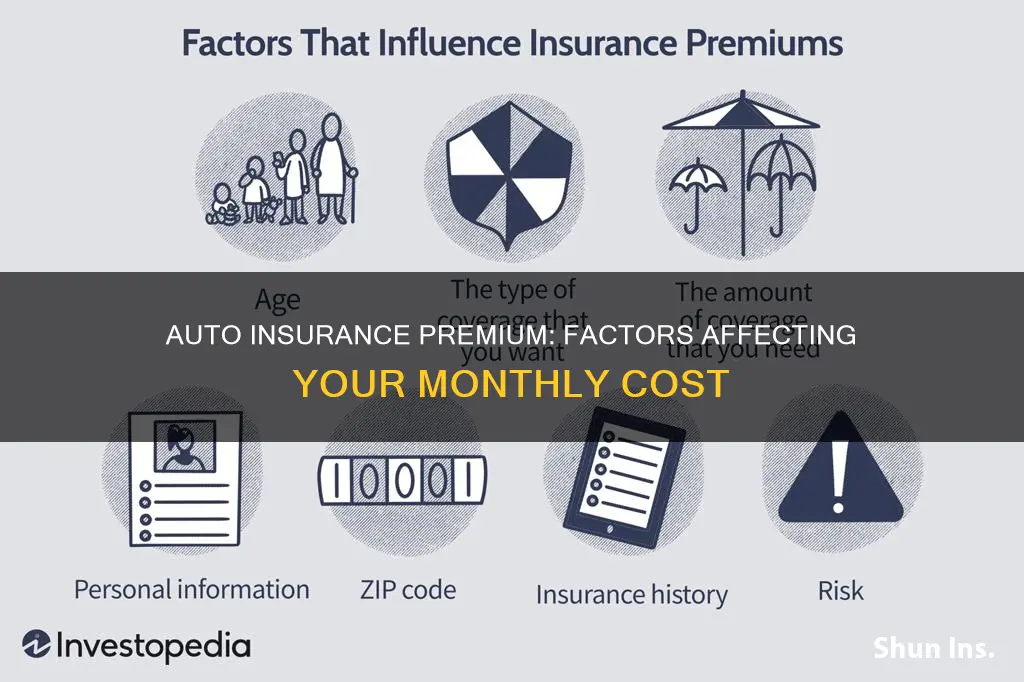

There are several factors that can impact your monthly auto insurance premium. These include your driving record, age, location, vehicle type, and the coverage options you select. Maintaining a clean driving record, choosing a higher deductible, and comparing quotes from multiple providers can help lower your premium. Additionally, factors such as your gender, credit score, and marital status may also influence your premium, depending on your state's regulations.

| Characteristics | Values |

|---|---|

| Age and demographics | Teenagers and senior drivers are considered higher risk and pay higher premiums. |

| Driving record | At-fault accidents and speeding tickets increase premiums. |

| Location | Living in a densely populated city increases the risk of collisions, theft, and other harm, leading to higher insurance rates. |

| Vehicle type | Expensive cars, particularly those with high theft or crash rates, result in higher premiums. |

| Mileage | Higher mileage and frequent driving lead to higher premiums. |

| Coverage and deductible | Higher coverage and lower deductibles result in higher premiums. |

| Claims history | A higher number of claims results in higher premiums. |

| Credit score | Poor credit score leads to higher premiums. |

What You'll Learn

Your age and demographics

Teenagers and young adults are more likely to be involved in accidents or take risks on the road due to inexperience. As a result, insurance companies view them as riskier to insure and charge higher premiums to offset potential claims. The highest rates are often assigned to drivers between the ages of 16 and 25. As drivers reach their early to mid-20s, premiums usually decrease as they gain more experience and establish a safer driving record.

On the other hand, seniors or older drivers may also experience an increase in insurance premiums. Aging-related factors such as vision or hearing loss and slower reaction times can increase the likelihood of accidents. While seniors may not pay premiums as high as teenage drivers, their rates are typically higher than middle-aged adults.

It is important to note that age-based premiums can vary by state. Some states, like Hawaii and Massachusetts, do not allow age to be used as a rating factor, while others may have different age thresholds for determining premium costs.

In addition to age, other demographic factors such as gender, marital status, and location can also impact your car insurance premium. In some states, gender is considered in premium calculations, with men typically paying higher rates due to a greater propensity for risky driving behaviour. However, this difference tends to narrow as drivers age. Marital status can also influence premiums, with married individuals often receiving lower rates compared to single drivers.

Where you live also plays a role in determining your premium. If you reside in a densely populated city, you may face higher rates due to an increased risk of collisions, theft, and other hazards. Insurance companies analyse data on accident trends, theft rates, and local regulations to set premiums accordingly.

Understanding Auto Insurance Requirements in Texas

You may want to see also

Your driving record

Accidents, particularly those that are deemed your fault, signal a higher risk to insurance providers. If you have multiple accidents on your record, insurers may perceive you as a higher liability and adjust your premiums accordingly. Additionally, a track record of accidents indicates a higher likelihood of filing insurance claims, resulting in increased costs for the insurer.

Traffic violations, such as speeding tickets, reckless driving, or running red lights, are red flags for insurers. These infractions indicate a disregard for traffic laws and responsible driving behaviour. Insurance companies view these violations as indicators of increased risk and may raise your premiums as a consequence. Multiple violations can have a cumulative effect, amplifying the impact on your insurance rates.

Driving under the influence (DUI) or driving while intoxicated (DWI) is a serious offence that significantly impacts your auto insurance premiums. Such convictions signal a high level of risk and demonstrate irresponsible behaviour behind the wheel. In some cases, insurance companies may refuse coverage altogether due to the elevated risk associated with DUI/DWI offences.

In certain jurisdictions, insurance companies employ a point-based system to assess a driver's risk. Points are assigned for accidents, violations, and other driving-related offences. Accumulating points can result in premium surcharges, leading to higher insurance rates based on the number of points on your driving record.

The impact of your driving record on your auto insurance premiums can vary depending on the insurance company and state regulations. Insurance companies typically review your driving record over the past three to five years when calculating your premium. More recent and severe violations or accidents are more likely to affect your rates.

While a less-than-perfect driving record may result in higher insurance premiums, there are steps you can take to mitigate its impact over time. These include completing defensive driving courses, maintaining a clean driving record for an extended period, and shopping around for quotes from multiple insurance providers.

AAA vs USAA: Unlocking the Auto Insurance Advantage

You may want to see also

Your vehicle's make and model

The make and model of your car can have a significant impact on your auto insurance premium. This is because insurers use this information to determine your car's worth, safety features, and how expensive it may be to repair. Here are some factors to consider:

Vehicle Age

Older vehicles are generally worth less than newer ones, and the cost of replacing an older car is typically lower. As a result, insurance on an older car is usually cheaper. However, older vehicles may not have the same safety features and advanced technology as newer models, which can impact repair costs.

Vehicle Size

Larger vehicles often come with higher price tags, which can lead to higher insurance premiums. On the other hand, smaller cars are more prone to theft and statistically more likely to be involved in accidents, which can also increase insurance costs.

Engine Size

Cars with larger engines and more horsepower may be considered riskier due to the potential for speeding and other unsafe driving behaviours. As a result, insurance premiums may be higher for these vehicles.

Repair Costs

The cost of repairing a vehicle can vary depending on its make and model. Cars with expensive specialized features or foreign-made parts can be more costly to repair, leading to higher insurance premiums. Certain makes, such as German cars like Volkswagens, BMWs, and Audis, tend to have higher repair costs.

Safety Features

Newer models often have more advanced safety features, which can help reduce insurance rates. Vehicles with higher safety ratings are seen as less risky and may qualify for lower premiums. Features like electronic stability control, anti-lock brakes, anti-theft systems, and curtain airbags are favourable when determining insurance costs.

Likelihood of Theft

Some makes and models are more attractive to thieves than others, and this can impact insurance rates. Check the National Insurance Crime Bureau's Hot Wheels report to see if your vehicle is among the most stolen, as this may result in a higher premium.

When considering the make and model of your vehicle, it's important to compare insurance rates from multiple providers. Additionally, factors such as your age, location, driving history, and credit history can also influence your auto insurance premium.

Auto Insurance: What's Not Covered?

You may want to see also

Your coverage selections

The coverage you select as part of your auto insurance policy is one of the key factors that determine the premium you pay. The more coverages you carry, the higher your car insurance premium will be. Similarly, the higher your coverage limits, the more you'll pay.

For example, if you live in Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, or Utah, you are required to carry personal injury protection, which pays medical bills if you or a passenger are injured in an accident. This additional coverage will increase your premium.

Additionally, collision and comprehensive insurance policies typically include a deductible. Choosing a higher deductible will result in a lower premium, while a low deductible means a higher rate.

The types of insurance you choose are also important. For instance, liability insurance, personal injury protection insurance, uninsured motorist insurance, comprehensive insurance, mechanical breakdown insurance, rental car insurance, commercial vehicle insurance, non-owner auto insurance, and family car insurance are all options to consider, each of which will impact your premium differently.

When selecting your coverage, it's important to understand your needs and finances. While you want to ensure you have sufficient coverage, you also want to avoid paying for coverages that you don't necessarily need. Regularly reviewing and adjusting your coverage selections can help you optimize your premium and ensure it remains relevant to your changing circumstances.

Auto Insurance: Can You Pause Coverage?

You may want to see also

Other drivers on your policy

The cost of your auto insurance premium can be influenced by the other drivers on your policy. The number of drivers on your policy can affect your premium rate, and each driver's details will be reviewed by the insurance company. This includes their driving record, age, gender, credit score, and marital status.

Insurance companies often require all household members to be listed on your policy, even if they don't drive your car. This is because anyone with access to your car keys may pose a risk. However, you may be able to exclude certain household members, such as non-drivers or those with their own insurance policies.

Adding a driver to your policy is usually a simple process and can be done by contacting your insurance agent or through the provider's website or mobile app. You will need to provide the additional driver's personal information, including their full name, date of birth, driver's license number, and any recent accidents or traffic violations.

The impact of adding a driver to your policy on your premium rate can vary. In some cases, adding an older driver with a clean driving record may reduce your premium, especially if you are a young or high-risk driver. On the other hand, adding a high-risk driver, such as a teenager or someone with a poor driving record, can increase your premium.

It is important to note that insurance companies calculate premiums based on the overall risk assessment of all drivers on the policy. Therefore, adding a low-risk driver can help balance out the risk profile and potentially lower your premium.

When adding a driver to your policy, it is essential to consider the potential impact on your premium and choose the insurance company that offers the best rate for your specific situation. Shopping around and comparing quotes from different insurance providers can help you find the most cost-effective option for multiple drivers.

Auto Insurance: How Much Does It Cost?

You may want to see also

Frequently asked questions

The premium is calculated based on the probability of an event occurring and the potential impact of that event. For example, age, location, and driving behaviour are used to estimate the likelihood of an accident, while the severity of an accident is measured in terms of property damage and personal injuries.

Factors such as age, location, driving record, claims history, vehicle type, and coverage selections influence the premium. Age is significant due to the correlation between driving age and accidents, while location affects exposure to risks like accidents, theft, and vandalism. A good driving record and fewer claims indicate lower risk and result in reduced rates. The cost of repairing or replacing a vehicle also impacts the premium, with higher-value cars typically leading to higher premiums.

Maintaining a good driving record, practising safe driving habits, taking advantage of discounts, and maintaining good credit can help lower the premium. Additionally, bundling insurance policies, adjusting coverage, limits, or deductibles, and dropping unnecessary coverages can also reduce costs.

A car insurance quote is an estimate of the policy cost based on the selected coverage package and provided information. The premium is the actual amount paid to the insurance company for the coverage.