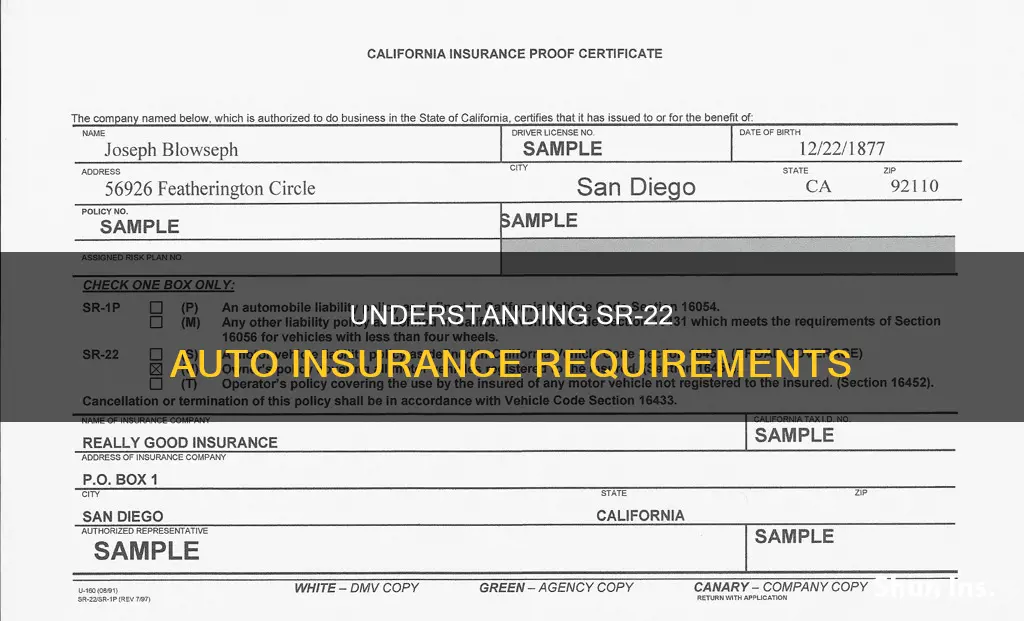

SR22 auto insurance is a certificate of financial responsibility that proves you have car insurance meeting the minimum coverage required by law. It is not a type of insurance but a form filed with your state. SR22 auto insurance is typically required for high-risk drivers who have been convicted of offences such as DUI, driving without insurance, or multiple traffic violations.

| Characteristics | Values |

|---|---|

| What is SR22 auto insurance? | A certificate of financial responsibility that proves you carry car insurance and meet your state's minimum insurance requirements. |

| Who needs SR22 auto insurance? | High-risk drivers with a history of violations such as DUIs, DWIs, driving without insurance, or multiple traffic violations. |

| How to obtain SR22 auto insurance? | Contact your insurance provider and indicate that you need to file an SR-22. They will then file the form with your state's Department of Motor Vehicles (DMV). |

| Cost of SR22 auto insurance | The cost of SR22 auto insurance varies by state and insurance company, but it typically involves a filing fee of around $25 to $50. |

| Duration of SR22 auto insurance | The duration of SR22 auto insurance depends on the state but is typically required for about three years. |

| Consequences of not having SR22 auto insurance | Failure to obtain SR22 auto insurance when required can result in license suspension, fines, and other penalties. |

What You'll Learn

SR22 is not a type of insurance

SR-22 is not a type of insurance. It is a certificate of financial responsibility, also known as an SR-22 Bond or SR-22 Form. It is a document filed with your state's department of motor vehicles to prove that you have car insurance that meets the minimum coverage required by law. It is typically required for drivers who have been convicted of certain driving offences, such as DUI, driving without insurance, or multiple traffic violations.

The SR-22 form is not insurance itself, but rather a form that your insurance company files on your behalf with the state's Department of Motor Vehicles (DMV). It serves as a guarantee that the driver will maintain the required insurance coverage for a specified period, typically about three years. This period may vary depending on the state and the severity of the offence.

The SR-22 is not something that all drivers need to file. It is usually required by a court order or mandated by the state for drivers with specific driving-related violations. These violations can include DUI or DWI convictions, driving without insurance, excessive at-fault accidents, or repeat offences within a short period.

The SR-22 form is often confused with the FR-44 form, which is required in Florida and Virginia. The FR-44 form is similar to the SR-22 but requires higher liability coverage amounts, making it a more stringent requirement. It is typically mandated for individuals convicted of more serious offences, such as DUIs with higher blood alcohol concentrations or repeat offences.

While the SR-22 is not a type of insurance, it does affect your car insurance rates. Insurance companies consider drivers who need to file an SR-22 as high-risk, which can lead to increased insurance premiums. The increase in rates will depend on the specific issue that led to the SR-22 requirement, such as DUI convictions or too many car accidents.

Burning Vehicle for Insurance: The 'How-To' Guide

You may want to see also

SR22 is a certificate of financial responsibility

An SR-22 is a certificate of financial responsibility that some drivers are required to have by their state or court order. It is not a type of insurance but rather a form filed with your state. This form serves as proof that your auto insurance policy meets the minimum liability coverage required by state law. It is also known as an "SR-22 Bond" or "SR-22 Form".

An SR-22 is typically required if you've been caught driving without insurance or a valid license. Other reasons for needing to file an SR-22 form include:

- DUI or DWI conviction

- Driving without enough insurance

- Too many at-fault accidents or violations

- Repeat offenses in a short time frame (e.g. three or more speeding tickets within six months)

- Not paying court-ordered child support

- Hardship license (issued for temporary driving needs, normally to and from work, because your license has been suspended or revoked)

The SR-22 form is filed by the driver's insurance company directly with the state's Department of Motor Vehicles (DMV) and serves as a guarantee that the driver will maintain the required insurance coverage for a specified period. The form can usually be obtained quickly and easily from your insurance provider, who will then file it with the DMV on your behalf.

If you don't own a car, you can still meet the SR-22 requirement by obtaining a non-owner SR-22 insurance policy, which is typically cheaper than an owner's policy. This type of policy provides liability coverage when you drive a vehicle that you don't own, ensuring compliance with state regulations.

Postal Vehicles: Insured?

You may want to see also

SR22 is required for high-risk drivers

SR-22 auto insurance is a certificate of financial responsibility required for high-risk drivers by their state or court order. It is not a separate type of insurance, but a form filed with a driver's state to prove they have the minimum required auto coverage mandated by the state. SR-22 insurance is required for high-risk drivers who have been convicted of multiple traffic violations or have received a DUI.

High-risk drivers are those who have accumulated too many moving violations in a short period of time, such as driving under the influence (DUI) or driving while intoxicated (DWI). Other reasons for needing an SR-22 include driving with a suspended or revoked driver's license, causing an accident while driving without insurance, or being charged with repeated traffic violations. SR-22 insurance is also necessary to reinstate a revoked or suspended license.

The SR-22 form is filed by the driver's insurance company directly with the state's Department of Motor Vehicles (DMV) and serves as a guarantee that the driver will maintain the required insurance coverage for a specified period, usually three years. The form confirms that the driver meets their state's car insurance coverage requirements for driving during the required period.

If a driver is required to have an SR-22, they will typically receive a court order or be notified by their state's Department of Motor Vehicles. The insurance company will then file the SR-22 form on the driver's behalf, and the driver will need to maintain the required amount of insurance for the entire time the SR-22 is in effect. Failure to do so can result in consequences such as license suspension, vehicle registration suspension, and hefty fees.

SR-22 insurance typically costs more than regular coverage because the driver is considered high-risk. The cost includes the SR-22 filing fee, which ranges from $15 to $25, and the increased cost of insurance, with premiums increasing by up to 18%.

Ohio Stop Gap Insurance: Must-Have or Not?

You may want to see also

SR22 is needed after a DUI

An SR-22 is a certificate of financial responsibility that is required for some drivers by their state or court order. It is not a type of insurance but a form filed with your state to prove that your auto insurance policy meets the minimum liability coverage required by state law.

SR-22 is often required after a DUI conviction, which triggers a suspended license. To get your license reinstated, you will need to obtain insurance that covers the SR-22 filing requirement. The SR-22 form is filed by the driver's insurance company directly with the state's Department of Motor Vehicles (DMV) and serves as a guarantee that the driver will maintain the required insurance coverage for a specified period, usually three years.

The SR-22 is necessary to continue driving with an ignition interlock device (IID) installed and is an acceptable form of "proof" of liability car insurance for any DMV action that requires you to provide proof of financial responsibility. The SR-22 must be obtained anytime you wish to reinstate your license following a DMV suspension or revocation.

In addition to a DUI conviction, there are other reasons why a driver may need to file for an SR-22, including driving without insurance, too many at-fault accidents or violations, and repeat offences in a short time frame.

Canceling Liberty Mutual Auto Insurance: A Guide

You may want to see also

SR22 is needed after driving without insurance

An SR-22 is a certificate of financial responsibility that is required for some drivers by their state or court order. It is not a type of insurance but a form filed with your state to prove that your auto insurance policy meets the minimum liability coverage required by state law.

If you are caught driving without insurance, your state may require you to get an SR-22. This is because you are considered a high-risk driver and your state wants proof that you have the financial coverage on your policy to pay for any people you could possibly injure based on your past driving experience.

To get an SR-22, you will need to contact an insurance company and ask them to issue you the certificate. Not all insurance companies will issue an SR-22, so it may require a little research. The certificate will be issued upon payment and will then be submitted to the Secretary of State. This process can take up to 30 days to complete. Once you have received the SR-22, the insurance company will notify the DMV that you meet all state laws regarding financial responsibility and minimum insurance requirements.

It is important to keep the SR-22 with you at all times and to renew your insurance at least 15 days before the expiration date. If your insurance lapses or is canceled, your insurance company is required to notify the DMV, which could result in your license being suspended.

Most states require drivers to have an SR-22 for about three years, but this may vary depending on the circumstances and the state.

Insurance Lapse: What Happens Next?

You may want to see also

Frequently asked questions

SR22 is a form filed with your state to prove that you carry car insurance. It is also known as a "Certificate of Financial Responsibility".

No, SR22 insurance is not mandatory in all states. For example, Pennsylvania is one of six states that do not require an SR22 filing to reinstate your driving privileges.

High-risk drivers with one or more violations on their recent driving record will likely need SR22 insurance. This includes people who have been caught driving under the influence (DUI), driving without insurance, or causing multiple accidents.

You can get SR22 insurance by contacting your insurance company and requesting that they add the SR22 endorsement to your existing policy. They will then file the SR22 insurance document with your state.

The cost of SR22 insurance may vary depending on your state and insurance company. In some states, there is a flat fee for filing the SR22 form, which is typically around $25.