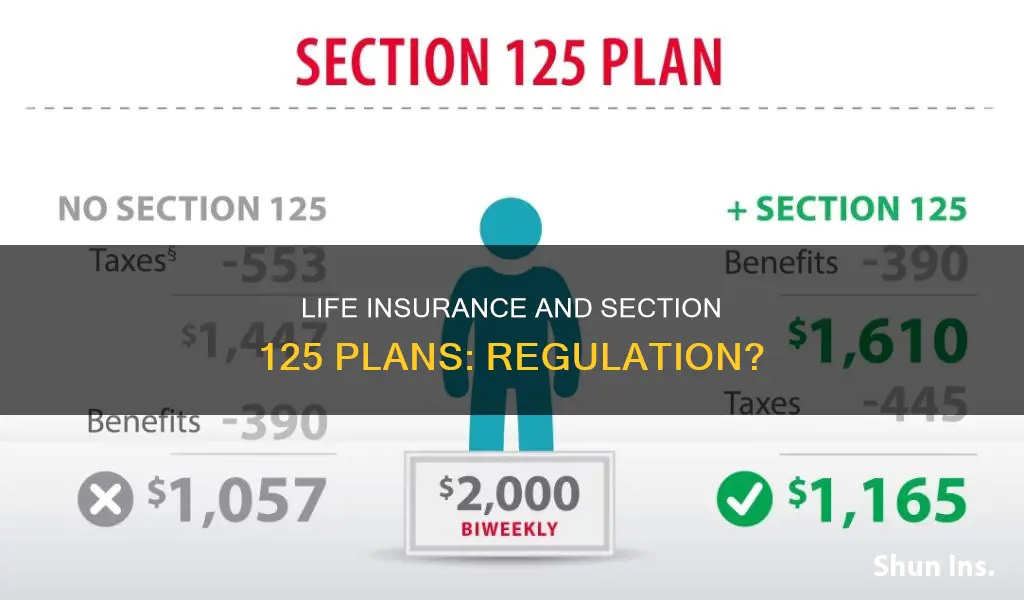

Section 125 plans, also known as cafeteria plans, are a great way for employers to offer their employees certain benefits on a pre-tax basis. These plans allow employees to choose between at least one taxable benefit (often cash) and at least one qualified benefit, such as health insurance, whose cost to the employee is excluded from their taxable gross income. While section 125 plans can include a variety of benefits, it is unclear whether life insurance can be regulated in this way. However, group-term life insurance coverage is listed as a permissible benefit in a cafeteria plan according to the IRS.

| Characteristics | Values |

|---|---|

| What is it? | A written plan that lets employees choose between two or more benefits, including qualified benefits (e.g. health insurance) and cash. |

| Who can participate? | Employees, their spouses, and their dependents. |

| What are the benefits? | Accident and health benefits, dependent care assistance, group-term life insurance coverage, health savings accounts (HSAs), and flexible spending accounts (FSAs). |

| What are the tax advantages? | Employees' taxable income decreases by the amount they use toward cafeteria plan contributions. This means they pay fewer federal income, Medicare, and Social Security taxes. Employers also save on taxes. |

| What are the drawbacks? | Initial setup fees, limited time frames, employees fund expenses upfront. |

| What are the requirements? | Must have a written plan document, limiting employee election changes, complying with non-discrimination requirements. |

| What are the types of Section 125 plans? | Premium Payment Plan, Flexible Spending Arrangements, Full Cafeteria Plan, Simple Cafeteria Plan. |

| What are the non-discrimination tests? | Eligibility Test, Benefits and Contributions Test, Key Employee Concentration Test. |

What You'll Learn

Life insurance plans maintained by educational institutions

Child education plans offer tax benefits under certain sections of the Income Tax Act, such as tax deductions on premiums paid and tax exemptions on maturity or death benefits. The plans also provide life cover, which means that a predetermined sum is paid to the child in the event of the parent's death during the policy term, ensuring that the child's education and other financial needs are not disrupted.

When choosing a child education plan, it is important to consider the reputation and financial stability of the insurance provider, as well as the plan's flexibility in terms of premium payment options, policy terms, and coverage. It is also beneficial to look for plans that offer partial withdrawal options and triple benefits, which include life cover for the parent, waiver of premiums upon the parent's death, and monthly income for the child. Starting to invest early in a child's life and taking advantage of compounding growth is generally recommended.

Borrowing Money Against Your American Memorial Life Insurance

You may want to see also

Group-term life insurance coverage

Group-term life insurance is one of the qualified benefits considered under Section 125 of the Internal Revenue Code. This means that the insurance is funded using pre-tax deductions, reducing the taxable income of employees. As a result, employees pay fewer federal income, Medicare, and Social Security taxes. The pre-tax deductions also reduce the employer's FICA and FUCA tax liabilities, as well as payroll taxes.

Under a group-term life insurance plan, employees can typically choose the term length that suits them best, usually ranging from 10 to 30 years. The premiums remain the same throughout the policy term unless the employee chooses to change them. If the insured person passes away during the term, their chosen beneficiary will receive the death benefit.

Group-term life insurance is a popular choice for those looking for cost-effective coverage. It is often more affordable than individual policies as the company purchases insurance for a large group of people, resulting in lower premiums. Additionally, employers may subsidize a portion of the premiums or provide coverage equal to the employee's annual salary at a low cost or as part of their benefits package. However, the total amount of coverage offered may be limited, and employees may lose their coverage if they leave the company.

Moose Membership: Life Insurance Benefits and Beyond

You may want to see also

Accident and disability coverage

A Section 125 plan enables employees to convert a portion of their total compensation into pre-tax qualified benefits. This means that employees can use pre-tax dollars to pay for certain benefits, reducing their taxable income. Accident and disability coverage are among the benefits that can be paid for with pre-tax dollars under a Section 125 plan.

The accident and disability coverage offered through a Section 125 plan can include a range of benefits to support employees in the event of an accident or disability. This may include coverage for medical expenses, rehabilitation costs, lost income due to time away from work, and other related expenses.

Additionally, Section 125 plans offer tax advantages for both employers and employees. For employees, the pre-tax deductions lower their federal income, Medicare, and Social Security taxes. Depending on their location, employees may save between 28% and 48% in total federal, state, and local taxes on the portion of their income contributed to the cafeteria plan.

For employers, pre-tax deductions reduce FICA and FUCA tax liabilities, and they can save an additional 7.65% on their payroll taxes. Section 125 plans also help employers attract and retain top talent by offering a robust benefits package without increasing employee tax liability.

It is important to note that there are certain requirements and restrictions for Section 125 plans. Employers must have a written plan document, and only common-law employees may participate on a pre-tax basis. Elections for the plan are generally irrevocable for the entire plan year, but there are exceptions for certain qualifying events, such as changes in marital status, employment status, or dependent eligibility.

Overall, accident and disability coverage under a Section 125 plan can provide valuable financial protection for employees, while also offering tax advantages for both employers and employees.

Life Insurance and Taxes: What Your Spouse Needs to Know

You may want to see also

Health insurance premiums

Under Section 125 plans, employees can choose to pay for various types of health insurance premiums, including medical, dental, and vision insurance. This is often done through a Premium-Only Plan (POP) or a cafeteria plan, which allows employees to pay for health insurance premiums and other qualified benefits on a pre-tax basis. By utilising Section 125 plans, employees can save between 28% and 48% in total federal, state, and local taxes on the portion of their income contributed towards health insurance premiums.

In addition to the tax advantages, Section 125 plans offer flexibility to employees in managing their healthcare expenses. They can use these plans to cover qualified out-of-pocket medical expenses, such as co-pays, routine prescriptions, and dental care. This helps employees better control their healthcare spending and provides them with a valuable perk that can improve satisfaction and retention.

Employers also benefit from Section 125 plans as they experience a reduction in payroll and tax liabilities. They save on matching Social Security and Medicare taxes, as well as federal and state unemployment taxes. Additionally, employers may be eligible for worker's compensation savings, depending on the state.

To implement a Section 125 plan, employers need to follow certain steps, including adopting a written plan document, updating plan enrollment forms, and selecting a vendor to perform nondiscrimination testing. It is important to note that Section 125 plans must comply with specific legal rules to receive federal tax advantages, such as having a written plan document and passing certain nondiscrimination tests.

Exercise and Life Insurance: Is There a Catch?

You may want to see also

Health savings accounts (HSAs)

A Health Savings Account (HSA) is a type of savings account that enables users to set aside money on a pre-tax basis to pay for qualified future medical expenses. This means that users can save money that hasn't been taxed to cover deductibles, copayments, coinsurance, and some other expenses. HSA funds generally cannot be used to pay premiums.

HSA-eligible plans are usually health plans that only cover preventive services before the deductible, also known as High Deductible Health Plans (HDHP). HSAs can earn interest or other earnings, which are not taxable. Banks, credit unions, and other financial institutions offer HSAs.

HSA users can save money on their annual tax bill with each contribution. Funds in an HSA do not expire and can be used to invest in mutual funds tax-free.

To be eligible for an HSA, users must have an HSA-eligible plan and cannot have healthcare coverage beyond qualified health plans, be enrolled in Medicare, be claimed as a dependent on someone's tax returns, or have received Veterans Affairs benefits within the past three months.

Surrender Value of Life Insurance: Taxable or Not?

You may want to see also

Frequently asked questions

A section 125 plan, also known as a cafeteria plan, allows employees to choose between two or more benefits, including qualified benefits (e.g. health insurance) and cash. Employees receive benefits as pre-tax deductions, which reduces their taxable income.

Any employer can sponsor a section 125 plan, but only employees can participate. Self-employed individuals, partners in a partnership, and shareholders who own more than 2% of an S corporation are excluded.

Qualifying benefits include accident and health benefits, dependent care assistance, group-term life insurance coverage, and health savings accounts (HSAs). A flexible spending account (FSA) can also be included, but there is a limit on these contributions.

Yes, section 125 plans can include group-term life insurance coverage.