Medicaid, a government-funded health insurance program, often plays a crucial role in providing healthcare coverage to low-income individuals and families. However, when it comes to insurance coverage, there can be some confusion regarding the status of Medicaid as a primary or secondary insurance. In this context, we will explore the possibility of Medicaid serving as a primary insurance and its implications for healthcare coverage and reimbursement. Understanding these nuances is essential for healthcare providers, policymakers, and individuals seeking comprehensive insurance solutions.

| Characteristics | Values |

|---|---|

| Medicaid as Primary Insurance | Yes, Medicaid can be designated as the primary insurance, especially in states that have expanded Medicaid under the Affordable Care Act. |

| Coverage for Low-Income Individuals | Medicaid provides essential health coverage for low-income individuals, pregnant women, children, the elderly, and people with disabilities. |

| Coordination with Other Insurance | When Medicaid is the primary insurance, it coordinates with other insurance plans to ensure comprehensive coverage for beneficiaries. |

| Cost-Sharing and Copayments | Medicaid typically covers a significant portion of medical expenses, and beneficiaries may have lower cost-sharing requirements compared to private insurance. |

| State Flexibility | States have some flexibility in designing their Medicaid programs, including the option to make Medicaid the primary insurance for certain populations. |

| Dual Eligibility | Some individuals may be eligible for both Medicaid and Medicare, and Medicaid can serve as the primary insurance in these cases. |

| Marketplace Coverage | In some cases, individuals may purchase coverage through the health insurance marketplace, and Medicaid can still be the primary insurance if it provides better coverage. |

| Income and Asset Limits | Medicaid eligibility is based on income and asset limits, ensuring that only those with limited financial resources receive coverage. |

| Continuous Enrollment | Medicaid beneficiaries generally maintain continuous enrollment, ensuring consistent access to healthcare services. |

| State-Specific Variations | The specifics of Medicaid coverage and eligibility can vary by state, including the option to make Medicaid the primary insurance. |

What You'll Learn

- Medicaid Coverage: Understanding eligibility and benefits as primary insurance

- Coordination with Other Plans: How Medicaid interacts with secondary insurance

- Enrollment Process: Steps to enroll in Medicaid as primary coverage

- Coverage Gaps: Potential gaps in benefits when Medicaid is secondary

- Policy Variations: State-specific rules regarding primary and secondary insurance

Medicaid Coverage: Understanding eligibility and benefits as primary insurance

Medicaid is a federal and state-funded health insurance program designed to provide coverage to low-income individuals and families. It is a joint federal-state program, meaning that while the federal government sets the overall guidelines, states have the flexibility to administer and tailor the program to their specific needs. This flexibility allows Medicaid to be a dynamic and adaptable insurance option, offering a range of benefits to eligible citizens.

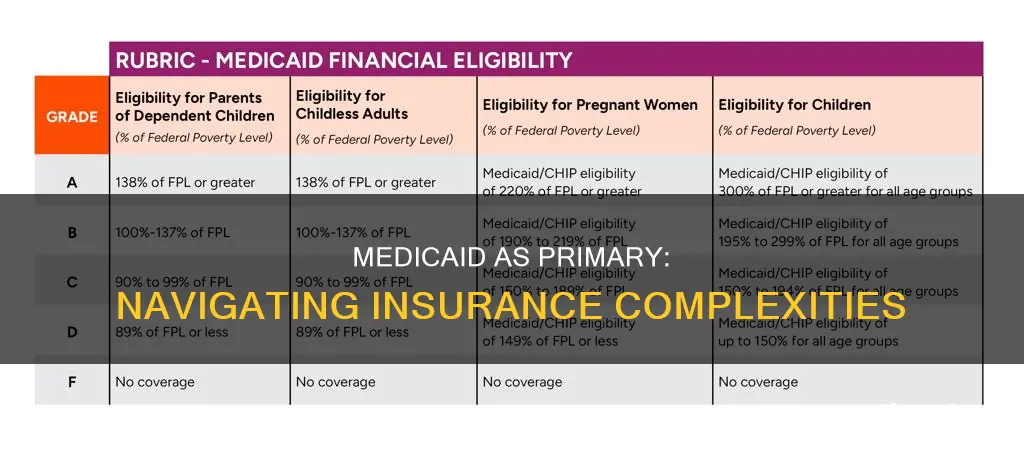

Eligibility for Medicaid is primarily based on income and asset levels, with the specific criteria varying by state. Generally, individuals and families with incomes below a certain threshold are eligible for Medicaid coverage. This threshold is often set at a percentage of the federal poverty level, ensuring that those with limited financial resources can access healthcare services. Additionally, certain categories of individuals, such as pregnant women, children, and the elderly, may qualify for Medicaid regardless of their income, as they are considered high-risk populations.

When it comes to primary insurance, Medicaid can indeed be considered a primary coverage option. This is because Medicaid often serves as the primary payer for eligible individuals, covering a comprehensive range of medical services. These services typically include doctor visits, hospital stays, emergency room visits, prescription drugs, and even long-term care. The program ensures that enrollees have access to essential healthcare, often providing coverage for services that might otherwise be unaffordable.

One of the key advantages of Medicaid as primary insurance is its ability to fill gaps in coverage. Many individuals with private insurance may still face out-of-pocket expenses, copayments, and deductibles. Medicaid, however, often covers these costs, ensuring that enrollees receive necessary medical care without incurring significant financial burdens. This comprehensive coverage can be particularly beneficial for those with chronic conditions or complex medical needs.

Understanding the eligibility criteria and benefits of Medicaid is crucial for those seeking primary insurance coverage. It is essential to review the specific requirements and guidelines set by your state's Medicaid program. By doing so, individuals can determine their eligibility and explore the various coverage options available to them. Medicaid's role as a primary insurance provider highlights its importance in ensuring access to healthcare for vulnerable populations, offering a safety net that complements other insurance options.

Unraveling Acupuncture Coverage: Medical Insurance Insights

You may want to see also

Coordination with Other Plans: How Medicaid interacts with secondary insurance

Medicaid, a joint federal and state program, often works in conjunction with other insurance plans, such as private health insurance or Medicare. When an individual has both Medicaid and another insurance plan, the coordination of these plans is crucial to ensure that the individual receives the necessary healthcare services without any gaps in coverage. This coordination is particularly important to understand when considering the primary and secondary insurance status.

In many cases, Medicaid is designed to be the primary payer for eligible individuals, covering essential health services and providing comprehensive benefits. However, when an individual also has secondary insurance, such as employer-sponsored coverage or private insurance, the coordination process becomes essential. The primary insurance, in this scenario, would be the secondary plan, while Medicaid takes on a secondary role. This means that the secondary insurance plan will typically pay for covered services after Medicaid has made its payment or reimbursement.

The coordination process involves several key steps. Firstly, the individual must ensure that their secondary insurance plan is aware of their Medicaid coverage. This can often be facilitated by the healthcare provider or the individual's primary care physician, who can guide them through the necessary steps to inform the secondary insurance provider. Once this information is shared, the secondary insurance plan will review the services provided and determine if they are covered under their policy. If so, they will make the necessary payments to the healthcare provider, and Medicaid will step in to cover any remaining costs.

This coordination is vital to ensure that individuals receive the full range of benefits they are entitled to. For example, if an individual has a high-deductible health plan (HDHP) as their secondary insurance, they may need to pay a significant portion of the costs out-of-pocket before the insurance kicks in. In such cases, Medicaid can provide the necessary coverage to fill the gap, ensuring that the individual can access essential healthcare services without incurring substantial financial burdens.

Understanding the coordination process between Medicaid and secondary insurance plans is essential for both individuals and healthcare providers. It ensures that individuals receive the appropriate care and that the healthcare system operates efficiently, utilizing the strengths of each insurance plan to provide comprehensive coverage. By being aware of these interactions, individuals can navigate the healthcare system more effectively and make informed decisions regarding their insurance coverage.

Is Medico Insurance Worth It? Unlocking the Benefits

You may want to see also

Enrollment Process: Steps to enroll in Medicaid as primary coverage

The process of enrolling in Medicaid as your primary insurance involves several steps, and understanding these steps is crucial to ensure a smooth transition to this public health coverage. Here's a detailed guide on how to navigate the enrollment process:

Step 1: Determine Eligibility

Before initiating the enrollment, it's essential to understand your eligibility for Medicaid. Medicaid eligibility criteria vary by state, so you need to check your state's specific requirements. Factors such as income, household size, age, and disability status play a significant role in determining eligibility. You can visit your state's official Medicaid website or contact their customer service to gather information about the eligibility guidelines.

Step 2: Gather Required Documents

Medicaid enrollment typically requires a set of documents to verify your identity, income, and residency. Common documents include birth certificates, social security cards, proof of income (such as pay stubs or bank statements), and identification cards. Make a list of these documents to ensure you have everything ready for the application process.

Step 3: Complete the Application

You can apply for Medicaid online, by mail, or in-person at your local Medicaid office. The application form will ask for detailed information about your personal and financial circumstances. Be accurate and honest in your responses, as providing false information can lead to penalties and legal consequences. If you prefer, you can also seek assistance from a local Medicaid representative who can guide you through the application process.

Step 4: Submit Required Proof

Along with the application, you'll need to submit the supporting documents mentioned earlier. Ensure that these documents are up-to-date and relevant to your current situation. If you have any challenges in obtaining certain documents, reach out to the Medicaid office for guidance on alternative options or temporary solutions.

Step 5: Wait for Approval

After submitting your application and documents, the Medicaid agency will review your case. This process may take some time, and you will receive a notification regarding the status of your application. If approved, you will be provided with an effective date for your Medicaid coverage, and if denied, you will be informed of the reasons and any available appeal options.

Step 6: Understand Your Coverage

Once enrolled, take the time to understand the specific coverage provided by Medicaid. Different states offer various benefits, including doctor visits, hospital stays, prescription drugs, and more. Familiarize yourself with the coverage details to ensure you know what services are covered and any potential out-of-pocket expenses you may incur.

Enrolling in Medicaid as your primary insurance is a straightforward process, but it requires careful preparation and attention to detail. By following these steps, you can ensure a smooth transition to Medicaid coverage and take advantage of the healthcare benefits it provides. Remember, each state's Medicaid program may have slight variations, so always refer to your state's specific guidelines for the most accurate information.

Medical Insurance Without a Social Security Number: Exploring Your Options

You may want to see also

Coverage Gaps: Potential gaps in benefits when Medicaid is secondary

Medicaid, a joint federal and state program, often plays a crucial role in providing healthcare coverage to millions of Americans. However, when Medicaid is designated as the secondary insurance, it can lead to potential gaps in coverage, leaving individuals with limited access to essential healthcare services. This scenario is particularly relevant when an individual's primary insurance, such as a private plan or Medicare, covers a significant portion of their medical expenses.

One of the primary concerns with Medicaid being secondary is the possibility of uncovered or under-covered services. When Medicaid steps in after another insurance, certain benefits might not be fully addressed, leading to financial burdens for the insured. For instance, if a person has a primary insurance that covers a substantial portion of their medical bills, Medicaid might not fully cover the remaining costs, leaving the individual responsible for the difference. This can result in delayed or avoided treatments, especially for chronic conditions that require ongoing care.

The gaps in coverage can extend to various healthcare services, including specialist referrals, prescription drugs, and preventive care. In some cases, primary insurance might cover a significant portion of the treatment costs, but Medicaid may not fully reimburse the healthcare provider, creating a financial incentive for providers to limit the number of Medicaid patients they treat. This situation can lead to a lack of access to specialized care, especially in areas where Medicaid providers are scarce.

Furthermore, the secondary nature of Medicaid can impact the overall quality of care. When patients have multiple insurance layers, coordination between providers and insurers becomes crucial. However, this coordination can be challenging, potentially leading to delays in treatment, missed appointments, and a lack of continuity in care. As a result, individuals might experience fragmented healthcare, which can negatively impact their health outcomes.

To address these coverage gaps, it is essential to understand the specific benefits and limitations of both primary and secondary insurance plans. Individuals should carefully review their insurance policies and be aware of the services covered by each. Additionally, healthcare providers and policymakers need to work together to ensure that Medicaid, as a secondary payer, does not inadvertently create barriers to essential healthcare services. This might involve regular reviews of coverage policies and the development of strategies to improve coordination between different insurance providers.

Medical Insurance vs. Health Insurance: Understanding the Difference

You may want to see also

Policy Variations: State-specific rules regarding primary and secondary insurance

Medicaid, a joint federal and state program, often plays a crucial role in providing healthcare coverage to eligible individuals. When it comes to insurance coverage, the concept of primary and secondary insurance becomes relevant, especially in the context of Medicaid. The rules regarding which insurance is considered primary and which is secondary can vary significantly from state to state, impacting how individuals access healthcare services.

In some states, Medicaid is designed to be the primary payer for eligible beneficiaries. This means that when an individual with Medicaid receives medical services, the Medicaid program is the first to be billed for the costs. This approach ensures that individuals with Medicaid coverage have access to necessary healthcare services without incurring high out-of-pocket expenses. For example, in State A, if a Medicaid recipient visits a healthcare provider, the provider will first seek reimbursement from Medicaid, and if the services exceed the Medicaid coverage, the remaining costs may be billed to the individual's secondary insurance, if available.

On the other hand, certain states have implemented policies where Medicaid acts as a secondary payer. In these cases, the individual's private insurance or other primary insurance coverage takes precedence. This can occur when the individual has both Medicaid and private insurance, and the private insurance is considered the primary source of coverage. For instance, in State B, if a person with Medicaid also has a private health plan, the private insurance will typically be the primary payer, and Medicaid will only cover the remaining costs after the private insurance has paid its share.

The variation in these policies can significantly impact beneficiaries and healthcare providers. Individuals with Medicaid in states where it is the primary payer may have more straightforward access to healthcare, as they are less likely to face large out-of-pocket expenses. Conversely, in states where Medicaid is secondary, beneficiaries might need to navigate the complexities of coordinating benefits from multiple insurance providers. Healthcare providers also need to be aware of these state-specific rules to ensure proper billing and reimbursement processes.

Understanding these policy variations is essential for individuals and healthcare providers alike. It ensures that beneficiaries receive the appropriate level of coverage and that healthcare providers can accurately bill and manage claims. When considering Medicaid as a primary insurance option, it is crucial to research and understand the specific rules and regulations in one's state to ensure a smooth and efficient healthcare experience.

Medical Card Impact: Navigating Insurance Complexities

You may want to see also

Frequently asked questions

Yes, in many cases, Medicaid can be designated as the primary insurance, especially for individuals who meet the eligibility criteria. Medicaid is a joint federal and state program that provides healthcare coverage to low-income individuals and families. It can be the primary insurance if it covers a significant portion of the medical expenses and is the first source of payment for eligible services.

The process of making Medicaid your primary insurance typically involves enrolling in the program and providing necessary documentation to your healthcare providers. You can apply for Medicaid through your state's health insurance marketplace or by contacting your local Medicaid office. Once approved, you can notify your doctors and medical facilities to accept Medicaid as the primary payer.

There are certain restrictions and limitations to consider. Medicaid coverage may vary by state, and some services might not be fully covered or may require prior authorization. It's important to understand the specific rules and benefits provided by your state's Medicaid program. Additionally, some healthcare providers might not accept Medicaid as the primary insurance, especially for specialized or out-of-network services.

In some circumstances, you may have both Medicaid and private insurance as primary coverage. This can happen if you meet the eligibility criteria for Medicaid and also have private insurance through your employer or purchase it individually. However, the specific arrangement and payment processes will depend on the terms of your private insurance policy and the state's Medicaid guidelines.

Medicaid offers several advantages as a primary insurance option. It provides comprehensive coverage for essential health services, including doctor visits, hospitalization, prescription drugs, and preventive care. Medicaid also ensures access to healthcare for low-income individuals who might not otherwise be able to afford private insurance. The program often has lower out-of-pocket costs and can help individuals manage their medical expenses more effectively.