Yes, an employer can ask for proof of your auto insurance if you use your personal vehicle for work-related activities or drive to work. This is to ensure that your policy is up to date and legitimate, and that you meet the minimum auto coverage requirements for your state. If you are using your car for business purposes, your employer has a right to know whether you have insurance on your vehicle. However, some lawyers argue that this could be seen as subtle discrimination and may not always be enforceable.

| Characteristics | Values |

|---|---|

| Can an employer ask for proof of auto insurance? | Yes |

| When will an employer ask for proof of auto insurance? | When you drive your personal vehicle to work or for business-related purposes |

| Why would an employer need proof of auto insurance? | To confirm your policy is current and legitimate, and that you meet the minimum auto coverage requirements for your state |

| What is proof of insurance? | Documentation that proves your car insurance policy is valid and up-to-date |

| What counts as proof of insurance? | Physical or electronic proof, such as an ID card, declarations page, or digital proof with a company app |

| What is your employer trying to verify by looking at your proof of insurance? | Names of insured parties, vehicle information, policy number, policy effective and expiration dates, coverage amounts and limits |

| How much insurance coverage do employees need? | A minimum amount of liability coverage, including bodily injury liability coverage and property damage liability coverage |

What You'll Learn

Driving your personal car for work

If you are using your personal car for work, your employer may ask for proof of auto insurance. This is to ensure that you are insured while driving for work-related purposes and that you meet the minimum auto coverage requirements for your state. Driving for work-related purposes can include driving to and from work, as well as driving for business-related purposes. If you are involved in an accident while driving for work, your personal auto insurance policy may not cover any damage or accidents that occur while you are on the clock. In this case, your employer's commercial auto insurance policy may provide coverage.

If you are using your personal car for work, it is important to review your insurance policy to ensure that you are adequately covered. You may need to add commercial coverage to your primary policy or increase your coverage limits. Additionally, using your vehicle for work may impact your insurance rates, as insurance companies take into account the average daily mileage of your vehicle.

If you are an employer, it is important to understand your responsibilities when it comes to employees using their personal vehicles for work. You may be required to provide your employees with an automobile or motor vehicle allowance to help cover expenses. This allowance is taxable unless it is based on a reasonable per-kilometre rate. The Canada Revenue Agency (CRA) considers an allowance reasonable if it is based on the number of business kilometres driven in a year and if the per-kilometre rate is reasonable.

In summary, if you are using your personal car for work, it is important to ensure that you have adequate insurance coverage and understand how this may impact your insurance rates. If you are an employer, you may be required to provide allowances or reimbursements to employees who use their personal vehicles for work.

Umbrella Insurance: Auto Accident Coverage

You may want to see also

Reducing employer liability

An employer can ask for proof of an employee's auto insurance, especially if they are using their personal vehicle for work. This is to ensure the employee has an active policy and meets the minimum auto coverage requirements for their state.

If an employee is using their personal vehicle for work, the employer may be held liable for any accidents that occur during work hours. This is called vicarious liability. In such cases, the employer could be held responsible for paying the difference between what the employee's auto insurance covers and the remaining accident-related losses.

- Set a minimum required car insurance coverage for employees who drive as part of their job. A good practice is to set a 250/500/100 policy.

- Verify employees' auto insurance coverage every six months. Policies typically renew every six months, so checking at this time will ensure the employee's coverage is up to date.

- Require employees to have commercial auto insurance if they are driving their personal vehicle for work. This will ensure the employee has the proper level of insurance coverage.

- Provide a company car for employees to use for work-related tasks. This way, the employer can set the auto insurance policy and ensure sufficient coverage.

- Implement effective risk management practices, such as providing a safe working environment, ensuring employees receive proper training, and following health and safety regulations.

Vehicle Weight and Insurance: Maximum Limit?

You may want to see also

Proof of insurance documentation

- The name and address of the insurance company

- The effective date and expiration date of the policy

- The policy number and National Association of Insurance Commissioners (NAIC) number

- The policyholder's first and last name

- The insured vehicle's year, make, model, and vehicle identification number (VIN)

In addition to the standard proof of insurance, some drivers may need an SR-22 form, also known as a certificate of financial responsibility. This form is typically required for drivers who have been convicted of a DUI or DWI, have had multiple speeding tickets, or have a hardship license. It is important to note that the SR-22 is not a separate insurance policy but a form that must be filed electronically or through mail to prove that the minimum auto liability requirements are met.

You can obtain proof of insurance from your insurance company after purchasing a policy. Most companies provide immediate proof through fax or email, and many also offer electronic access through mobile apps. It is essential to keep a copy of your proof of insurance in your vehicle, as you may need to show it to your employer, law enforcement, or the department of motor vehicles.

Lyft Auto Insurance: Claims and Denials

You may want to see also

Commercial auto insurance

The cost of commercial auto insurance varies depending on factors such as the type of business, the number and type of vehicles, driving records of employees, and the location of the company. It is important to note that personal auto insurance policies typically do not cover vehicles used for commercial purposes, so a separate commercial policy is necessary.

In summary, commercial auto insurance is crucial for businesses that rely on vehicles to protect themselves from financial losses, liability claims, and vehicle damage. By having the appropriate coverage, businesses can ensure that their vehicles, employees, and operations are adequately protected.

BMW Gap Insurance: What You Need to Know

You may want to see also

Minimum coverage requirements

Nearly all states in the U.S. require drivers to have a minimum amount of car insurance to drive on public roads legally. This generally includes bodily injury liability and property damage liability but may also include other types of coverage, depending on the state.

Bodily Injury Liability

If you cause an accident with another driver or pedestrian, bodily injury liability coverage will help pay for medical expenses related to the other person’s injuries. It may also cover your legal fees if the other person sues you for their losses.

Property Damage Liability

Property damage liability coverage is designed to pay toward property damage that you cause to others. For example, if you hit another vehicle on the road, your property damage liability insurance could help pay for the other vehicle’s repairs.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage offer financial protection in the event that you get into an accident with a driver who is uninsured or does not have enough coverage to pay for your losses.

Personal Injury Protection Coverage

Personal injury protection is a requirement in states that have no-fault laws. If you get into an accident, PIP can pay for your medical bills, lost wages, rehabilitation costs and related expenses, regardless of who caused the accident. This coverage can also be purchased in some at-fault states.

Medical Payments Coverage

Medical payments coverage may help pay your medical expenses following an accident but is typically not as robust as PIP. It is generally considered optional coverage. However, a few states do require drivers to carry medical payments coverage.

The minimum amount of coverage per person and per accident is different depending on your location. To find the exact minimum coverage auto insurance requirements in your state, you can visit your state’s Department of Insurance website or contact your auto insurer.

Auto Insurance: Aunt's Policy Extension

You may want to see also

Frequently asked questions

Yes, your employer can ask for proof of your auto insurance, especially if you drive your personal vehicle for work.

Employers are primarily concerned with protecting themselves and their business from liability or financial responsibility if you are involved in a crash during work hours. They will also want to ensure that you are adhering to the minimum coverage rules in your state.

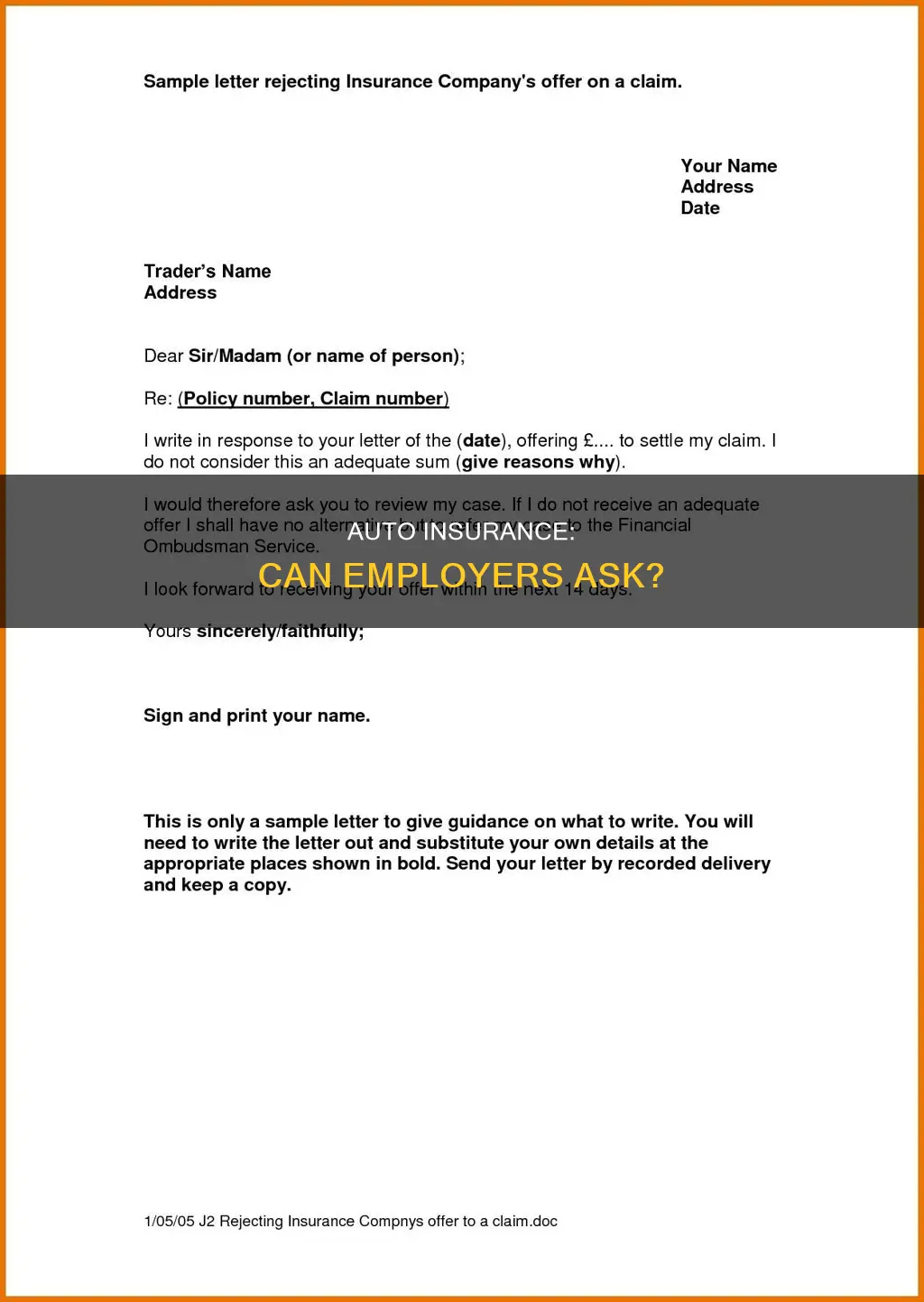

You can provide physical proof of insurance with an ID card or a letter. You can also provide digital proof with an app.

To ensure your policy is up-to-date, your employer may ask for proof of insurance on a bi-annual or semi-annual basis.