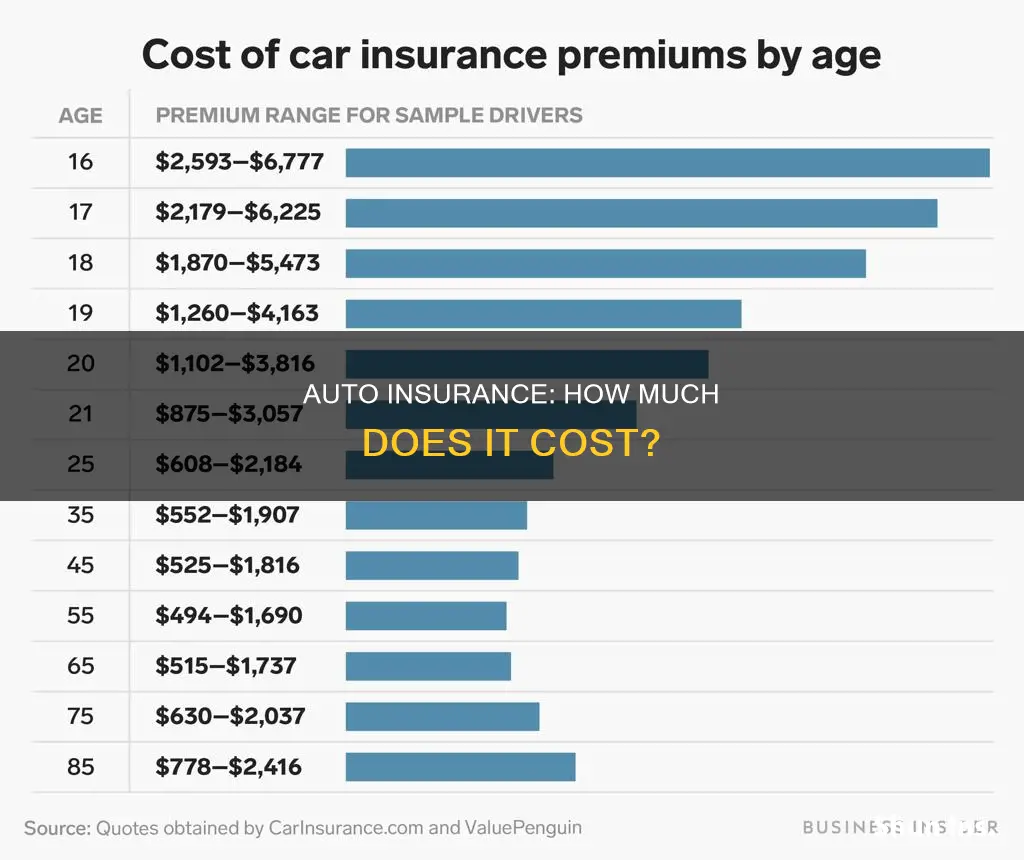

The cost of auto insurance varies depending on several factors, including location, age, gender, driving history, and the type of vehicle. In the United States, the average monthly cost of car insurance is around $124, while the average annual cost is about $1,500. However, these rates can differ significantly from state to state and even within the same state, depending on the insurance company. For example, in Illinois, the average monthly cost of car insurance is $95 for full coverage and $38 for minimum coverage, while in Florida, the average monthly cost is $170 for full coverage and $82 for minimum coverage. Additionally, age plays a significant role in determining insurance rates, with younger drivers often paying higher premiums due to their lack of driving experience.

| Characteristics | Values |

|---|---|

| Average monthly cost of auto insurance in the US | $72 for minimum coverage, $223 for full coverage |

| Average yearly cost of auto insurance in the US | $869 for minimum coverage, $2,681 for full coverage |

| Average monthly cost of auto insurance in Illinois | $38 for minimum coverage, $95 for full coverage |

| Average yearly cost of auto insurance in Illinois | $461 for minimum coverage, $1,139 for full coverage |

| Average monthly cost of auto insurance in Florida | $82 for minimum coverage, $170 for full coverage |

| Average yearly cost of auto insurance in Florida | $986 for minimum coverage, $2,044 for full coverage |

What You'll Learn

How much is auto insurance for young drivers?

Auto insurance for young drivers can be expensive. The cost of insuring a young driver depends on several factors, including their age, gender, driving experience, and location. Here are some key factors that influence the cost of auto insurance for young drivers:

Age and Driving Experience

Younger and less experienced drivers are considered high-risk by insurance companies due to their lack of driving experience and the higher likelihood of accidents. As a result, they often face higher insurance premiums. The good news is that rates tend to decrease as young drivers gain more experience and reach milestones like turning 25. Maintaining a clean driving record and completing driving courses can also help lower premiums over time.

Gender

In most states, insurance companies use gender as a factor in determining insurance rates. Young male drivers typically pay higher premiums than young female drivers because they are considered higher-risk. According to the Insurance Institute for Highway Safety, male teenagers cause crashes at higher rates than any other group.

Type of Vehicle

The type of vehicle a young driver operates also impacts insurance rates. High-performance cars and luxury vehicles tend to be more expensive to insure, while more conventional and used vehicles often have lower insurance costs.

Academic Performance

Many insurance companies offer good student discounts, rewarding young drivers who maintain a certain grade point average or GPA. For example, a "B" average or a 3.0 GPA may qualify for a discount on specific coverages.

Policy Options

Adding a young driver to an existing policy is typically more affordable than purchasing a separate policy for them. By including them on a parent's or guardian's policy, young drivers can benefit from the lower rates that come with having an experienced driver as the policyholder. However, adding a young driver will still result in an increase in the insurance premium.

Discounts and Safe Driving Programs

Insurance companies often offer various discounts that can help reduce the cost of auto insurance for young drivers. These may include good student discounts, defensive driving course discounts, multi-car discounts, and safe driving programs that monitor and reward safe driving habits through mobile apps or telematics devices.

State Requirements

Car insurance rates for young drivers also vary by state due to differences in local insurance minimums, population density, and disaster rates. Some states, such as Nevada, New Jersey, and New York, are known for having higher insurance rates for teens.

Insurance Company

Comparing quotes from multiple insurance companies is essential, as rates can vary significantly between providers. It's worth shopping around and considering companies that offer specialized discounts or programs for young drivers, such as Liberty Mutual, State Farm, GEICO, and Erie Insurance.

In summary, while auto insurance for young drivers tends to be costly, there are several strategies to mitigate the expense. Adding young drivers to existing policies, taking advantage of discounts, choosing the right vehicle, and comparing rates from different insurance companies can all help reduce the financial burden.

Fight Back: File a Complaint Against Your Auto Insurer

You may want to see also

How much is auto insurance for older drivers?

Auto insurance rates for older adults are typically higher than for middle-aged drivers. This is due to a variety of factors, including the increased risk of accidents, serious injuries, and costly hospital bills associated with older drivers. However, there are ways for senior citizens to save on auto insurance, and some companies offer lower rates and special discounts for this demographic.

Average Cost of Auto Insurance for Seniors

The average cost of car insurance for a 65-year-old is around $1,646 per year for minimum coverage and $2,057 per year for full coverage. These rates tend to increase with age, with 75-year-olds paying 13% more for full coverage than 65-year-olds, and 85-year-olds paying 44% more, on average. By age 80, auto insurance rates for seniors can be 31% higher than they were at age 65.

Factors Affecting Auto Insurance Rates for Seniors

Several factors contribute to the increase in auto insurance rates for older drivers. One key factor is the higher risk of accidents among older adults. According to the CDC, older drivers are more prone to serious injuries in the event of a crash, which can result in expensive medical bills and higher costs for insurance companies. Additionally, age-related changes in hearing, vision, and overall health, as well as the side effects of medications, can impair driving skills and lead to more accidents.

Ways for Seniors to Save on Auto Insurance

Despite the higher rates, there are several strategies that senior citizens can use to save on auto insurance:

- Compare quotes from multiple insurers: It is important to shop around and compare rates from different insurance companies, as rates can vary significantly.

- Maintain a good driving record: Keeping a clean driving record, free of accidents, tickets, and violations, can help offset age-related rate increases.

- Take a defensive driving course: Many states offer mature driver discounts for seniors who complete approved driving courses. Organizations like AARP, AAA, and The National Safety Council (NSC) provide these classes, which can result in discounts of up to 15% on car insurance premiums.

- Reduce mileage: Seniors who drive fewer miles per year may be eligible for low-mileage discounts. Usage-based insurance programs or pay-per-mile insurance plans can also help reduce costs for seniors who drive less.

- Consider vehicle safety: Insurers may offer discounts for vehicles equipped with safety features like airbags, anti-lock brakes, anti-theft systems, and anti-collision technology.

- Bundle policies: Combining auto and home insurance policies with the same provider can often result in significant discounts.

- Increase the deductible: A higher deductible will lower your insurance premium, but make sure you can comfortably cover the out-of-pocket expenses in the event of an accident.

Best Auto Insurance Companies for Seniors

When it comes to finding the best auto insurance company for seniors, there is no one-size-fits-all answer. Some companies may offer lower rates, while others may excel in customer service or coverage options. Here are some of the top-rated companies for senior citizens:

- State Farm: State Farm is consistently ranked as one of the best overall auto insurance providers for seniors, offering a balance of competitive rates, excellent customer service, and a wide range of discounts.

- Geico: Geico is known for having the lowest rates for most senior drivers and offers a guaranteed auto insurance renewal program called the Prime Time contract for drivers over 50.

- Nationwide: Nationwide's SmartMiles program is ideal for seniors who drive fewer miles after retirement, as rates are based on how much you drive.

- USAA: USAA offers competitive rates and a wide range of discounts for retired veterans, active-duty military members, and their families.

- The Hartford: In partnership with AARP, The Hartford offers special features and discounts tailored to drivers aged 50 and over.

Insurance Valuation: Your Vehicle's Worth

You may want to see also

How much is auto insurance for high-risk drivers?

High-risk car insurance is more expensive than car insurance for experienced drivers or those with a clean driving record. Drivers are considered high-risk if they are young or inexperienced, or have offences on their record such as speeding tickets, accidents, or DUIs. Other factors that can lead to a driver being considered high-risk include a lapse in coverage, certain types of car models, or poor credit.

High-risk drivers can expect to pay more for their car insurance, with premiums varying depending on the driver's specific circumstances and location. For example, a 40-year-old driver with a clean driving record pays on average $1,220 per year for car insurance, while a high-risk driver could pay up to $2,160 for the same coverage.

The cost of high-risk car insurance also depends on the driver's profile. For instance, an 18-year-old driver added to a family policy can expect to pay an average of $2,641 per year, while the average rate for a 40-year-old driver is $1,220 annually.

High-risk car insurance costs can also vary by state. For example, in Idaho, the cheapest high-risk car insurance is offered by State Farm at $567 per year, while in Nevada, the cheapest option is provided by Country Financial at $1,377 per year.

How to get cheaper high-risk auto insurance

There are several ways high-risk drivers can get cheaper car insurance:

- Shop around for coverage: Compare quotes from multiple insurance companies, as rates can vary significantly.

- Work on your credit score: Improving your credit score can help lower insurance costs, as drivers with poor credit tend to pay more for car insurance.

- Bundle insurance policies: Combining your car insurance with a home, condo, or renters insurance policy can often lead to discounts.

- Take a defensive driving course: This can help demonstrate to insurance companies that you're taking steps to improve your driving, and may result in lower premiums.

- Improve your driving record: Over time, as violations are removed from your record (typically after three years), your insurance costs should decrease.

Best auto insurance companies for high-risk drivers

While high-risk drivers may face higher insurance costs, several companies offer competitive rates and are worth considering:

- State Farm: State Farm is a top pick for high-risk drivers, offering excellent customer satisfaction, a wide range of discounts, and coverage in all 50 states.

- Erie: Erie offers some of the lowest premiums for high-risk drivers, particularly those with at-fault accidents, but is only available in 12 states.

- Geico: Geico has the lowest rates for high-risk drivers with speeding tickets and is available nationwide.

- Progressive: Progressive offers coverage for drivers with DUIs, as well as non-owner car insurance and SR-22 certificates.

- USAA: USAA provides competitive rates for high-risk drivers, but is only available to military members, veterans, and their families.

Insurance Scores: Good Auto Rates

You may want to see also

How much is auto insurance for low-risk drivers?

Low-risk drivers are those who have a clean driving record and no history of accidents, speeding tickets, or DUI/DWI convictions. They are considered less likely to file a claim and are therefore offered lower insurance rates.

The cost of auto insurance for low-risk drivers will depend on various factors, including age, location, vehicle type, and credit score. It's recommended that low-risk drivers shop around and compare quotes from multiple insurance companies to find the most affordable and suitable coverage for their specific circumstances.

Some insurance companies that offer competitive rates for low-risk drivers include:

- State Farm: Known for its high customer satisfaction, State Farm offers a range of discounts and is available in all 50 states.

- Erie: Erie Insurance provides affordable premiums and customizable policies but is only available in 12 states.

- GEICO: GEICO has a wide range of discounts and is available nationwide. They consistently offer cheap quotes for low-risk drivers.

- Progressive: Progressive offers various insurance products and safe-driving discounts.

- USAA: USAA is known for its competitive rates, but its coverage is only available to military members, veterans, and their families.

- American Family: American Family has a low level of complaints and offers accident forgiveness and a vanishing deductible. However, their insurance is only available in 19 states.

Insuring Homes Held in Trust: Unraveling the Complexities for Auto Owners

You may want to see also

How much is auto insurance for drivers with a DUI?

A DUI conviction will make it harder to get car insurance and will significantly increase your premiums. The exact cost of DUI insurance depends on the driver's state and insurance company, but you can expect to pay more for several years. You'll likely need to find an insurer that will file an SR-22 for you, which proves you have insurance.

According to WalletHub, the cheapest car insurance companies after a DUI are State Farm, Travelers, and Progressive. Progressive has the cheapest DUI rates from a national insurance company. Full coverage car insurance from Progressive costs $212 per month, on average. However, rates can vary significantly across different insurance providers, so it's recommended to shop around to find the best rate.

USAA also offers competitive rates for drivers with a DUI, but it is only available to military families.

The cost of car insurance after a DUI can vary by state. For example, in California, it's illegal for your insurance company to raise your rates or cancel your policy in the middle of your term. However, you should still inform your company of your DUI and prepare to shop around for new coverage. In Florida, drivers with a DUI must have higher insurance limits than drivers with a clean record, and an FR-44 form is required to reinstate your license.

In addition to increased insurance costs, a DUI conviction can result in legal and financial consequences, including losing your license, fines, probation, or jail time.

Stacking Auto Insurance: What It Means

You may want to see also

Frequently asked questions

The cost of auto insurance per month depends on various factors, including location, age, gender, driving history, and the type of vehicle. On average, auto insurance costs $158 per month for a full coverage policy in the U.S.

Age, location, driving record, vehicle type, accidents, and credit score are some of the main factors that influence auto insurance rates.

The average cost of a liability-only policy from Progressive ranges from $79.83 to $157.27 per month, depending on the state.

The average cost of full coverage auto insurance in the U.S. is $223 per month or $2,681 per year.

To get affordable auto insurance, it is recommended to compare rates from multiple companies, maintain a clean driving record, choose a vehicle that is cheap to insure, and look for available discounts.