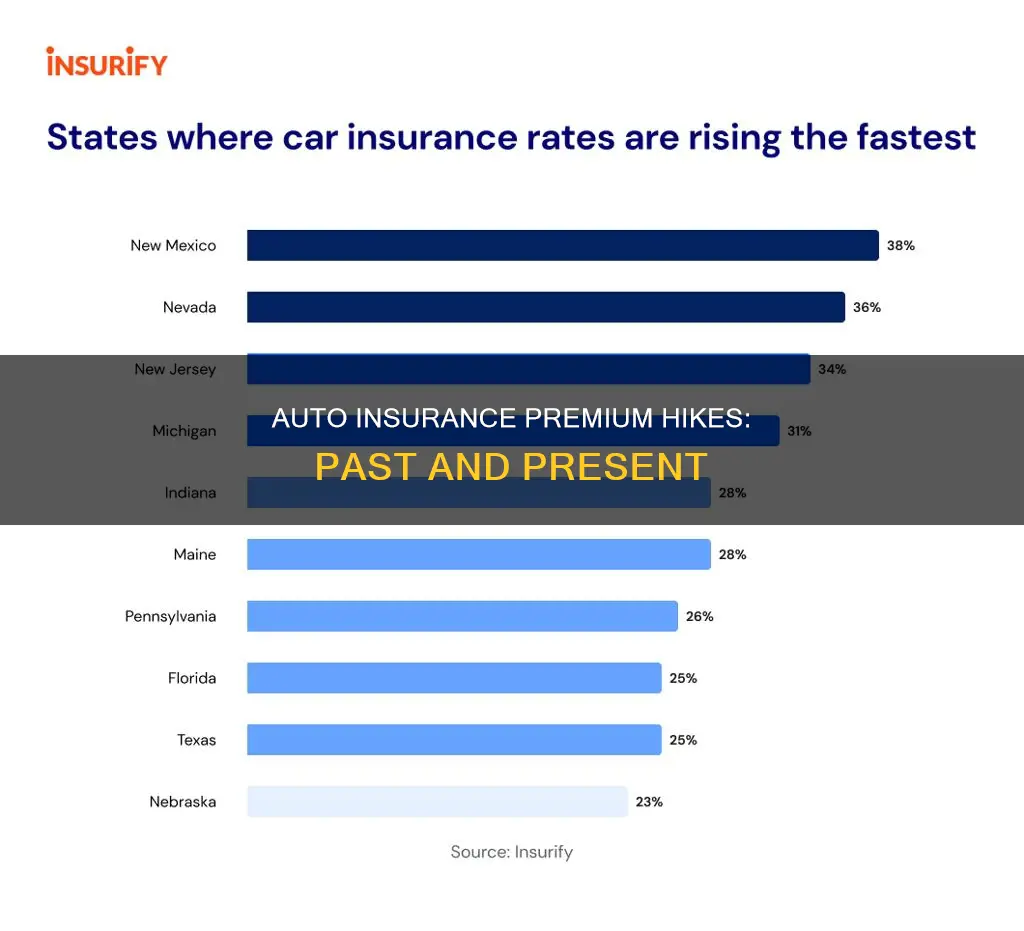

There are many reasons why past premiums on auto insurance can be raised. For example, driving behaviour such as receiving speeding tickets or being at fault in an accident can cause insurance providers to raise your rate when it's time to renew your insurance. Other reasons include the make and model of your car, your age, gender, and credit score. Additionally, factors outside of your control, such as an increase in claims in your area or higher car repair costs, can also lead to higher premiums.

| Characteristics | Values |

|---|---|

| Accidents | Even if the accident wasn't your fault, insurers may see you as a high-risk driver. |

| Tickets | Speeding tickets and other moving violations can increase your premium. |

| Claims History | A history of claims increases the odds that you'll make another one. |

| Credit Score | People with low credit scores are deemed more likely to get into accidents. |

| Vehicle Type | The make and model of your vehicle can determine expected repair costs and theft rates. |

| Location | An uptick in claims in your area could cause your rate to rise. |

| Inflation | When the cost of goods and services increases, insurance companies may increase prices. |

| Discounts | Your rate may increase when a discount deal expires. |

| Additional Drivers | Adding a new driver to your policy will likely increase your rate due to the added risk. |

| Coverage | Any changes in your coverage can change your rate. |

What You'll Learn

Driving behaviour

Speeding

Frequent speeding can increase your premium. Speeding tickets and other moving violations indicate a higher risk of accidents, leading to a higher premium.

Braking

Sudden or hard braking is often considered an indicator of risky driving behaviour. This can also lead to higher premiums as it suggests a higher likelihood of accidents or abrupt driving patterns.

Time of Day

Driving at night is generally seen as riskier due to reduced visibility and higher chances of fatigue. As a result, insurers may increase premiums for those who frequently drive during nighttime hours.

Accidents and Claims

Being involved in accidents, regardless of fault, can impact your premium. Insurers view accidents as indicators of higher risk, even if you were not at fault. Additionally, filing comprehensive claims for incidents like car theft, vandalism, or weather-related damage can also lead to higher premiums.

Vehicle Type

The make and model of your vehicle can affect your premium. More expensive or high-performance cars tend to have higher premiums due to increased repair or replacement costs and a higher risk of theft.

Location

Living in an area with a high number of claims can increase your premium. This is because insurers consider the overall risk of the region when determining rates, and a higher number of claims indicates a greater chance of future incidents.

Demographics

Personal factors such as age, gender, and credit score can influence your premium. For example, younger or older drivers may be considered higher-risk and have higher premiums. Additionally, factors like your credit score can impact your insurance rate, with a higher score potentially leading to lower premiums.

Additional Drivers

Adding new drivers to your policy can increase your premium due to the added risk. The age and driving history of the additional driver will be considered, and teen drivers or those with a poor driving record may result in a higher premium.

Discounts and Loyalty

Insurers may offer discounts for various reasons, such as safe driving records, low mileage, or loyalty to the company. These discounts can help lower your premium. However, if you no longer qualify for a discount, your premium may increase.

Telematics Programs

Telematics programs track your driving behaviour through mobile apps or devices installed in your car. These programs can offer significant savings, up to 30-40%, for safe driving habits. However, they also raise privacy concerns, as your driving habits may be tracked in ways you don't realise.

In conclusion, driving behaviour is a critical factor in determining auto insurance premiums. Insurers assess factors like speeding, braking patterns, driving hours, accident history, and vehicle type to evaluate the risk level associated with insuring a particular driver. By understanding these factors, drivers can take steps to improve their driving behaviour and potentially lower their insurance costs.

Auto Insurance: Aunt's Policy Extension

You may want to see also

Claims history

When it comes to auto insurance, your claims history is a crucial factor that insurers consider when determining your premium. This history provides valuable insights into your driving behaviour and the likelihood of future claims. Here's a detailed overview of how your claims history impacts your auto insurance premium:

The Impact of Claims History

Your claims history serves as a predictor of your potential future claims. Insurance providers analyse this history to assess the risk associated with insuring you. If you have a history of frequent or costly claims, insurers may consider you a high-risk driver, which can lead to higher premiums. Conversely, a claims history demonstrating safe driving behaviour and minimal claims can work in your favour, potentially resulting in lower rates.

Nature of Claims

Not all claims are created equal. The nature and circumstances of each claim play a significant role in determining your premium. For instance, claims resulting from collisions or accidents are generally viewed differently from those related to natural causes or weather-related damage. At-fault claims, where you are deemed responsible for the incident, typically carry more weight and can lead to substantial increases in your premium. On the other hand, not-at-fault claims may have a lesser impact, but they can still result in slightly higher rates.

Timing of Claims

The timing of your claims also matters. Insurers consider how recently you've made a claim and the frequency of claims over a specific period. If your last claim was several years ago, and your driving history has improved, you may benefit from lower premiums. Conversely, multiple claims within a short period can significantly impact your rates, as insurers may view you as a higher risk.

Claim Details

Insurers delve into the specifics of your claims, including the cost of repairs, medical expenses, and the extent of damage. The higher the cost of the claim, the more likely it is to affect your premium. Additionally, your driving record, including any violations or previous accidents, is also taken into account when assessing the impact of a claim on your premium.

Impact on Premium

The exact increase in your premium due to a claim can vary. It depends on numerous factors, such as the severity of the accident, your driving history, and the insurance company's policies. In some cases, a single at-fault claim can increase your rates by an average of 28%, while minor accidents may have a less significant impact. It's important to note that these increases typically remain in effect for a few years, after which your improved driving record can help lower your premium again.

Insuring Vehicles for Transport: The Basics

You may want to see also

Credit score

In most states, insurers can legally use credit-based insurance scores when determining premiums. However, some states, including California, Hawaii, Washington, Massachusetts, and Michigan, have strict limitations or prohibitions in place regarding the use of credit information for auto insurance rates.

Credit-based insurance scores are calculated using several factors, with payment history and outstanding debt typically being the most influential. Other factors include the length of credit history, pursuit of new credit, and credit mix. It is important to note that these scores do not consider personal information such as race, income, or location.

Having a good credit score can help you secure lower insurance premiums. Conversely, a poor credit score may result in higher rates. For example, drivers with excellent credit save an average of $2,198 per year on premiums compared to those with poor credit. Improving your credit score can be beneficial in reducing insurance costs and enhancing your overall financial health.

Insuring Yourself to Drive Hospital Vehicles

You may want to see also

Vehicle type

The make and model of your vehicle, as well as its mileage, are important factors in determining your auto insurance premium. The type of car you drive will influence the cost of repairs or replacement, as well as the likelihood of it being stolen.

For example, if you purchase a more expensive car, your rate is likely to increase because it may be more desirable to thieves and cost more to repair or replace than a cheaper vehicle. The age of your car also matters, as older cars with little cash value may not benefit from comprehensive and collision coverage, especially if you have a high deductible.

Additionally, the type of fuel your car uses can impact your insurance premium. Electric vehicles, for instance, may be more expensive to insure due to the higher cost of repairs. The same may apply to hybrid vehicles, depending on the insurer.

Your vehicle's safety features and technologies can also affect your premium. Advanced safety features, such as collision avoidance systems, adaptive cruise control, and lane-keeping assist, can help reduce your premium by mitigating the risk of accidents. On the other hand, high-performance vehicles with powerful engines may result in higher premiums due to the increased risk of speeding and accidents.

It's worth noting that insurance companies may also take into account any modifications or customisations made to your vehicle, as these can impact its performance, safety, and value.

Commercial Vehicle Insurance: What You Need to Know

You may want to see also

Location

The address where your car is kept overnight can also affect your premium. If you live in an area with a high rate of theft, accident, or weather-related claims, your premium is likely to be higher, as insurance companies consider it riskier to cover drivers in these areas. Even if you have a perfect driving record, your location can still impact your premium.

The quality of local roads and the prevalence of wild weather can also influence premiums for those living in regional areas. The distance you drive each year can also be a factor, with some insurers offering discounts if you drive less.

In the United States, car insurance is regulated at the state level, and state regulations can impact the cost of insurance. For example, if you live in a state prone to floods, hurricanes, or wildfires, you may pay more for insurance as insurance companies compensate for these risks with higher premiums.

Auto Insurance for Seniors: Best Options

You may want to see also

Frequently asked questions

Yes, a history of claims and driving violations can lead to an increase in insurance premiums. This is because insurers consider a history of claims and violations as indicators of higher risk, and they may charge more to cover potential costs.

Even if you have a good driving record, your insurance premium may increase if you live in an area with a high number of claims. Insurers take into account the likelihood of a claim being made, so if there is an increase in claims in your area, your premium may be affected.

Yes, if you no longer meet the criteria for a discount that was applied to your insurance premium, you may see an increase. For example, if you received a discount for being a safe driver and then got into an accident, you may lose that discount.

Yes, adding a new driver to your policy can result in an increase in your insurance premium. The additional driver brings added risk, and the exact increase will depend on their age and driving history.