically rolled into your car loan, and you will also pay interest on it.

Vehicle Insurance: Property Damage Explained

You may want to see also

It can be purchased directly from a dealership or lender, or added to an existing insurance policy

When buying a new car, you can get gap insurance from the dealer or your auto insurance company. Usually, gap insurance is optional if you're financing a purchase, but it might be mandatory if you're leasing a vehicle.

Buying from a Dealership

If you buy gap insurance from a dealer, it can be bundled into your loan amount, which means you'll pay interest on your gap coverage. Dealership gap insurance is usually more expensive than buying it through an insurer. Dealers typically charge a flat rate of $500 to $700 for a gap policy, and you may also be paying interest on it if it's bundled with your loan.

Buying from a Lender

You can also buy gap insurance from a lender, which will be rolled into your loan payments. As with buying from a dealership, you'll be paying interest on the cost of your gap insurance over the life of the loan, making the coverage far more expensive.

Adding to an Existing Insurance Policy

You can typically add gap coverage to an existing car insurance policy or a new policy, as long as your loan or lease hasn't been paid off. Buying gap insurance from an insurance company may be less expensive, and you won't pay interest on your coverage. If you already have car insurance, you can check with your current insurer to determine the cost of adding gap coverage to your existing policy. Note that you need comprehensive and collision coverage to add gap coverage to a car insurance policy.

Insurance: Proof of Vehicle Ownership?

You may want to see also

It can be cancelled when the loan balance is less than the car's value

Gap insurance is an optional form of coverage that can be added to your comprehensive auto insurance policy. It covers the difference between the amount you owe on your car loan and the depreciated value of your car if it is stolen or involved in an accident. This is also known as "guaranteed auto protection" or "loan/lease coverage".

Gap insurance is worth considering if you have a large car loan or you've bought a vehicle that depreciates in value quickly. Electric vehicles, for example, lose about half their value in five years.

You can buy gap insurance from car insurance companies, banks, and credit unions. It can be purchased separately or added to an existing auto insurance policy.

Gap insurance is typically paid for in a lump sum or monthly instalments. If you pay a lump sum, you may be able to get a refund for the unused portion of the coverage if you cancel the policy.

You can cancel gap insurance when you no longer need it, such as when your loan balance is lower than your vehicle's value. To determine your car's value, you can use resources like the National Automobile Dealers Association (NADA) guide or Kelley Blue Book.

When cancelling gap insurance, you may need to provide information and documents to your insurance company, such as proof that your vehicle has been sold or traded, verification of your car's mileage, and any other relevant details. It's important to review the specific requirements of your insurance company and policy to understand the process and any potential fees or refunds involved.

Retitle First: Vehicle Insurance Removal 101

You may want to see also

Frequently asked questions

No, gap insurance is not a one-time payment. It is typically paid monthly or annually and can be added to your existing car insurance policy.

The cost of gap insurance varies depending on where you buy it. Dealerships and banks usually charge a one-time fee of around $400 to $700 for gap insurance. On the other hand, insurance companies often charge a few dollars a month or around $20 to $40 per year for gap insurance.

Yes, you may be entitled to a refund for unused gap insurance premiums if you paid for coverage upfront and then cancelled it early. The amount of the refund will depend on the terms of your policy and your state's laws.