Life insurance is a valuable benefit that employers may choose to offer their employees. Whole life insurance is one type of insurance that can be offered, and it provides coverage throughout the life of the insured. It is more expensive than term life insurance, but it also has a cash savings component that can be used for loans or withdrawals. Whole life insurance can be offered as a group benefit or as an individual policy that employees can purchase. If offered as a group benefit, it is typically tied to the employee's job and may not be portable if they leave. If offered as an individual policy, it is portable and remains with the employee even if they change jobs or retire.

| Characteristics | Values |

|---|---|

| Coverage | Whole life insurance provides coverage for the entire life of the insured person. |

| Death benefit | Whole life insurance pays a tax-free death benefit to beneficiaries. |

| Savings component | Whole life insurance has a cash savings component that the policy owner can draw on or borrow from. |

| Interest | Interest accrues on a tax-deferred basis in the savings component. |

| Premium payments | Premium payments are level and remain unchanged throughout the duration of the policy. |

| Flexibility | Whole life insurance does not allow for changes to the premium or death benefit. |

| Cost | Whole life insurance is more expensive than term life insurance. |

What You'll Learn

Whole life insurance is portable and permanent

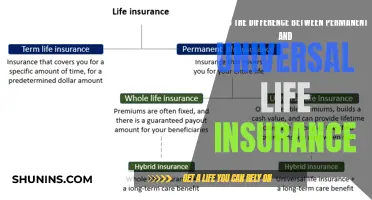

Whole life insurance is a permanent life insurance policy that provides coverage for the entire life of the insured person. It is a popular choice for those seeking lifelong coverage and offers several benefits, such as guaranteed death benefits, tax advantages, and cash value accumulation.

One of the key advantages of whole life insurance is its portability and permanence. Unlike term life insurance, which is limited to a specific term, whole life insurance offers permanent coverage that lasts for the insured's lifetime. This means that as long as the policyholder continues to pay the premiums, the coverage will remain in effect until their death. This permanence provides peace of mind and ensures that loved ones are financially protected, regardless of when the insured person passes away.

The portable nature of whole life insurance enhances its flexibility. Policyholders can take their whole life insurance policy with them as they transition through different life stages or change jobs. This portability ensures continuous coverage and eliminates the need to worry about losing insurance protection due to changes in employment or other life circumstances.

Whole life insurance also offers the benefit of guaranteed death benefits. The death benefit amount is established when the policy is issued and remains unchanged as long as the policy remains active. This provides certainty and assurance that the beneficiary will receive a predetermined payout upon the insured's death.

In addition to the death benefit, whole life insurance features a cash value component. The policy owner can access this cash value by withdrawing or borrowing against it during their lifetime. The cash value grows in a tax-deferred account, allowing tax-free accumulation. This feature makes whole life insurance a useful investment tool, as the cash value can be utilized for various purposes, such as supplementing retirement income or making large purchases.

Whole life insurance is a popular choice for individuals seeking lifelong coverage and those with dependents or financial obligations who want to ensure their loved ones are provided for. While it tends to have higher premiums compared to term life insurance, the permanence, portability, guaranteed death benefits, and cash value accumulation make it a valuable option for long-term financial planning and protection.

Selling Life Insurance in Texas: A Guide to Success

You may want to see also

Employees can decide on coverage amount

Whole life insurance is a type of permanent life insurance that covers the insured for their entire life. It is typically more expensive than term life insurance, but it offers a guaranteed death benefit and a savings component known as the cash value, which the policyholder can draw on or borrow from. The cash value typically earns a fixed rate of interest, and withdrawals up to the value of the total premiums paid are tax-free.

When it comes to employees deciding on their coverage amount, there are a few factors to consider. Firstly, it's important to assess their financial situation, including their salary, dependents, budget, and any other financial obligations. This will help determine how much coverage they need and how much they can afford. For example, if an employee has a spouse, children, or other dependents who rely on their income, they may require a higher coverage amount to provide for their needs in the event of their death. On the other hand, if an employee has no dependents or has alternative plans for providing for their dependents, they may need a lower coverage amount.

Another factor to consider is the employee's health status. If they have a serious medical condition, they may need a higher coverage amount to ensure their dependents are taken care of if their health declines. Additionally, the employee's age will impact the cost of coverage, with older employees typically paying higher rates than younger ones.

When deciding on the coverage amount, employees should also take into account any existing life insurance policies they have, including the group life insurance offered by their employer. Group life insurance is often provided as a workplace perk, with employers subsidising some or all of the benefits. However, the coverage amounts are usually capped at low amounts, such as one to two times the employee's annual salary. Employees may have the option to purchase supplemental life insurance through their workplace plans, but even with this additional coverage, they may still not have enough protection to meet their financial needs.

Therefore, it is recommended that employees consider purchasing a separate individual policy to complement the group life insurance provided by their employer. This will give them the flexibility to customise their coverage based on their specific needs and goals. They can decide on the amount of coverage they require and choose from different types of policies, such as term life or whole life insurance. By seeking guidance from a financial professional, employees can make informed decisions about their coverage amount and ensure they have adequate protection for themselves and their loved ones.

Life Insurance License: Foreclosure Impact on Health Coverage

You may want to see also

Premiums are locked in

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the insured person's life. It is often more expensive than term life insurance due to its lifelong coverage and its accumulation of cash value.

Whole life insurance policies feature level premiums, meaning the amount paid every month will not change. This is in contrast to term life insurance, where premiums increase at every renewal as the insured person grows older. Whole life insurance premiums are typically fixed at the outset and will not vary over the insured person's lifetime.

Whole life insurance policies are permanent and remain in force for the duration of the insured person's life, as long as premiums are paid. The premiums are locked in for the life of the policy, and the policy will stay in effect until the insured person passes away or until it is cancelled. This is unlike term life insurance, which only covers a specific number of years and must be renewed periodically.

The locked-in premiums of whole life insurance policies provide certainty and peace of mind, as the insured person knows exactly how much they will be paying at any given time. This can aid in financial planning and budgeting, as there are no unexpected increases in premiums.

Additionally, the locked-in premiums contribute to the policy's overall value. Whole life insurance policies are often chosen for their ability to provide lifelong coverage, and the fixed premiums ensure that this coverage is maintained without sudden increases in cost. This feature also makes whole life insurance policies attractive to those who wish to use them as investment vehicles, as the consistent premiums allow for more accurate projections of the policy's cash value over time.

While whole life insurance offers locked-in premiums, it is important to note that the premiums for group life insurance, a type of insurance often provided by employers, may increase annually or every five years.

Life Insurance Proceeds: Oklahoma's Tax Laws Explained

You may want to see also

Whole life insurance has a cash value

Whole life insurance is a type of permanent life insurance that provides coverage throughout the life of the insured person. It is different from term life insurance, which only covers a specific number of years. Whole life insurance has a cash savings component, known as the cash value, which the policy owner can draw on or borrow from.

The cash value of a whole life insurance policy grows over time and can be used as an investment-like savings account. It is a permanent life insurance policy, which means it can remain in effect until the policyholder dies, as long as the premiums are paid. The cash value typically earns interest or investment gains and grows tax-deferred. This means that the IRS doesn't take a cut as the cash value grows.

Whole life insurance policies are more expensive than term life insurance policies, with higher premiums to cover the cost of insurance and provide a cash value. The cash value of a whole life policy typically earns a fixed rate of interest, although some policies may offer a variable rate based on investment returns and interest rate fluctuations.

The cash value of a whole life insurance policy can be accessed in several ways:

- Withdrawing funds: The policyholder can withdraw funds from the cash value, up to the amount of the total premiums paid, tax-free. Withdrawing more than this amount will be taxable.

- Borrowing against the cash value: The policyholder can borrow money against the cash value, with the loan amount accruing interest until it is paid back in full. Policy loans are not taxed.

- Surrendering the policy: The policyholder can cancel the policy and receive the accumulated cash value, minus any surrender or termination fees.

- Covering premium payments: The policyholder can use the cash value to pay their monthly premium payments.

It's important to note that withdrawals and outstanding loan balances will reduce the death benefit paid out to beneficiaries. Additionally, if the cash value is withdrawn or borrowed against, the policy may lapse or terminate if the remaining cash value falls below a certain level.

Whole life insurance with a cash value component offers advantages such as lifetime coverage, a guaranteed death benefit, predictable premium payments, and the ability to use the cash value for loans or withdrawals. However, it also has disadvantages, including higher costs compared to term life insurance, slower cash value growth, and limited flexibility in adjusting premiums and the death benefit.

Life Insurance Beneficiaries: Earned Income or Not?

You may want to see also

Whole life insurance is a good supplement to group life insurance

Secondly, whole life insurance has a cash savings component, known as the cash value, which policyholders can borrow against or withdraw from during their lifetime. This feature adds flexibility and can be particularly useful for employees who want to supplement their income or make large purchases.

Thirdly, whole life insurance guarantees a fixed premium and death benefit amount, providing stability and predictability for employees. In contrast, group life insurance premiums can fluctuate based on decisions made by the employer or changes in the insurance market.

Additionally, whole life insurance does not require a medical examination for enrollment, making it accessible to employees with health conditions that might otherwise disqualify them from individual coverage. This feature also simplifies the enrollment process, as employees do not need to undergo medical underwriting.

Finally, whole life insurance can serve as an investment for employees. The cash value of a whole life policy can grow over time, providing a financial return in addition to the death benefit. This feature distinguishes whole life insurance from term insurance, which only provides a death benefit with no investment component.

Life Insurance: Age is Just a Number

You may want to see also