Life insurance is intended to provide financial security for a person's loved ones after they pass away. However, in some cases, creditors may be able to go after the benefits of a life insurance policy to pay off any outstanding debts. So, can life insurance be garnished in California?

| Characteristics | Values |

|---|---|

| Can life insurance be garnished for debt in California? | It depends. If the insured person has passed away, there is a chance that creditors will be able to go after the benefits of the life insurance policy to pay off debts. |

| Who is a life insurance beneficiary? | The person or entity that receives the death benefit from a life insurance company after the insured person passes away. |

| Who can be a life insurance beneficiary? | A beneficiary can be a person, such as a spouse or a child, or an entity, such as a trust or charity. |

| Can a beneficiary be changed? | Yes, the policy owner can change the beneficiary at any time by updating the policy. |

| What happens if there is no beneficiary? | The death benefit will be paid according to the policy provisions regarding beneficiaries. |

| Can a beneficiary be contested? | Yes, this can occur if there are questions about the validity of the beneficiary designation or if a beneficiary is accused of exerting undue influence over the policyholder. |

| What is the California Life & Health Insurance Guarantee Association? | An association of all insurance companies licensed to sell life insurance, health insurance, and annuities in California. |

What You'll Learn

Life insurance and debt

Life insurance is intended to provide financial security for a person's loved ones after they pass away. However, in some cases, creditors may be able to access the benefits of a life insurance policy to pay off any outstanding debts. Whether or not life insurance can be garnished for debt depends on the state in which the policy was taken out.

In California, life insurance beneficiary designations can be governed by policy provisions, state and federal laws. The owner of the policy can change beneficiaries at any time during the life of the policy, but they must comply with the insurance company's procedures for doing so. If the insured person passes away and the policy does not have a valid beneficiary designation, the death benefit will be paid according to the policy provisions regarding beneficiaries.

In California, if a spouse is named as a beneficiary on a life insurance policy, divorce does not automatically revoke the beneficiary designation. Instead, the former spouse will remain as a valid beneficiary until the policy owner actively changes the designation. This is further complicated by California's community property laws, which state that each spouse owns an equal, undivided interest in all assets acquired during the marriage. As such, the value of a whole life insurance policy may be considered marital property, and the former spouse may be entitled to half its value in a divorce.

If the insured person has any outstanding debts when they pass away, there is a chance that creditors will be able to access the benefits of their life insurance policy to pay off these debts. However, this is not always the case, and it is important to note that life insurance itself cannot be garnished. Instead, if the courts are aware that a beneficiary has received a death benefit, they may go after their bank accounts or salary.

To protect your life insurance policy and named beneficiaries from creditors, it is recommended that you speak to your insurance agency to find out what options are available.

Life Insurance Payouts: Can Your Ex-Spouse Claim Them?

You may want to see also

Life insurance and divorce

In California, life insurance policies are considered community property, which means that they are owned jointly by both spouses. This is true even if only one spouse is the policyholder and the other is the beneficiary. In the event of a divorce, the policy is typically classified as community property, and each spouse is entitled to half of its value. However, if the policy was purchased using one spouse's separate property (such as an inheritance or assets acquired before the marriage), then it may be considered separate property, and the named beneficiary would receive the full death benefit.

It's important to note that a divorce decree does not automatically remove an ex-spouse as a beneficiary on a life insurance policy. If the insured person wishes to remove their ex-spouse as a beneficiary, they must take explicit action to do so. Otherwise, the ex-spouse may still be entitled to collect the death benefit, even if they are no longer married to the insured person.

In some cases, a court may order a spouse to maintain a life insurance policy with their ex-spouse or children as beneficiaries, especially if there is a need for ongoing alimony or child support payments. This is more likely to occur if there is a significant financial disparity between the spouses or if the supporting spouse is in poor health.

To protect your interests and ensure a fair division of assets during a divorce, it is recommended to consult with a divorce lawyer who can help navigate the complex laws surrounding life insurance and community property in California.

Terminating Irrevocable Life Insurance Trusts: Is It Possible?

You may want to see also

Choosing a beneficiary

When you apply for a life insurance policy, you will be asked to choose a beneficiary. This is the person or entity that will receive the death benefit from a life insurance company after you pass away. The beneficiary can be a person, such as a spouse or child, or an entity, such as a trust or charity. You can name one or more beneficiaries, and you can change your beneficiary at any time by updating your policy.

It is important to choose your beneficiary carefully and keep your beneficiary designations up to date, especially after major life events such as marriage, having children, or divorce. Failure to do so may result in your assets being distributed to unintended individuals.

In California, life insurance beneficiary designations can be governed by policy provisions, state and federal laws. For example, if you get divorced, you should send a copy of the divorce decree to your insurance company to ensure they update the record. If your ex-spouse is still listed as your beneficiary, you should rename them as your 'former spouse' to avoid issues if someone tries to challenge the beneficiary designation following your death.

If you do not name a beneficiary, it may be unclear who is entitled to the funds, which can delay the benefit payment. In the case of retirement accounts like a 401(k), your assets will likely be held in probate – a legal process where a court has to sort out your financial situation and determine how to distribute your assets.

To name a beneficiary, most financial services companies provide a form or website for you to fill out. If you have life insurance through your employer, they may keep your beneficiaries on file for all of your employee benefits. If you have investments, retirement accounts, or life insurance through a financial professional, check with them to ensure they have your beneficiaries on file.

When naming your beneficiary, be specific and provide as much information as possible. Most beneficiary designations will require you to provide a person's full legal name and their relationship to you. Some designations also include information such as mailing address, email, phone number, date of birth, and Social Security number.

Almost anyone can be named as a beneficiary, but your state of residence or benefits provider may restrict who you can name. Make sure you research your state's laws before naming your beneficiary. In some states, you may be required to list your spouse as your primary beneficiary.

Protecting your life insurance from creditors

In some states, life insurance is protected from creditors; in other words, creditors cannot garnish the benefits of your policy to pay for your outstanding debts. However, this is not always the case, and it depends on the state you live in.

If you have named your estate as the beneficiary of your life insurance, or if the beneficiary you have named has passed away, your life insurance payouts are particularly vulnerable to creditors. There is a chance that the assets listed in your estate will need to be liquidated to pay off any outstanding debts, which could include your life insurance.

To find out how you can protect your life insurance and your named beneficiaries from creditors, speak to your insurance agency. There may be ways to ensure that the payout from your policy will not be used to pay off debt.

Insuring Life: Understanding the Basics of Coverage and Benefits

You may want to see also

Spousal beneficiaries

In California, spousal beneficiaries of life insurance policies can be a complex issue, especially when divorce is involved. Here are some key points to consider regarding spousal beneficiaries in California:

Community Property Laws

California is a community property state, which means that any property acquired during a marriage is generally considered to be owned equally by both spouses. This has important implications for life insurance policies. If the policy was purchased with community funds during the marriage, the spouse may be entitled to a portion of the life insurance proceeds, even if they are not named as a beneficiary. This is because the spouse has a community property interest in the policy.

Divorce and Beneficiary Changes

Divorce can significantly complicate life insurance beneficiary designations. In California, unlike some other states, divorce does not automatically revoke a spouse's beneficiary status. The former spouse will remain as a valid beneficiary until the policy owner takes affirmative action to change the designation. This means that if the insured person passes away without updating their beneficiary, their ex-spouse may still receive the death benefit.

Impact of Divorce Settlements

The division of assets during divorce can further complicate life insurance beneficiary designations. If life insurance premiums were paid from joint funds during the marriage, an ex-spouse may be entitled to a payout or death benefits, even if they are not named as a beneficiary. This is because the value of a whole life insurance policy may be considered marital property, and the former spouse could be entitled to half its value as part of the divorce settlement.

Group Life Insurance Policies

Group life insurance policies, often offered as an employment benefit, are subject to the Employee Retirement Income Security Act (ERISA), a federal law. In cases where there is a conflict between California state law and ERISA, the federal law controls. This means that the beneficiary designation on an ERISA-governed policy will be honoured, regardless of how state law might treat it differently after a divorce.

Contesting a Beneficiary

It is possible for someone to contest a life insurance beneficiary designation, particularly if there are questions about the validity of the designation or if undue influence is suspected. For example, if the insured person made a last-minute change or was mentally incapacitated when the designation was made. These disputes can result in lengthy and expensive legal battles, so it is crucial to seek qualified legal advice.

In summary, spousal beneficiaries of life insurance policies in California can be a complex issue, especially when divorce is involved. State laws, the type of policy, and the way premiums are paid all play a role in determining beneficiary rights. It is essential to understand these factors and consult with an experienced attorney to ensure compliance with California's life insurance beneficiary laws.

Lincoln Heritage Life Insurance: Drug Testing Policy Explained

You may want to see also

ERISA and California life insurance

ERISA, or the Employee Retirement Income Security Act of 1974, is a federal statute that governs certain types of employee benefits, including life, health, and disability insurance policies. It sets minimum standards for most voluntarily established retirement and health plans in private industries to provide protection for individuals in these plans.

ERISA requires plans to provide participants with plan information, including important details about plan features and funding. It also establishes fiduciary responsibilities for those who manage and control plan assets, and requires plans to establish a grievance and appeals process for participants to obtain benefits. Additionally, ERISA gives participants the right to sue for benefits and breaches of fiduciary duty.

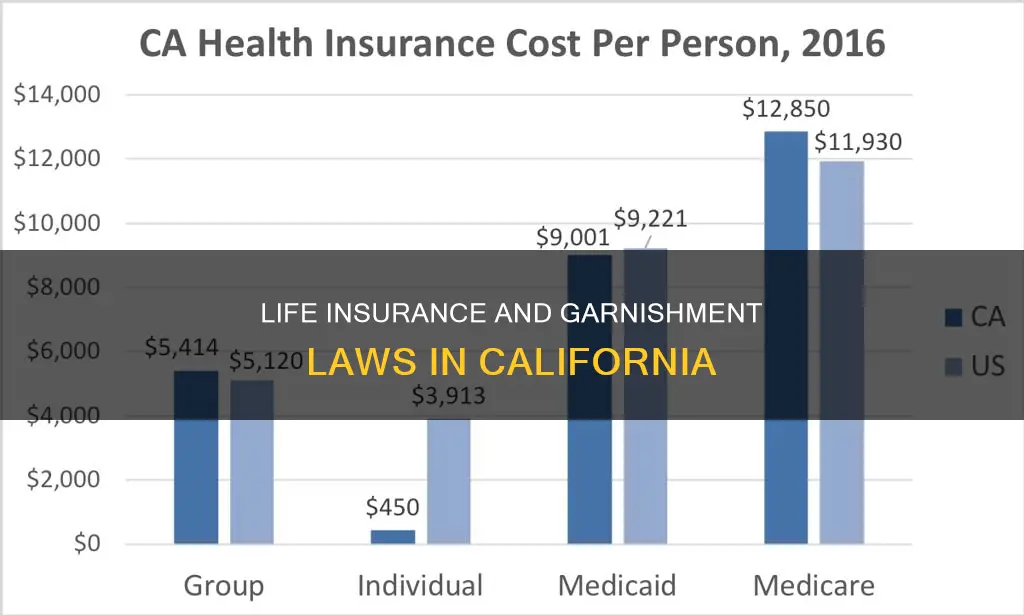

In the context of life insurance, ERISA typically applies to "group" policies provided by employers, which cover employees working at least 30 hours per week. These policies are most often subject to ERISA, whereas "individual" policies, purchased without an employer's involvement, are typically not.

In California, the application of ERISA to life insurance can be further complicated by the state's community property laws, which consider each spouse to have an equal, undivided interest in assets acquired during the marriage. As a result, the value of a whole life insurance policy may be considered marital property, with the former spouse entitled to half its value in a divorce.

However, when there is a conflict between California law and ERISA regarding an ERISA-governed plan, federal law controls. Therefore, the beneficiary designation on a life insurance policy governed by ERISA would be honoured, even if it conflicts with California's community property laws or other state regulations.

It is important to note that ERISA does not cover all group health plans. Specifically, it does not apply to plans provided by governmental entities, churches, or religious organizations, unless they opt into ERISA. Additionally, ERISA does not cover plans maintained solely to comply with workers' compensation, unemployment, or disability laws, nor does it cover plans maintained outside the United States for non-resident aliens or unfunded excess benefit plans.

Life Insurance Proceeds: Taxable in South Africa?

You may want to see also

Frequently asked questions

Life insurance itself cannot be garnished, but if the courts are aware that you are receiving a death benefit, they may go after your bank accounts. If you have outstanding debts, there is a chance that creditors will be able to go after the benefits of your life insurance policy to pay them off.

The California Life & Health Insurance Guarantee Association is an association of all insurance companies licensed to sell life insurance, health insurance, and annuities in California. It provides limited protection to policyholders when an insurance company licensed in California to sell life insurance, health insurance, and annuities becomes insolvent.

The California Life and Health Insurance Guarantee Association provides limited protection of your life, health, and annuity benefits if, when your insurance company becomes insolvent, you are a California resident policyholder or the beneficiary, assignee, or payee of such a policyholder, regardless of your residency.